Interactive Whiteboard Market Size, Share, Trends, Industry Analysis Report: By Technology, Form, Projection Technique, Screen Size, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 107

- Format: PDF

- Report ID: PM1899

- Base Year: 2023

- Historical Data: 2019-2022

Interactive Whiteboard Market Overview

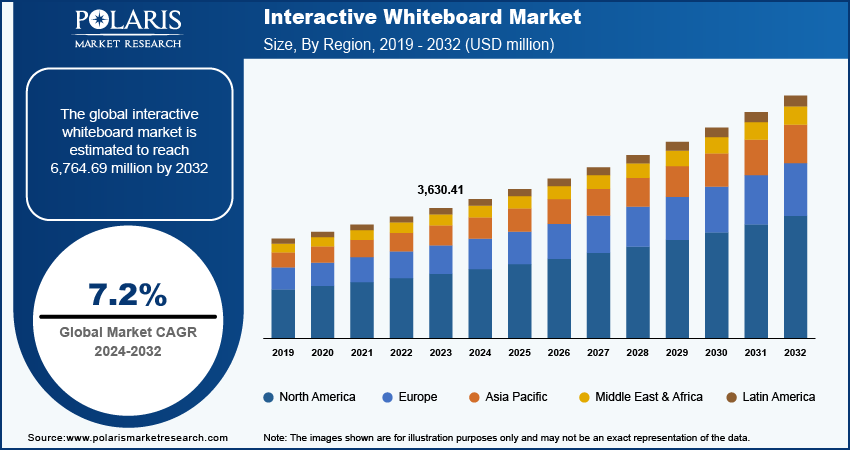

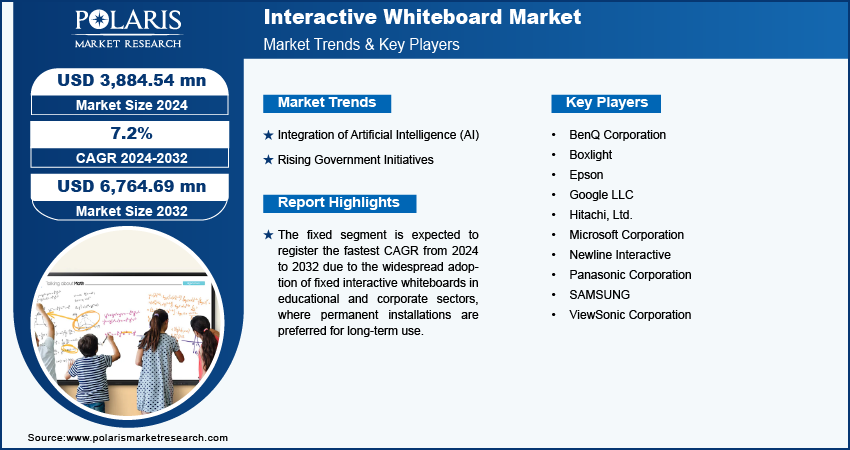

The interactive whiteboard market size was valued at USD 3,630.41 million in 2023. The market is projected to grow from USD 3,884.54 million in 2024 to USD 6,764.69 million by 2032, exhibiting a CAGR of 7.2% from 2024 to 2032.

The interactive whiteboard market involves the production of electronic boards that allow users to interact with content using a touch or a digital pen. These boards are commonly used in classrooms, business meetings, and presentations to make sessions more engaging and interactive.

The interactive whiteboard market is growing rapidly due to the rising need for digital learning tools and collaborative workspaces. Technological advancements enable instructors to use high-quality videos, graphics, photographs, and internet connectivity, enhancing their ability to work efficiently and driving the growth of the interactive whiteboard market.

To Understand More About this Research: Request a Free Sample Report

The need for interactive whiteboards that support remote work settings is another major contributor to the expansion of the interactive whiteboard market size. More companies are embracing remote work policies as this facilitates communication between teams working from offices and employees working from home. The key market players are catering to the market demand by introducing new products.

