Intelligent Document Processing Market Share, Size, Trends, Industry Analysis Report

By Technology; By Component; By Deployment Mode; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 116

- Format: PDF

- Report ID: PM2984

- Base Year: 2024

- Historical Data: 2020-2023

What is the Market Size of Intelligent Document Processing Market?

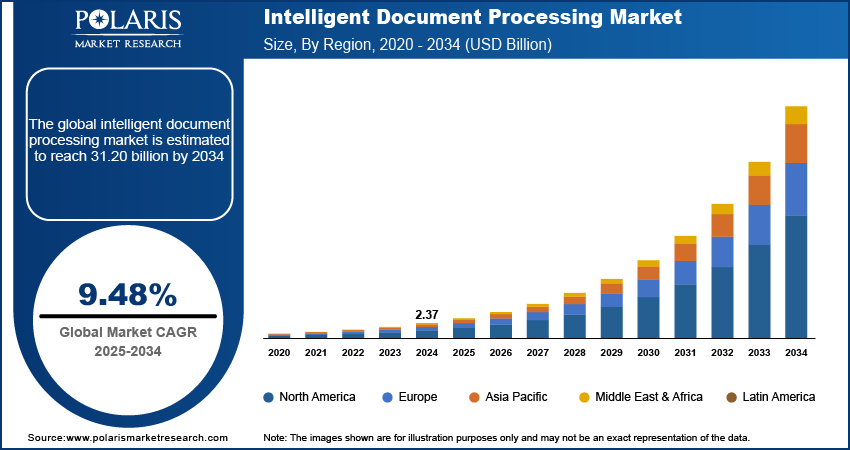

The global intelligent document processing market was valued at USD 2.37 billion in 2024 and is expected to grow at a CAGR of 29.50% during the forecast period. Key factors driving the demand includes growing investments in digital transformation, increasing need for efficient and cost-effective document processing solutions.

Key Insights

- The robotic process automation (RPA) segment is expected to witness robust growth during the forecast period. This is due to intelligent automation, which requires intelligent document processing as a key component.

- In 2024, the healthcare and Life Sciences segment held the largest share of the market, as many life sciences organizations seek effectiveness and control over the regulatory process.

- In 2024, North America held the largest market share. This is due to the rapid adoption of advanced technologies, including AI, machine learning, NLP, and computer vision.

- Europe is expected to experience significant growth during the forecast period, driven by the increasing adoption of IDP technologies to enhance banking procedures.

Industry Dynamics

- Rising investments in digital transformation have increased the demand for IDP to automate the processing of vast document archives, as companies shift from paper-based to digital workflows.

- The increasing need for efficient and cost-effective document processing solutions reduces operational costs and improves workflows and accuracy, delivering a clear ROI.

- Processing of unstructured or complex documents creates challenges as it requires custom solutions.

- The demand for AI tools to process unstructured data creates growth opportunities for automating extraction and classification.

Market Statistics

- 2024 Market Size: USD 2.37 billion

- 2034 Projected Market Size: USD 31.20 billion

- CAGR (2025-2034): 29.48%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

What Does the Current Market Landscape Look for Intelligent Document Processing Industry?

Intelligent document processing (IDP) tools convert semi- and unstructured data into usable information. Organizational data is the driving force behind digital transformation, but 80% of all organizational data is sadly trapped in unstructured forms including business papers, emails, photos, and PDF documents. Intelligent document processing is becoming more popular because it offers innovative ways to automate data extraction tasks that were previously very challenging, if not impossible, to complete. Aside from other benefits, using an intelligent document processing technology can directly save costs and increase accuracy, operational efficiencies, and strategic goal achievement. The next stage of automation is called intelligent document processing (IDP), and it captures, extracts, and processes data from various formats. To classify, categorize, extract relevant information, and verify the collected information, it makes use of artificial intelligence technologies such as natural language processing (NLP), learning techniques, computer vision, and machine learning (ML).

Additionally, document processing is a word that is familiar to many businesses, and business departments have been conducting it regularly for several years. It is the process of transforming a document's (physical or electronic) contents into something useful and meaningful. Due to the enormous volume of documents received, the repetitive and manual nature of the duties necessary for document processing makes them labor-intensive and frequently unsatisfying for the personnel.

