Insulating Glass Window Market Share, Size, Trends & Industry Analysis Report

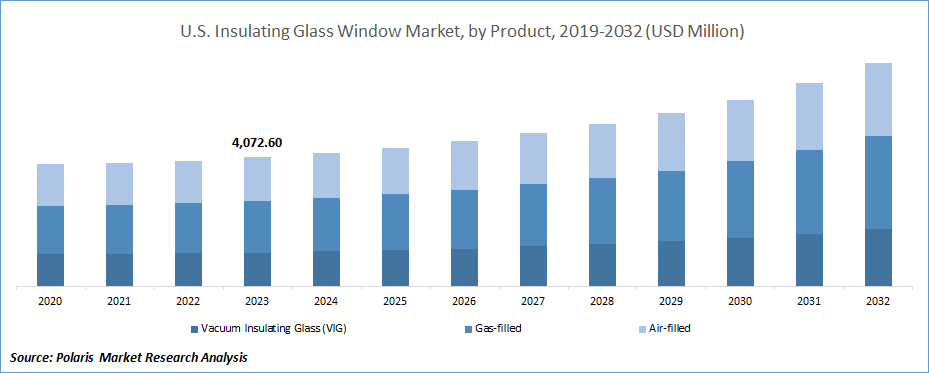

By Product (Vacuum Insulating Glass, Gas-filled, Air-filled); By Glazing; By Sealant; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 117

- Format: PDF

- Report ID: PM2228

- Base Year: 2024

- Historical Data: 2020-2023

The global Insulating Glass Window Market was valued at USD 12.30 billion in 2024 and is projected to grow at a CAGR of 6.0% from 2025 to 2034. Increasing construction activities and energy-efficient building designs are driving market expansion.

Industry Trends

Insulating glass windows are used to decrease the transmission of heat over a portion of the building by combining various insulating panes into a single unit. The huge energy consumption of commercial & residential structures is expected to propel the growth of the industry.

To Understand More About this Research:Request a Free Sample Report

Insulating glass windows regulate the room temperature by preventing air from escaping, thus reducing the need for artificial air conditioning. The use of insulating glass windows can reduce the cost of annual air conditioning by over 20-30%. The rising trend of energy rating systems such as IGBC green ratings in India and LEED (Leadership in Energy & Environmental Design) in the U.S., among others across various countries, is further anticipated to provide huge industry growth opportunities. The growing government measures to reduce the global carbon footprints and the rising focus towards environmental sustainability are anticipated to drive the market's growth. Additionally, the rising trend of lightweight vehicles is further expected to boost the growth of the industry.

The outbreak of the COVID-19 had a negative influence on the overall insulating glass window market. The outbreak impacted various factors of the value chain in the market. The restriction on cross-border movements and the lockdowns across nations globally disrupted the supply chain of the global industry. This caused the shutdown of the majority of production plants for insulating glass windows globally. Additionally, the negative effect on the global trade, finance, and economy due to the outbreak of the virus, further hindered the growth of the product.

Key Takeaways

- North America dominated the market and contributed over 36% share of the insulating glass window market in 2023

- By product category, gas-filled segment dominated the global insulating glass window market size in 2024

- By end-use category, the commercial segment is projected to grow with a significant CAGR over the insulating glass window market forecast period

What are the Market Drivers Driving the Demand for Market?

Increasing Awareness of Energy Efficiency

The escalating awareness of energy efficiency stands as a formidable driver propelling the insulating glass window market forward. In recent years, there has been a remarkable shift in consciousness regarding environmental sustainability and energy conservation. This heightened awareness is driven by several interconnected factors that have catalyzed a growing emphasis on energy-efficient building practices. Primarily, the pressing need to mitigate climate change and reduce greenhouse gas emissions has spurred governments, industries, and consumers alike to seek innovative solutions that minimize energy consumption. As a pivotal component of building envelope design, insulating glass windows offer a tangible means of enhancing energy efficiency within both residential and commercial structures.

One of the central imperatives driving the demand for energy-efficient solutions is the escalating cost of energy consumption. As energy prices continue to rise, property owners and facility managers are increasingly cognizant of the long-term financial benefits associated with investing in energy-efficient technologies. Insulating glass windows, renowned for their ability to significantly reduce heat loss or gain, play a pivotal role in optimizing a building's thermal performance. By minimizing the need for excessive heating or cooling, these windows help curtail energy consumption and alleviate the financial burden of utility bills, thereby bolstering their appeal in the marketplace.

Which Factor is Restraining the Demand for the Market?

Potential Durability Challenges

Potential durability issues are a significant concern in the insulating glass window market, impacting the performance and longevity of window units over time. Although insulating glass windows offer numerous benefits, such as energy efficiency, sound insulation, and enhanced comfort, several factors can affect their durability and reliability. One major issue is sealant degradation; the sealant used to bond the glass panes and spacer is critical for maintaining the integrity of the insulating glass unit. Over time, exposure to environmental factors like temperature fluctuations, UV radiation, and moisture can cause the sealant to degrade, resulting in air leakage, moisture infiltration, and reduced thermal performance, which compromises the overall efficiency and functionality of the window unit.

Additionally, insulating glass windows are subject to thermal stress, particularly in regions with extreme temperature variations. The temperature differentials between the interior and exterior surfaces of the glass panes lead to expansion and contraction, placing mechanical strain on the window assembly. Prolonged exposure to thermal stress can cause glass breakage, sealant failure, or distortion of the window frame, negatively affecting both performance and aesthetics.

