Insurance Brokerage Market Size, Share, Trends, Industry Analysis Report: By Insurance (Life Insurance and Property & Casualty Insurance), Brokerage, End User, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM5098

- Base Year: 2023

- Historical Data: 2019-2022

Insurance Brokerage Market Overview

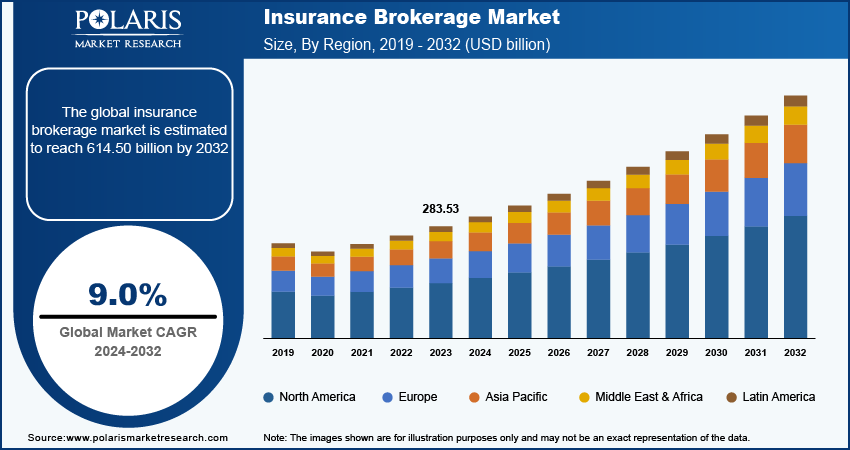

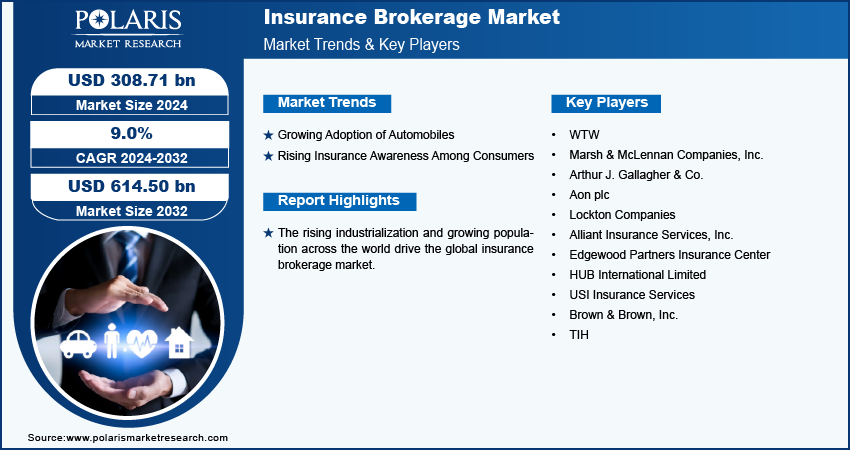

The insurance brokerage market size was valued at USD 283.53 billion in 2023. The market is projected to grow from USD 308.71 billion in 2024 to USD 614.50 billion by 2032, exhibiting a CAGR of 9.0% during 2024–2032.

Insurance brokerage is a process where a broker serves as an intermediary between clients seeking insurance coverage and insurance companies offering policies. The primary role of insurance brokerage is to help clients find and purchase insurance policies that best fit their needs. Government authorities regulate insurance brokerages to ensure they adhere to industry standards and ethical practices.

The rising disposable income drives the insurance brokerage market growth. Increased disposable income allows individuals and businesses to have greater financial flexibility to invest in various types of insurance such as life, health, property, and liability insurance.

Increasing population across the world fuels the growth of the insurance brokerage market. As per the report published by the United Nations, the global human population reached 8.0 billion in mid-November 2022 from an estimated 2.5 billion people in 1950, adding 1 billion people since 2010 and 2 billion since 1998. Growing population often leads to increased demand for life insurance policies to protect families and dependents. Insurance brokerage firms provide personalized life insurance solutions to meet these needs. Thus, as the population increases, the demand for insurance brokerage firms also rises.

To Understand More About this Research: Request a Free Sample Report

The rising industrialization also fuels the insurance brokerage market. Industrialization leads to the establishment and expansion of various industries, from manufacturing to technology. These businesses face numerous risks such as property damage, liability, and operational interruptions, which require specialized commercial insurance coverage. Insurance brokers help these businesses identify and obtain appropriate insurance policies to manage these risks.

Insurance Brokerage Market Drivers

Growing Adoption of Automobiles

The demand for auto insurance naturally increases as more people purchase automobiles. According to a report published by the European Automobile Manufacturers' Association, the new car sales grew by almost 10% globally after remaining stable in 2022. Insurance brokers help individuals and businesses navigate the variety of auto insurance options available and find policies that best meet their needs. Therefore, the growing adoption of automobiles propels the insurance brokerage market expansion.

Rising Insurance Awareness Among Consumers

Consumers are becoming aware of the importance of insurance and its various types. Therefore, they seek out knowledgeable brokers to help them make informed choices about their coverage. Brokers provide expert advice on different insurance products, helping clients understand their options and select policies that suit their needs. Thus, the rise in insurance awareness among consumers drives the insurance brokerage market.

