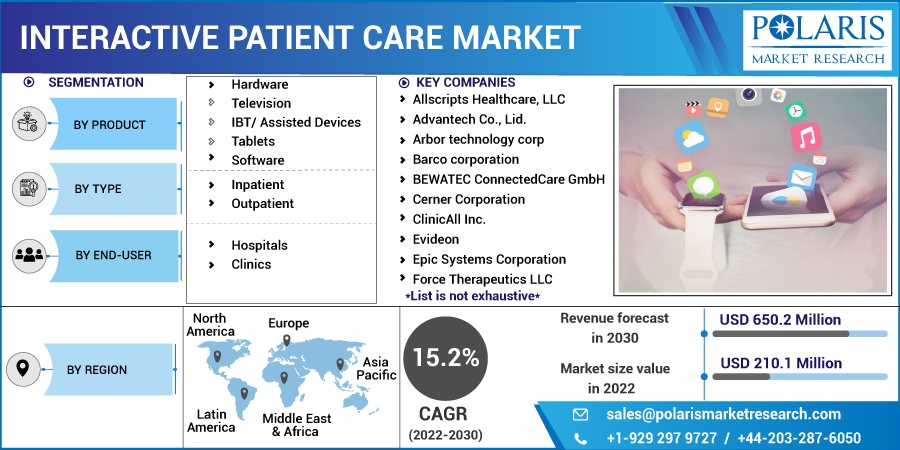

Interactive Patient Care Market Share, Size, Trends, Industry Analysis Report, By Product (Hardware, Software); By Type; By End User; By Region; Segment Forecast, 2022-2030

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2887

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

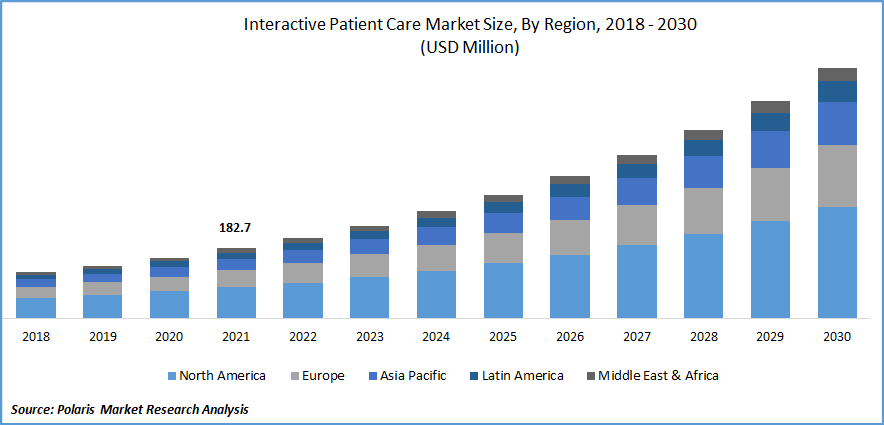

The global interactive patient care market was valued at USD 182.7 million in 2021 and is expected to grow at a CAGR of 15.2% during the forecast period.

Increasing need for tracking patient data along growing adoption of interactive patient engagement solutions is projected to drive the industry growth. IPC systems can be installed on laptops, tablets, cellphones, or desktop PCs and are frequently made for usage in emergency rooms or intensive care units in hospitals. By using an interactive system like IPACS, clinicians and patients will be able to communicate their medical needs more effectively.

Know more about this report: Request for sample pages

Benefits include better clinical outcomes due to better data management as well as chances for cost savings due to fewer mistakes brought on by misunderstandings between staff members who would not have been able to collaborate since they were located in various areas of the hospital.

The utilization of patient engagement solutions has increased dramatically around the globe as a result of factors including the burden of chronic illnesses and the aging population. For instance, the American Diabetes Association 2020 estimates that 1.5 million new cases of diabetes are diagnosed each year in the United States. According to the International Diabetic Federation, around 425 million, several diabetic patients were reported, in 2015, globally, whereas this number is estimated to grow to about 578 million by 2030 and about 700 million by 2045. Thus, the increased cases of chronic disease across the globe have increased the requirement for medical devices such as IPC. It is gradually used to diagnose and treat physiological parameters like blood pressure, heartbeats, blood sugar levels, and many more.

Moreover, companies are concentrating on the innovation of patient-centric engagement solutions in response to the increasing number of diabetic patients. For instance, in May 2022, the comprehensive lifestyle medicine program called GOQii Diabetes Care was introduced by GOQii. The Central Drugs Standard Control Organization (CDSCO) has registered wearable smart devices as diagnostic instruments, and all data produced by GOQii devices are suitable for use in clinical applications. Also, in December 2020, Roche launched a digital solution to customize diabetes therapy in Thailand. The software platform for Roche Diabetes Care gathers and stores all patient-related health data and enables interaction between patients and their medical teams. Programs like these also aid in improving efficiency, clinical results, and cost assessment.

The COVID-19 Public Health Emergency of International Concern has presented health systems with difficulty as they try to manage increasing COVID-19 cases, while also providing necessary medical care. This has influenced the emergence of specific advice on outstanding measures, transitory strategies for the sensible use of the PPE, patient management, community facilities, & policy considerations, bringing IPC & WASH practices from healthcare settings to the general public. These have all contributed to the need for emergency protocols around the world.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising adoption of IPC solutions in the healthcare sector, owing to their benefits, is projected to boost market growth over the forecast period. Due to patient case management software, hospitals can keep track of patient data, including test results and other information. Both nurses and doctors use these solutions for documentation needs. The insights devised from such technology enable hospital administrators to pinpoint the underlying causes of issues in their healthcare system.

