Integrated Visual Augmentation System Market Size, Share, Trends, Industry Analysis Report: By Product, Technology, Application, End User (Air Force, Army, and Navy), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5263

- Base Year: 2024

- Historical Data: 2020-2023

Integrated Visual Augmentation System Market Overview

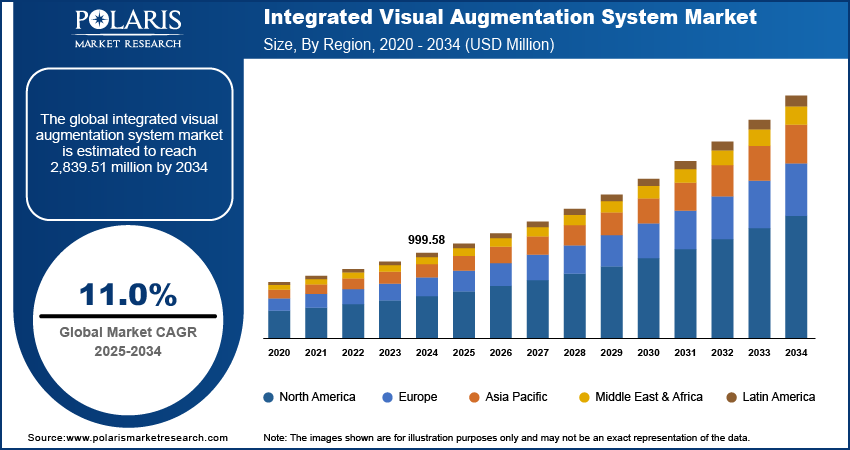

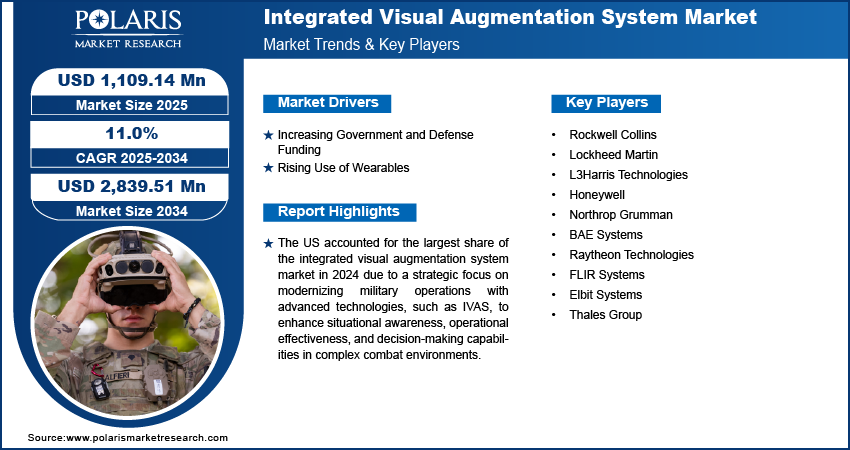

The integrated visual augmentation system market size was valued at USD 999.58 million in 2024. The market is projected to grow from USD 1,109.14 million in 2025 to USD 2,839.51 million by 2034, exhibiting a CAGR of 11.0% during 2025–2034.

An integrated visual augmentation system (IVAS) is a technology that enhances situational awareness by overlaying critical information, such as navigation, thermal imagery, and real-time data, onto a user’s field of view through augmented reality glasses or a heads-up display. IVAS is primarily used in military and high-risk environments to improve decision-making and operational effectiveness. Increasing demand for advanced technology in defense to enhance situational awareness, targeting, and decision-making in complex environments is fueling the integrated visual augmentation system market growth. Furthermore, in high-risk operations, IVAS improves safety and operational efficiency by providing real-time data overlays, reducing the cognitive load on users, and enhancing their decision-making capabilities, thereby fueling the IVAS market growth.

