Inspection Camera System Market Share, Size, Trends, Industry Analysis Report

By Component (Hardware, Services); By Video Quality; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 116

- Format: PDF

- Report ID: PM2946

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

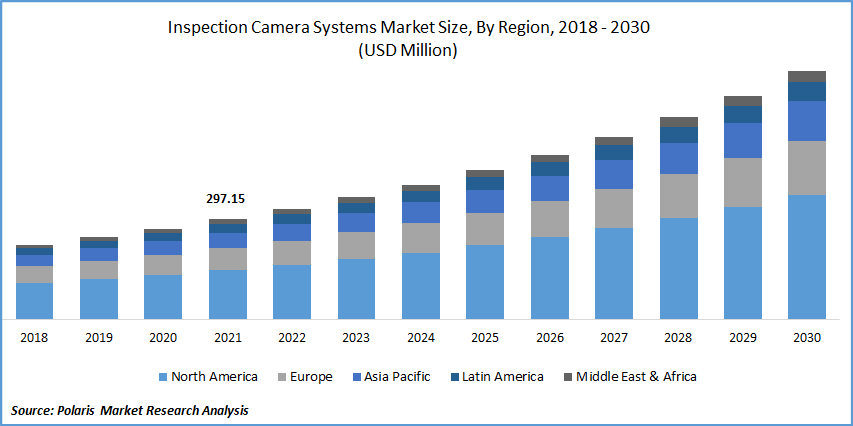

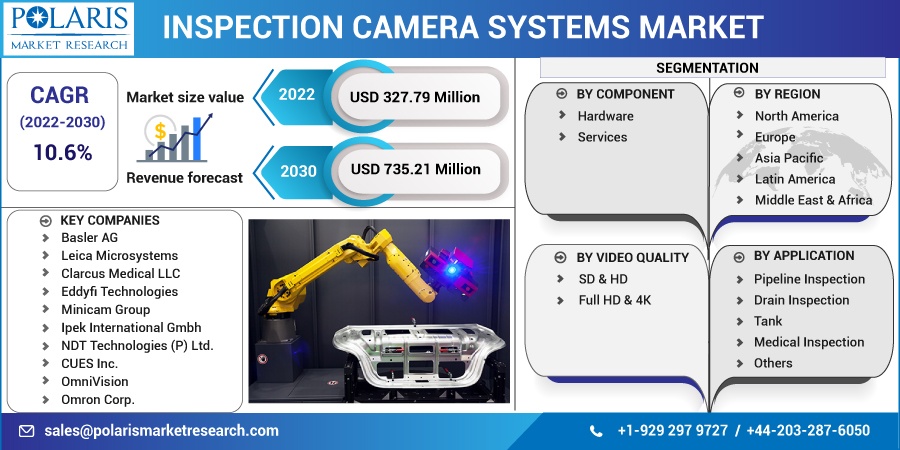

The global inspection camera system market was valued at USD 297.15 million in 2021 and is expected to grow at a CAGR of 10.6% during the forecast period.

A factor contributing to the market expansion is the use of inspection cameras for visual inspection and the ability of these cameras to articulate in industrial applications, which helps to provide a clearer picture of the machine's inner workings. In order to dispose of clean water and prevent the stagnation of polluted water, sewer systems in commercial, residential, institutional, and public sites must be appropriately maintained.

Know more about this report: Request for sample pages

Since the technology may be used to monitor a wide range of physical parameters, such as voltage, current, frequency, resistance, and inspection cameras are utilized in various industrial and commercial applications as security inspection devices. They frequently come with endoscopes inserted inside devices and systems.

Manufacturers have many prospects for growth as they implement innovations, change systems, make technological advancements, and invest in the study and development of inspection camera systems. One example is the new camera-based inline inspection system that ISRA VISION unveiled, which comes with modernized features and cutting-edge software tools.

A few battery-powered inspection camera systems are available, and their producers are constantly looking for ways to improve their lithium-ion batteries' dependability, longevity, and lack of faults and flaws. The demand for inspection cameras is rising in the semiconductor and pharmaceutical industries.

The rapid expansion of the industrial and municipal sectors and the requirement for video inspection fuels the need for inspection camera systems. A public-private organization called the Advanced Robotics for Manufacturing (ARM) Institute works to increase the competitiveness of US manufacturers through partnerships and the creation of cutting-edge robotics technologies and a vision system for quality control.

