Ink Additives Market Share, Size, Trends, Industry Analysis Report, By Process (Lithography, Digital, Gravure and Flexography); By Technology (Water-Based and Solvent-Based); By Type; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4817

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

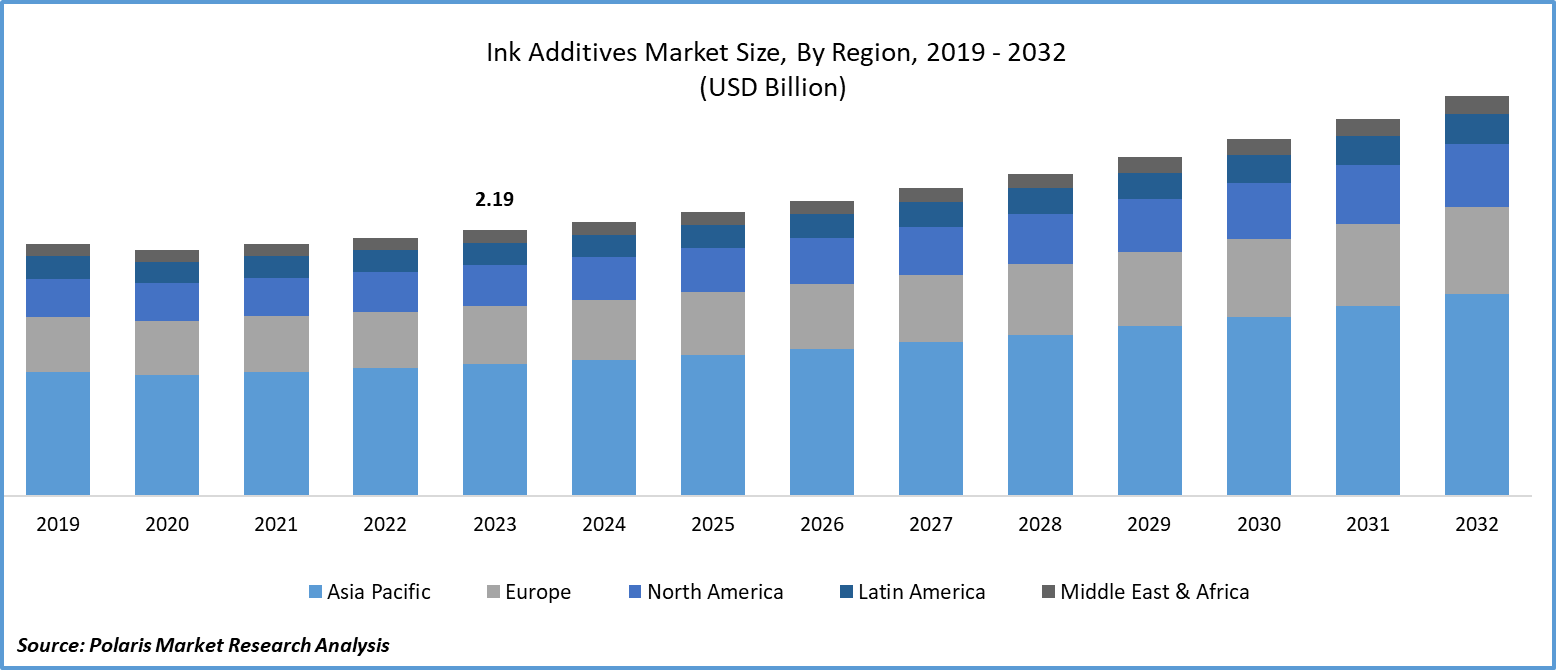

Global ink additives market size was valued at USD 2.19 billion in 2023. The market is anticipated to grow from USD 2.26 billion in 2024 to USD 3.30 billion by 2032, exhibiting the CAGR of 4.8% during the forecast period

Ink Additives Market Overview

Printing inks are employed for the purpose of printing or coloring a range of materials such as paper, plastics, and textiles. The addition of various additives such as defoamers, rheology modifiers, anti-oxidizers, wetting agents, and dispersants enhances ink performance, ensuring top-notch printing results. These additives contribute to improving the transparency and color intensity of the ink, which in turn determines the saturation and brightness of the colors produced. Furthermore, they bolster the ink's wetting properties, aid in the application of overprint varnishes, and increase its resistance to abrasion. Unlike varnish, printing inks are applied onto the surface in a thick coating, typically ranging from 2 to 30 μm.

