Intrauterine Devices Market Size, Share, Trends, Industry Analysis Report

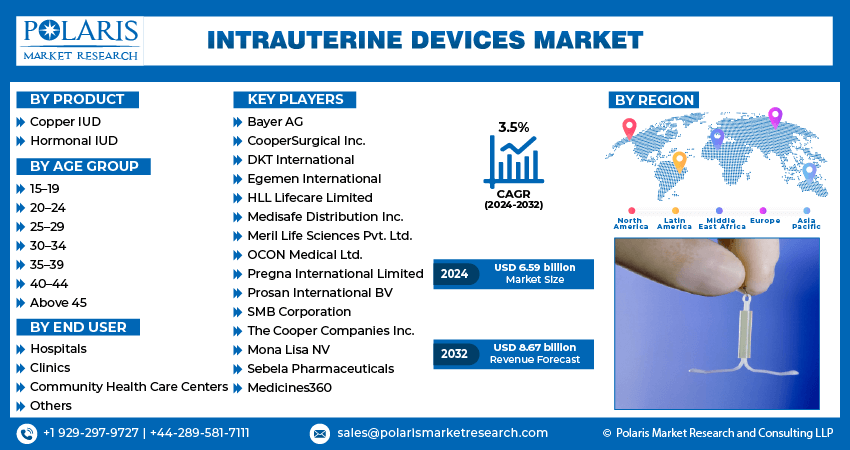

: By Product (Copper IUD and Hormonal IUD), By Age Group, By End User, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Aug-2024

