Intelligent Building Automation Technologies Market Size, Share, Volume, Trends, Industry Analysis Report

By Component (Hardware, Software, Services), By End User, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 117

- Format: PDF

- Report ID: PM1431

- Base Year: 2024

- Historical Data: 2020-2023

Overview

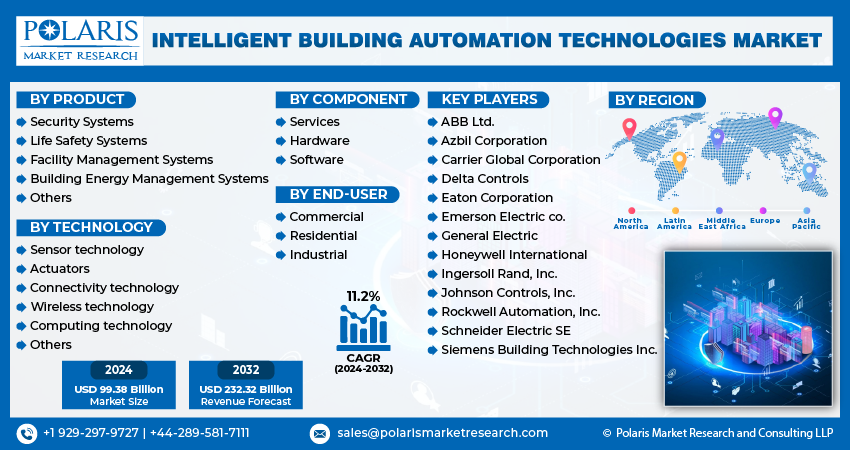

The global intelligent building automation technologies (IBAT) market size was valued at USD 93.61 billion in 2024, growing at a CAGR of 10.32% from 2025 to 2034. Expanding urbanization worldwide drives the demand for intelligent building automation technologies. Also, rising demand for smart homes and increasing investments in the development of smart cities propel industry growth.

Key Insight

- The hardware segment accounted for 46.25% of revenue share in 2024. The hardware segment witnessed 663 million unit sales in 2024. The widespread deployment of IoT sensors, controllers, access control systems, and HVAC control devices propels the demand for hardware.

- 55 million licenses were registered under the software segment in the industry in 2024. The growing emphasis on data-driven decision-making and real-time analytics fuels the requirement for software.

- The commercial segment was valued at USD 50.53 billion in 2024. The high demand for smart infrastructure across office complexes, airports, shopping malls, hospitals, and hotels drives the dominance.

- The North America market accounted for 39.56% of global market share in 2024. The region witnessed 254 million unit sales of hardware components in 2024. The growth is driven by the investments in the development of smart cities.

- The U.S. held a 78.02% share of the North America market in 2024. Strict energy regulations, corporate sustainability goals, and the proliferation of smart buildings boost the U.S. market.

- The intelligent building automation technologies industry in Asia Pacific is registering a CAGR of 11.71% from 2025 to 2034. The growth is fueled by rapid urbanization and smart city projects.

Industry Dynamics

- Rising demand for smart homes propels the adoption of intelligent building automation technologies to manage smart home solutions.

- Increasing investments in the development of smart cities boost the adoption of intelligent building automation technologies. Smart city management needs intelligent building automation technologies to enhance security.

- The rising focus on energy efficiency globally would create a lucrative opportunity during the forecast period.

- The high cost of intelligent building automation technologies hinders the market growth.

Market Statistics

- 2024 Market Size: USD 93.61 billion

- 2034 Projected Market Size: USD 248.37 billion

- CAGR (2025–2034): 10.32%

- North America: Largest market in 2024

AI Impact on Intelligent Building Automation Technologies Market

- Artificial intelligence revolutionizes the intelligent building automation technologies market. The technology is turning traditional structures into responsive, efficient ecosystems.

- AI-enabled energy management systems analyze usage patterns and dynamically adjust lighting, HVAC, and power distribution to reduce waste.

- The technology adapts HVAC settings in real time based on weather, user preferences, and occupancy.

- AI enhances building security as it is integrated into facial recognition, anomaly detection, and automated threat response systems.

- AI tools analyze foot traffic and usage patterns to optimize lighting zones, space allocation, and cleaning schedules.

