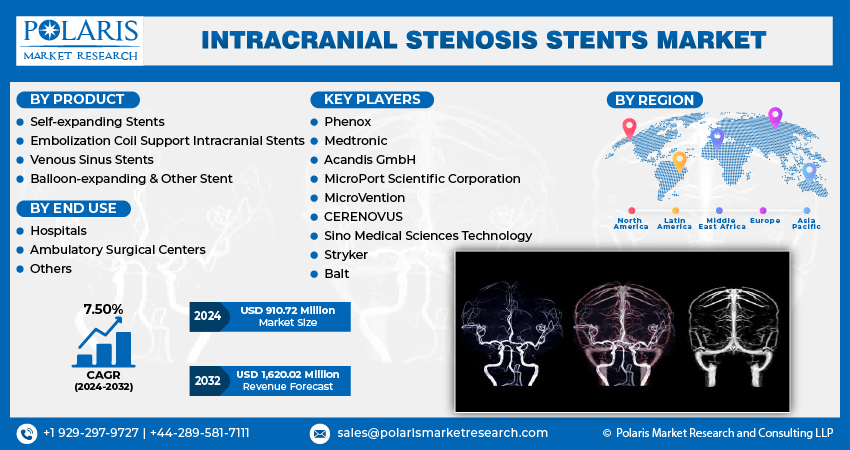

Intracranial Stenosis Stents Market Share, Size, Trends, Industry Analysis Report, By Product (Self-expanding Stents, Embolization Coil Support Intracranial Stents, Venous Sinus Stents, Balloon-expanding), By End-Use, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM3633

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

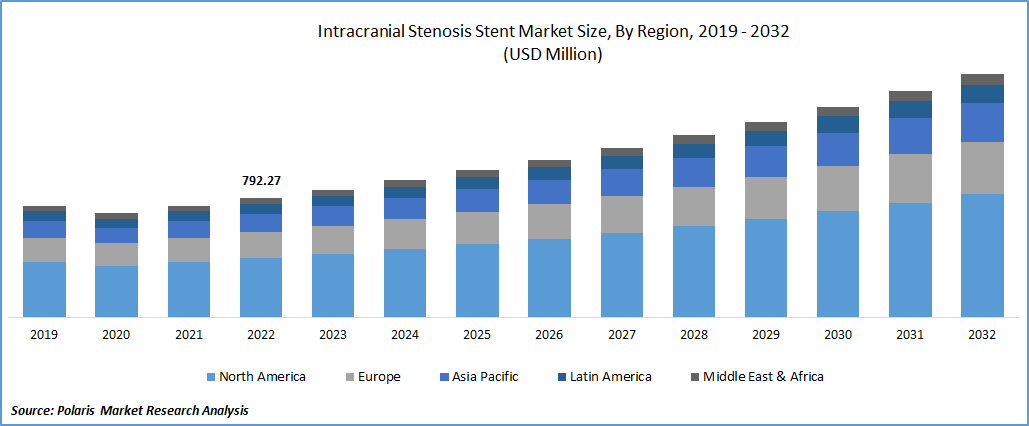

The global intracranial stenosis stents market was valued at USD 849.24 million in 2023 and is expected to grow at a CAGR of 7.50% during the forecast period.

Factors contributing to the market growth include the increasing incidence of stroke, rising demand for minimally invasive intracranial surgeries, and the growing population of elderly individuals. According to a 2022 report by the World Stroke Organization, over 12.2 million new stroke cases are reported globally each year. The report also highlights that stroke is most prevalent among individuals aged 70 and older (67%), followed by those between 15 and 49 (22%). These factors are anticipated to drive market expansion in the upcoming years.

The research report offers a quantitative and qualitative analysis of the intracranial stenosis stents market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

To Understand More About this Research: Request a Free Sample Report

Cerebrovascular complications associated with intracranial stenting are adverse events that can occur during or after the procedure, impacting the blood vessels and blood flow in the brain. These complications can be influenced by various factors, including the location of the stenosis, particularly in low-volume areas, the presence of posterior circulation stenosis, and the stenting procedure itself. Additionally, the stenting process itself carries inherent risks. During the placement of the stent, there is a possibility of injury to the blood vessels, dislodgement of plaque or clots, or the formation of new blood clots. These complications can disrupt blood flow in the brain and potentially lead to ischemic stroke or other cerebrovascular events.

A study published in the Journal of Stroke and Cerebrovascular Diseases demonstrated that balloon-expandable intracranial stent placement resulted in favorable outcomes for 97% of stable and 67% of unstable patients. However, within the initial 30-day period after the procedure, adverse events were reported in 10% of cases involving cerebral stents. These events included fatalities, with one attributed to myocardial infarction (4%), as well as instances of mild stroke and three cases of major stroke.

The United States has reported a shortage of neuro-interventionalists, which can restrict the availability of specialized treatments like intracranial stenosis stenting for patients with neurological conditions. A survey conducted among healthcare providers in the U.S. and published in the Journal of Stroke and Cerebrovascular Diseases in 2018 revealed that only 40% of respondents felt confident in performing intracranial stenting procedures. Additionally, concerns regarding patient safety, limited access to training programs, and inadequate reimbursement were significant obstacles to acquiring expertise in this field.

The short-term impact of the COVID-19 pandemic on the market was assessed to be relatively modest. As the pandemic gradually came under control and the healthcare sector started recovering, there was an increase in demand for these stents. Furthermore, the market is experiencing growth due to technological advancements in stent design and materials.