- Pages: 117

- Format: PDF

- Report ID: PM5034

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

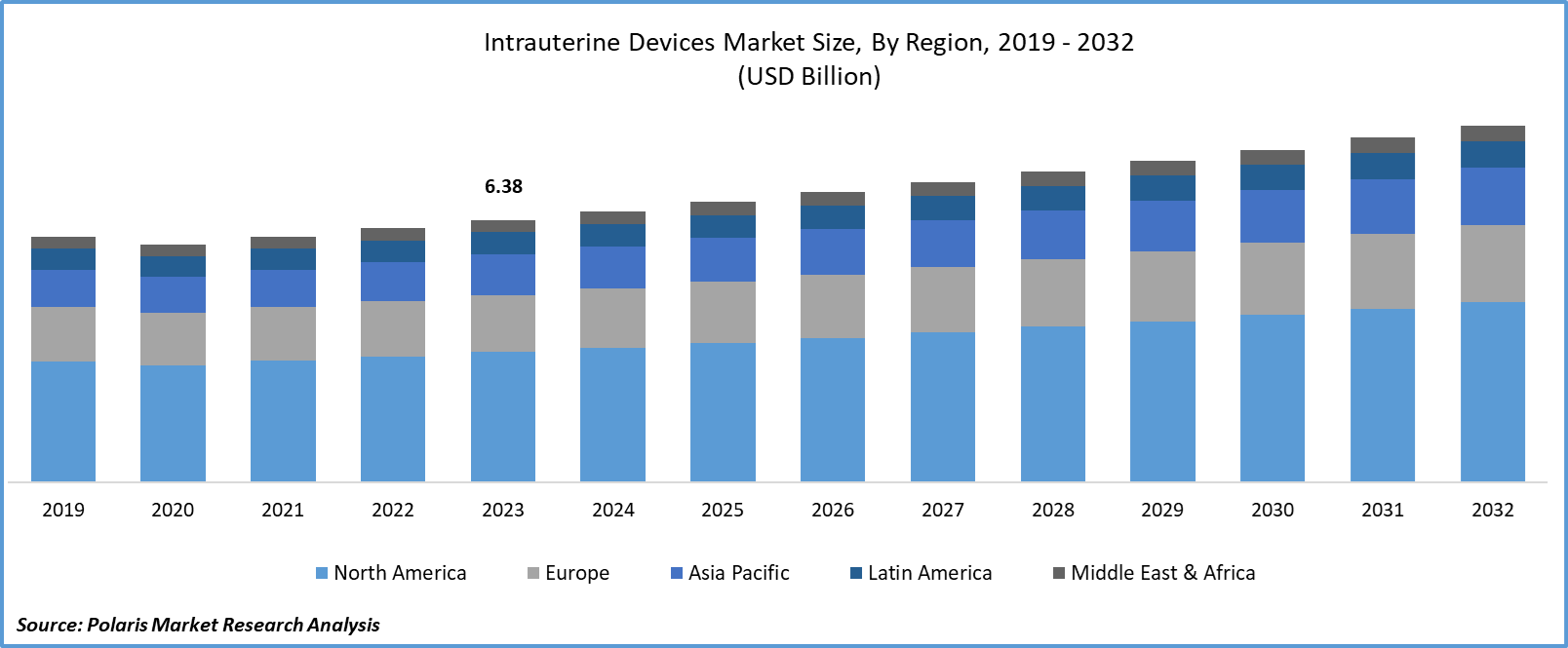

The global intrauterine devices market size was valued at USD 6.38 billion in 2023. The market is projected to grow from USD 6.59 billion in 2024 to USD 8.67 billion by 2032, exhibiting a CAGR of 3.5% during forecast period.

The global intrauterine devices (IUD) market involves products used for long-term contraception by placing a T-shaped device inside the uterus. IUDs offer effective, reversible birth control and include hormonal and copper types, catering to diverse patient needs and preferences.

The global intrauterine devices (IUD) market is experiencing significant growth, driven by increasing awareness of long-acting reversible contraceptives (LARC), rising incidence of unintended pregnancies, and favorable government initiatives promoting family planning. Technological advancements in IUD, such as the development of hormone-releasing devices that offer contraceptive and therapeutic benefits, propel the market expansion. Key trends include the growing preference for noninvasive, effective birth control methods and rising demand in developing regions due to improved access to healthcare services. Additionally, the market is benefiting from increased investments in research and development, leading to the introduction of more efficient and safer IUDs.

To Understand More About this Research:Request a Free Sample Report

Intrauterine Devices Market Trends

Increasing Adoption of Long-Acting Reversible Contraceptives (LARC)

The increasing adoption of Long-Acting Reversible Contraceptives (LARC) is significantly influenced by government initiatives and funding aimed at improving access and awareness. In 2022, the U.S. Department of Health and Human Services (HHS) reported expanded support for LARC methods through programs like Title X, which provides essential family planning services to underserved populations. This initiative has notably increased LARC utilization among women, with the CDC indicating that LARC use among women aged 15-49 rose to 11% in 2022, up from previous years. Furthermore, the Affordable Care Act (ACA) mandates coverage of contraceptives, including LARC methods, without co-payments, further facilitating their adoption. These policies help address barriers such as cost and accessibility, leading to higher rates of LARC adoption and contributing to effective, long-term reproductive health management.

Technological Advancements and Innovations

Technological advancements and innovations are pivotal drivers in the broader healthcare sector. In 2022, the U.S. National Institutes of Health (NIH) highlighted significant investments in cutting-edge medical technologies, including telemedicine, AI diagnostics, and wearable health devices. The NIH allocated over $5 billion towards research and development in these areas, reflecting a commitment to enhancing healthcare delivery and patient outcomes. Additionally, the FDA approved numerous novel devices and digital health tools, expanding their accessibility and application in clinical settings. For instance, the integration of AI in diagnostics has improved accuracy and efficiency, while advancements in telemedicine have increased healthcare access, particularly in underserved areas. These innovations are transforming patient care, driving market growth, and addressing critical gaps in healthcare delivery, as evidenced by the significant increase in adoption rates of these technologies in 2022.

Further, the development of new IUD designs, such as smaller and comfortable devices and hormone-releasing IUDs offering additional therapeutic benefits beyond contraception, boosts the intrauterine devices market growth. These innovations are enhancing user experience by reducing side effects and improving ease of use. Furthermore, advancements in insertion techniques and the availability of more precise insertion tools are making the procedure safer and more accessible. Such technological progress attracts more users and encourages healthcare providers to recommend IUDs as a viable contraceptive option. Thus, the increasing technological advancements and innovations in IUDs drives the intrauterine devices market growth.

Rising Demand in Developing Regions

Rising demand in developing regions is a major driver in the global healthcare market. In 2022, the World Health Organization (WHO) reported increased healthcare expenditure in these regions, highlighting a 10% rise in funding for health systems strengthening. Governments in countries such as India, Brazil, and Nigeria have prioritized investments in healthcare infrastructure, expanding access to medical technologies and services. For example, India’s National Health Mission saw a 12% increase in budget allocation, aimed at improving health outcomes and increasing access to advanced medical treatments. Additionally, the U.S. Agency for International Development (USAID) invested approximately $2.3 billion in health programs across developing nations, focusing on disease prevention, maternal health, and technology integration. This surge in investment and policy support is driving the demand for innovative medical products and services, reflecting a growing emphasis on improving healthcare standards and accessibility in developing regions.