For instance, in March 2024, Cisco Systems, Inc. introduced the Cisco Board Pro G2, an all-in-one interactive whiteboard for productivity and remote collaboration. This board has built-in intelligence and open integrations to offer distant participants a seamless, secure collaboration experience.

Interactive Whiteboard Market Trends and Drivers

Integration of Artificial Intelligence (AI)

The interactive whiteboard market is experiencing growth due to the integration of artificial intelligence in whiteboard technology. AI brings advanced features such as handwriting recognition, voice commands, and real-time language translation, making the boards more versatile and user-friendly. These capabilities cater to a broader range of consumers and improve student engagement by allowing easy conversion of handwritten notes into digital text and reducing language barriers through instant translations.

For example, in May 2024, at ISTELive 2024, Samsung introduced an AI class assistant for the interactive whiteboard display. The AI-powered features include voice-activated whiteboard capabilities, generative class summaries and quizzes, and automatic transcription, all of which enhance student engagement.

AI-driven interactive whiteboards adapt to individual user preferences and learning styles, providing personalized experiences that improve engagement and productivity in the educational sector, driving market expansion.

Rising Government Initiatives

The interactive whiteboard market is experiencing significant growth, driven by government initiatives that are significantly investing in and promoting digital education. Governments are prioritizing the modernization of educational infrastructure to prepare students for a technology-driven future. This includes collaboration with market players for smart classrooms equipped with interactive whiteboards to enhance the learning experience.

For instance, in September 2023, LG launched interactive whiteboards in collaboration with the government of Puducherry as part of a School Education Department. This initiative is said to improve student learning.

Government policies supporting digital literacy and the integration of technology in teaching methodologies are propelling the adoption of interactive whiteboards, driving the interactive whiteboard market revenue.

Interactive Whiteboard Market Segment Insights

Interactive Whiteboard Market Breakdown by Form Insights

The interactive whiteboard market segmentation, based on form, includes fixed and portable. The fixed segment is expected to register the fastest CAGR from 2024 to 2032 due to the widespread adoption of fixed interactive whiteboards in educational and corporate sectors, where permanent installations are preferred for long-term use.

Fixed interactive whiteboards offer stability, have larger display sizes, and are often integrated into the infrastructure of classrooms and conference rooms, making them ideal for regular, intensive use. Additionally, advancements in technology, such as 4K Ultra HD resolution and AI integration, enhance the functionality and user experience of fixed boards.

For instance, in May 2024, SHARP launched a fixed Ultra HD 4K interactive whiteboard to promote workplace collaboration, enable extraordinary solutions that empower enterprises, and increase company efficiency through impactful presentations.

Interactive Whiteboard Market Breakdown by Application Insights

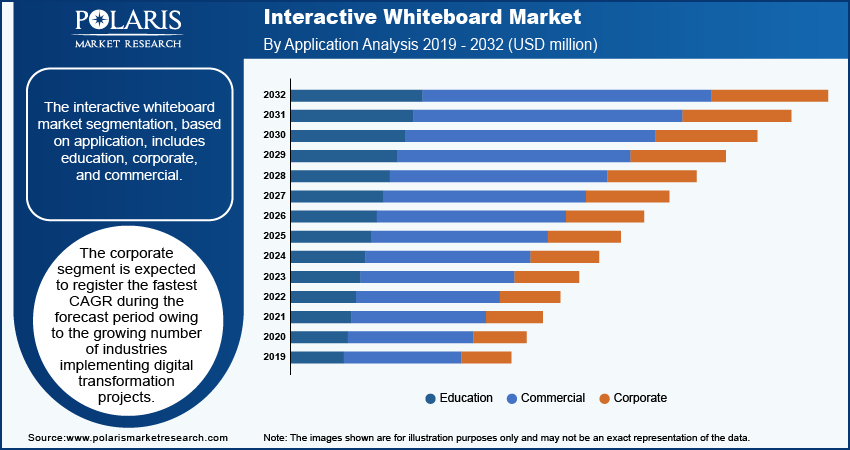

The interactive whiteboard market segmentation, based on application, includes education, corporate, and commercial. The corporate segment is expected to register the fastest CAGR during the forecast period owing to the growing number of industries implementing digital transformation projects.

