Internet of Things Analytics Market Size, Share, Trends, Industry Analysis Report: By Component (Solutions and Services), Organization Size, Deployment, Type, Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5419

- Base Year: 2024

- Historical Data: 2020-2023

Internet of Things Analytics Market Overview

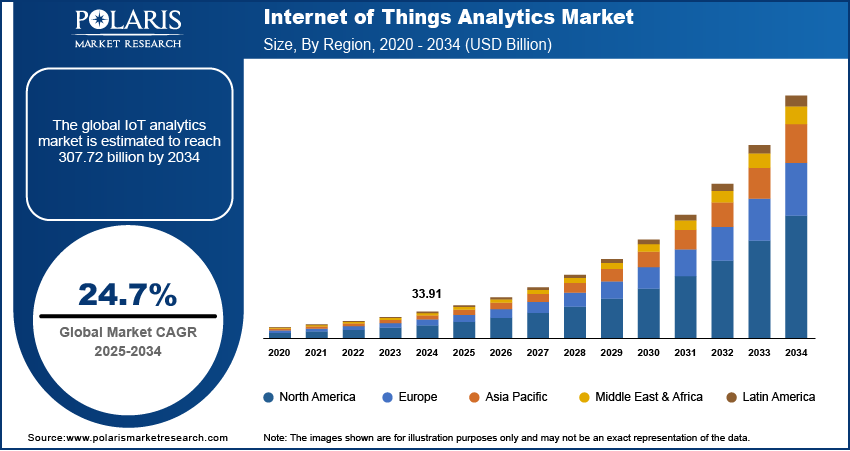

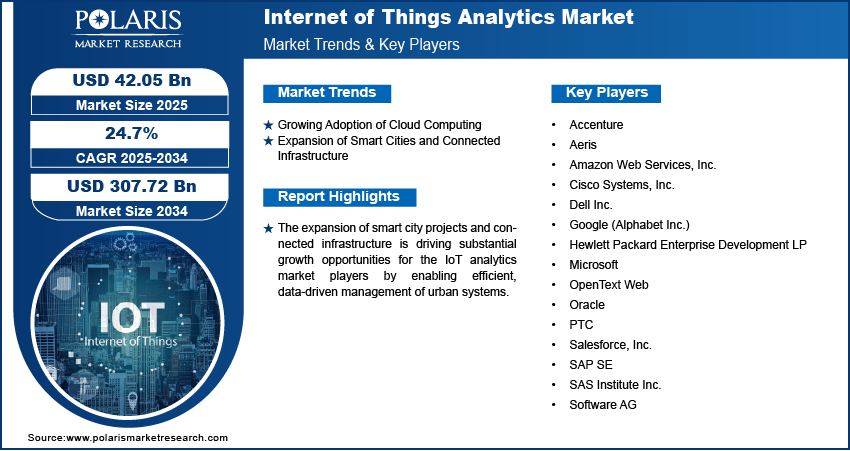

The global internet of things analytics market size was valued at USD 33.91 billion in 2024 and is expected to reach USD 42.05 billion by 2025 and 307.72 billion by 2034, exhibiting a CAGR of 24.7% during 2025–2034.

The Internet of Things analytics market focuses on the tools, platforms, and solutions used to analyze data generated by IoT devices. This market enables businesses to derive actionable insights, optimize operations, enhance decision making, and predict trends using advanced analytics, machine learning, and big data technologies.

To Understand More About this Research: Request a Free Sample Report

The increasing deployment of IoT devices across industries generates vast amounts of data, driving the need for advanced analytics solutions to extract actionable insights, which is significantly propelling the Internet of Things analytics market development. Integration of AI and machine learning technologies enhances the efficiency and accuracy of IoT analytics, enabling predictive maintenance, anomaly detection, and real-time decision-making, which is further driving the Internet of Things analytics market demand.

Businesses are prioritizing real-time data processing to optimize operations, reduce downtime, and respond swiftly to changing conditions, which is fueling the Internet of Things analytics market growth. Furthermore, organizations across sectors are leveraging IoT analytics to enhance operational efficiency, improve customer experiences, and stay competitive. This factor is further propelling the IoT analytics market demand.

