Insect Protein Market Size, Share, Trends, Industry Analysis Report

: By Product, Type (Crickets, Mealworms, Black Soldier Flies, Grasshoppers, and Others), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: PDF

- Report ID: PM1920

- Base Year: 2024

- Historical Data: 2020-2023

Insect Protein Market Overview

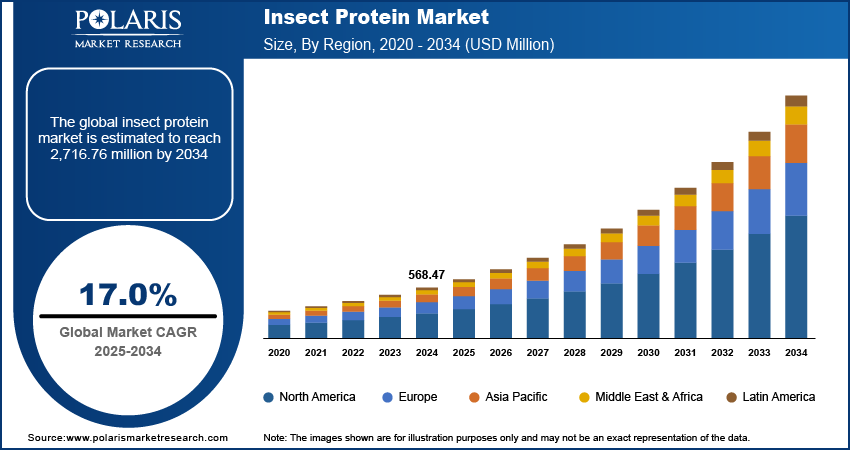

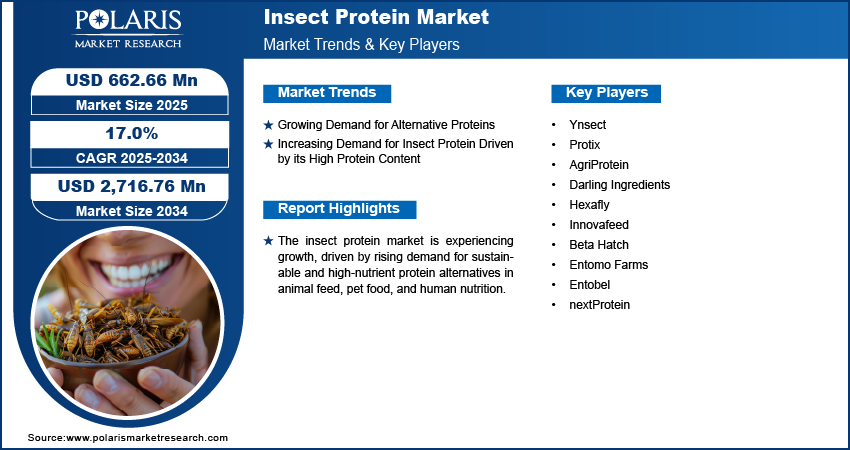

The global insect protein market size was valued at USD 568.47 million in 2024 and is projected to grow at a CAGR of 17.0% during 2025–2034. It is primarily driven by the rising demand for sustainable protein sources. Environmental concerns and efforts to minimize carbon footprints in food production are key drivers behind this trend.

Insect protein, primarily sourced from edible insects, serves as a sustainable and efficient alternative to conventional protein sources. It is rich in essential amino acids, vitamins, and minerals, offering significant nutritional and environmental benefits. Technological advancements have improved insect farming methods, increasing production efficiency and scalability. These innovations have made insect proteins more accessible and widely accepted as viable alternatives to traditional proteins. As a result, insect proteins are now being used in various applications, including animal feed, pet food ingredients, and human nutrition.

To Understand More About this Research: Request a Free Sample Report

Increased investments in research and development, as well as support for startups, fuels the overall growth. Companies are implementing strategies such as launching new products, forming strategic partnerships, and pursuing acquisitions to expand their presence and capture a larger share. In September 2022, Smart Vet Group and Global Bugs Asia collaborated to develop sustainable pet food solutions featuring cricket protein. The collaboration focuses on creating product offerings such as EntoPowder and EntoCrisp, aimed at enhancing eco-friendly pet food options.

