Integrated Bridge Systems Market Size, Share, Trend, & Industry Analysis Report

By Component (Hardware, Software, and Services), By Subsystem, By Platform, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM2931

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

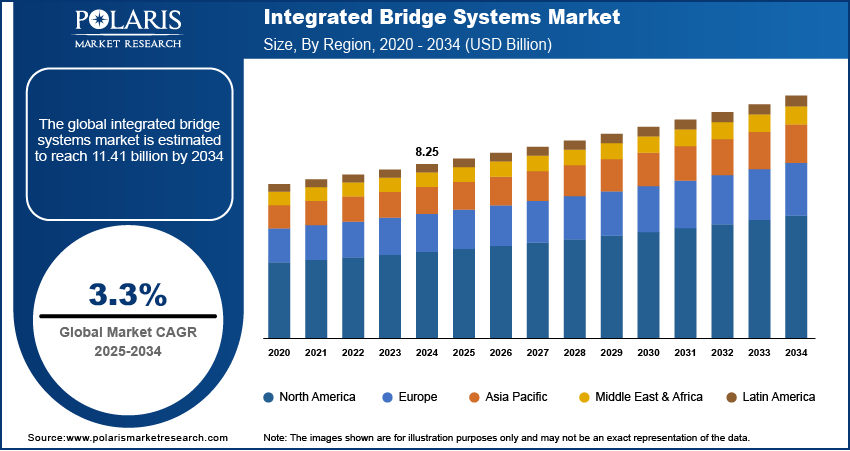

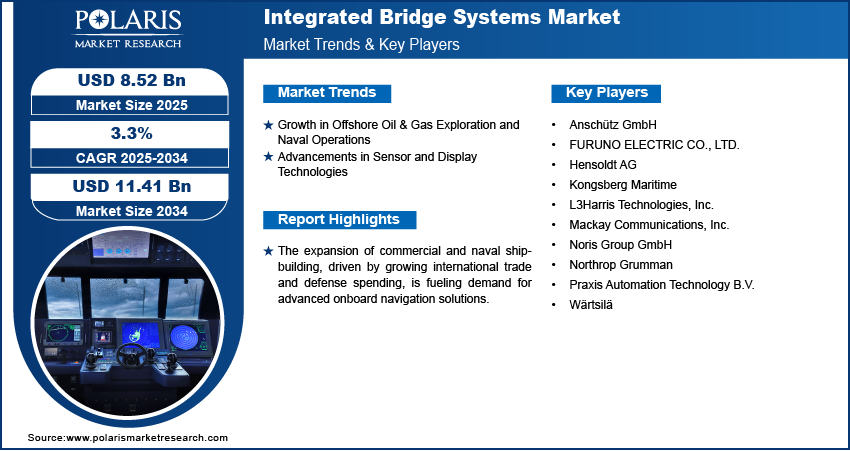

The global integrated bridge systems market size was valued at USD 8.52 billion in 2024 and is projected to register a CAGR of 3.3% during 2025–2034. Growing emphasis on maritime safety and the rising need to reduce human error are pushing vessel operators to adopt integrated bridge systems. These systems centralize navigation controls and improve situational awareness, aiding safer navigation through congested and challenging waterways.

The integrated bridge systems (IBS) market refers to the industry focused on the development, manufacturing, and deployment of integrated navigation and control systems. The system combines various shipboard technologies such as radar, electronic chart display, autopilot, communication, and engine monitoring into a unified interface for enhanced maritime vessel operations, safety, and efficiency. Stricter regulations from bodies such as the International Maritime Organization (IMO) regarding navigation safety and electronic chart display are compelling shipowners to retrofit or incorporate integrated systems that fulfill compliance mandates while streamlining vessel operation.

To Understand More About this Research: Request a Free Sample Report

Older vessels are undergoing retrofitting to remain competitive and compliant. Ship-owners are upgrading navigation and control systems with modern integrated bridge solutions that offer improved performance, lower maintenance, and longer service life. Additionally, the expansion of commercial and naval shipbuilding, driven by growing international trade and defense spending, is fueling demand for advanced onboard navigation solutions. New vessels are increasingly being equipped with IBS to meet regulatory and operational requirements from the outset.