Advancements have determined the trajectory of product improvements in the market for inspection cameras in mechatronics and mechanics on the one hand and the incorporation of cutting-edge illumination and sensors on the other. Security inspection products' image technology and the system linking the cameras to the screen have experienced continuous developments. One major element driving uptake is the increasing requirement for inspection at various inspection facilities to have a complete view of the inner workings of diverse machinery. Additionally, the market is anticipated to grow due to ongoing innovations in the machine vision sector. Pharmaceutical, packaging, semiconductor, security, and surveillance industries are other end-use sectors with extensive use of inspection cameras.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The primary factor fueling the inspection camera system market expansion during the projection period is that the municipalities are increasingly using inspection camera systems to prevent clogging of drainage and sewage systems. The market acceptance is increasing due to the desire for inspection and getting a complete view of the inner workings of diverse machinery at various inspection facilities. Inspection camera systems are utilized to assess physical parameters, including resistance, frequency, voltage, and current, as they are used as surveillance equipment in the industrial and commercial sectors.

Manufacturers are concentrating on releasing new goods with improved capabilities by evolving requirements based on how consumers use the desired technology. Businesses aim to offer cutting-edge software platforms coupled with cloud computing to get an edge with AI and machine learning technology. Because standard approaches only allow for 2D measurement and inspection, there is a great need in the industry for 3D inspection systems that offer promising futures.

The main advantage of using inspection cameras in the plumbing business is their ability to do non-invasive inspections, which allows for a detailed examination of the pipeline and sewage systems without tearing down the entire infrastructure. This inspection does not necessitate physical touch, although the sensor component may need to be put inside a machine system.

Report Segmentation

The market is primarily segmented based on component, video quality, application and region.

|

By Component |

By Video Quality |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The hardware segment dominated the market in 2021

Improvements in hardware systems over the previous few years made it easier for end users to conduct inspections in small places. The market is anticipated to continue growing steadily during the forecast period, maintaining its leadership position. The camera's sturdy design provides imaging in a challenging setting. Better video quality has also been made possible by developing camera lenses and display units. Hardened and waterproof wiring and cables allow for reach in high-pressure and damp environments.

Conversely, the services segment is anticipated to increase quickly over the projection period. Technology advancements in inspection camera systems are also linked to aftermarket assistance and training services the players offer. To meet the increasing demand, manufacturers are diversifying their product lines.

The demand in Asia-Pacific is expected to witness significant growth.

Asia Pacific region is anticipated to experience the fastest rate of growth. The need for inspection in natural gas pipeline developments throughout nations is responsible for this growth. This camera system inspects underwater pipelines for maintenance and repair because humans cannot reach them due to increased water pressure and other dangerous conditions.

In 2021, North America was the largest region and contributed the highest percentage of total revenue. The development of the industrial core contributes to the growth of the area. The requirement for sophisticated video inspection equipment to support local industrial and governmental growth drives the demand for inspection camera systems. The United States has established several rules. The Pipeline and Hazardous Materials Safety Administration of the Department of Transportation provide information to pipeline operators about anything from safety standards to equipment replacement and leak prevention.

Competitive Insight

Some of the major players operating in the global market include Basler AG, Leica Microsystems, Clarcus Medical LLC, Eddyfi Technologies, Minicam Group, Ipek International Gmbh, NDT Technologies (P) Ltd., CUES Inc., OmniVision, I.C. LERCHER Solutions GmbH Canon Inc., Omron Corp., Pleora Technologies Inc., eInfochips, Kintronics Inc., Pro-Vigil, CameraFTP, Camcloud, Exacq Technologies, Stealth Monitoring.

Recent Developments

- For instance, Omron Corp. has unveiled the B series of GigE Vision cameras, offering simplicity in integration and adaptability for compact form factor applications.

Inspection Camera System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 327.79 million |

|

Revenue forecast in 2030 |

USD 735.21 million |

|

CAGR |

10.6% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By Video Quality, by Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Basler AG, Leica Microsystems, Clarcus Medical LLC, Eddyfi Technologies, Minicam Group, Ipek International Gmbh, NDT Technologies (P) Ltd., CUES Inc., OmniVision, I.C. LERCHER Solutions GmbH Canon Inc., Omron Corp., Pleora Technologies Inc., eInfochips, Kintronics Inc., Pro-Vigil, CameraFTP, Camcloud, Exacq Technologies, Stealth Monitoring |

FAQ's

Key companies in the inspection camera system market are Basler AG, Leica Microsystems, Clarcus Medical LLC, Eddyfi Technologies, Minicam Group, Ipek International Gmbh, NDT Technologies (P) Ltd.

The global inspection camera system market expected to grow at a CAGR of 10.6% during the forecast period.

The inspection camera system market report covering key segments are component, video quality, application and region.

Key driving factors in inspection camera system market are Growing Adoption Of Technological Advanced Products Propel The Market Growth.

The global inspection camera system market size is expected to reach USD 735.21 million by 2030.