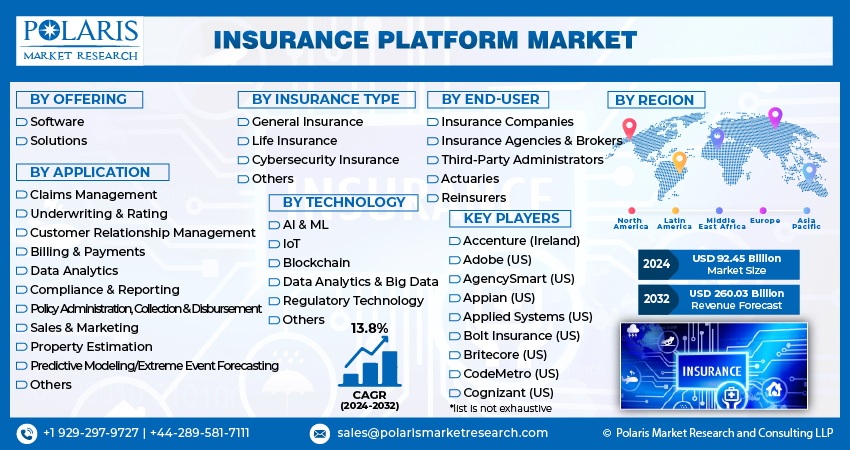

Insurance Platform Market Share, Size, Trends, Industry Analysis Report, By Offering (Software, Services); By Application; By Insurance Type; By Technology; By End-User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 120

- Format: PDF

- Report ID: PM4735

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

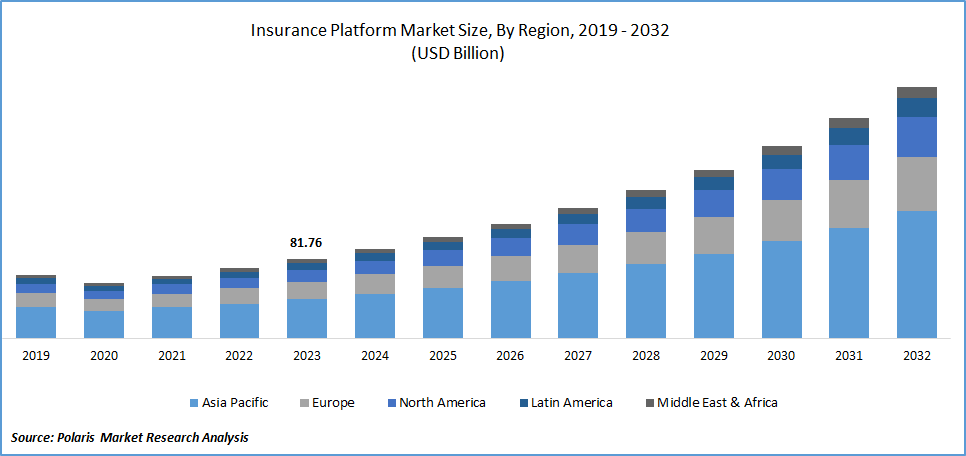

Insurance Platform Market size was valued at USD 81.76 billion in 2023. The market is anticipated to grow from USD 92.45 billion in 2024 to USD 260.03 billion by 2032, exhibiting the CAGR of 13.8% during the forecast period.

Market Overview

The growing technological advancements in the world is playing a prominent role in promoting the convenience of humans in multiple sectors. Insurance platforms are registering a significant rise in adoption with the enhanced customer service, seamless online interaction, and fast insurance claim accessibility. Growing smartphone users in the world are propelling the integration of the internet of things and insurance platforms. The increasing efforts taken by the insurance companies to improve accessibility and trust with the user-friendly online interfaces are expected to stimulate new growth opportunities in the marketplace.

For instance, in November 2023, Novidia introduced cutting-edge improvements to its insurance management platform to serve brokers, wholesalers, agents, and carriers.