Market Dynamics

Growth in Offshore Oil & Gas Exploration and Naval Operations

Growth in offshore oil and gas exploration, along with rising naval operations, is creating a strong need for advanced navigation and control systems. According to the Bureau of Ocean Energy Management, in fiscal year 2024, offshore federal production totaled approximately 668 million barrels of crude oil and 700 billion cubic feet of natural gas, with nearly all output sourced from the Gulf of Mexico. This represents about 14% of total US oil production and contributes approximately 2% to domestic natural gas production. Operating in remote and often hazardous marine environments requires vessels to be equipped with highly reliable and responsive systems that ensure safety and efficiency. Integrated bridge systems (IBS) are essential for such operations as they bring together radar, sonar, GPS, communication, and engine controls into one seamless interface. This integration allows for real-time decision-making and accurate situational awareness, which is critical when maneuvering in tight spaces or navigating near offshore platforms. Defense vessels also rely on IBS for mission readiness, as these systems support tactical navigation and operational coordination across complex sea operations.

Advancements in Sensor and Display Technologies

Modern radars, sonars, and electronic chart systems offer higher resolution, faster data processing, and better target tracking than earlier versions. These improvements give ship crews a clearer and more comprehensive view of their surroundings, helping to prevent collisions and improve route planning. Large, high-definition displays and intuitive user interfaces make it easier for operators to interpret data quickly and accurately. These upgrades are making IBS more efficient and reliable, especially during long voyages or in crowded maritime corridors. Shipbuilders and fleet operators are increasingly adopting these advanced systems to enhance safety, performance, and compliance, driving wider acceptance of IBS in both commercial and defense maritime sectors. Hence, advancements in sensor and display technologies are playing a major role in enhancing the capabilities of integrated bridge systems.

Segment Insights

Market Assessment by Component

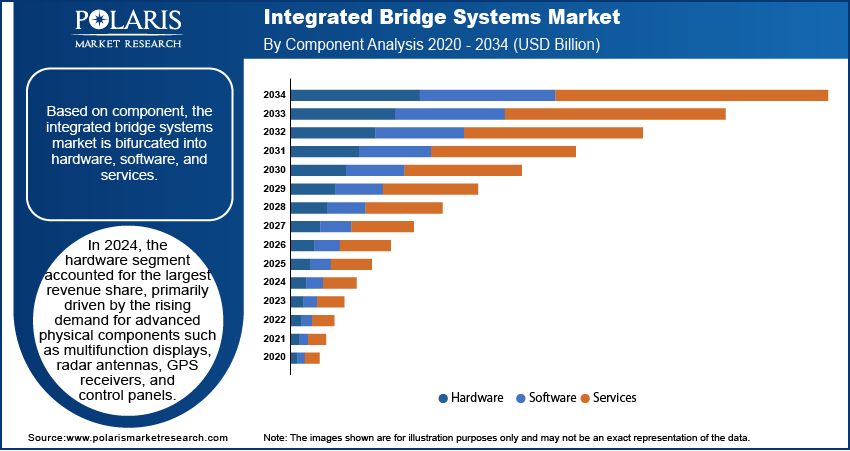

Based on component, the segmentation includes hardware, software, and services. In 2024, the hardware segment accounted for the largest revenue share, primarily driven by the rising demand for advanced physical components such as multifunction displays, radar antennas, GPS receivers, and control panels. These components form the backbone of IBS setups and are essential for system integration. The growing number of new ship deliveries and modernization of older fleets has increased the demand for high-performance hardware that supports seamless operation. Shipbuilders prioritize reliable hardware during initial installations to ensure smooth functionality across all navigation, control, and monitoring subsystems, which continues to drive strong hardware sales in the IBS ecosystem.

