Insulated Packaging Market Size, Share, Trends, Industry Analysis Report: By Type (Flexible, Rigid, and Semi-Rigid), Material, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 116

- Format: PDF

- Report ID: PM1589

- Base Year: 2024

- Historical Data: 2020-2023

Insulated Packaging Market Overview

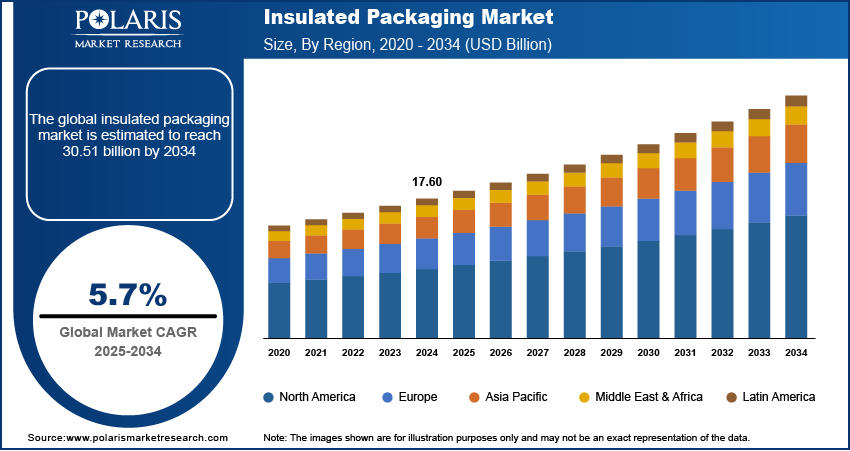

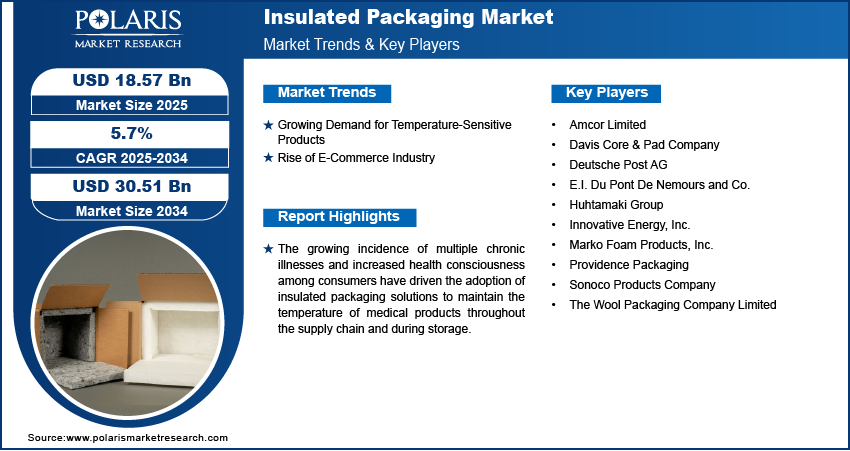

The global insulated packaging market size was valued at USD 17.60 billion in 2024. The market is projected to grow from USD 18.57 billion in 2025 to USD 30.51 billion by 2034, at a CAGR of 5.7% from 2025 to 2034.

Insulated packaging protects the temperature of packaged contents from extreme external temperatures. It is used to transport and store temperature-sensitive products, such as food, pharmaceuticals, and organs, to ensure their quality and integrity. Insulated packaging is part of a cold chain that helps maintain the freshness and efficacy of products. It is important to preserve the condition and appearance of food products, as well as the chemical composition of pharmaceuticals. A few of the common insulating materials are polyurethane, expanded or extruded polystyrene, and polyethylene insulating panels.

To Understand More About this Research: Request a Free Sample Report

Insulated packaging works by minimizing the loss of heat from the product by restricting heat flow through conduction, convection, and radiation along with keeping the product at a consistent temperature to prevent deterioration during transit. Insulated packaging can be customized to fit the specific needs of the product, such as the thickness of the insulating layer and the type of material used. Some aspects of green thermal packaging are recyclable, but the materials may vary depending on the manufacturer and the content being shipped.