Internet of Things (IoT) Analytics Market Dynamics

Growing Adoption of Cloud Computing

Cloud-based IoT analytics platforms provide scalable, cost-efficient, and remotely accessible solutions for managing and analyzing vast amounts of IoT-generated data. Unlike on-premises systems, cloud-based platforms allow businesses to process and store data dynamically, scaling resources up or down based on demand without significant capital investments. This flexibility is particularly beneficial for industries with fluctuating data volumes, such as manufacturing or retail, as it reduces infrastructure costs and operational complexity. Additionally, the remote accessibility of cloud platforms enables organizations to monitor and analyze IoT data in real time from anywhere, improving decision-making and operational efficiency. For instance, Amazon Web Services (AWS) IoT Analytics offers a fully managed service for analyzing IoT data. Companies in the logistics sector use AWS IoT Analytics to process sensor data from fleets, optimizing routes and reducing fuel consumption. Hence, the rising adoption of cloud computing boosts the IoT analytics market development.

Expansion of Smart Cities and Connected Infrastructure

The expansion of smart city projects and connected infrastructure is driving substantial growth opportunities for the IoT analytics market players by enabling efficient, data-driven management of urban systems. Cities adopt advanced technologies to enhance operational efficiency and sustainability; IoT analytics serves as a critical tool for processing and analyzing the vast amounts of data generated by connected devices and sensors. This data provides actionable insights that empower authorities to address urban challenges more effectively. Moreover, in traffic management, IoT analytics is utilized to monitor and analyze real-time data from road sensors, connected vehicles, and smart traffic systems. This enhances the ability to predict congestion patterns, optimize traffic flow, and reduce commute times. Moreover, energy optimization benefits significantly, as IoT analytics helps monitor and manage energy usage across smart grids, reducing wastage and enabling more efficient energy distribution. Furthermore, as smart city initiatives continue to expand globally, IoT analytics is becoming an integral component of managing interconnected systems, driving innovation, and improving the quality of urban living. The connected infrastructure propels the demand for sophisticated analytics solutions, contributing to the Internet of Things (IoT) analytics market growth.

Internet of Things Analytics Market Segment Insights

IoT Analytics Market Assessment by Component Outlook

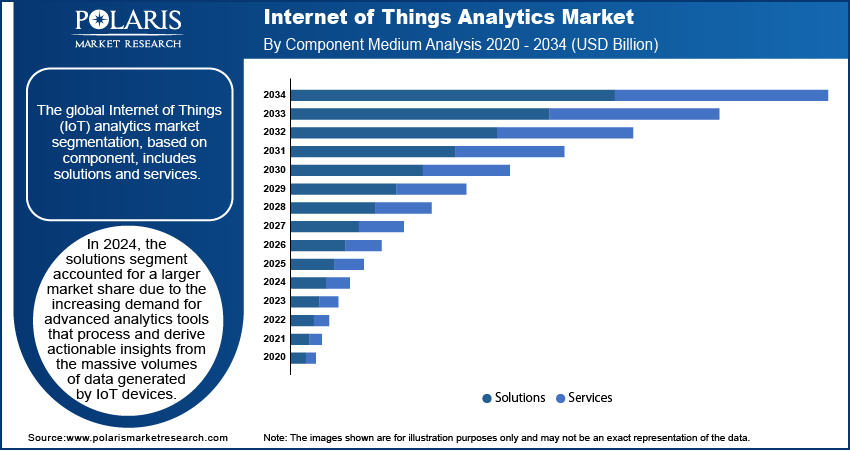

The global Internet of Things analytics market segmentation, based on component, includes solutions and services. In 2024, the solutions segment accounted for a larger market share due to the increasing demand for advanced analytics tools that process and derive actionable insights from the massive volumes of data generated by IoT devices. These solutions, including real-time analytics platforms, data visualization tools, and machine learning algorithms, offer scalability, accuracy, and efficiency, making them essential for businesses seeking to optimize operations and improve decision-making. The growing adoption of IoT analytics solutions across various industries such as manufacturing, healthcare, and transportation further drives the Internet of Things analytics market expansion for the solutions segment, as organizations prioritize integrating data-driven technologies to enhance performance. Moreover, the availability of customizable and industry-specific IoT analytics solutions adds to their widespread adoption, solidifying their dominant position in the market.

