Insolvency Software Market Share, Size, Trends, Industry Analysis Report, By Offering (Solutions, Services); By Organization Size; By Application; By Vertical; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 120

- Format: PDF

- Report ID: PM4484

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

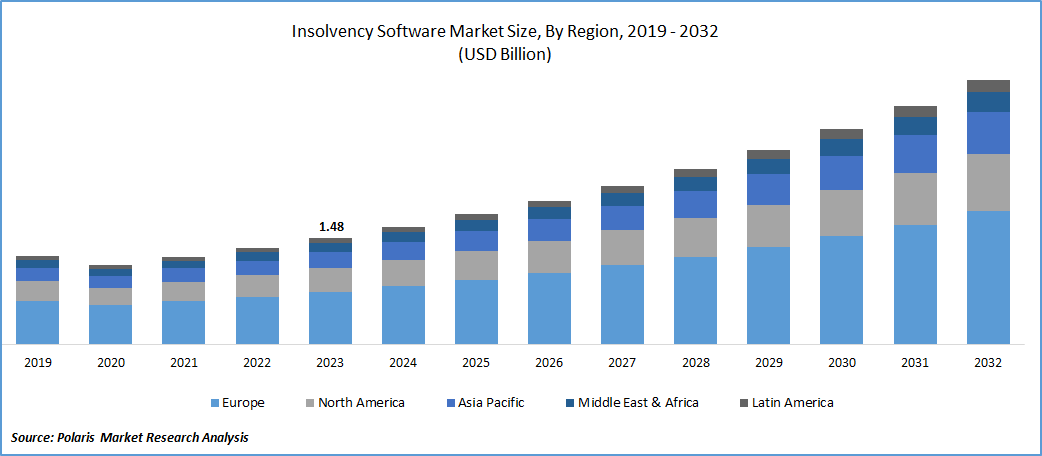

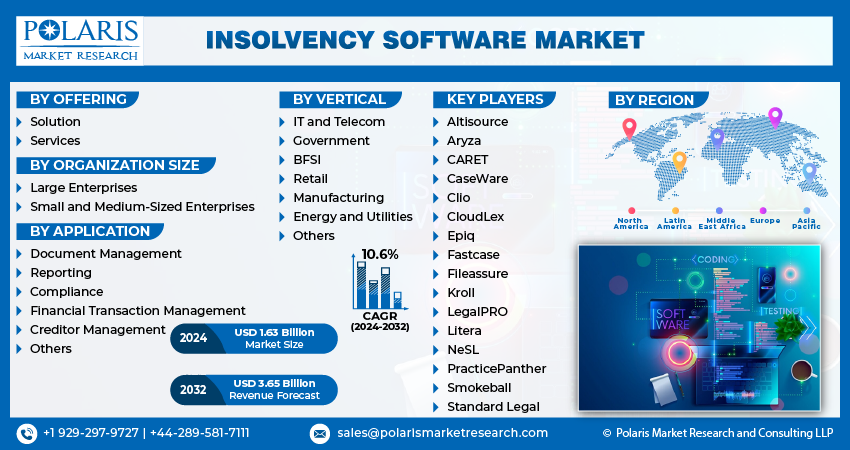

The global insolvency software market was valued at USD 1.48 billion in 2023 and is expected to grow at a CAGR of 10.6% during the forecast period.

Insolvency software is gaining momentum nowadays due to the rising financial frauds in the marketplace. Financial professionals use this software to monitor the real-time debt collection process and manage bankruptcy cases. The higher accuracy in solving numerous complex cases is the driving factor for the growth of the market.

The rising focus on risk management in the company's decision-making process, along with the capabilities of insolvency software including, reporting, compliance and credit management are becoming crucial in obtaining new demand from businesses. The presence of companies engaged in providing financial software solutions is driving new product innovations with the adoption of advanced technologies.

To Understand More About this Research:Request a Free Sample Report

- For instance, in July 2023, Aryaza, a financial software services provider, unveiled Aryaza Dunning to promote receivable management in the UK and Ireland.

Moreover, the ongoing technological innovations in the marketplace are expanding various industries and driving data-driven decision-making with the utmost precision. Artificial intelligence and machine learning algorithms are gaining utility in the financial space due to their enormous capabilities in analysing vast amounts of data, along with the risk associated with insolvency.

However, the higher initial costs of investment along with the resistance to adopting the latest technologies are the major factors likely to impede the demand for insolvency software. The changing rules and regulations of bankruptcy are becoming a challenge for companies engaged in insolvency software.

Growth Drivers

- Technological evolution is driving the replacement of man hours in businesses

The establishment of technologies is modifying the way humans work in the global space. Companies are stepping forward to adopt new technologies for tasks that are prone to human errors. Nowadays, automation is one of the places where artificial intelligence is building its footprint. Furthermore, the global stagnation in growth and the lower pace of consumer purchase interests with increasing interest rates are leading to a rise in insolvency cases. According to the Reserve Bank of India’s Financial Stability Review 2023, there is an upward trend of insolvency cases among medium and large enterprises. This is demonstrating the need for efficient financial tools among financial providers to monitor business health and take measures to tackle the prevalence of insolvencies.