Different factors influencing the insulated packaging market demand include a rise in urbanization, an increase in the need for convenience, and enhanced product shelf life. The rising demand for temperature-sensitive packaging and strong demand from the food & beverage industries support the market growth rate. Growing demand from industries such as pharmaceuticals, healthcare, chemicals, and cosmetics, rising disposable income, and changing lifestyles have contributed to the insulated packaging market expansion. The increasing prevalence of various chronic diseases and rising health awareness among consumers have spurred the use of insulated packaging solutions to maintain the temperature of medical products across the supply chain and storage. Various factors, such as the rising need for fresh products, expanding pharmaceutical industry, increasing penetration of e-commerce, and growing demand from emerging nations, are predicted to provide growth prospects for the insulated packaging business during the forecast period.

Insulated Packaging Market Dynamics

Growing Demand for Temperature-Sensitive Products

Import and export activities between nations across the world are rising due to rapid globalization. Various temperature-sensitive products such as frozen foods, fish, meat, vegetables, fruits, and medical supplies require insulated packaging during transportation and storage to maintain a consistent temperature inside the container regardless of external conditions. Demand for processed and packaged food is rising in urban areas as they are easier to make and take less cooking time, which saves time and efforts of working population. The food is temperature sensitive and requires insulated packaging to increase its shelf life. Therefore, the rising demand for temperature-sensitive products boosts the insulated packaging market growth.

Rise of E-Commerce Industry

E-commerce often involves shipping goods across larger geographical areas, which increases the time products spend in transit, making temperature control crucial. E-commerce packaging needs to be designed for efficient space utilization within shipping boxes while maintaining temperature stability. The rise of e-commerce has significantly increased the demand for insulated packaging, particularly for products that require temperature control during transit, like food, pharmaceuticals, and beverages, as it requires reliable packaging to maintain product quality throughout long-distance shipping, leading to substantial growth in the insulated packaging market. Foam boxes, phase change materials (PCMs), reusable thermal bags, and vacuum sealed pouches are among few of the examples of insulated packaging materials being used in e-commerce.

Insulated Packaging Market Segment Insights

Insulated Packaging Market Outlook by Type

Based on type, the insulated packaging market is segmented into flexible, rigid, and semi-rigid. With a market share of 42.2% in 2024, the rigid segment held the largest market share. Paperboard, fiberboard, corrugated cardboard, plastics, and paper are among the materials used to make rigid packing items. Adhesives, tapes, and staples are used to seal rigid goods. The goods can be produced using a variety of color printing designs and radio-frequency identification. Rigid packaging items such as cases, trays, bottles, cans, cups, pots, and cartons are made with these rigid packaging materials. During the forecast period, the flexible segment is estimated to register a significant CAGR. Ply and plastic films are often used to make flexible packaging products. To seal these types of packaging materials, heat & pressure are usually employed.

Insulated Packaging Market Assessment by Material

Based on product type, the insulated packaging market is segmented into metal, plastic, corrugated cardboard, glass, and others. In 2024, the corrugated cardboard segment held the largest market share (i.e., 30.3%). Corrugated cardboards are made of fluted corrugated sheets and linerboard. These elements strengthen and enable corrugated cardboard to endure high pressures. High impact, bending, tear, and burst strength are all exhibited by the cardboard. Typically, flute lamination machines, sometimes referred to as corrugators, are used to create corrugated cardboard. The plastic segment is expected to register the highest CAGR during the forecast period. Products that need to be stored under controlled pressure and temperature are packaged in plastic. Additionally, meats can be packed in plastic and preserved and dry-aged for a number of months to years.

Insulated Packaging Market Regional Insights

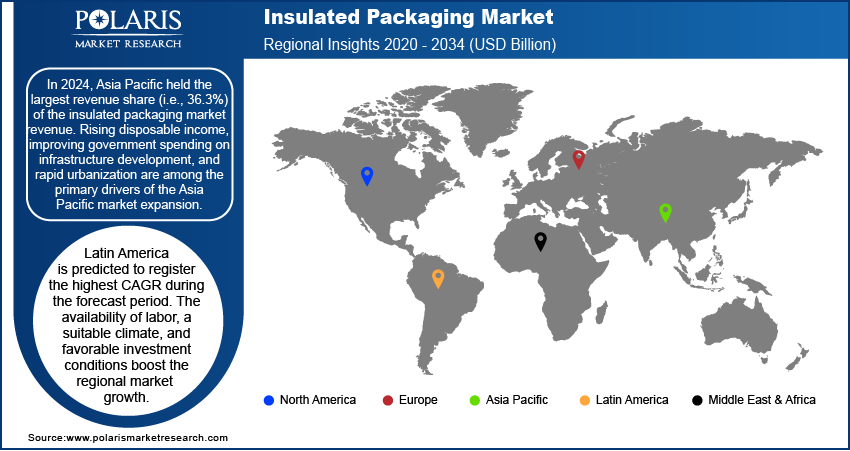

The insulated packing market report provides region-specific insights on North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