IoT Analytics Market Evaluation by End Use Outlook

The global Internet of Things analytics market segmentation, based on end use, includes manufacturing, energy & utilities, retail & e-commerce, healthcare & life sciences, transportation & logistics, IT & Telecom, and others. In 2024, the manufacturing segment accounted for the largest IoT analytics market share due to the widespread adoption of IoT technologies to enhance operational efficiency, reduce costs, and enable predictive maintenance. Manufacturers are increasingly leveraging IoT analytics to monitor production processes, optimize supply chain operations, and minimize downtime through real-time data insights. The integration of IoT analytics in smart factories, combined with the rising demand for automation and Industry 4.0 initiatives, has further driven adoption. Additionally, the ability of IoT analytics to provide actionable intelligence for quality control, resource management, and energy efficiency has made it a critical component in modern manufacturing, contributing to its dominant market position.

Internet of Things (IoT) Analytics Market Regional Analysis

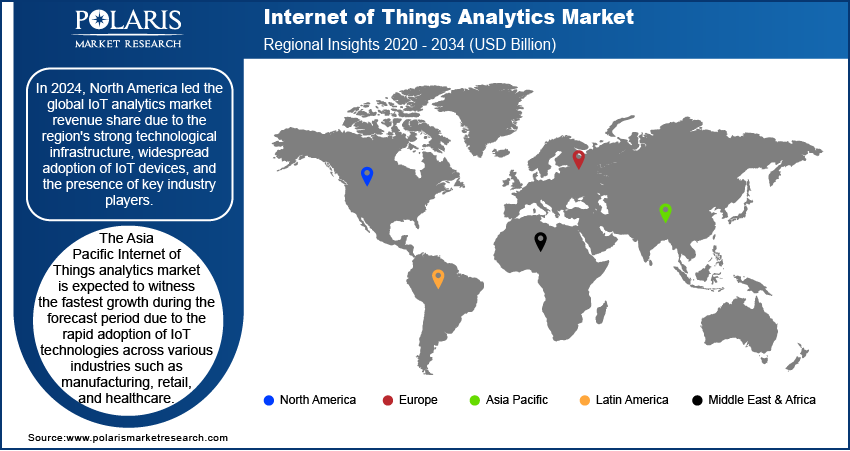

By region, the study provides Internet of Things analytics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the global IoT analytics market revenue due to the region's strong technological infrastructure, widespread adoption of IoT devices, and the presence of key industry players. The rapid digital transformation across industries such as manufacturing, healthcare, and retail has driven significant investments in advanced analytics solutions to harness the vast data generated by IoT ecosystems. For instance, in May 2023, SAS announced to invest USD 1 billion over the next three years to enhance its advanced analytics solutions tailored for industries including banking, government, insurance, healthcare, retail, and energy. Additionally, supportive government initiatives and funding for smart city projects, along with increasing demand for real-time analytics and data-driven decision-making, have fueled the IoT analytics market growth in the region.

The Asia Pacific Internet of Things analytics market is expected to witness the fastest growth during the forecast period due to the rapid adoption of IoT technologies across many industries such as manufacturing, retail, and healthcare. The growing investments in smart city projects, rising industrial automation, and increasing deployment of connected devices are driving demand for advanced analytics solutions. For instance, the National Industrial Corridor Development Programme is India's strategic initiative to develop advanced “Smart Cities” by integrating advanced technologies across infrastructure sectors. Additionally, the expanding IT infrastructure, a large consumer base, and supportive government initiatives promoting digital transformation contribute significantly to the region's accelerated market growth.

Internet of Things Analytics Market – Key Players & Competitive Analysis Report

The competitive landscape of the Internet of Things (IoT) analytics market is characterized by the presence of numerous key players, ranging from established technology companies to emerging startups, all striving to capture a significant market share through innovative solutions. Companies are focusing on enhancing their IoT analytics platforms with advanced features such as artificial intelligence (AI), machine learning (ML), and real-time data processing capabilities to meet the growing demand for actionable insights from IoT-generated data. Strategic collaborations, and mergers and acquisitions are common as firms seek to expand their market presence and improve service offerings. Additionally, market players are increasingly targeting industry-specific solutions to provide the unique needs of sectors such as manufacturing, healthcare, retail, and transportation. Subscription-based and cloud-driven models are also gaining traction as companies offer cost-effective and scalable analytics platforms. The competitive dynamics are further influenced by regional players, particularly in Asia Pacific and Europe, where growing IoT adoption is creating growth opportunities for localized solutions.

