Intermediate Bulk Container Market Size, Share, Trends, Industry Analysis Report: By Material (Plastic, Metal, and Corrugated), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 117

- Format: PDF

- Report ID: PM5524

- Base Year: 2024

- Historical Data: 2020-2023

Intermediate Bulk Container Market Overview

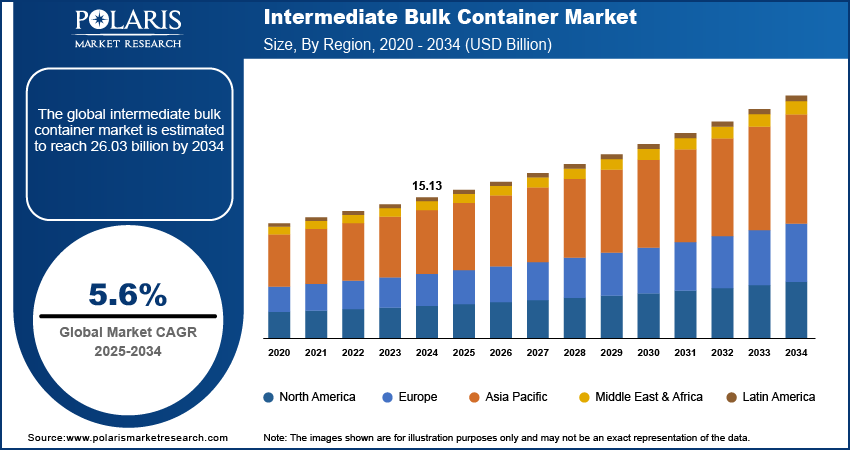

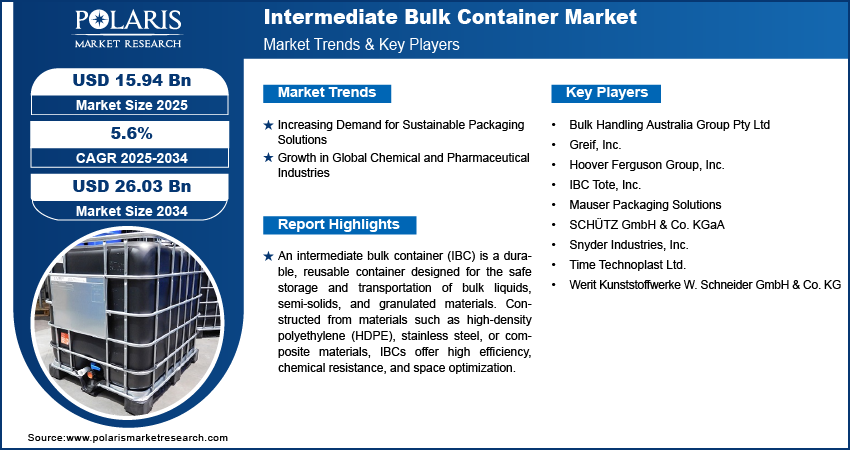

The intermediate bulk container market size was valued at USD 15.13 billion in 2024. The market is projected to grow from USD 15.94 billion in 2025 to USD 26.03 billion by 2034, exhibiting a CAGR of 5.6% during 2025–2034.

The intermediate bulk container market report encompasses the production, distribution, and utilization of large-capacity containers designed for the storage and transportation of bulk liquids, semi-solids, and granulated materials. These containers, typically made from plastic, metal, or composite materials, are widely used in industries such as chemicals, food & beverages, pharmaceuticals, and agriculture. Their standardized design and reusability contribute to cost-effectiveness and operational efficiency. The intermediate bulk container market growth is driven by increasing demand for efficient logistics solutions, stringent regulations on safe handling of hazardous substances, and a rising preference for sustainable packaging alternatives.