Growth Drivers

The popularity of minimally invasive surgeries is increasing due to their associated benefits, such as reduced risk and trauma compared to traditional surgical procedures. These surgeries involve smaller incisions, resulting in decreased postoperative pain and faster recovery times. As a result, there is a high adoption rate of minimally invasive procedures. In response to this growing demand, many key players in the medical industry are investing significantly in research and development (R&D) activities. These investments are aimed at developing and launching innovative minimally invasive surgical instruments. The focus of R&D efforts is to enhance these instruments' precision, efficiency, and safety, further improving patient outcomes.

Report Segmentation

The market is primarily segmented based on product, end use, and region.

|

By Product |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Self-expanding stents segment accounted for the largest market share in 2022

Self-expanding stents segment accounted for the largest market share in 2022. Intracranial stenosis poses a risk of ischemic stroke, but research has indicated that self-expanding stents (SES) are generally considered safe for restoring blood flow in cases of acute ischemic strokes. For instance, according to the Centers for Disease Control and Prevention (CDC), stroke is a significant cause of long-term disability & reduces mobility in around half of the stroke survivors aged 65 & above. To address this issue, intracranial stenosis stents are specifically designed to prevent heart attacks. They achieve this through their self-expanding feature, where the stent expands and holds the blood vessel open, ensuring improved blood flow to the brain.

The embolization coils segment is anticipated to be the fastest-growing segment, with a healthy CAGR over the study period. Increasing incidence of brain strokes, a growing target population, advancements in technology, improvements in healthcare facilities, and the adoption of new surgical options. These factors collectively contribute to the rising usage of stent-assisted coiling, which drives the segment's growth. Using embolization coil support in intracranial stents has emerged as an effective treatment option for addressing intracranial stenosis.

Ambulatory surgical centers segment is likely to witness highest growth during forecast period

The ambulatory center's segment registered steady growth. Ambulatory surgery centers are enhancing their healthcare delivery offerings by providing specialized facilities for brain-related injuries, creating new growth opportunities for medical devices and equipment. These centers are known for offering low-risk procedures in a convenient setting, often at lower costs than hospitals.

The hospital's segment led the industry market with a substantial revenue share in 2022. This can be attributed to the growing prevalence of stenosis, aneurysms, brain strokes, and neurovascular diseases. Additionally, adopting advanced technology-based devices in hospitals significantly contributes to market growth. Furthermore, the rising number of neurosurgical procedures being performed in hospitals has also contributed to the overall market expansion.

North America region dominated the global market in 2022

The North American region dominated the global market with a considerable revenue share in 2022. The regional growth is primarily driven by the high incidence rates of hypertension and stroke, along with the presence of well-established healthcare facilities. According to the Centers for Disease Control and Prevention (CDC), hypertension was identified as the primary contributing cause of approximately 670,000 deaths in the U.S. in 2020. Additionally, the CDC reports that around 87 percent of strokes in the U.S. alone are ischemic strokes, which occur when blood to the brain is stopped.

The Asia Pacific region will likely emerge as the fastest-growing region, with a significant growth rate during the forecast period. This growth can be attributed to various factors, including the increasing aging population, negative lifestyle choices, and stress-related factors. The region is witnessing a rise in the incidence of ischemic stroke, which further drives the demand for intracranial stenosis stents. The region's large population and increasing patient affordability contribute to the market's growth potential. Additionally, developing economies such as India and China present lucrative growth opportunities in the market. These factors, combined with the improving healthcare infrastructure and rising awareness about neurological conditions, are expected to fuel the growth of the intracranial stenosis stents market in the region.

Competitive Insight

Global players are actively contributing to market growth in the region by obtaining approvals from regulatory authorities and expanding their product portfolios. As an example, in December 2020, MicroPort Scientific received approval from China's NMPA for its flagship product “Bridge Drug-Eluting Stent”. This stent is specifically designed to treat symptomatic vertebral artery stenosis in China. Such developments highlight the efforts of major players in introducing innovative products and expanding their market presence.

Some of the major players operating in the global market include Phenox, Medtronic, Acandis GmbH, MicroPort Scientific Corporation, MicroVention, CERENOVUS, Sino Medical Sciences Technology, Stryker, and Balt.

Recent Developments

- In August 2022, MicroPort Scientific announced that the first implantation of the NeuroTech APOLLO Intracranial Arterial Stent System had been successfully completed in Brazil.

Intracranial Stenosis Stents Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 910.72 million |

|

Revenue forecast in 2032 |

USD 1,620.02 million |

|

CAGR |

7.50% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Phenox, Medtronic, Acandis GmbH, MicroPort Scientific Corporation, MicroVention, CERENOVUS, Sino Medical Sciences Technology, Stryker, and Balt. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

FAQ's

The global intracranial stenosis stents market size is expected to reach USD 1,620.02 million by 2032.

Key players in the intracranial stenosis stents market are Phenox, Medtronic, Acandis GmbH, MicroPort Scientific Corporation, MicroVention, CERENOVUS, Sino Medical Sciences Technology.

North America contribute notably towards the global intracranial stenosis stents market.

The global intracranial stenosis stents market is expected to grow at a CAGR of 7.4% during the forecast period.

The intracranial stenosis stents market report covering key segments are product, end use, and region.