IVAS systems are integrating biometric sensors to monitor health metrics such as heart rate and fatigue, supporting military efforts to ensure physical well-being and optimize performance in the field. Moreover, beyond military applications, there is growing interest in IVAS for civilian emergency response, search and rescue, and disaster management, as it provides responders with critical information and situational awareness in dynamic environments, which is contributing to the growing integrated visual augmentation system market value.

To Understand More About this Research: Request a Free Sample Report

Integrated Visual Augmentation System Market Trend Analysis

Increasing Government and Defense Funding

Governments and defense sectors across the world recognize the importance of modernizing their military capabilities to address evolving security challenges. Significant investments are being allocated to the development and acquisition of advanced technologies, including IVAS, to enhance operational efficiency, situational awareness, and decision-making capabilities for soldiers in complex environments. Government fundings often support extensive R&D efforts, accelerating the innovation and refinement of IVAS technology to meet the rigorous demands of modern warfare.

Rising Use of Wearables

The increasing use of wearable technologies across industries, such as defense, law enforcement, and industrial sectors, is significantly driving the adoption of IVAS systems. Wearable devices, including smart glasses, biometric sensors, and heads-up displays, are becoming vital tools for improving real-time data access and situational awareness, allowing personnel to operate more effectively in dynamic and high-risk environments. Furthermore, in defense and law enforcement, wearables equipped with IVAS provide soldiers and officers with real-time intelligence, thermal imaging, and navigation tools directly in their line of sight, reducing reaction times and enhancing decision-making in critical situations. For instance, in June 2021, the US Army partnered with Microsoft to develop an advanced IVAS using modified HoloLens augmented reality goggles.

Integrated Visual Augmentation System Market Segment Analysis

Integrated Visual Augmentation System Market Assessment by End User

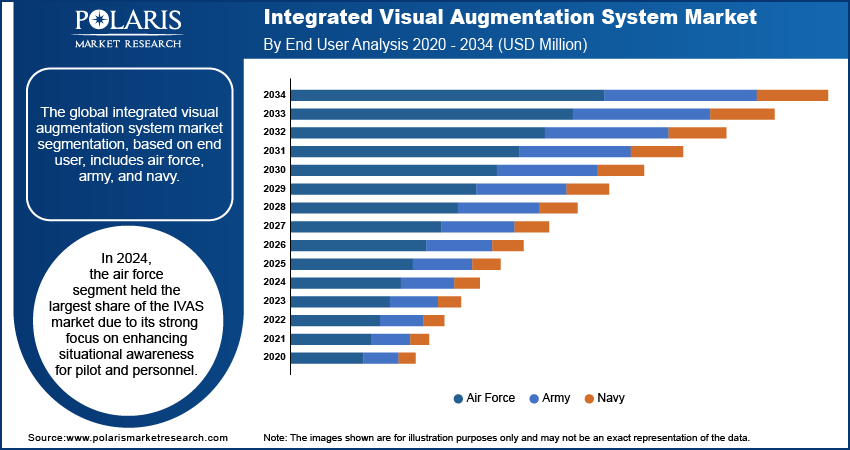

The global integrated visual augmentation system market segmentation, based on end user, includes air force, army, and navy. In 2024, the air force segment held the largest share of the market due to its strong focus on enhancing pilot and personnel situational awareness and operational efficiency in complex air combat environments. Additionally, substantial government funding and initiatives aimed at modernizing air combat capabilities have fueled the deployment of IVAS in the air force.

Integrated Visual Augmentation System Evaluation by Product

The global integrated visual augmentation system market, based on product, is bifurcated into helmet mounted display and night vision device. The helmet mounted display segment is expected to witness a higher CAGR during the forecast period due to its growing integration with augmented reality (AR) technologies, which enhance situational awareness and provide real-time data overlays for users. In the military and defense sectors, helmet mounted displays offer critical benefits such as improved targeting, navigation, and communication. The rising demand for lightweight, user-friendly wearable devices in tactical and non-tactical operations further accelerates the adoption of helmet mounted displays. Thus, the demand for these helmet mounted displays is rising in sectors such as aviation, defense, and industrial applications.