Market Dynamics

Growing Demand for Alternative Proteins

Several key factors, including rapid urbanization, increased venture investments in alternative protein companies, and advancements in food technologies, propel the demand for alternative proteins. It also benefits from the high nutritional value of edible insects and the sustainability associated with alternative protein production and consumption. In May 2023, Protix announced that its recent pet food trial demonstrated that 94% of dogs and 81% of cats accepted insect protein-based food. The study, involving 17 dogs and 16 cats, shows promising results that could drive further research into sustainable pet nutrition. Growing awareness about the negative effects of chemical proteins on health and the environment is driving consumers and regulatory bodies to seek alternative solutions, leading to the insect proteins overall growth.

Increasing Demand for Insect Protein Driven by its High Protein Content

Insects offer a highly efficient source of protein, surpassing many traditional plant and animal proteins. Initially, insect-based protein was primarily utilized in animal feed. Growing awareness of its high protein content has led to widespread adoption across various industries, including food and beverages, medicines, nutraceuticals excipients, cosmetics, pet food, and aquafeed. A report from the National Institute of Health, published in November 2023, highlighted that edible insects contain a protein content ranging from 35% to 60% of their dry weight or 10% to 25% of their fresh weight. This surpasses the protein levels found in traditional animal sources such as beef and chicken, as well as plant-based proteins such as cereals, soybeans, and lentils. Insect protein is incorporated into various products due to its cost-effective production and nutritional benefits.

The use of insect protein across these industries is expected to expand, positioning it as a key player in the future of food, medicine, and animal nutrition as consumer demand for sustainable and nutritious alternatives grows.

Segmental Analysis

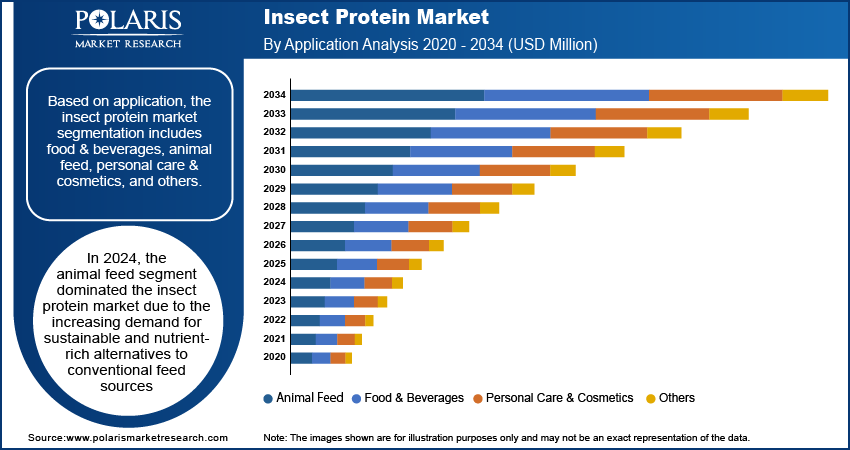

Market Assessment by Application Outlook

The global insect protein market segmentation, based on application, includes food & beverages, animal feed, personal care & cosmetics, and others. In 2024, the animal feed segment accounted for the largest share due to the increasing demand for sustainable and nutrient-rich alternatives to conventional feed sources, such as soy and fishmeal, which has led to a growing interest in insect proteins. Species such as black soldier flies and mealworms provide high-quality amino acids and essential nutrients, making them particularly suitable for aquaculture, poultry, and pet food products. Additionally, insect protein production is environmentally sustainable, as it utilizes organic waste and requires less land and water, aligning with the heightened focus on sustainability in agriculture.

Market Evaluation by Product Outlook

The global insect protein market segmentation, based on product, includes coleoptera, lepidoptera, hymenoptera, orthoptera, hemiptera, diptera, and others. The orthoptera segment is expected to grow fastest during the forecast period due to the increasing recognition of these insects as a sustainable and high-protein food source. They offer a complete amino acid profile that rivals traditional animal proteins. Additionally, their increasing popularity is driven by the ease of farming and minimal environmental impact, making them an appealing alternative in the search for sustainable protein solutions.