Businesses utilize interactive whiteboards to increase their productivity and efficiency by digitizing manual workflows and streamlining procedures. The fixed interactive whiteboards are essential to facilitate virtual meetings and video conferences, offer multimedia presentations, collaborate on digital documents, and promote corporate innovation and agility.

For instance, in September 2021, Dahua Technology launched DeepHub, a smart interactive whiteboard designed specifically for the corporate sector to enable effective and cooperative video conferences.

Interactive Whiteboard Market Breakdown by Regional Insights

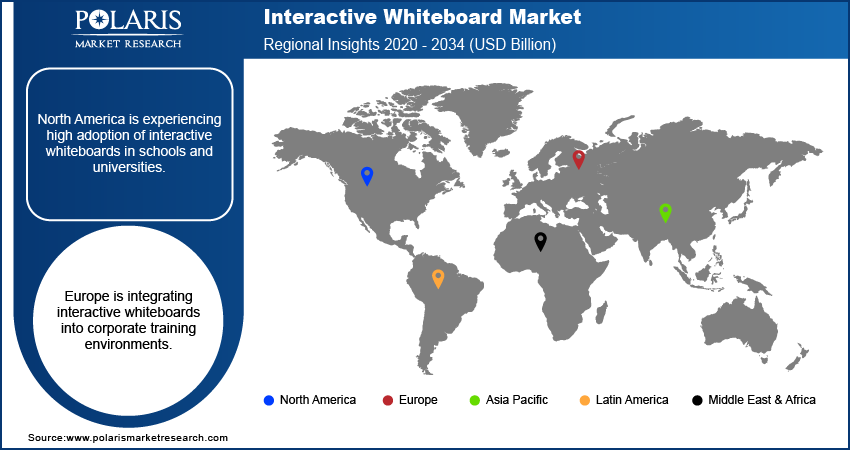

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the interactive whiteboard market in 2023 due to schools in this region adopting advanced technologies. The interactive whiteboards can support group activities and interactive presentations, further driving their adoption to enhance interactive and collaborative learning settings.

For instance, in May 2024, BenQ reported that around 1,800 BenQ Boards have been installed in K-12 classrooms throughout the 45 schools in the Spring Independent School District in North America.

The US interactive whiteboard market accounted for a significant market share, owing to the role of interactive whiteboards in learning management systems (LMS), which are being extensively deployed in both corporate and academic settings. Moreover, interactive whiteboard assists students and teachers in lesson preparation, content distribution, and evaluation procedures with LMS, propelling the market expansion.

Asia Pacific interactive whiteboard market is expected to register the fastest CAGR from 2024 to 2032. This is due to the increase in the adoption of student information systems and e-learning solutions. Technological advancements, a rise in internet penetration, and a growing emphasis on remote learning and digital literacy are driving the adoption of interactive whiteboards.

In order to improve the educational experience, educational institutions in this region are progressively incorporating the newest technology into teaching approaches.

India interactive whiteboard market accounted for a significant market share owing to the presence of producers and exporters of interactive whiteboards. They provide a range of products to meet the rising demands from corporate and educational sectors. The key players are also focused on introducing digitalized interactive whiteboards to cater to the Indian market.

For instance, in August 2022, Samsung launched the Samsung Flip, a digital interactive whiteboard in India for Rs. 3,00,000. It is customizable, comes with smart features, and has 20 pages of writing space for users to enhance work productivity.

Interactive Whiteboard Market – Key Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the interactive whiteboard market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the interactive whiteboard market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers to benefit clients and increase the market sector. In recent years, the interactive whiteboard market has offered some technological advancements. Major players in the interactive whiteboard market include BenQ Corporation; Boxlight; Epson; Google LLC; Hitachi, Ltd.; Microsoft Corporation; Newline Interactive; Panasonic Corporation; SAMSUNG; and ViewSonic Corporation.