Report Segmentation

The market is primarily segmented based on product, glazing, sealant, end-use, and region.

|

By Product |

By Glazing |

By Sealant |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Product Insights

Based on product category analysis, the market has been segmented on the basis of vacuum insulating glass (VIG), gas-filled, and air-filled. The gas-filled segment captured the largest market share in the insulating glass window market due to its superior thermal insulation properties compared to air-filled or vacuum-insulated alternatives. Gas-filled insulating glass units, typically filled with inert gases like argon or krypton, significantly reduce heat transfer between the interior and exterior environments. These gases have lower thermal conductivity than air, enhancing the energy efficiency of windows by minimizing heat loss in winter and heat gain in summer. This improved thermal performance translates to reduced energy consumption for heating and cooling, leading to lower utility bills and increased comfort for building occupants.

Also, gas-filled windows provide better sound insulation, adding another layer of appeal for both residential and commercial applications. As energy efficiency becomes an increasingly critical factor in building design and construction, the demand for gas-filled insulating glass units continues to rise.

By End-Use Insights

Based on end-use category analysis, the market has been segmented on the basis of residential and commercial. The commercial segment is experiencing a significant CAGR in the insulating glass window market due to the growing emphasis on energy efficiency and sustainability in building design and construction. Commercial buildings, such as office complexes, hotels, and retail spaces, have substantial energy consumption needs, and insulating glass windows play a crucial role in reducing heating and cooling costs. Stricter building codes and regulations, along with green building certifications like LEED, drive the adoption of energy-efficient solutions, making insulating glass windows an attractive option for developers and property owners.

Regional Insights

North America

North America held the largest market share in the global market since the region benefits from a thriving construction industry, characterized by extensive residential, commercial, and infrastructure projects. Urbanization trends and population growth further fuel demand for energy-efficient building solutions, including insulating glass windows, to meet stringent regulatory requirements and sustainability goals. Stringent energy efficiency standards and building codes set by organizations such as ENERGY STAR and the U.S. Green Building Council propel the adoption of insulating glass windows across residential, commercial, and institutional sectors.

Asia Pacific

The Asia Pacific region's insulating glass window market is experiencing rapid growth and transformation, driven by urbanization, infrastructure development, and rising construction activities across emerging economies. The region's expanding middle class, increasing disposable incomes, and changing lifestyle preferences are driving demand for energy-efficient and aesthetically pleasing building solutions, including insulating glass windows. Rapid urbanization and population growth in countries such as China, India, and Southeast Asian nations are fueling the construction of residential, commercial, and mixed-use developments, creating lucrative opportunities for market players.

Competitive Landscape

The insulating glass window market is highly competitive, with key players such as Saint-Gobain, Glaston Corporation, Guardian Industries, H.B. Fuller Company, INTERNORM, Nippon Sheet Glass Co., Ltd, Scheuten, and Sika AG leading the way. These companies have strong distribution networks and extensive customer bases, giving them a significant edge in terms of market reach and penetration. Intense competition in the market has led to a focus on technological advancements, strategic collaborations, and a strong commitment to innovation. Companies are heavily investing in research and development to meet evolving industry needs and adhere to rigorous quality standards.

Some of the major players operating in the global market include:

- AGC Inc.

- CARDINAL GLASS INDUSTRIES INC.

- Central Glass Co., Ltd.

- Glaston Corporation

- Guardian Industries

- H.B. Fuller Company

- INTERNORM

- Nippon Sheet Glass Co Ltd.

- Saint-Gobain

- Scheuten

- Shandong Ambit Building Materials Co., Ltd.

- Sika AG

- Viracon

- Vitro

Recent Developments

- In March 2025, AeroShield partnered with ODL to create full-size aerogel-insulated entry doors, boosting energy efficiency, surpassing ENERGY STAR standards, and reducing heating and cooling costs, with commercial availability by 2026.

- In September 2023, Saint-Gobain Glass introduced ORAÉ, the world's first low-carbon glass, with a verified EPD showing a 42% reduction in CO2 emissions.

- In February 2023, Guardian Glass introduced ClimaGuard 70 residential glass, which offers advanced coating solutions with bright neutrality. This latest addition to the ClimaGuard product line boasts solar control, low reflectivity, and high light transmission.

- In May 2022, NSG Group launched a new High-Performance Materials Website to showcase its functional glass products globally, providing technical information and features. The site, available in Japanese, English, and Chinese, aims to promote innovation and value creation across various industries.

- In May 2021, AGC Glass Europe and Schüco have agreed to form a strategic development partnership to combine their knowledge and technical expertise. This collaboration aims to leverage synergies in research, actively fostering the advancement of innovative solutions involving vacuum-insulating glass and aluminum systems.

Report Coverage

The insulating glass window market report emphasizes on key regions across the globe to provide better understanding of the sealant to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, glazing, sealant, end-use, and their futuristic growth opportunities.

Insulating Glass Window Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 13.1 Billion |

|

Revenue forecast in 2034 |

USD 22.5 Billion |

|

CAGR |

6.00% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Glazing, By Sealant, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key segments in Insulating Glass Window Market Are AGC Inc., CARDINAL GLASS INDUSTRIES INC., Central Glass Co., Ltd

Insulating Glass Window Market Size Worth USD 22.5 Billion by 2034

Insulating glass window market exhibiting the CAGR of 6.00% during the forecast period.

North America is leading the global market

The key driving factors in Insulating Glass Window Market are Stringent Building Codes and Regulations