Amazon Web Services, a subsidiary of Amazon.com Inc., offers on-demand cloud computing platforms, website hosting, digital marketing, analytics, backup, application integration, networking, blockchain, and other related services. The company’s product line comprises featured services, analytics, application integration, blockchain, business applications, cloud financial management, computing, database, developer tools, front-end web & mobile, IoT, games, ML, media services, robotics, satellite, and others. The company’s solutions segment, by use case, is segmented into archiving, blockchain, cloud migration, cloud operations, containers, database migrations, DevOps, e-commerce, edge computing, scientific computing, serverless computing, and others.

Google LLC, a subsidiary of Alphabet Inc., provides search and advertising services on the Internet. The company operates in two major reportable segments–Google Services and Google Cloud. The Google Services segment comprises a wide range of core products and platforms, including Android, Ads, Hardware, Chrome, Google Drive, Gmail, Google Photos, Google Maps, Google Play, YouTube, and Search. The segment’s hardware products are characterized by various products such as Pixel 5a 5G, Pixel 6 phones, Chromecast with Google TV, the Fitbit Charge 5, Google Nest Cams, and Nest Doorbells. The company's cloud segment is further categorized into Google Cloud Platforms and Google Workspace. The Google Cloud platform aids developers in building, testing, and deploying applications on its scalable and reliable infrastructure. The Google collaboration tools include applications such as Gmail, Calendar, Docs, Drive, Meet, and more. The company also provides OCR on Google Cloud Platform, including image uploading, text extraction, translation, and Cloud Pub/Sub integration. Google LLC is engaged in Internet of Things (IoT) analytics through its Google Cloud IoT Core, which enables the connection, management, and analysis of IoT device data. This platform integrates with services like Google BigQuery and Cloud Pub/Sub to provide scalable and real-time analytics capabilities, helping organizations optimize operations and improve decision-making.

List of Key Companies in Internet of Things Analytics Market

- Accenture

- Aeris

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Dell Inc.

- Google (Alphabet Inc.)

- Hewlett Packard Enterprise Development LP

- Microsoft

- OpenText Web

- Oracle

- PTC

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Software AG

Internet of Things Analytics Industry Developments

In April 2024, XL Axiata partnered with Cisco to launch the IoT Connectivity+ product, designed to enhance IoT services in Indonesia. This solution integrates Cisco’s IoT Control Center, offering a robust platform for managing IoT connectivity, thereby improving scalability, security, and operational efficiency for businesses in the region.

In March 2023, Ericsson transferred its IoT Accelerator and Connected Vehicle Cloud segment, along with related assets, to Aeris, while also acquiring a minority stake in the company.

Internet of Things Analytics Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- Services

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- SMEs

- Large Enterprises

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- On-Premises

- Cloud

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Energy Management

- Predictive Maintenance

- Asset Management

- Inventory Management

- Remote Monitoring

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Manufacturing

- Energy & Utilities

- Retail & E-commerce

- Healthcare & Life Sciences

- Transportation & Logistics

- IT & Telecom

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Internet of Things Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 33.91 billion |

|

Market Size Value in 2025 |

USD 42.05 billion |

|

Revenue Forecast by 2034 |

USD 307.72 billion |

|

CAGR |

24.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global IoT analytics market size was valued at USD 33.91 billion in 2024 and is projected to grow to USD 307.72 billion by 2034.

The global market is projected to register a CAGR of 24.7% during the forecast period.

In 2024, North America accounted for the largest market share due to the region's strong technological infrastructure, widespread adoption of IoT devices, and the presence of key industry players.

A few of the key players in the market are Accenture; Aeris; Amazon Web Services, Inc.; Cisco Systems, Inc.; Dell Inc.; Google (Alphabet Inc.); Hewlett Packard Enterprise Development LP; Microsoft; OpenText Web; Oracle; PTC; Salesforce, Inc.; SAP SE; SAS Institute Inc.; and Software AG.

In 2024, the solutions segment accounted for a larger market share due to the increasing demand for advanced analytics tools that process and derive actionable insights from the massive volumes of data generated by IoT devices

In 2024, the manufacturing segment accounted for the largest market share due to the widespread adoption of IoT technologies to enhance operational efficiency, reduce costs, and enable predictive maintenance.