The global intelligent building automation technologies (IBAT) market refers to the ecosystem of smart technologies integrated into buildings. The technologies are used to automate and optimize the management of various systems, including heating, ventilation, air conditioning (HVAC), lighting, security, energy, and other essential functions. They use a network of sensors, controllers, and software platforms. The platforms powered by artificial intelligence (AI), the Internet of Things (IoT), and advanced analytics create more responsive, energy-efficient, and secure building environments.

One of the fundamental advantages of intelligent building automation is energy efficiency. Automated systems continuously monitor energy consumption patterns and environmental conditions. It enables real-time adjustments that reduce energy waste. Smart lighting systems dim or switch off based on occupancy or natural light levels. Intelligent HVAC systems adjust temperatures based on room usage and external weather data. This reduces operational costs and contributes to sustainability efforts and lowers a building’s carbon footprint.

Safety and security are strengthened through intelligent building automation. Advanced security systems in smart buildings include biometric access controls, real-time surveillance with facial recognition, intrusion detection, and emergency response automation. These systems can be centrally managed and integrated with building management platforms. This allows immediate alerts and actions in case of emergencies. Thus, the use of such systems improves the overall safety and resilience of facilities.

The expanding urbanization worldwide drives the demand for intelligent building automation technologies. World Economic Forum, in its 2022 report, stated that the share of the world’s population living in cities is expected to rise to 80% by 2050. This increase in urbanization is creating pressure on developers and property managers. They seek intelligent building automation technologies (IBAT) to optimize energy use, enhance security, and improve occupant comfort in high-density environments. Additionally, the demand for seamless connectivity and data-driven management in modern urban infrastructure propels the adoption of IBAT.

Rising Demand for Smart Homes: Consumers demand smart homes for luxury and comfort. These smart homes feature voice-controlled lighting, smart thermostats, and automated security systems. Developers and manufacturers integrate intelligent building automation technologies to manage integrated smart solutions. Additionally, energy-saving regulations and rising utility costs prompt homeowners to prefer smart homes. Thus, rising demand for smart homes boosts the requirement for scalable, intelligent building automation technologies.

Increasing Investments in Development of Smart Cities: Smart cities require buildings to integrate automation systems for energy management, real-time monitoring, and optimized resource use. The push for data-driven smart city management accelerates the need for IBAT to enhance security, reduce carbon footprints, and improve occupant comfort. Investments in smart city projects are rising globally. The investments focus on modernizing urban infrastructure, improving sustainability, and enhancing the quality of life. Therefore, the rising investments in the development of smart cities fuel the demand for intelligent building automation technologies (IBAT).

Segmental Insights

Component Analysis

Based on component, the segmentation includes hardware, software, and services. The hardware segment accounted for 46.25% of revenue share in 2024 and witnessed 663 million unit sales. The growth is attributed to the widespread deployment of IoT sensors, controllers, access control systems, and HVAC control devices. Organizations across commercial, residential, and industrial sectors prioritize hardware to improve energy efficiency, safety, and operational convenience. The proliferation of smart sensors and IoT-enabled devices contributed to the dominance. These components form the backbone of any intelligent building setup. Moreover, the rising demand for retrofitting older buildings with automated lighting and energy management systems boosted hardware adoption.

The software segment is expected to register a CAGR of 11.52% from 2025 to 2034. The segment is expected to register 156 million licenses by 2034. It growth is attributed to growing emphasis on data-driven decision-making and real-time analytics. Facility managers increasingly rely on centralized software to optimize energy usage, monitor equipment health, and implement predictive maintenance strategies. Additionally, advancements in AI and machine learning are enhancing the functionality of software platforms, enabling automated anomaly detection, occupant behavior analysis, and adaptive climate control. The increasing shift toward smarter, scalable, and more secure automation ecosystems continues to fuel demand for software solutions across new construction and renovation projects.

End User Analysis

In terms of end use, the segmentation includes commercial, residential, and industrial. The commercial segment was valued at USD 50.53 billion in 2024. The dominance is driven by high demand for smart infrastructure across office complexes, airports, shopping malls, hospitals, and hotels. Facility owners in the commercial sector prioritized automation to enhance operational efficiency, reduce energy consumption, and comply with evolving building codes and sustainability regulations. The growing adoption of advanced HVAC, lighting, and security control systems enabled businesses to lower operating costs while providing a safer and more comfortable environment for occupants. Additionally, Intelligent systems support real-time monitoring and performance optimization in commercial buildings. Thus, the increased focus on green building certifications such as LEED and BREEAM drove investments in these systems.