Intrauterine Devices Market – Segment Insights

Intrauterine Devices Market – Product-Based Insights

The global intrauterine devices market, by product, is bifurcated into copper IUDs and hormonal IUDs. The hormonal IUDs segment dominates the market due to their dual functionality of providing effective contraception and managing conditions such as heavy menstrual bleeding. These IUDs, such as Mirena and Kyleena, are favored for their high efficacy, reduced side effects, and extended action duration. Their popularity is further increased by ongoing advancements in hormonal IUD technology that can enhance user comfort and safety. As a result, hormonal IUDs lead in market share and consumer preference, supported by strong demand from healthcare providers and patients seeking long-term contraceptive solutions.

The copper IUDs segment is growing significantly owing to the increasing awareness of non–hormonal contraceptive options and their long-term effectiveness. Copper IUDs, such as Paragard, are appealing due to their hormone-free nature, making them suitable for users who prefer or need nonhormonal methods. The growing demand for copper IUDs is also fueled by expanding access to family planning services and rising consumer awareness about different contraceptive choices. As more women seek alternative methods to hormonal options, the demand for copper IUDs is rapidly increasing, positioning them as the highest-growing product segment in the market.

Intrauterine Devices Market – Age Group-Based Insights

In the global intrauterine devices market, by age group, shows varied trends in adoption and is segmented into 15–19, 20–24, 25–29, 30–34, 35–39, 40–44, and above 45. The 25–29 is the largest and most dominant segment, primarily due to its significant proportion of women seeking effective and long-term contraceptive solutions while managing career and family planning. This age group benefits from IUDs' reliability and minimal maintenance requirements, leading to higher adoption rates compared to other age brackets. Additionally, this demographic is often more informed about reproductive health options, contributing to the segment's dominance in the market.

The 20–24 is the fastest-growing segment, driven by increasing awareness and acceptance of IUDs among younger women. This trend is supported by rising educational initiatives and access to family planning resources targeted at younger populations. As more young women seek long-term contraceptive options to avoid unintended pregnancies and manage their reproductive health proactively, the demand for IUDs in this age group is accelerating. This growing interest reflects a shift toward early adoption of reliable contraceptive methods, making the 20–24 age group the highest growth segment in the market.

Intrauterine Devices Market – End User-Based Insights

The global intrauterine devices market, by end user, is segmented into hospitals, clinics, community health care centers, and others. The hospitals segment dominates the market, as they are often the primary setting for IUD insertions due to their comprehensive healthcare services and availability of specialized medical staff. Hospitals are equipped with the necessary infrastructure and expertise to handle routine and complex cases, making them a preferred choice for IUD procedures. Additionally, hospitals benefit from higher patient footfall and can offer a wide range of reproductive health services, further solidifying their dominant position in the market.

Community health care centers are the fastest-growing segment in the IUD market. These centers are increasingly recognized for their role in providing accessible and affordable healthcare services, particularly in underserved and rural areas. Community health care centers often run government-supported family planning programs and outreach initiatives, which contribute to the rising uptake of IUDs. The market growth for this segment is driven by efforts to improve reproductive health education and the availability of contraception in local communities. As these centers continue to expand their reach and services, they are expected to significantly contribute to the market growth by making IUDs more accessible to a broader population.

Global Intrauterine Devices Market, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

Intrauterine Devices Market – Regional Insights

By region, the study provides the market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the market, driven by factors such as high awareness and acceptance of contraceptive methods, robust healthcare infrastructure, and strong support from government and nongovernmental organizations for family planning initiatives. The region benefits from widespread access to advanced healthcare services and a proactive approach to reproductive health, leading to higher adoption rates of IUDs. Additionally, significant investments in research and development, coupled with the presence of major market players, further propel North America's leading position in the IUD market. Other regions, particularly Asia Pacific, are also showing rapid growth due to improving healthcare access and increasing awareness of IUD benefits.

Global Intrauterine Devices Market, Regional Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

The intrauterine devices market in Europe is robust and well-established, driven by high levels of awareness and acceptance of IUDs as a preferred contraceptive method. Countries such as Germany, France, and the UK lead the market, benefiting from advanced healthcare infrastructure and supportive government policies promoting family planning. The presence of comprehensive public health insurance systems in many European countries also facilitates access to IUDs, making them an affordable option for a wide demographic. Additionally, ongoing research and development in the region contribute to the introduction of new and improved IUD products, further boosting market growth.