To Understand More About this Research:Request a Free Sample Report

Moreover, the growing financial awareness in the world is driving the importance of purchasing insurance policies among the population. The rising disposable income at the global level is enabling people to keep some amount aside for uncertain and unforeseen circumstances. This transformation is ensuring insurance companies adopt compatible insurance platforms to promote user satisfaction, propelling the growth of insurance platforms in the global market.

Growth Drivers

Rising adoption of technological advancements

The increasing knowledge about the benefits of integrating internet of things, artificial intelligence, and cloud solutions among the majority of companies is facilitating new growth potential for the insurance platform market. According to the World Cloud Report—Financial Services 2023, around 91% of the insurance companies have incorporated cloud solutions, compared to 37% in 2020, a significant rise in the adoption of cloud in business operations. This is attributable to the ability of cloud-based solutions to automate repetitive tasks, including underwriting and claim processing.

Increased preferences for user-friendly interfaces

The increasing competition, changing consumer behaviors, and strategic initiatives among the companies are anticipated to provide potential opportunities for the insurance platform market. Internet users are habituated to e-commerce solutions, driving preferences for digital channels. This trend is leading insurance companies to adopt user-friendly insurance platforms to optimize their business activities and gain new customers. Additionally, increasing support from the regulatory authorities to promote accessibility to the insurance platform to the wider consumer base are fueling new insurance platform development. For instance, in December 2023, Capri Global Capital received the approval from Insurance Regulatory and Development Authority of India to introduce insurance platform catering general, health, and life insurance products. It is planning to automate customer support, and insurance claim process with the use of AI, block chain, and data analytics.

Restraining Factors

Digital transformation challenges

The huge costs of developing insurance platforms requires higher initial investments from the companies. This is expected to cause significant burden among small insurance players. Additionally, the higher familiarity of traditional insurance management among the companies and significant difficulty in adopting digital transformation are likely to hamper the growth of the insurance platform during the forecast timeframe.

Report Segmentation

The market is primarily segmented based on offering, application, insurance type, technology, end-user and region.

|

By Offering |

By Application |

By Insurance Type |

By Technology |

By End-User |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Offering Analysis

Policy management software segment is projected to witness the highest growth during the forecast period

The policy management software segment is anticipated to grow at a healthy CAGR during the projected period, mainly driven by increased efficiency with the capability to automate various tasks with the incorporation of insurance platforms. Data analytics has the potential to support effective management of insurance company operations in policy issue and renewal, policy documentation, premium calculation, and quotation management.

The insurance workflow automation segment led the industry market with a substantial revenue share in 2023, largely attributable to its ability to provide streamlined services, leading to increased consumer satisfaction. The enhanced productivity, higher rate of return on investment, efficiency, and lower chance of human errors are driving the adoption of insurance platforms among companies.

By Application Analysis

Claims management segment registered the largest market share in 2023

The claims management segment accounted for the largest market share in 2023. This is due to the higher convenience offered by the insurance platform through claim management. An effective claim management system promotes the company's ability to retain existing consumers. In January 2024, hyper exponential raised USD 73 million, aiming to invest in an insurance pricing platform. In the insurance business, a smooth claim management process plays a crucial role in boosting the number of policy purchasers.

The customer relationship management segment is expected to grow at the fastest rate over the next few years owing to the offerings of customer data management, customer interaction and engagement, and customer support and service. Companies are working on ensuring a superior user experience, with the adoption of advanced insurance platforms in the marketplace, to build good will, and retain earlier customers.

By Insurance Type Analysis

General insurance segment held a significant market revenue share in 2023

The general insurance segment held a significant market share in revenue in 2023, which is highly accelerated due to the continuous rise in the number of people opting for health insurance, automobile insurance, homeowner insurance, and travel insurance. This trend is driving insurance companies to build efficient insurance platforms with the capability to manage a wide range of customers' needs and queries quickly.