The residential segment is projected to hold 27.80% of revenue share by 2034. The growth is fueled by rising urbanization, growing consumer awareness about energy conservation, and the increasing popularity of smart homes. Homeowners are increasingly adopting integrated systems that manage lighting, security, HVAC, and entertainment through centralized platforms or mobile apps. Moreover, falling prices of smart devices and government incentives for energy-efficient home upgrades accelerate adoption in single-family homes and multi-unit residential buildings.

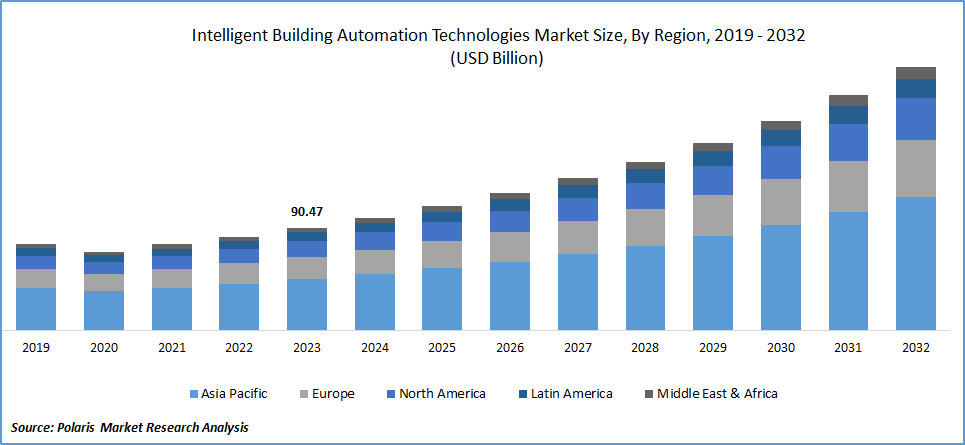

Regional Analysis

The North America intelligent building automation technologies market accounted for 39.56% of global market share in 2024. This dominance is attributed to the rising need for energy efficiency and increasing investments in the development of smart cities. Governments and organizations in the region have increasingly adopted green building standards. It pushed the integration of hardware components such as IoT-enabled HVAC, lighting, and security systems. The hardware components in North America witnessed 254 million unit sales in 2024. The rise of hybrid work models has also increased demand for smart office solutions that optimize space utilization and energy consumption. Additionally, advancements in AI and cloud computing enabled predictive maintenance and real-time monitoring. It further propelled demand for intelligent building automation technologies in the region.

U.S. Intelligent Building Automation Technologies Market Insights

The U.S. held a 78.02% share of the North America industry and registered sales of 178 million hardware components in 2024. The U.S. market growth is attributed to strict energy regulations, corporate sustainability goals, and the proliferation of smart buildings. The Department of Energy (DOE) and the EPA incentivized energy-efficient buildings through programs such as ENERGY STAR, which fueled IBAT adoption. The growth of proptech and increasing cybersecurity concerns in smart infrastructure in the U.S. also contributed to market dominance.

Europe Intelligent Building Automation Technologies Market Trends

The market in Europe is projected to hold 31.03% revenue share and report 450 million unit sales of hardware components by 2034. The growth is propelled by EU directives such as the Energy Performance of Buildings Directive (EPBD) and the Green Deal. It mandated near-zero-emission buildings by 2030. Countries such as the UK, Germany, France, Italy, and others adopt IBAT to reduce carbon footprints. The rise of sustainable urban development and smart city projects drives the adoption of automation. Additionally, high energy costs and the need for occupant comfort and safety in the region are pushing demand for intelligent automation.

Germany Intelligent Building Automation Technologies Market Overview

The industry in Germany is estimated to register a CAGR of 11.39% during 2025–2034. The imposition of Energieeffizienzstrategie 2050 and stringent building energy act (GEG) regulations drives the industry expansion. The push for energy-neutral buildings and the integration of renewable energy sources drives the IBAT demand. The country’s strong manufacturing sector, which demands smart factories with automated HVAC and lighting, boosts market growth in the country.