The Asia Pacific intrauterine devices market is experiencing rapid growth, driven by increasing awareness of long-acting reversible contraceptives and improving access to healthcare services. Countries such as China, India, and Japan are at the forefront of this growth due to their large populations and rising demand for effective contraceptive methods. Government initiatives focused on family planning and reproductive health, along with support from international organizations, are significantly enhancing the adoption of IUDs. Additionally, the growing middle-class population and urbanization in these countries are contributing to a higher acceptance of modern contraceptives, thereby propelling the market growth. The region also benefits from a growing number of healthcare providers and improved distribution channels, making IUDs more accessible to a broader population.

Intrauterine Devices Market – Key Market Players and Competitive Insights

Bayer AG, CooperSurgical Inc., DKT International, Egemen International, HLL Lifecare Limited, Medisafe Distribution Inc., Meril Life Sciences Pvt. Ltd., OCON Medical Ltd., Pregna International Limited, Prosan International BV, SMB Corporation, The Cooper Companies Inc., Mona Lisa NV, Sebela Pharmaceuticals, and Medicines360 are among the key players in the global intrauterine devices market. These companies are at the forefront of the market, leveraging their extensive research and development capabilities, robust distribution networks, and strong brand reputations to maintain and grow their market presence.

The competitive landscape of the IUD market is characterized by intense competition among key players to innovate and introduce advanced products. Bayer AG and CooperSurgical Inc. are particularly prominent, with strong portfolios of copper and hormonal IUDs. These companies invest heavily in research and development to enhance the efficacy, safety, and user comfort of their products. Additionally, companies such as DKT International and HLL Lifecare Limited play a significant role in expanding access to IUDs in developing regions through cost-effective solutions and strong collaboration with governmental and nongovernmental organizations. The market also sees competition from newer entrants and regional players who focus on niche markets and innovative product features to differentiate themselves.

Insights into the market reveal that technological advancements, strategic partnerships, and expansions into emerging markets are key strategies adopted by leading players to stay competitive. For example, the introduction of smaller, more comfortable IUDs and hormone-releasing variants addresses the demand for improved user experience. Moreover, partnerships and collaborations, such as those between manufacturers and healthcare providers, facilitate wider distribution and adoption of IUDs. The competitive landscape is also influenced by regulatory approvals and market entry barriers, which favor established players with strong compliance and quality assurance capabilities. Overall, the market is dynamic, with continuous innovation and strategic maneuvers shaping the competitive environment.

Bayer AG is a global player in the global intrauterine devices market, renowned for its popular hormonal IUDs such as Mirena, Kyleena, and Jaydess (Skyla in the US). These products are widely recognized for their high efficacy, safety, and extended duration of action, making Bayer a dominant force in the market. The company's strong research and development capabilities, coupled with its robust global distribution network, have solidified its position as a market leader. In July 2023, Bayer announced the expansion of its Mirena product line in several emerging markets, aiming to increase access to long-acting reversible contraceptives and support global family planning initiatives.

CooperSurgical Inc., a division of The Cooper Companies Inc., is another major player in the IUD market, offering a diverse range of copper and hormonal IUDs. The company's Paragard (copper IUD) and the range of hormonal IUDs under its portfolio are well-regarded for their reliability and safety. CooperSurgical's commitment to innovation and quality has enabled it to maintain a strong market presence. In May 2023, CooperSurgical announced a significant collaboration with healthcare providers in Asia Pacific to enhance the distribution and accessibility of its IUD products, aiming to address the growing demand for effective contraceptive options in the region.

Key Companies in Intrauterine Devices Market

- Bayer AG

- CooperSurgical Inc.

- DKT International

- Egemen International

- HLL Lifecare Limited

- Medisafe Distribution Inc.

- Meril Life Sciences Pvt. Ltd.

- OCON Medical Ltd.

- Pregna International Limited

- Prosan International BV

- SMB Corporation

- The Cooper Companies Inc.

- Mona Lisa NV

- Sebela Pharmaceuticals

- Medicines360

Intrauterine Devices Industry Developments

- In April 2024, Women's health medtech company ASPIVIX partnered with Bayer Switzerland to launch Carevix, a cervical stabilizer aimed at reducing pain and bleeding during transcervical procedures, including IUD insertions.

- In May 2023, CooperSurgical announced a notable partnership with healthcare providers in Asia Pacific to improve the distribution and accessibility of its IUD products, aiming to meet the increasing demand for effective contraceptive options in this area.