Insurance Brokerage Market Segment Insights

Insurance Brokerage Market Breakdown – Insurance Insights

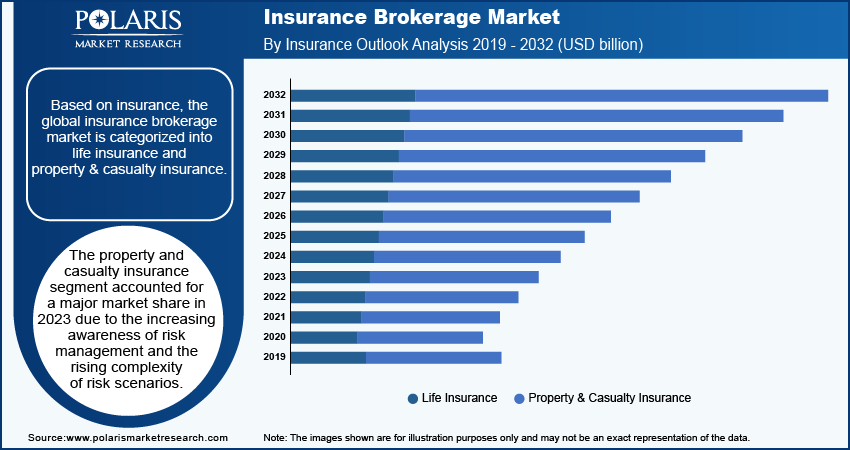

Based on insurance, the global insurance brokerage market is bifurcated into life insurance and property & casualty insurance. The property & casualty insurance segment accounted for a larger market share in 2023 due to the increasing awareness of risk management and the rising complexity of risk scenarios. The growing frequency of natural disasters such as hurricanes, floods, and wildfires significantly increased the demand for comprehensive property coverage. Additionally, the rise in commercial activities and real estate development drove the need for liability insurance and specialized policies for businesses. Brokers played a crucial role in helping individuals and companies navigate these complex needs, from securing coverage for physical assets to managing liability exposures. The ongoing urbanization and expansion of industrial activities further fueled the demand for P&C insurance as businesses and property owners need protection against a wide range of potential risks.

The insurance brokerage market for the life insurance segment is expected to grow at a robust pace in the coming years, owing to the growing aging population and increasing health awareness. There is a focus on financial security and long-term planning as the global population ages, driving the demand for life insurance products that offer protection and investment opportunities. Moreover, advances in life insurance products, such as those integrating health and wellness incentives, further contribute to the segment growth.

Insurance Brokerage Market Breakdown – End User Insights

In terms of end user, the global insurance brokerage market is bifurcated into individual and corporate. The individual segment held a larger market share in 2023 due to the increasing awareness of personal financial security and a growing emphasis on long-term planning. Individuals are increasingly investing in insurance products that offer protection against life’s uncertainties, including health issues, accidental injuries, and retirement planning.

The corporate segment is projected to register a higher CAGR during the forecast period owing to the rising complexity of business operations and an increasing focus on managing risks associated with growth and expansion. Companies across various industries faced rising exposure to risks such as cyber threats, regulatory compliance issues, and environmental liabilities. These companies turned to brokers for tailored insurance solutions that address specific operational risks, legal liabilities, and employee-related needs. The surge in mergers and acquisitions, along with growing regulatory scrutiny, further fuels the demand for commercial insurance coverage. Additionally, the expansion of global trade and supply chains necessitated sophisticated risk management strategies and multinational insurance policies, strengthening the significant role of insurance brokers in the corporate sector.

Insurance Brokerage Market – Regional Insights

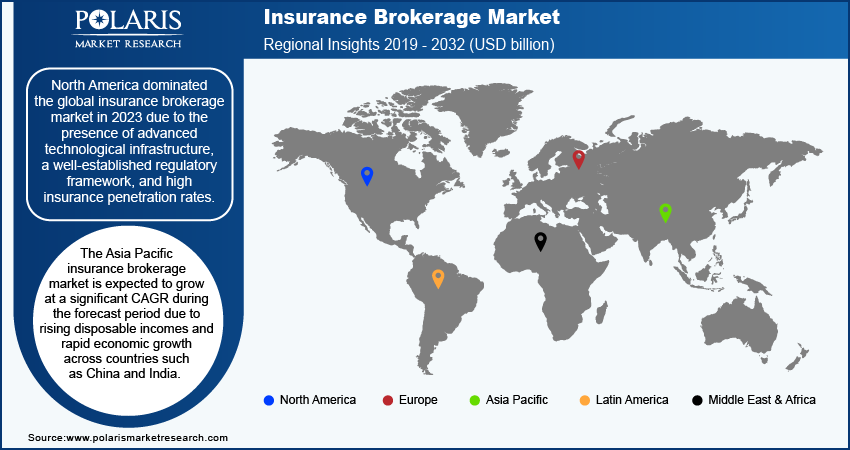

By region, the study provides the insurance brokerage market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2023 due to the presence of advanced technological infrastructure, high insurance penetration rates, and a well-established regulatory framework. The US, in particular, has a diverse and sophisticated insurance landscape, with strong competition among brokers, enhancing service quality and pushing the adoption of advanced digital platforms. The sector's expansion in North America also reflects the ongoing trend of mergers and acquisitions, which unite market players and magnify their service capabilities.