Key drivers of the intermediate bulk container market demand include the growth of industrial and agricultural sectors, which require secure and efficient bulk material transport solutions. The expansion of chemical and pharmaceutical industries further fuels demand, as these sectors require containers that meet regulatory standards for hazardous and sensitive materials. Additionally, the shift toward sustainable supply chain practices, including the adoption of recyclable and reusable containers, is shaping intermediate bulk container market trends. Increasing globalization and cross-border trade are also influencing market growth, as companies seek cost-efficient and reliable packaging solutions for bulk goods.

To Understand More About this Research: Request a Free Sample Report

Intermediate Bulk Container Market Dynamics

Increasing Demand for Sustainable Packaging Solutions

The intermediate bulk container market demand is rising due to a heightened emphasis on sustainable packaging solutions across various industries. Companies are increasingly seeking packaging options that minimize environmental impact while maintaining efficiency and cost-effectiveness. IBCs, particularly those made from recyclable materials such as high-density polyethylene (HDPE), align with these sustainability goals by offering reusability and reduced waste generation. This shift toward eco-friendly packaging is driven by both corporate responsibility initiatives and regulatory pressures aimed at reducing carbon footprints. For example, the European Union has implemented stringent policies promoting sustainability and waste reduction, encouraging industries to adopt reusable and recyclable packaging solutions such as IBCs. As environmental concerns continue to influence corporate strategies and consumer preferences, the demand for sustainable packaging solutions such as IBCs is expected to rise during the forecast period.

Growth in Global Chemical and Pharmaceutical Industries

The expansion of the chemical and pharmaceutical sectors significantly contributes to the increasing demand for IBCs. These industries require reliable and safe storage and transportation solutions for various substances, including hazardous materials. IBCs offer sustainable pharmaceutical packaging with durability, chemical resistance, and compliance with stringent safety standards, making them ideal for such applications. The chemical industry's positive outlook, particularly in regions such as China, which leads in chemical exports, underscores the growing need for efficient bulk handling solutions. Similarly, the pharmaceutical industry's emphasis on hygiene and contamination prevention drives the adoption of medical-grade IBCs. As these industries continue to grow, the reliance on IBCs for secure and efficient material handling is anticipated to increase correspondingly. Thus, the growing global chemical and pharmaceutical industries are driving the IBC market development.

Intermediate Bulk Container Market Segment Insights

IBC Market Assessment – by Material

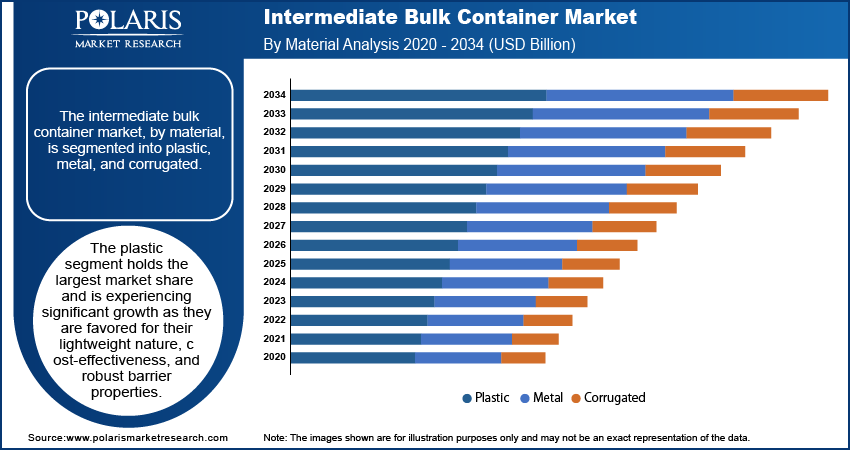

The intermediate bulk container market, by material, is segmented into plastic, metal, and corrugated. The plastic segment holds the largest market share and is experiencing significant growth. Plastic IBCs, predominantly made from high-density polyethylene (HDPE) and polypropylene, are favored for their lightweight nature, cost-effectiveness, and robust barrier properties. These containers offer high tensile strength and are less expensive compared to metal alternatives, making them attractive to various industries. Their ability to withstand diverse weather conditions and safely store hazardous chemicals and sensitive ingredients further enhances their appeal, particularly in manufacturing sectors.