Intrauterine Devices Market Segmentation

Intrauterine Devices Market – Product Outlook

- Copper IUD

- Hormonal IUD

Intrauterine Devices Market – Age Group Outlook

- 15–19

- 20–24

- 25–29

- 30–34

- 35–39

- 40–44

- Above 45

Intrauterine Devices Market – End User Outlook

- Hospitals

- Clinics

- Community Health Care Centers

- Others

Intrauterine Devices Market – Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Intrauterine Devices Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 6.38 billion |

|

Market size value in 2024 |

USD 6.59 billion |

|

Revenue forecast in 2032 |

USD 8.67 billion |

|

CAGR |

3.5% from 2024 to 2032 |

|

Base year |

2023 |

|

Historical data |

2019–2022 |

|

Forecast period |

2024–2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive landscape |

|

|

Report format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

How the report is valuable for an organization?

Workflow/Innovation Strategy: The market has been segmented into detailed segments of products, including different IUD product types such as hormonal IUDs and copper IUDs. Moreover, the study provides the reader with a detailed understanding of the different age groups and end users in which these products are utilized.

Growth/Marketing Strategy: To drive growth in the global intrauterine devices market, companies are focusing on expanding their product portfolios with innovative designs and improved user experiences, such as smaller, more comfortable devices and hormone-releasing options. Strategic partnerships and collaborations with healthcare providers and governmental organizations are enhancing market reach and accessibility, particularly in developing regions. Additionally, targeted marketing campaigns and educational initiatives are increasing awareness about the benefits of IUDs, while investments in research and development are fueling technological advancements. Companies are also exploring new distribution channels to tap into emerging markets and address varying consumer needs across different demographics.

FAQ's

The global intrauterine devices market size was valued at USD 6.38 billion in 2023 and is projected to grow to USD 8.67 billion by 2032.

The global market is projected to register a CAGR of 3.5% during 2023–2032.

North America held the largest share of the global market in 2023.

Bayer AG, CooperSurgical Inc., DKT International, Egemen International, HLL Lifecare Limited, Medisafe Distribution Inc., Meril Life Sciences Pvt. Ltd., OCON Medical Ltd., Pregna International Limited, Prosan International BV, SMB Corporation, The Cooper Companies Inc., Mona Lisa NV, Sebela Pharmaceuticals, and Medicines360 are among key players in the global intrauterine devices market.

The hormonal IUDs segment dominated the market in 2023.

The hospitals segment accounted for the largest share of the global market in 2023.

The global intrauterine devices market encompasses the production, distribution, and sales of IUDs, which are small, T-shaped devices inserted into the uterus to prevent pregnancy. The market includes a variety of IUD products, primarily categorized into copper IUDs, which release copper to inhibit sperm movement, and hormonal IUDs, which release progestin to thicken cervical mucus and sometimes suppress ovulation. Key factors driving the market growth are rising awareness and acceptance of long-acting reversible contraceptives (LARCs), technological advancements in IUD design and functionality, and supportive governmental and nongovernmental initiatives promoting family planning and reproductive health. The market is segmented on the basis of product, age group, and end user, with significant variations in regional adoption rates and preferences.

A few of the key trends in the global intrauterine devices market are described below: Increasing Adoption of Long-Acting Reversible Contraceptives (LARC): Growing preference for long-term, reliable contraceptive methods over short-term options. Technological Advancements and Innovation: Development of smaller, more comfortable IUDs and hormone-releasing variants with added therapeutic benefits. Rising Demand in Developing Regions: Improved access to healthcare and family planning services, along with educational campaigns, driving adoption in Asia Pacific, Latin America, and Africa. Government and Nongovernmental Support: Enhanced support for family planning initiatives and reproductive health programs boosting market growth.

A new company looking to enter the global intrauterine devices market must focus on several key areas to stay ahead of the competition. Prioritizing technological innovation, such as developing more comfortable, smaller, and user-friendly IUDs, can attract a broader customer base. Emphasizing nonhormonal options, such as advanced copper IUDs, could appeal to those seeking hormone-free contraception. Establishing strategic partnerships with healthcare providers and governmental organizations can enhance market penetration and accessibility. Additionally, investing in educational campaigns to raise awareness about the benefits of IUDs and improving distribution networks in emerging markets can drive business growth and competitive advantage.

Companies manufacturing and distributing IUDs, healthcare providers, medical device manufacturers, and NGOs must buy the report.