Regional Outlook

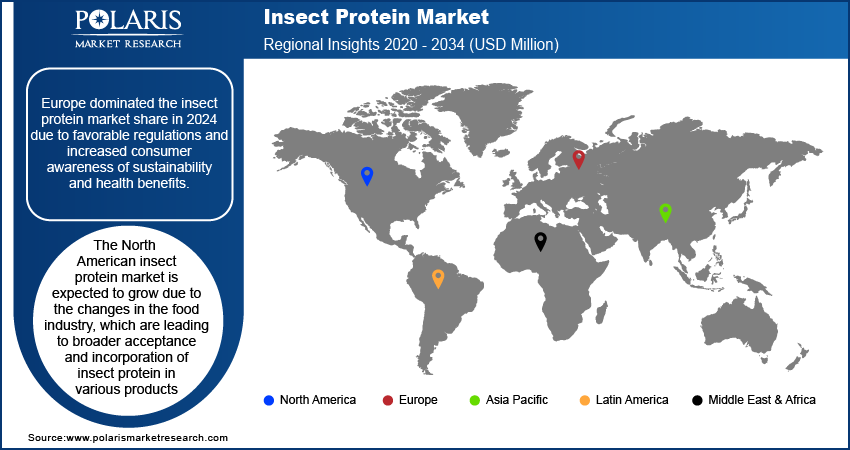

By region, the study provides the insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe insect protein market accounted for the largest share in 2024 due to favorable regulations and increased consumer awareness of sustainability and health benefits. The strong regulatory framework in Europe makes it easier to incorporate insect protein into a wide range of products. Additionally, major industry players are focusing on research and development aimed at enhancing the efficiency and environmental advantages of insect protein to promote sustainable food production. For instance, the European Union's authorization of insect protein for use in chicken and pig feed, extending its previous approval for farmed fish in April 2021, has boosted overall growth. This regulatory endorsement has promoted wider adoption and acceptance of insect protein across various agricultural and food industries.

The North America insect protein market demand is expected to grow due to the changes in the food industry, which are leading to broader acceptance and incorporation of insect protein in various products. In July 2022, Beta Hatch inaugurated North America's largest regenerative mealworm hatchery in Cashmere, Washington. The facility aligns with industry trends of integrating insect protein into products, driven by increased self-care awareness and the nutritional benefits of insect-based proteins. Additionally, the growing trend toward self-care, combined with compelling scientific evidence linking nutrition to overall health and lifestyle, is expected to drive the expansion during the forecast period.

The US development is attributed to the increasing recognition of insects as a sustainable protein source. In October 2023, Tyson Foods partnered with Protix to address sustainability challenges in the production of animal protein by exploring alternative protein sources. This collaboration enables the efficient repurposing of animal waste, positioning both companies to meet growing consumer and industry demand for sustainable solutions. This is particularly evident in the animal feed and pet food industries, where there is a strong demand for environmentally friendly and nutritious protein alternatives, leading to market expansion.

Key Players and Competitive Analysis

The market is becoming highly competitive, with global leaders and regional players aiming for a significant share through innovation, strategic alliances, and regional expansion. Major global players, such as Protix, Ynsect, and Aspire Food Group, are leveraging strong R&D capabilities and large distribution networks to offer sustainable insect protein products for the food and pet food industries. Insect protein market trends indicate a growing demand for insect-based proteins, driven by the need for more sustainable and eco-friendly protein sources. This shift is supported by consumer preferences for alternatives to traditional animal proteins, as well as government policy and regulations and corporate initiatives to promote environmental sustainability. Regional players are also capitalizing on local consumer needs by offering tailored products that cater to specific dietary requirements, including the use of insects in plant-based diets and pet foods. Competitive strategies in the market include partnerships, technological advancements in protein extraction, and the development of novel insect-based food products, such as protein powders and snack bars. These efforts highlight the ongoing innovation and adaptability driving the expansion of the market. A few major players in the market are Ynsect, Protix, AgriProtein, Darling Ingredients, Hexafly, Innovafeed, Beta Hatch, Entomo Farms, Entobel, and nextProtein.