IBC Market Evaluation – by Application

The intermediate bulk container market, by application, is segmented into chemical & petroleum, food, pharmaceutical, construction, and others. The pharmaceutical sector is experiencing significant growth in IBC adoption. This surge is driven by an escalating emphasis on hygiene and contamination prevention, critical factors in pharmaceutical manufacturing and distribution. The industry's stringent requirements for cleanliness and product integrity have led to a heightened demand for medical-grade IBCs that ensure safe and sterile conditions during storage and transport. Manufacturers are increasingly focusing on developing IBCs that meet these rigorous standards, facilitating the sector's swift expansion within the market.

Intermediate Bulk Container Market Regional Insights

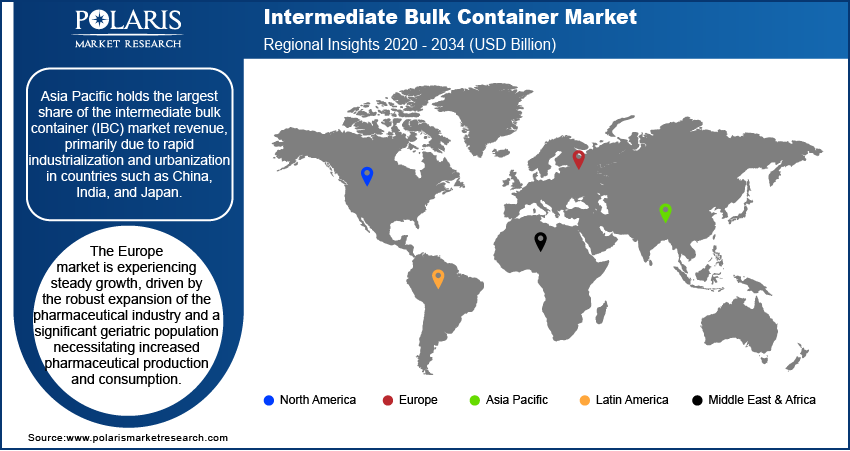

By region, the study provides intermediate bulk container market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific region holds the largest share of the IBC market revenue, primarily due to rapid industrialization and urbanization in countries such as China, India, and Japan. These nations have witnessed substantial growth in sectors such as chemicals, pharmaceuticals, and food and beverages, which are major consumers of IBCs. The expansion of manufacturing activities, coupled with increasing exports and favorable government initiatives, has further propelled the demand for efficient bulk packaging solutions in this region.

The Europe intermediate bulk container market is experiencing significant growth, driven by the robust expansion of the pharmaceutical industry and a significant geriatric population necessitating increased pharmaceutical production and consumption. The region's emphasis on stringent safety and quality standards further propels the demand for high-quality IBCs, particularly those made from plastic materials. Italy, in particular, is expected to register notable growth in the coming years, reflecting the broader regional trend.

Intermediate Bulk Container Market – Key Players and Competitive Insights

The intermediate bulk container market features several active key players. A few notable companies include Bulk Handling Australia Group Pty Ltd; Greif, Inc.; SCHÜTZ GmbH & Co. KgaA; Mauser Packaging Solutions; Hoover Ferguson Group, Inc.; Snyder Industries, Inc.; Time Technoplast Ltd.; and Werit Kunststoffwerke W. Schneider GmbH & Co. KG.

These companies contribute to the competitive landscape of the IBC market through diverse strategies and offerings. Greif, Inc. and SCHÜTZ GmbH & Co. KGaA, for instance, have extensive global operations, providing a wide range of IBC solutions tailored to various industrial needs. Mauser Packaging Solutions, under Stone Canyon Industries, emphasizes sustainability by offering reconditioning services, aligning with environmental initiatives.