In 2024, Asia Pacific held the largest revenue share of 36.3% and dominated the market. Public-Private Partnerships (PPPs) have been formed by governments to expand the region's automotive and electronics sectors. A few main factors driving the expansion of the insulated packaging industry in Asia Pacific are rising disposable income, improving government spending on infrastructure development, and rapid urbanization. The insulated packaging business is being driven by the concerted efforts made by different governments to supply effective modern electronics.

During the forecast period, Latin America is expected to record the highest CAGR. Government programs are propelling the expansion of Mexico's industrial sectors. The main motivating elements are anticipated to be the availability of labor, a conducive climate, and good investment conditions. Owing to these initiatives, the region is rapidly becoming more industrialized. The insulated packing market in Latin America is anticipated to be favorably driven by the developed smart packaging sector and the regional government's attempts to supply technologically sophisticated packing solutions.

Insulated Packaging Market – Key Players and Competitive Insights

Market leaders in the insulated packaging sector are launching innovative goods to meet the rising demand from customers. The market for insulated packaging is competitive and diverse, with the presence of many multinational companies as well as local and regional players. Businesses are significantly spending on research and development to create advanced packaging solutions that meet the expanding needs of diverse end consumers. A considerable proportion of mergers and acquisitions are also viewed as a step in the direction of expanding market share.

Amcor Limited; Providence Packaging; E.I. Du Pont De Nemours and Co.; Davis Core & Pad Company; Innovative Energy, Inc.; Sonoco Products Company; Deutsche Post AG; Marko Foam Products, Inc.; Huhtamaki Group; and The Wool Packaging Company Limited are among the major companies mentioned in the insulated packaging market research report. To grow their clientele, increase their brand awareness, and gain a larger portion of the market, multinational corporations are venturing into emerging economies.

List of Key Players

- Amcor Limited

- Cold Ice Inc.

- Davis Core & Pad Company

- Deutsche Post AG AG

- E.I. Du Pont De Nemours and Co.

- Huhtamaki Group

- Innovative Energy, Inc.

- MARKO Foam Products

- Marko Foam Products, Inc.

- Providence Packaging

- Sonoco Products Company

- The Wool Packaging Company Limited

- TP Solutions GmbH

Insulated Packaging Industry Developments

In September 2024, Vizient Pharma selected Cryopak as its contracted cold chain packaging partner. Cryopak is suited to supply dependable solutions to Vizient Aggregation Group members, with multiple production sites, some of the largest testing labs and design centers in North America.

In June 2024, ProAmpac, a leading flexible packaging and material science company, debuted its patent-pending ProActive Recyclable FiberCool. Specifically intended for the food and grocery delivery business, this curbside recyclable insulated bag offers improved temperature retention and curbside recyclability, going above and beyond the standard self-opening sack (SOS).

Insulated Packaging Market Segmentation

By Type Outlook

- Flexible

- Rigid

- Semi-Rigid

By Material Outlook

- Metal

- Plastic

- Corrugated Cardboards

- Glass

- Others

By Application Outlook

- Pharmaceutical

- Food & Beverages

- Cosmetic

- Industrial

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Insulated Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 17.60 billion |

|

Market Size Value in 2025 |

USD 18.57 billion |

|

Revenue Forecast by 2034 |

USD 30.51 billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The insulated packaging market size is expected to reach USD 30.51 billion by 2034 from USD 18.57 billion in 2025.

The market is expected to exhibit a CAGR of 5.7% during the forecast period.

In 2024, Asia Pacific held the largest market share (i.e., 36.3%) in global insulated packaging market revenue.

Amcor Limited; E.I. Du Pont De Nemours and Co.; Providence Packaging; Davis Core & Pad Company; Sonoco Products Company; Innovative Energy, Inc.; Deutsche Post AG; Marko Foam Products, Inc.; Huhtamaki Group; and The Wool Packaging Company Limited are amongst the key players in the insulated packaging market.

The rigid segment held the largest insulated packaging market share (i.e., 42.2%) of the total revenue in 2024.

The corrugated cardboard segment held the largest market share (i.e., 30.3%) in 2024.