The software segment is projected to register the highest CAGR during the forecast period, supported by the increasing complexity of maritime operations and the need for data integration and intelligent decision-making tools. Modern software platforms enable real-time data processing, advanced route planning, collision avoidance, and system diagnostics. Ship operators are investing in software upgrades that allow remote access, automation, and interoperability with other shipboard systems. The rising focus on digitalization, along with regulatory compliance requiring continuous software updates, is pushing fleet operators to adopt advanced IBS software solutions. Software also plays a critical role in cybersecurity and data analytics, which are becoming key concerns for modern maritime operations.

Market Assessment by Subsystem

Based on subsystem, the segmentation includes navigation systems, control systems, communication systems, monitoring systems, automatic identification system, and others. In 2024, the navigation systems segment held the largest market share, largely due to its central role in ensuring vessel safety and operational efficiency. Integrated navigation systems combine radar, GPS, electronic chart display, and autopilot functions into a unified interface that supports precise route planning and collision avoidance. Growing maritime traffic and increasingly complex sea routes require ships to rely on accurate navigation tools. Fleet operators and shipbuilders prioritize navigation integration in bridge systems to ensure compliance with international regulations and to reduce the risk of human error during navigation, particularly in congested waters or hazardous weather conditions.

The automatic identification system (AIS) segment is expected to register the highest CAGR over the forecast period, driven by the rising need for enhanced vessel tracking and real-time communication. AIS enables ships to automatically transmit identity, position, speed, and course to nearby vessels and coastal authorities. This improves situational awareness, reduces collision risk, and supports traffic management in busy maritime corridors. Increasing regulatory mandates for AIS installation on both commercial and non-commercial vessels are also boosting demand. Advanced IBS platforms include AIS as a standard feature, enabling better integration with other navigation and control systems for more responsive operations.

Market Evaluation by Platform

Based on platform, the segmentation includes commercial vessels, naval vessels, offshore support vessels, fishing vessels, yachts & recreational boats, and others. In 2024, the commercial vessels segment dominated the market, fueled by a high rate of IBS adoption across container ships, tankers, and cargo vessels. These vessels operate on international routes that require compliance with strict safety and navigation standards. Operators are investing in comprehensive bridge systems to enhance efficiency, reduce crew workload, and comply with regulations such as SOLAS and MARPOL. The shift toward digital map and fleet-wide system standardization is encouraging large commercial fleets to deploy advanced IBS setups during vessel construction or major retrofits, contributing to the segment’s dominant revenue contribution.

The naval vessels segment is projected to register the highest CAGR over the forecast period, driven by defense modernization programs and the rising need for secure, mission-specific navigation and communication capabilities. Naval IBS platforms integrate combat management, surveillance, and command systems for real-time situational awareness and tactical maneuvering. Military vessels require high reliability and operational flexibility, which integrated bridge systems are uniquely designed to deliver. The growing importance of automation, cybersecurity, and interoperability in defense fleets is encouraging governments to invest in next-generation IBS solutions that enhance mission readiness and reduce crew dependency during critical operations.

Market Evaluation by End User

Based on end use, the segmentation includes OEM and aftermarket. In 2024, the OEM segment dominated the market, fueled by increased installation of IBS during vessel construction. Shipbuilders are incorporating complete, factory-fitted systems that offer higher integration accuracy and reduced installation time. OEM solutions ensure full system compatibility, meet international safety standards, and allow fleet operators to begin operations immediately after delivery. This demand is particularly strong in the commercial and defense vessel categories.

The aftermarket segment is projected to experience significant growth during the forecast period, driven by the increasing retrofitting of existing vessels with modern navigation and communication technologies. Fleet owners are upgrading older systems to improve operational efficiency, meet evolving regulatory standards, and enhance vessel safety. Demand is also rising for modular upgrades and software enhancements, which allow operators to keep systems current without full replacements. This trend is especially strong among mid-sized operators seeking cost-effective modernization.