BenQ Corporation is a company that develops technology products, computing, consumer electronics, and communications devices. The company’s product portfolio includes monitors, projectors, lighting, interactive displays, and mobile computing devices. BenQ operates in Europe, Asia Pacific, Latin America, and North America. In September 2023, BenQ Corporation collaborated with Marshmallow Games to create interactive panels and visual displays for a more immersive and interesting learning environment for instructors and students around the United Kingdom.

Microsoft Corporation is a multinational technology company known for its software products, hardware devices, and cloud services. Its product portfolio includes the Windows operating system, Microsoft 365 suite, Xbox gaming consoles, and Azure cloud computing platform, along with hardware like Surface tablets and PCs. Microsoft offers a wide range of services, including cloud-based solutions, consulting, and support services. The company operates through subsidiaries, such as Microsoft Canada and Microsoft Germany. The company has a global presence in the Americas, Europe, and Asia Pacific. In October 2022, Microsoft introduced the Post-it App for Teams in association with 3M to enhance teamwork in mixed work settings. The software was created to bridge the gap between the real and virtual worlds by enabling users to create and manage ideas using a digital whiteboard tool.

List of Key Companies in Interactive Whiteboard Market

- BenQ Corporation

- Boxlight

- Epson

- Google LLC

- Hitachi, Ltd.

- Microsoft Corporation

- Newline Interactive

- Panasonic Corporation

- SAMSUNG

- ViewSonic Corporation

Interactive Whiteboard Industry Developments

July 2024: Sharp launched Interactive Whiteboards for teaching. The Interactive Whiteboards are available in three distinct screen sizes: PN-LC652 (65"), PN-LC862 (86"), and PN-LC752 (75") to accommodate a range of room sizes.

January 2024: The MimioPro G Interactive Flat Panel was launched by Boxlight. It is a comprehensive classroom solution with an interactive flat panel display and advanced security features. The display also features a high-precision infrared touch frame with a dynamic stylus.

October 2023: STS Education partnered with Samsung to use interactive whiteboards to promote cooperative learning in the classroom. The goal of the partnership was to improve student engagement by combining technology with education.

Interactive Whiteboard Market Segmentation

By Technology Outlook

- Infrared

- Resistive touch

- Electromagnetic pen

- Capacitive

- Others

By Form Outlook

- Fixed

- Portable

By Projection Technique Outlook

- Rear Projection

- Front Projection

By Screen Size Outlook

- < 50 Inch

- 50-70 Inch

- 71-90 Inch

- > 90 Inch

By Application Outlook

- Education

- Commercial

- Corporate

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Interactive Whiteboard Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 3,630.41 million |

|

Market Size Value in 2024 |

USD 3,884.54 million |

|

Revenue Forecast in 2032 |

USD 6,764.69 million |

|

CAGR |

7.2% from 2024–2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

· By Technology · By Form · By Projection Technique · By Screen size · By Application |

|

Regional Scope |

· North America · Europe · Asia Pacific · Latin America · Middle East & Africa |

|

Competitive Landscape |

Interactive Whiteboard Industry Trends Analysis (2023) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The interactive whiteboard market size was valued at USD 3,630.41 million in 2023 and is projected to be valued at USD 6,764.69 million in 2032.

The market is projected to grow at a CAGR of 7.2% from 2024 to 2032.

North America had the largest share of the market in 2023.

The key players in the market are BenQ Corporation; Boxlight; Epson; Google LLC; Hitachi, Ltd.; Microsoft Corporation; Newline Interactive; Panasonic Corporation; SAMSUNG; and ViewSonic Corporation.

The fixed segment is expected to register the fastest CAGR in the market.

The corporate segment is anticipated to witness the fastest CAGR from 2024 to 2032.