The amount of data produced by businesses is increasing exponentially, which is the main factor boosting the intelligent document processing market. With the explosion of digital transformation, data is being generated by enterprises at an accelerated rate. Industry experts predict that by 2025, global data would amount to more than 175 zettabytes. The majority of this data is only available in text, emails, PDFs, and scanned documents. The government sector, including the banking, finance, healthcare, and education sectors, has traditionally had trouble manually processing documents.

However, the procedures become more efficient with the introduction of sophisticated document processing systems. Invoices, sales orders, and other semi-structured and unstructured documents that are frequently insufficiently processed by rules-based automation software are received in large quantities by organizations. As a result, intelligent document processing solutions have become increasingly important to businesses and are anticipated to experience rapid adoption during the anticipated timeframe.

However, international regulations governing document processing have tightened. Additionally, compliance standards are subject to periodic revision, which is anticipated to be a significant barrier for the market. The laws governing document and data processing frequently change, particularly in the US and Europe. The need to comply with these rules is anticipated to be a significant barrier for market participants in intelligent document processing.

Industry Dynamics

Growth Drivers

What are the Factors Driving the Expansion Opportunities?

The use of AI for document processing has increased as a result of AI developments and simple tools. Digitalization is becoming crucial in the modern day if a business wants to remain competitive. Technology enabled by artificial intelligence (AI) has fast gone from the fringe to the mainstream. The major players in the market are focusing on the development of AI-based platforms which is bolstering the growth of the market. For instance, in March 2021, ABBYY introduced Vantage 2, a no-code platform. Vantage 2 gives digital workers and procedures cognitive skills that read, comprehend, and extract information from documents, assisting businesses in accelerating their digitalization.

ABBYY Marketplace, which the business also introduced, offers a sizable online library of reusable technological assets, including cognitive abilities for classification tasks and data extraction, ready-to-use process flows, and which were before connectors. Marketplace provides pre-trained abilities for all types of papers, including invoices, customer orders, receipts, loan paperwork, insurance claims, bills of lading, and more, as more businesses become attracted to the try-and-buy technique. Therefore, advanced technologies must be combined with current intelligent document processing.

Report Segmentation

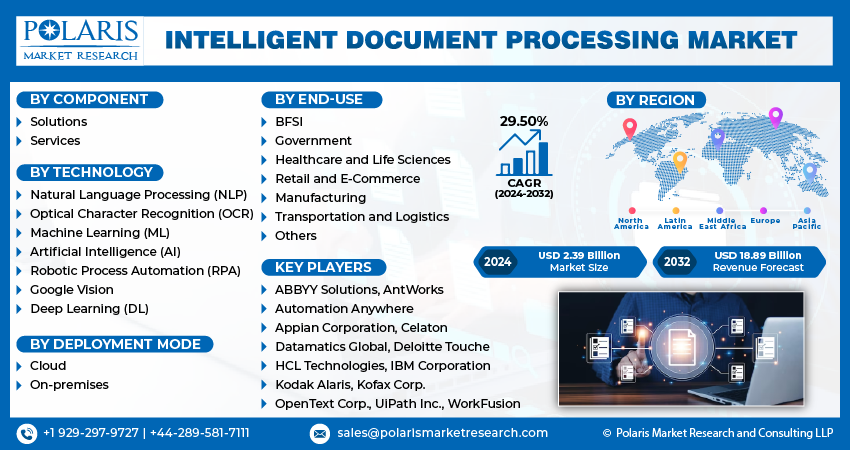

The market is primarily segmented based on component, technology, deployment mode, end-use, and region.

|

By Component |

By Technology |

By Deployment Mode |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Segmental Insights

Technology Analysis

Which Segment by Technology is Expected to Witness the Fastest Growth?

The robotic process automation (RPA) segment is expected to witness the fastest growth during the forecast period as intelligent automation requires intelligent document processing as a key component. Automation can only go so far, though, if there is data to work with. The majority of business activities that currently depend on manual inputs and involvement can be automated with the help of effective data extraction and information structuring. Business users can fully automate their operations by integrating their IDP and RPA platforms.

Together, IDP and RPA offer a straightforward yet powerful solution for automating enterprise business activities. IDP tools are equally as non-intrusive, integrable, and broadly applicable across sectors and business functions as RPA. Therefore, combining RPA and IDP could open up new business potential for various sectors of the economy as well as lucrative revenue and sales opportunities for manufacturers of intelligent document processing.

End Use Analysis

Why Healthcare and Life Sciences Segment Held the Largest Share?