Regional Analysis

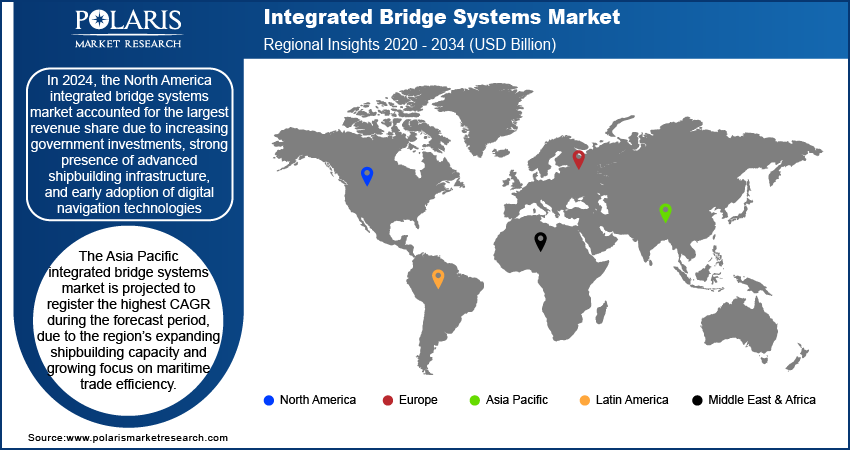

In 2024, the North America integrated bridge systems market accounted for the largest revenue share due to increasing government investments, strong presence of advanced shipbuilding infrastructure, and early adoption of digital navigation technologies. The region benefits from significant investments in commercial shipping, defense modernization, and offshore exploration, all of which require reliable and integrated control solutions. For instance, in November 2024, according to the US Department of Transportation, the Biden-Harris Administration allocated approximately USD 580 million as part of its initiative to enhance the operational efficiency of US ports. This strategic investment aims to strengthen American supply chains and reduce logistical costs, ultimately improving the stability and reliability of the maritime transportation network. Fleet operators in North America prioritize automation, safety compliance, and operational efficiency, leading to consistent demand for sophisticated bridge systems. Regulatory enforcement related to electronic navigation and real-time vessel monitoring has further encouraged widespread IBS deployment across various maritime platforms.

US Integrated Bridge Systems Market

In 2024, the US integrated bridge systems (IBS) market held the dominant share in North America due to its extensive naval fleet upgrades and growing commercial shipping activity. The country’s focus on strengthening maritime defense capabilities has led to large-scale procurement of technologically advanced IBS solutions. Commercial vessel operators in the US are also investing heavily in integrated systems to streamline fleet management and meet evolving safety standards. Government funding and strong partnerships between OEMs and shipbuilders have accelerated the integration of smart bridge systems in both new builds and retrofit programs.

Asia Pacific Integrated Bridge Systems Market

The Asia Pacific integrated bridge systems market is projected to register the highest CAGR during the forecast period, due to the region’s expanding shipbuilding capacity and growing focus on maritime trade efficiency. Countries such as South Korea, Japan, and India are heavily investing in smart navigation technologies for both civilian and defense fleets. Rapid growth in offshore support vessels and fishing industries is also contributing to increased demand. Rising regional awareness around vessel safety, along with supportive government initiatives, is pushing for wider IBS adoption across all vessel types.

China Integrated Bridge Systems market

The China integrated bridge systems market accounted for the largest revenue share in Asia Pacific in 2024, fueled by its strong shipbuilding industry and increasing use of automation in marine operations. Domestic manufacturers are scaling up production of advanced navigation and communication systems to serve commercial fleets and navy programs. The demand for IBS in China is further driven by the country’s commitment to maritime safety and technological modernization of its vast inland and coastal shipping network. Local players are also expanding their export capacity, making China a major supplier of IBS solutions in the global market.