Additionally, remote monitoring technologies offer real-time alerts on crucial vitals like blood pressure, weight, glucose level, etc., which can be monitored from anywhere in the world via a computer device or smartphone application. This solution enables patients with complex medical conditions or multiple chronic illnesses to live at home.

In addition, by utilizing patient engagement software, hospitals can build close bonds with their patients. The fundamental goal of patient engagement solutions is to enhance interactions and communication between a patient and a healthcare professional, particularly throughout a patient appointment or consultation.

Doctors can monitor a patient's development with this approach throughout their therapy. In November 2021, MyHealthcare teamed up with international technology providers like Amazon, Microsoft, and others to integrate digital clinical solutions across a sizable healthcare data lake. The company then uses this data to construct a patient process that requires a map. Thus, these innovations are propelling market growth.

Report Segmentation

The market is primarily segmented based on product, type, end-user, and region.

|

By Product |

By Type |

By End-User |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The software segment is expected to witness the fastest growth

Growing penetration of software-based solutions in IPC is projected to segment growth over the forecast period. IPC system that can be accessed through web browsers is software. Compared to the conventional software approach, it gives healthcare providers better access to patient data and a chance for more effective, efficient communication. In many situations, web applications offer a more affordable choice because they frequently have lower costs than their desktop equivalents while utilizing the same technical needs. An application that can be accessed online through a browser is referred to as web-based software. Servers, which may be internal or external to the firm, host the data and code. Web apps are developing into central platforms as they provide more advanced functionality in areas like analytics, artificial intelligence (AI), Internet of Things (IoT) integration, and mobile capabilities.

The Inpatient segment industry accounted for the highest market share in 2021

In-patient and out-patient solutions make up two halves of the interactive patient management solutions market. Patients are safer in hospitals due to interactive patient care. The care team can change these systems' parameters to provide notifications in the event of an anomaly. Because these devices are integrated, the alarms are reflected on the main dashboard, allowing the patient to receive quick medical attention. Patient care in hospitals is becoming more proactive as a result of process automation in interactive patient care platforms. It is simple to set up any alert regarding a patient's medicine. All of these steps raise patient satisfaction levels while also enhancing the patient care cycle.

The demand in North America is expected to witness significant growth

North America is anticipated to have the greatest revenue market share. Due to their intense focus on enhancing the general quality of care given to patients, healthcare organizations in countries like Canada and the US are increasingly using patient experience software, which is the cause of the increase. The main drivers promoting the market growth of this sector include favorable government initiatives, the rising prevalence of chronic diseases, and growing consumer awareness of digital healthcare goods.

The market for interactive patient engagement solutions in Asia is expanding as a result of increased government healthcare spending and encouraging the implementation of HCII solutions. Authorities in China are focusing on revamping the country's healthcare management sector, which is currently dealing with issues like underfunded rural health facilities, overburdened metropolis hospitals, and a shortage of doctors nationally. Technology improvements are playing a significant part in this effort.

Behind the United States, China presently holds the second-place spot globally in the healthcare sector. The Chinese government is advising hospitals all around the nation to integrate Internet use into their clinical workflows. The intention is to promote the use of telemedicine technologies, enabling patients and clinicians in underserved regions to consult with the nation's top medical professionals, who are often headquartered in bigger cities like Beijing and Shanghai.

Competitive Insight

Some of the major players operating in the global market include Allscripts Healthcare, LLC, Advantech Co., Lid., Arbor technology corp., Barco corporation, BEWATEC ConnectedCare GmbH, Cerner Corporation, ClinicAll Inc., Evideon, Epic Systems Corporation, Force Therapeutics LLC, GetWellNetwork Inc., Greenway Health, LLC, HealthHub Patient Engagement Solutions, Klara Technologies, Inc., McKesson Corporation, Medix-Care GmbH, Onyx Healthcare, Inc., PDi Communications Systems Corp., SONIFI Health Inc., Siemens AG, Vecoton Industries Ltd., and Wolters Kluwer N.V.

Recent Developments

In September 2022, Dash Chat was introduced by Relatient. It is an interactive chat program that provides straightforward two-way communication between staff and clients on the website of the provider group. By providing constant access to care, the system increases patient satisfaction by enabling employees and clinicians to handle routine patient inquiries swiftly, while also lowering call volume.

In September 2021, The collaboration between Imprivata and Advantech to make sure Advantech products are compatible with the Imprivata OneSign single sign-on (SSO) authentication solution benefited both players. The collaboration intends to certify medical PCs and tablets for better data security in healthcare.

Interactive Patient Care Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 210.1 million |

|

Revenue forecast in 2030 |

USD 650.2 million |

|

CAGR |

15.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Product, By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Allscripts Healthcare, LLC, Advantech Co., Lid., Arbor technology corp., Barco corporation, BEWATEC ConnectedCare GmbH, Cerner Corporation, ClinicAll Inc., Evideon, Epic Systems Corporation, Force Therapeutics LLC, GetWellNetwork Inc., Greenway Health, LLC, HealthHub Patient Engagement Solutions, Klara Technologies, Inc., McKesson Corporation, Medix-Care GmbH, Onyx Healthcare, Inc., PDi Communications Systems Corp., SONIFI Health Inc., Siemens AG, Vecoton Industries Ltd., and Wolters Kluwer N.V. |