Regional players play a significant role in addressing local market demands. For example, Bulk Handling Australia Group serves the Australasian market with customized IBC solutions, and Werit Kunststoffwerke W. Schneider GmbH & Co. KG operates primarily in Europe, offering specialized plastic products. These companies, alongside others such as Orbis Corporation and Snyder Industries, Inc., contribute to a dynamic and competitive IBC market by providing tailored solutions and maintaining strong regional presence.

Greif, Inc., established in 1877 and headquartered in Delaware, Ohio, is a global leader in industrial packaging products and services, operating approximately 188 production locations across 37 countries. The company's product portfolio includes steel, plastic, and fiber drums, intermediate bulk containers, and flexible products, serving diverse industries worldwide.

SCHÜTZ GmbH & Co. KGaA, based in Selters, Germany, specializes in processing metal and plastic to develop innovative packaging solutions. With over 55 production locations globally, SCHÜTZ offers products such as intermediate bulk containers and plastic and steel drums, catering to various industrial sectors.

List of Key Companies in Intermediate Bulk Container Market

- Bulk Handling Australia Group Pty Ltd

- Greif, Inc.

- Hoover Ferguson Group, Inc.

- Mauser Packaging Solutions

- SCHÜTZ GmbH & Co. KGaA

- Snyder Industries, Inc.

- Time Technoplast Ltd.

- Werit Kunststoffwerke W. Schneider GmbH & Co. KG

Intermediate Bulk Container Industry Developments

- October 2024: SCHÜTZ announced the launch of a new plastic frame pallet designed for intermediate bulk containers (IBCs), enhancing the durability and sustainability of their packaging solutions.

- February 2024: Aran Group, an Israel-based manufacturer of sustainable liquid packaging, acquired IBA Germany to develop 1,000-liter IBCs. This acquisition facilitates Aran Group's entry into the German market and enhances its product offerings in the IBC segment.

Intermediate Bulk Container Market Segmentation

By Material Outlook (Revenue – USD Billion, 2020–2034)

- Plastic

- Metal

- Corrugated

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Chemical & Petroleum

- Food

- Pharmaceutical

- Construction

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Intermediate Bulk Container Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 15.13 billion |

|

Market Size Value in 2025 |

USD 15.94 billion |

|

Revenue Forecast by 2034 |

USD 26.03 billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The intermediate bulk container market has been segmented on the basis of material and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The intermediate bulk container market growth and marketing strategy focuses on expanding product innovation, sustainability initiatives, and regional market penetration. Companies are investing in eco-friendly materials and reusable IBC solutions to align with increasing environmental regulations and customer preferences. Strategic mergers and acquisitions, and collaborations are strengthening global supply chains and enhancing production capabilities. Additionally, businesses are leveraging digital marketing, e-commerce platforms, and direct distribution channels to improve market reach and customer engagement. Customization options and industry-specific solutions further drive demand across key sectors such as chemicals, food, and pharmaceuticals.

FAQ's

The market size was valued at USD 15.13 billion in 2024 and is projected to grow to USD 26.03 billion by 2034.

The market is projected to register a CAGR of 5.6% during the forecast period.

Asia Pacific held the largest share of the market in 2024.

The market features several active key players. A few notable companies include Bulk Handling Australia Group Pty Ltd; Greif, Inc.; SCHÜTZ GmbH & Co. KgaA; Mauser Packaging Solutions; Hoover Ferguson Group, Inc.; Snyder Industries, Inc.; Time Technoplast Ltd.; and Werit Kunststoffwerke W. Schneider GmbH & Co. KG.

The plastic IBCs segment accounted for the largest share of the market in 2024.

An intermediate bulk container (IBC) is a reusable, industrial-grade container designed for the storage, transportation, and handling of bulk liquids, semi-solids, and granulated substances.