Integrated Visual Augmentation System Market Breakdown by Regional Outlook

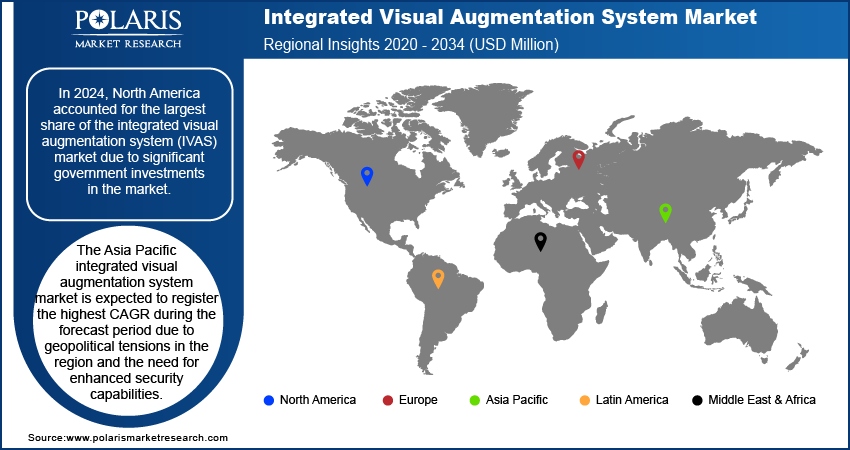

By region, the study provides integrated visual augmentation system market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest IVAS market share due to the significant government investments in the regional market. For instance, in 2023, the US military allocated approximately USD 820.3 billion, representing about 13.3% of the federal budget. For 2024, the Department of Defense (DoD) requested USD 842.0 billion, marking a 2.6% increase. The U.S. Department of Defense is heavily investing in modernizing military capabilities with advanced technologies such as IVAS. North America is also home to advanced technological development and innovation, with major defense contractors and tech companies leading the research and development of IVAS systems. Additionally, the growing adoption of IVAS in military and industrial sectors, along with the increasing focus on enhancing operational efficiency, situational awareness, and safety, further drives the integrated visual augmentation system (IVAS) market growth in the region. The region’s strong defense and aerospace sectors, along with a high rate of technological integration, make North America the dominant market for IVAS in 2024.

The US accounted for the largest share of the North America integrated visual augmentation system market in 2024 due to a strategic focus on modernizing military operations with advanced technologies, such as IVAS, to enhance situational awareness and operational effectiveness.

The Asia Pacific integrated visual augmentation system market is expected to register the highest CAGR during the forecast period. Geopolitical tensions in the region and the need for enhanced security capabilities are driving demand for advanced solutions such as IVAS across military and defense sectors. For instance, in the Indo-Pacific region, the Chinese Communist Party is using its military and economic power to pressure neighboring countries, make illegal maritime claims, threaten shipping routes, and create instability in areas near China’s borders. Furthermore, the rapid technological advancements and increasing use of wearable technologies in both military and industrial applications contribute to the market demand in the region.

The China integrated visual augmentation system market is expected to witness the highest CAGR during the forecast period. As China continues to modernize its military infrastructure, the adoption of IVAS is expected to rise significantly in the coming years, particularly for applications in ground combat and tactical operations.

Integrated Visual Augmentation System Market – Key Players and Competitive Insights

The competitive landscape of the integrated visual augmentation system (IVAS) market is driven by key players from defense contractors and technology firms, who are competing to capture the largest market share through technological innovations and strategic partnerships. Major companies leverage augmented reality (AR) and artificial intelligence (AI) to enhance situational awareness and decision-making capabilities for military personnel. Prominent players, such as Elbit Systems, Thales Group, and SAAB, are contributing to the market with advanced visual systems designed to improve military operations, emphasizing AR integration, wearable technology, and AI-driven enhancements. Strategic partnerships, particularly between technology firms and defense agencies, are crucial for securing large-scale government contracts, which remain a significant revenue source. Additionally, international collaborations and growing military expenditures in regions such as Asia Pacific, Europe, and the US offer expanded market growth opportunities. However, the integrated visual augmentation system market ecosystem faces challenges such as high R&D costs and navigating complex regulatory requirements, particularly around defense contracts. A few key major players are Rockwell Collins, Lockheed Martin, L3Harris Technologies, Honeywell, Northrop Grumman, BAE Systems, Raytheon Technologies, FLIR Systems, Elbit Systems, and Thales Group.