Healthcare and Life Sciences segment held the largest share of the market in 2024 as many life sciences organizations are looking for effectiveness and control over the regulatory process. In the field of regulatory information management (RIM), there is a greater need for efficiency, accuracy, and streamlined procedures. Projects that will swiftly provide the greatest benefit to patients are given priority. When it comes to registering insurance claims, RPA and intelligent document processing abilities can reduce the need for human intervention, lessening the workload on insurance customer advisers. In the middle of the pandemic, the insurance industry has emerged as a significant vertical, adopting intelligent document processing technologies in conjunction with RPA more frequently.

Smart cities use outdated paper-based processes like processing invoices are used. Citizens may stay connected and educated by installation of the IDP solution that can read, analyze, & produce timely, accurate data. Additionally, they would get earlier access to crucial information & services.

Regional Analysis

What are the Factors for the North America Region's Domination?

North America dominated the market share in 2024. This is due to the region's increasing industry vertical adoption and rising IT spending. Enterprises are adopting advanced technologies like AI, machine learning, NLP, and computer vision very quickly. The market is growing because regional companies are setting the standard for machine learning, artificial intelligence, character recognition, and natural language processing. The existence of significant corporations is another important element in North America's acceptance of intelligent document processing. The government, logistics and transportation, BFSI, and the healthcare and life sciences sectors are among those leading the way in implementing intelligent document processing technologies.

Why Europe is Projected to Witness Substantial Growth?

Europe is expected to witness significant growth during the forecast period. This is due to the expansion of the regional market being supported by the BFSI sector. Europe's growing adoption of IDP technologies to enhance banking procedures also contributes to the growth opportunities. Within the European market, the UK has the largest share. Significant amounts of money are also coming into the European market from Germany and France. The deployment of IDP technologies has been significantly seen in the Benelux and Nordic nations. To protect sensitive consumer data, several government rules and compliances encourage the implementation of IDP solutions, which would boost the expansion of the regional IDP market. These elements are working together to fuel the expansion of the market in this area.

Competitive Insight

Some of the major players operating in the global market include ABBYY Solutions, AntWorks, Automation Anywhere, Appian Corporation, Celaton, Datamatics Global, Deloitte Touche, HCL Technologies, IBM Corporation, Kodak Alaris, Kofax Corp., OpenText Corp., UiPath Inc., and WorkFusion.

Recent Developments

- July 2024: Reveille Software and ABBYY collaborated to Advance IDP with Advanced Monitoring and Visibility, providing the combined cluster of customers with benefits such as touchless processing, rapid onboarding, significantly reduced costs, and enhanced visibility.

- March 2021: Deloitte and Automation Anywhere, a leader in robotic process automation and provider of cloud-native, web-based, intelligent automation solutions, forged a partnership. This partnership sought to promote cloud deployments on Automation 360. To deliver a groundbreaking solution that successfully transforms customer automation to the cloud, empowering businesses to increase the rate and delivery of company performance while also significantly lowering costs, Deloitte is expected to incorporate its world-class capabilities in cloud infrastructure & robotization.

- February 2021: Kofax collaborated with Coupa Software. This partnership intends to support businesses as they digitally modernize their spending management procedures.

Intelligent Document Processing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.37 billion |

| Market size value in 2025 | USD 3.05 billion |

|

Revenue forecast in 2034 |

USD 31.20 billion |

|

CAGR |

29.48% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Component, By Deployment Mode, By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

ABBYY Solutions Limited, AntWorks, Automation Anywhere Incorporation, Appian Corporation, Celaton GmbH, Datamatics Global Services Limited (Delta Infosolutions Private Limited), Deloitte Touche Tohmatsu Limited, HCL Technologies Limited, IBM Corporation, Kodak Alaris GmbH, Kofax Corp., OpenText Corp., UiPath Inc., and WorkFusion Corporation |

FAQ's

Intelligent Document Processing Market Size Worth USD 31.20 Billion By 2034.

key players are ABBYY Solutions, AntWorks, Automation Anywhere, Appian Corporation, Celaton, Datamatics Global, Deloitte Touche, HCL Technologies, IBM Corporation, Kodak Alaris.

North America dominated the global intelligent document processing market in 2024.

The global intelligent document processing market expected to grow at a CAGR of 29.48% during the forecast period.

key segments are component, technology, deployment mode, end-use, and region.