Asia Pacific Intelligent Building Automation Technologies Market Trends

The IBAT industry in Asia Pacific is expected to register a CAGR of 11.71% and register 395 million unit’s sales of hardware components during 2025–2034. Rapid urbanization, smart city projects, and government initiatives drive the industry growth. United Nations Human Settlements Programme, in its report, stated that the urban population in Asia is expected to grow by 50% by 2050. Countries such as China, Japan, and South Korea are investing heavily in 5G-enabled smart buildings and AI-driven automation. In India and Southeast Asia, rising commercial real estate development and energy cost concerns are increasing demand for automated building systems. Additionally, green building certifications in the region are promoting the adoption of intelligent building automation technologies. The growing middle class and demand for smart homes are contributing to market expansion.

Key Players and Competitive Analysis

The intelligent building automation technologies market is highly competitive. Players such as ABB Limited, Azbil Corporation, Carrier Global Corporation, Daikin Industries, Emerson Electric Co., Johnson Controls, Schneider Electric, and Siemens dominate the industry. These companies compete on innovation, energy efficiency, IoT integration, and AI-driven automation to deliver smart building solutions. Schneider Electric and Siemens lead with comprehensive ecosystems that integrate building management systems (BMS), HVAC controls, lighting, and security into unified platforms. Johnson Controls (OpenBlue) and Honeywell (Forge) emphasize AI-powered analytics for predictive maintenance and energy optimization. Carrier Global and Daikin focus on next-gen HVAC solutions with IoT connectivity. Emerging competitors such as Distech Controls and Delta Controls specialize in open-protocol automation, appealing to customers seeking vendor-agnostic systems. Mitsubishi Electric and Robert Bosch leverage their expertise in industrial automation to enhance the reliability of smart buildings. Rockwell Automation and Eaton Corporation target commercial and industrial facilities with scalable automation solutions.

A few major companies operating in the industry include ABB Limited; Azbil Corporation; Carrier Global Corporation; Daikin Industries, Ltd.; Delta Controls; Distech Controls; Eaton Corporation; Emerson Electric Co.; Johnson Controls, Inc.; Mitsubishi Electric Corporation; Robert Bosch GmbH; Rockwell Automation, Inc.; and Schneider Electric.

Key Players

- ABB Limited

- Azbil Corporation

- Carrier Global Corporation

- Daikin Industries, Ltd.

- Delta Controls

- Distech Controls

- Eaton Corporation

- Emerson Electric Co.

- Johnson Controls, Inc.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- Schneider Electric

Intelligent Building Automation Technologies Industry Developments

May 2025: ABB announced the launch of ABB Smart EMS, a smart energy management solution. The solution empowers homeowners to control their energy use, reduce costs, and maximize efficiency.

May 2025: Carrier Global Corporation, a global company in intelligent climate and energy solutions, announced its plans to invest an additional $1 billion over five years in manufacturing, innovation, and workforce expansion across the U.S.

June 2021: Azbil Corporation announced that it has started developing new digital solutions for use with intelligent building management systems (IBMS), with support from the Singapore Economic Development Board (EDB).

Intelligent Building Automation Technologies Market Segmentation

By Component Outlook (Revenue, USD Billion, Volume, 2020–2034)

- Hardware

- Sensors

- Controllers

- Actuators

- Networking Devices

- Others

- Software

- Building Management Systems (BMS)

- Energy Management Software

- Lighting Control Software

- HVAC Control Software

- Fire, Life & Safety and Security

- Others

- Services

- Professional Services

- Managed Services

By End User Outlook (Revenue, USD Billion, Volume, 2020–2034)

- Commercial

- Residential

- Industrial

By Regional Outlook (Revenue, USD Billion, Volume, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Intelligent Building Automation Technologies Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 93.61 Billion |

|

Market Size in 2025 |

USD 102.59 Billion |

|

Revenue Forecast by 2034 |

USD 248.37 Billion |

|

CAGR |

10.32% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 93.61 billion in 2024 and is projected to grow to USD 248.37 billion by 2034.

The global market is projected to register a CAGR of 10.32% during the forecast period

North America dominated the market in 2024.

A few of the key players in the market are ABB Limited; Azbil Corporation; Carrier Global Corporation; Daikin Industries, Ltd.; Delta Controls; Distech Controls; Eaton Corporation; Emerson Electric Co.; Johnson Controls, Inc.; Mitsubishi Electric Corporation; Robert Bosch GmbH; Rockwell Automation, Inc.; and Schneider Electric.

The hardware segment dominated the market in 2024.

The residential segment is expected to witness the fastest growth during the forecast period.