The Asia Pacific insurance brokerage market is expected to grow at a significant CAGR during the forecast period due to the rapid economic growth and rising disposable incomes across countries such as China and India. The regulatory environments in several Asia Pacific countries are evolving, encouraging investments in insurance technology and enhancing service accessibility, which supports market growth. The regional market is further bolstered by an increasing awareness of risk management and the growing preference for digital insurance solutions among tech-savvy consumers. Additionally, ongoing urbanization in the region is estimated to fuel market expansion. As per the report published by the UN-Habitat, 54% of the global urban population (i.e., more than 2.2 billion people) live in Asia and is expected to grow by 50% by 2050. Urbanization leads to a surge in commercial real estate development, including office buildings, retail spaces, and industrial facilities. These facilities need commercial property insurance to protect against risks such as property damage, business interruption, and liability, thereby boosting demand for insurance brokerage.

Insurance Brokerage Market – Key Players and Competitive Insights

Prominent market players are investing heavily in research and development to expand their offerings, which will help the insurance brokerage market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the insurance brokerage industry must offer innovative solutions.

The insurance brokerage market is fragmented, with the presence of numerous global and regional market players. Major players in the market include WTW; Marsh & McLennan Companies, Inc.; Arthur J. Gallagher & Co.; Aon plc; Lockton Companies; Alliant Insurance Services, Inc.; Edgewood Partners Insurance Center; HUB International Limited; USI Insurance Services; Brown & Brown, Inc.; and TIH.

Marsh & McLennan Companies, Inc., established in 1871, is a global professional services firm headquartered in New York City, specializing in insurance brokerage, risk management, and consulting services. The company operates in over 130 countries, serving a diverse clientele that includes businesses, government entities, and individuals. This extensive reach allows MMC to leverage global insights and expertise to meet local needs. In January 2024, Marsh announced the launch of ReadyCell, a simplified and flexible risk financing solution that enables organizations of all sizes to quickly open their own insurance company and take greater control of their risk management.

Willis Towers Watson (WTW) is a global broking, advisory, and solutions company that specializes in consulting services, risk management, and insurance brokerage. The company is headquartered in London and operates in over 140 countries, making it one of the largest firms in the industry. In November 2022, WTW launched a digital commercial insurance platform in collaboration with Liberty Specialty Markets (LSM) and Markel.

Key Companies in Insurance Brokerage Market

- WTW

- Marsh & McLennan Companies, Inc.

- Arthur J. Gallagher & Co.

- Aon plc

- Lockton Companies

- Alliant Insurance Services, Inc.

- Edgewood Partners Insurance Center

- HUB International Limited

- USI Insurance Services

- Brown & Brown, Inc.

- TIH

Insurance Brokerage Industry Developments

January 2024: Hub International Limited (HUB) announced the launch of HUB Multinational Protection, a comprehensive risk management services and insurance product tailored to the evolving complex risk needs of multinational clients in all industries who operate in five countries or less.

January 2024: Lockton, the world's largest independent insurance brokerage, announced its entry into the Indian market with the appointment of Dr. Sandeep Dadia as Chief Executive Officer of India.

August 2024: Marsh, the world’s major insurance broker and risk advisor, announced the launch of a USD 50 million port blockage insurance facility covering shipping ports and terminals across the world.

October 2021: Arthur J. Gallagher & Co., an international insurance brokerage and risk management services company, announced that it had completed its acquisition of Mumbai, India-based Edelweiss Gallagher Insurance Brokers Limited, which also has branches in Delhi, Kolkata, and Bangalore.

Insurance Brokerage Market Segmentation

By Insurance Outlook (Revenue, USD billion, 2019–2032)

- Life Insurance

- Property & Casualty Insurance

By Brokerage Outlook (Revenue, USD billion, 2019–2032)

- Retail

- Wholesale

By End User Outlook (Revenue, USD billion, 2019–2032)

- Individual

- Corporate

By Regional Outlook (Revenue, USD billion, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Insurance Brokerage Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 283.53 billion |

|

Market Size Value in 2024 |

USD 308.71 billion |

|

Revenue Forecast in 2032 |

USD 614.50 billion |

|

CAGR |

9.0% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 283.53 billion in 2023 and is projected to grow to USD 614.50 billion by 2032

The global market is projected to grow at a CAGR of 9.0% during the forecast period.

North America accounted for the largest share of the global market in 2023.

A few key players in the market are WTW; Marsh & McLennan Companies, Inc.; Arthur J. Gallagher & Co.; Aon plc; Lockton Companies; Alliant Insurance Services, Inc.; Edgewood Partners Insurance Center; HUB International Limited; USI Insurance Services; Brown & Brown, Inc.; and TIH.

The life insurance segment is projected to record a significant growth rate in the global market during the forecast period.

The individual segment dominated the market in 2023.