Ynsect Company is focused on harnessing the potential of mealworms to benefit humanity and the environment. With over 40 years of combined insect farming experience, the company holds more than 440 patents, representing over 50% of the industry's total patent portfolio. Ynsect's portfolio features two distinct mealworm species known for their high-quality nutritional profiles, providing a rich source of protein, vitamins, minerals, and fibers. In August 2024, Ÿnsect achieved a notable milestone by becoming the first company authorized to market mealworm proteins for dog food. This development signifies a major advancement in integrating insect protein into pet food.

Protix is working on sustainable food systems through insect-based ingredients. With a mission to balance the food system with nature, Protix has perfected low-footprint ingredients and innovative commercial models, enabling international expansion. The company's collaborative approach has driven significant market advancements and legislative changes. Recognized for its innovation, Protix places a strong emphasis on research, engineering, and partnerships, including collaborations with Hendrix. In May 2023, Protix's palatability test revealed that insect-based pet food is highly accepted, with 94% of dogs and 81% of cats consuming it as their sole animal protein source.

List of Key Companies in Insect Protein Industry

- Ynsect

- Protix

- AgriProtein

- Darling Ingredients

- Hexafly

- Innovafeed

- Beta Hatch

- Entomo Farms

- Entobel

- nextProtein

Insect Protein Industry Development

In February 2024: Innovafeed launched its new insect protein brand, Hilucia, offering high-quality ingredients for pets, livestock, aquaculture, and agriculture. Hilucia utilizes Hermetia illucens larvae, enhancing sustainability with lower environmental impacts compared to traditional protein sources.

In June 2024: Protix partnered with Scottish aquaculture stakeholders to enable 'Label Rouge' salmon to be fed insect-derived ingredients during their juvenile stages. This collaboration underscores Protix’s commitment to enhancing sustainable aquaculture practices and improving the nutritional profiles of premium salmon products.

In June 2024, Alltech Fennoaqua, Volare, a fish farming company, and a wholesaler collaborated for the trial of sustainable rainbow trout in Finland. The fish will be fed insect-based feed, reducing environmental impact. A 150,000 kg test batch will reach markets in winter 2024–2025.

In May 2023: Ÿnsect launched Sprÿng, a new B2B2C brand focusing on sustainable insect-based solutions for the pet food market. This launch reflects Ÿnsect’s dedication to innovation and environmental sustainability by providing high-quality, eco-friendly protein options for pets.

Insect Protein Market Segmentation

By Product Outlook (Volume, Metric Tons; Revenue – USD Million, 2020–2034)

- Coleoptera

- Lepidoptera

- Hymenoptera

- Orthoptera

- Hemiptera

- Diptera

- Others

By Type Outlook (Volume, Metric Tons; Revenue – USD Million, 2020–2034)

- Crickets

- Mealworms

- Black Soldier Flies

- Grasshoppers

- Others

By Application Outlook (Volume, Metric Tons; Revenue – USD Million, 2020–2034)

- Food & Beverages

- Animal Feed

- Personal Care & Cosmetics

- Others

By Regional Outlook (Volume, Metric Tons; Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Insect Protein Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 568.47 million |

|

Market Size Value in 2025 |

USD 662.66 million |

|

Revenue Forecast by 2034 |

USD 2,716.76 million |

|

CAGR |

17.0 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global insect protein market size was valued at USD 568.47 million in 2024 and is projected to grow to USD 2,716.76 million by 2034.

The global market is projected to register a CAGR of 17.0% during the forecast pe

Europe had the largest share of the global market in 2024.

A few key players in the market are Ynsect, Protix, AgriProtein, Darling Ingredient, Hexafly, Innovafeed, Beta Hatch, Entomo Farms, Entobel, and NextProtein

The animal feed segment dominated the insect protein market in 2024.

The orthoptera segment is expected to grow fastest during the