Insurtech Market Share, Size, Trends, Industry Analysis Report, By Deployment Model (On-Premise, Cloud); By Insurance Type (Commercial Insurance, Property and Casualty Insurance, Health Insurance, Life Insurance, Others); By End-Use; By Technology; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 113

- Format: PDF

- Report ID: PM1825

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

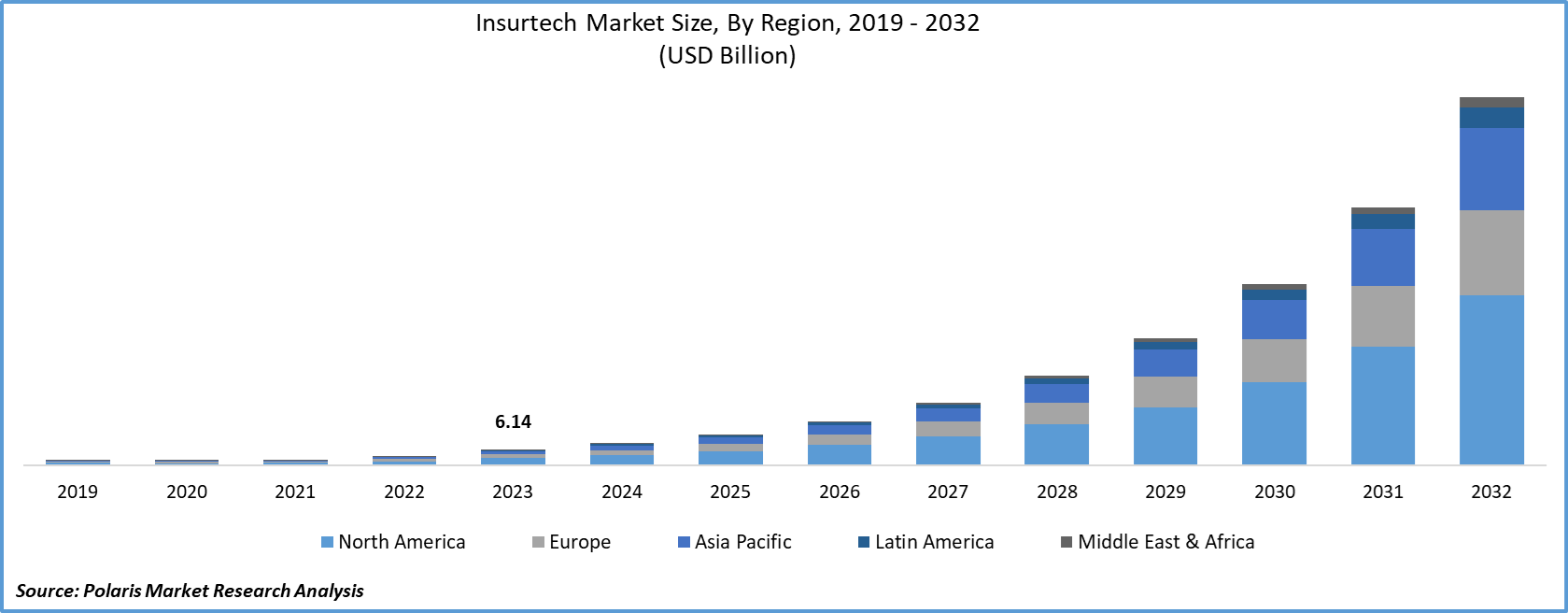

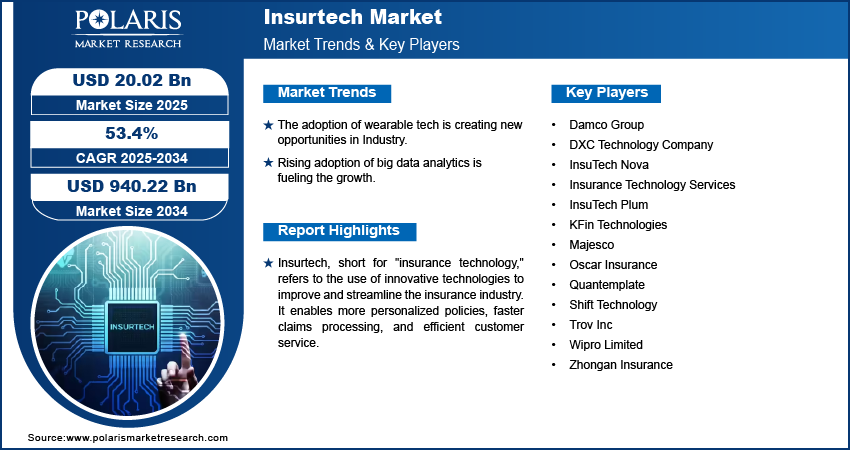

The global insurtech market size was valued at USD 6.14 billion in 2023. The market is anticipated to grow from USD 8.74 billion in 2024 to USD 147.46 billion by 2032, exhibiting the CAGR of 42.4% during the forecast period.

There has been a massive increase in data generation owing to the increased adoption of mobile devices and social media.

Know more about this report: Request for sample pages

Data availability allows a company to follow customer behavior and obtain insights to improve the customer experience and provide better services. As insurtech becomes more widely used, it enables more effective decision-making and the implementation of creative business strategies to meet the expanding needs in the global insurance market.