With the COVID-19 pandemic, the global economy is witnessing stagnation, as it has changed the buying behaviour of consumers and necessitated the need to save. This step is driving significant losses among the companies, leading to bankruptcies. Based on statistics from the US court system in 2023, corporate bankruptcies in the US witnessed a 30% increase in the past 12 months. This is driving the incorporation of insolvency software at a higher rate. Poor financial management and the ongoing economic slowdown are motivating companies in retail, manufacturing, IT, and telecom to adopt effective financial solutions with a view to lowering the chance of getting into bankruptcy.

Report Segmentation

The market is primarily segmented based on offering, organization size, application, vertical, and region.

|

By Offering |

By Organization Size |

By Application |

By Vertical |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Offering Analysis

- Managed services segment is expected to witness the highest growth during the forecast period

The managed services segment will grow with substantial pace, primarily driven by the increasing preferences for financial consultancy in the market. Companies are showing strong interest in taking experts' advice in tackling financial issues to benefit from their profound knowledge in solving a wide range of business problems. As financial services providers mostly work in this space, there will be a significant demand for insolvency software as it can assist in providing technical skills and speed up the analysis process.

By Application Analysis

- Credit management segment accounted for the largest market share in 2023

The credit management segment held the largest share. Insolvency software guides businesses in insolvency and bankruptcy proceedings. It facilitates a suitable environment for the creditors relationship and assists in managing their debt cases. The importance of credit management among financial institutions is likely to support the demand for insolvency software.

The financial transaction management segment is expected to grow at the fastest rate over the next few years due to the real-time monitoring capabilities of insolvency software. Its ability to predict unforeseen financial risks early on with its risk assessment capability is likely to enhance the demand for insolvency software.

By Vertical Analysis

- BFSI segment held the significant market revenue share in 2023

The BFSI segment held a significant market share in revenue in 2023, which was highly accelerated due to the continuous rise in demand for debt management solutions among banks and financial institutions. One of the crucial tasks for these entities is to meet certain rules and regulations. Failure to follow can lead to penalties and drive them into complex problems. This is the place where the adoption of insolvency software is vital, as it can play a significant role in helping entities comply with regulations.

The government segment is expected to witness significant growth in the coming years owing to the increasing integration of technologies in various tasks. The need for monitoring financial information more frequently for efficient functioning, funding new schemes, and taking significant steps in controlling financial crimes is expected to boost the demand for insolvency software.

By Organization Size Analysis

- Small and medium enterprises segment saw a significant growth in 2023

The small and medium enterprises segment registered significant growth and is expected to continue its growth trajectory with the ongoing global financial crises. Currently, banks and companies are struggling to promote their companies' growth and build trust among consumers. The recent failures of Silicon Valley Bank, Bed, Bath & Beyond Company, and more are raising the importance of opting for financial software to streamline financial analysis, credit, and financial management among us small and medium enterprises.

Regional Insights

- Europe region registered the largest share of global market in 2023

The European region held the global market with the largest market share and is expected to continue its dominance over the study period. The growth of the segment market can be largely attributed to the growing expansion activities among the companies. For instance, Aryza, a provider of financial solutions, entered into a strategic partnership with Parklawn to promote its presence in Canada. With the ongoing innovations in the field of insolvency software, this is likely to foster market growth throughout the study period.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing insolvency cases. According to Allianz Trade, an insurance company, business insolvencies in Asia Pacific are set to grow by 5% in 2024. As insolvency cases are increasing, there will be a significant demand for insolvency software during the forecast period, attributable to its ability to assist companies in encountering future financial issues in the early stages.

Key Market Players & Competitive Insights

The insolvency software market is considered to be fragmented and is expected to witness competition due to the presence of several market players. Major companies are stepping forward to enhance their global market presence through strategic collaborations, mergers, and acquisitions. In addition, companies are focusing on integrating technological advancements, including artificial intelligence and machine learning, into their software development processes to gain a competitive edge.

Some of the major players operating in the global market include:

- Altisource

- Aryza

- CARET

- CaseWare

- Clio

- CloudLex

- Epiq

- Fastcase

- Fileassure

- Kroll

- LegalPRO

- Litera

- NeSL

- PracticePanther

- Smokeball

- Standard Legal

Recent Developments

- In October 2023, Aryaza introduced new embedded lending solutions in partnership with Dreams with the aim of providing a simple, secure, fully digital, and automated journey that can meet user demands.

- In March 2023, Aryaza launched its next-generation insolvency software, Aryza Insolvency.

Insolvency Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.63 billion |

|

Revenue forecast in 2032 |

USD 3.65 billion |

|

CAGR |

10.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Offering, By Organization Size, By Application, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Insolvency Software Market Size Worth $3.65 Billion By 2032.

The top market players in Insolvency Software Market include Altisource, Aryza, CARET, CaseWare, Clio, CloudLex, Epiq, Fastcase, Fileassure.

Europe is contribute notably towards the Insolvency Software Market.

The global insolvency software market is expected to grow at a CAGR of 10.6% during the forecast period.

Insolvency Software Market report covering key segments are offering, organization size, application, vertical, and region.