Europe Integrated Bridge Systems Market

The Europe IBS market is experiencing steady growth driven by regulatory mandates and increasing investments in sustainable maritime technologies. Regional shipping companies are focusing on fleet renewal and retrofitting to comply with IMO standards, including e-navigation and emissions control. The growth of offshore wind energy projects is also creating new demand for support vessels equipped with modern bridge systems. European naval programs are incorporating IBS into their new-generation vessels, supporting long-term demand. Innovation hubs across Northern and Western Europe continue to drive R&D in user-centric, integrated navigation technologies, keeping the region competitive in the global IBS market.

Key Players & Competitive Analysis Report

The competitive landscape of the integrated bridge systems (IBS) market is shaped by ongoing industry analysis, rapid technology advancements, and evolving customer demands. Key players are focusing on market expansion strategies through strategic alliances, joint ventures, and global distribution agreements to strengthen their presence across commercial and naval sectors. Mergers and acquisitions are being leveraged to access complementary technologies and accelerate innovation pipelines. Post-merger integration efforts are increasingly directed at unifying digital navigation platforms and enhancing interoperability across system components. Continuous product launches that incorporate advanced radar, GPS, ECDIS, and automation capabilities are setting new benchmarks in user experience and vessel safety. Companies are prioritizing customized solutions that cater to vessel type, operational complexity, and regulatory compliance. Investment in cybersecurity-enhanced systems and scalable software platforms reflects the market's pivot toward digital transformation. Partnerships between OEMs, software providers, and shipyards are reinforcing competitiveness, allowing for faster implementation of integrated bridge systems in both retrofit and newbuild programs.

List of Key Companies

- Anschütz GmbH

- FURUNO ELECTRIC CO., LTD.

- Hensoldt AG

- Kongsberg Maritime

- L3Harris Technologies, Inc.

- Mackay Communications, Inc.

- Noris Group GmbH

- Northrop Grumman

- Praxis Automation Technology B.V.

- Wärtsilä

Integrated Bridge Systems Industry Developments

In May 2024, Integrated bridge and radar systems have been selected for the new Royal Fleet Auxiliary (RFA) vessels, designed to support the Royal Navy's aircraft carriers. These advanced surveillance and integrated systems will enhance situational awareness and operational efficiency during maritime operations.

In October 2023, Anschütz delivered customized integrated bridge systems (IBS) for three multi-purpose vessels built by Abeking & Rasmussen for the German Waterways and Shipping Administration (WSV). The LNG-powered vessels feature advanced systems for various missions.

Integrated Bridge Systems Market Segmentation

By Component Outlook (Revenue USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Subsystem Outlook (Revenue USD Billion, 2020–2034)

- Navigation Systems

- Control Systems

- Communication Systems

- Monitoring Systems

- Automatic Identification System

- Others

By Platform Outlook (Revenue USD Billion, 2020–2034)

- Commercial Vessels

- Naval Vessels

- Offshore Support Vessels

- Fishing Vessels

- Yachts & Recreational Boats

- Others

By End User Outlook (Revenue USD Billion, 2020–2034)

- OEM

- Aftermarket

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Integrated Bridge Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 8.25 billion |

|

Market Size in 2025 |

USD 8.52 billion |

|

Revenue Forecast by 2034 |

USD 11.41 billion |

|

CAGR |

3.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.25 billion in 2024 and is projected to grow to USD 11.41 billion by 2034.

The global market is projected to register a CAGR of 3.3% during the forecast period.

In 2024, the North America integrated bridge systems market accounted for the largest revenue share due to increasing government investments, strong presence of advanced shipbuilding infrastructure, and early adoption of digital navigation technologies.

A few of the key players are Northrop Grumman; L3Harris Technologies, Inc.; Anschütz GmbH; Mackay Communications, Inc.; Kongsberg Maritime; Wärtsilä; Hensoldt AG; FURUNO ELECTRIC CO., LTD.; Noris Group GmbH; and Praxis Automation Technology B.V.

In 2024, the hardware segment accounted for the largest revenue share, primarily driven by the rising demand for advanced physical components such as multifunction displays, radar antennas, GPS receivers, and control panels.

In 2024, the navigation systems segment held the largest market share, largely due to its central role in ensuring vessel safety and operational efficiency.