L3Harris Technologies, Inc., a US-based company, focuses on detection systems, security, image intensification equipment, night vision intensification equipment, training, simulation, aircraft sustainment, and intelligence, surveillance, and reconnaissance (ISR) systems. The company has a global presence that delivers end-to-end solutions to meet commercial and government customer's critical needs in over 100 countries. The space & airborne system business unit of the company is further segmented into four sectors—space, intel & cyber, mission avionics, and electronic warfare. They offer several products and solutions in these sectors, including avionic sensors, hardened electronics, release systems, situational awareness optical networks, and advanced wireless solutions for classified intelligence and cyber defense customers.

Honeywell International Inc. is a multinational conglomerate corporation headquartered in Charlotte, North Carolina. The company offers products in four areas, including building technologies, aerospace, safety & productivity solutions (SPS), and performance materials and technologies (PMT). Honeywell Aerospace provides aircraft engines; avionics; flight management systems; and services to airlines, airports, manufacturers, space programs, and militaries. Moreover, in 2020, the company acquired Ballard Unmanned Systems to expand the product portfolio of aerospace segments. It operates for various industries such as aerospace and travel, commercial real estate, energy, healthcare, life sciences, logistics & warehouse, retail, and utilities.

Key Companies in the Integrated Visual Augmentation System Market

- Rockwell Collins

- Lockheed Martin

- L3Harris Technologies

- Honeywell

- Northrop Grumman

- BAE Systems

- Raytheon Technologies

- FLIR Systems

- Elbit Systems

- Thales Group

Integrated Visual Augmentation System Industry Developments

In September 2024, Anduril Industries and Microsoft partnered to integrate its Lattice platform into the US Army's Integrated Visual Augmentation System. This partnership aims to enhance IVAS's real-time situational awareness and tracking capabilities, providing soldiers with improved insights for better operational effectiveness on the battlefield.

Integrated Visual Augmentation System Market Segmentation

By Product Outlook (Revenue, USD Million; 2020–2034)

- Helmet Mounted Display

- Night Vision Device

By Technology Outlook (Revenue, USD Million; 2020–2034)

- Augmented Reality

- Virtual Reality

- Mixed Reality

By Application Outlook (Revenue, USD Million; 2020–2034)

- Combat Missions

- Simulation & Training

By End User Outlook (Revenue, USD Million; 2020–2034)

- Air Force

- Army

- Navy

By Regional Outlook (Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Integrated Visual Augmentation System Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 999.58 million |

|

Market Size Value in 2025 |

USD 1,109.14 million |

|

Revenue Forecast by 2034 |

USD 2,839.51 million |

|

CAGR |

11.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global integrated visual augmentation system market value reached USD 999.58 million in 2024 and is projected to grow to USD 2,839.51 million by 2034.

The global market is projected to register a CAGR of 11.0% during the forecast period.

In 2024, North America dominated the integrated visual augmentation system market share due to significant government investments in the regional market.

A few key players in the market are Rockwell Collins, Lockheed Martin, L3Harris Technologies, Honeywell, Northrop Grumman, BAE Systems, Raytheon Technologies, FLIR Systems, Elbit Systems, and Thales Group.

In 2024, the air force segment held the largest share of the IVAS market due to its strong focus on enhancing pilot and personnel situational awareness.

The helmet mounted display segment is expected to witness the highest CAGR during the forecast period due to its growing integration with augmented reality (AR) technologies.