The life insurance segment is anticipated to register significant growth due to the rising prevalence of health problems and accidents, driving the global population to purchase life insurance policies in the marketplace. This is enforcing businesses to acquire policy pricing and risk assessment tools, resulting in significant upgrades to their insurance platforms.

By Technology Analysis

Data Analytics & Big Data segment is expected to witness significant growth in 2023

The data analytics and big data segment registered significant growth in 2023 and is expected to carry out this growth trajectory in the coming years. The incorporation of data analytics in insurance platforms assists in the analysis of vast amounts of data, permitting faster risk assessment and underwriting. Most firms are embracing data analytics and big data technologies to compete with other insurance companies and gain a competitive edge over their peers.

Regional Insights

Asia Pacific region registered the largest share of the global market in 2023

The Asia Pacific region held the dominant share in 2023. This can be largely attributed to the growing major players expansion activities in the region.

- According to the Insurance Regulatory and Development Authority of India (IRDAI) 2022–23 report, the Indian life insurance industry registered a premium income of 7.83 lakh crore with a growth of 12.98%.

According to the national financial regulatory administration of China, the insurance companies’ primary insurance premium income in the first three quarters of 2024 registered RMB 4.3 trillion, a growth of 11% annually. The new insurance policies recorded a growth of 39.2% annually, compared to 53.7 billion on a yearly basis. The growing purchase of insurance policies is motivating insurance companies to innovate sophisticated insurance platforms to meet ongoing consumer demand.

The North America region is expected to be the fastest-growing region with an optimal CAGR during the study period, owing to the presence of larger insurance players in the region. According to the insurance business magazine, the top market players in the United States combined market capitalization is USD 1.05 trillion, registering a third of the global business figure of USD 3.231 trillion. This is a sign of the level of competition in the insurance business, facilitating significant growth opportunities for the insurance platform market as companies are more likely to invest in building efficient insurance platforms during the forecast period.

Based on the Commercial Property/Casualty Market Report Q2, 2023, published by the Council of Insurance Agents and Brokers, the commercial premium of respondents increased by 8.9% across multiple account sizes. This is encouraging insurance companies to adopt competitive pricing strategies, fueling the demand for insurance platforms as they are efficient in establishing pricing models.

Key Market Players & Competitive Insights

Strategic collaborations to drive the competition

The competitive landscape of the insurance platform market is a mix of consolidation and fragmentation. Major companies are working on the adoption of the latest technologies. For instance, in June 2023, Accenture and AWS entered into a collaboration to accelerate the development of large language models and generative artificial intelligence for financial services.

Some of the major players operating in the global market include:

- Accenture (Ireland)

- Adobe (US)

- AgencySmart (US)

- Appian (US)

- Applied Systems (US)

- Bolt Insurance (US)

- Britecore (US)

- CodeMetro (US)

- Cognizant (US)

- Duck Creek Technologies (US)

- DXC Technology (US)

- EIS Group (US)

- Fineos (Ireland)

- Guidewire Software (US)

- IBM (US)

- Inzura (UK)

Recent Developments

- In September 2023, Open Network for Digital Commerce (ONDC) unveiled its plan to expand its platform with investments, insurance, and gift cards.

- In July 2023, PhonePe Insurance Broking Services introduced a new health insurance platform in India that can permit monthly premium payments through online mode with the UPI.

Report Coverage

The insurance platform market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, offering, application, insurance type, technology, end-user, and their futuristic growth opportunities.

Insurance Platform Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 92.45 billion |

|

Revenue forecast in 2032 |

USD 260.03 billion |

|

CAGR |

13.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in Insurance Platform Market Accenture, Adobe, AgencySmart, Appian, Applied Systems, Bolt Insurance, Britecore,

Insurance Platform Market exhibiting the CAGR of 13.8% during the forecast period.

Insurance Platform Market report covering key segments are offering, application, insurance type, technology, end-user and region.

The key driving factors in Insurance Platform Market are Rising adoption of technological advancements

Insurance Platform Market Size Worth $ 260.03 Billion By 2032