Insurtech has simplified micropayments for consumers owing to the increased adoption of mobile phones and wearable tech. Key players operating in the Insurtech market are developing micropayment systems to service consumers in regions with low insurance penetration levels. Insurtech enables the development of platforms offering one-stop solutions for customers for purchase, payments, servicing, and interaction with social media.

Insurance companies are developing self-directed solutions for customer acquisition and customer service to cater to the growing demand for online and mobile channels. Customer-centric solutions are increasingly used for enhanced user experience, transaction efficiency, and transparency. Rising consumer demands for efficient services and personalized solutions are leading to the emergence of Usage-based Insurance (UBI) models.

Industry Dynamics

Growth Drivers

The adoption of wearable tech has increased significantly over the past few years, leading to insurtech being implemented in the telemedicine market. The demand for insurtech is expected to increase considerably in the healthcare sector during the forecast period. Implementation of insurtech enables data gathering by carriers for risk mitigation and improving customer experience.

Integration of technologies such as big data analytics, cloud computing, and IoT assists in avoiding the development of chronic health conditions while resulting in considerable savings in claims. Digitization of complete healthcare data would provide a healthy ecosystem to manage risks and customer engagement. Growing adoption of genomic and epigenetic technology in the market for biological age determination would alter the costing and execution of life policies. Some companies operating in this segment of the insurtech market include Babylon, Discovery Vitality, Good Doctor, and Wellthy Therapeutics, among others.

Greater availability of transactional data is fueling increased adoption of data analytics in insurtech to minimize risks, reduce costs, optimize profits, and offer enhanced customer services and customized solutions. The move towards data analytics for customer analytics, marketing analytics, etc., enables companies to provide personalized customer solutions while improving operating efficiency and profits. The growing adoption of artificial intelligence simplifies and improves onboarding and customer service, claims settlement experience, fraud prevention, and anti-money laundering.

The research report offers a quantitative and qualitative analysis of the Insurtech Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Report Segmentation

The market is primarily segmented based on insurance type, deployment mode, technology, end-use, and region.

|

By Insurance Type |

By Deployment Model |

By Technology |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Deployment Mode

Cloud-based deployment insurtech segment is expected to increase during the forecast period owing to the significant increase in data generation and rising use of mobile devices and social media. Decreasing the cost of data storage coupled with the growing adoption of cloud computing accelerates the growth of this insurtech market segment.

Insight by Insurance Type

The market demand for property and casualty insurance is expected to increase during the forecast period. Businesses are increasingly using wearables and sensors to avoid workplace injury. Organizations are also incorporating technologies into workers’ compensation.

Insight by End-Use

A massive increase in the use of smartphones, mobile devices, multimedia content, and clickstream data has increased the adoption of insurtech market. A significant increase in the data generated by banking and financial institutions has encouraged the use of advanced analytics and artificial intelligence for fraud detection and prevention.

Insight by Technology

The technology market segment has been divided into cloud computing, blockchain, big data and analytics, artificial intelligence, IoT, machine learning, and others. A growing trend of blockchain-based smart contracts has been observed in the insurtech industry.

Blockchain-based smart contracts enable the automation of life insurance policy claims by offering independent traction by the customer through a decentralized ledger and a set of pre-defined conditions. The adoption of smart contracts results in the timely processing of claims and improved efficiency.

Geographic Overview

North America market dominated the global insurtech market in 2021. Due to a significant increase in the need for automation of insurance operations, timely services, and improved efficiency, businesses are increasingly turning towards insurtech solutions. Established internet infrastructure in the region combined with increasing integration of advanced technologies in the insurance sector fuels the growth of the market for insurtech in the region.

Competitive Insight

The leading players in the insurtech market include Damco Group, DXC Technology Company, InsuerTech Nova, Insurance Technology Services, InuserTech Plum, KFin Technologies, Majesco, Oscar Insurance, Quantemplate, Shift Technology, Trov, Inc., Wipro Limited, and Zhongan Insurance. These players collaborate with other market leaders to expand their offerings and acquire new customers.

Recent Development

- June 2023: Clover Health announced consensus to resolve derivative litigation, settling all endured civil litigation connected to its de-SPAC transaction. These lawsuits are unsettled in Delaware, New York, and Tennessee courts.

- March 2024: CNB bank and trust NA associated with Insuritas to launch CNB Insurance Services, its embedded full-service insurance agency. Through the association, CNB is now capable of offering its customers the auto, home, commercial, and ancillary insurance commodities they buy every year. It deepens wallet allocation and structuring a vital source of annuitizing non-interest income.

Insurtech Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.74 Billion |

|

Revenue forecast in 2032 |

USD 147.46 Billion |

|

CAGR |

42.4% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Insurance Type, By Deployment Mode, By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Damco Group, DXC Technology Company, InsuerTech Nova, Insurance Technology Services, InuserTech Plum, KFin Technologies, Majesco, Oscar Insurance, Quantemplate, Shift Technology, Trov, Inc., Wipro Limited, and Zhongan Insurance. |

Uncover the dynamics of the Insurtech Market sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Extruded Polystyrene Market Size, Share 2024 Research Report

Healthcare Contract Research Organization Market Size, Share 2024 Research Report

EV Connector Market Size, Share 2024 Research Report