For instance, in March 2024, hubergroup launched the NewV set UEL 5000, the evolution of its two-ink series within the NewV set range with incorporation with additives like Substifix AF 8319-19, it delivers superior results. These inks are designed for high-performance applications on both coated and uncoated substrates.

To Understand More About this Research:Request a Free Sample Report

The need for corrugated boxes tends to rise due to the e-commerce sectors' quickly expanding demand, which propels the ink additives market expansion. In addition to the increasing consumer demand for flexible packaging, the introduction of new additive kinds is another driver driving the ink additives market expansion. Additionally, the growing use of recyclable materials contributes to the market's favorable outlook. It is anticipated that the reusable nature of the flexible packaging containers will achieve sustainability and result in less waste. The use of ink in flexible packaging enhances the package's visual appeal.

However, several obstacles and limitations are expected to hinder the growth of the ink additives market. Government regulations, the potential toxicity of materials, and the shift from print to digital media are among the factors that may impede market expansion. Changing environmental laws are also affecting the additives industry, with stringent regulations significantly impacting the sectors that utilize them.

Ink Additives Market Dynamics

Market Drivers

Increased Utilization of Ink Additives for Inkjet Technology

Since jetting produces high shear conditions, ink additives such as rheology modifiers are used in inkjet technology due to their various qualities. Since these compounds increase viscosity, they also assist the ink formulators avoid using too many co-solvents. The rising popularity of inkjet technology for photo and poster printing can be ascribed to its affordability. Moreover, inkjet technology's ability to deliver messages with high relevance and image quality at the right moment has led to a surge in its demand. Furthermore, the biomedical industry is expected to adopt more ink additives as inkjet technology is increasingly used in textile, ceramic, and 3D printing, pertaining to its high printing speed.

A Rise in the Market for Flexible Packaging

A variety of materials, including laminates, foils, and plastic films, are frequently used in flexible packaging. To ensure correct adherence and print quality on these various substrates, ink additives play a critical role in enhancing ink compatibility. The need for novel ink solutions is driven by the need for specialized additives that work well with flexible materials. Flexible packaging is widely used in the pharmaceutical, food, and consumer products industries. Ink additives improve the performance of the ink in these areas by making it more resilient to abrasion, long-lasting, and able to tolerate the flexible nature of the material during transportation, storage, and handling.

Making an impression on customers and sticking out on store shelves are essential in the cutthroat world of flexible packaging. In order to keep packaging visually appealing and coherent, ink additives are necessary to preserve brilliant, consistent colors. Quick-drying ink additives are essential to maintaining productivity and meeting production demands in the fast-paced printing processes used in the production of flexible packaging. Furthermore, certain inks with barrier coatings are frequently needed for flexible packaging in order to shield contents from outside factors, including moisture, light, and gases.

Market Restraints

Regulatory Standards and Their Compliance are Likely to Impede the Market Growth

Changes in environmental restrictions are impacting the market for conventional ink additives. By selecting raw materials with a lower environmental impact, manufacturers in North America and Europe are attempting to reduce volatile organic compound (VOC) emissions. The shift to sustainable ones has negatively impacted the demand for conventional additives.

Additives used in inks have to meet industry-recognized safety standards set forth by laws such as the Toxics in Packaging (C.O.N.E.G.) Legislation and Toy Standards like ASTM F963 and EN71. The Food and Drug Administration (US); Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH); Nestle's adherence to Good Manufacturing Practices; the Clean Air Act (CAA) (US); the Swiss Ordinance; the German Draft Ordinance; and the German BFR regulations are just a few of the regulatory guidelines that limit the use of additives in printing inks.

Report Segmentation

The market is primarily segmented based on process, technology, type, application, and region.

|

By Process |

By Technology |

By Type |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Ink Additives Market Segmental Analysis

By Process Analysis

- The lithography segment led the industry market with a substantial revenue share in 2023. Lithography plays a crucial role in the printing of various materials such as books, advertisements, cards, catalogs, direct mail inserts, posters, packaging, coupons, and artwork. This printing technology is primarily used for non-food applications. The market for lithography is expected to grow due to the increasing demand for paper boards and corrugated boxes driven by the rise in online purchases. As e-commerce continues to expand, there is a greater need for packaging materials, which in turn boosts the demand for lithography in the printing industry.

- The digital segment is expected to grow at the fastest CAGR during the ink additives market forecast period. The rise in digital printing's popularity is attributed to its ability to streamline the printing process, starting from digital document files to the final prints, by eliminating the requirement for film plates and photo chemicals. Moreover, digital printing significantly saves time and money by eliminating the production and disposal of printing plates. The increasing demand for digital printing is also fueled by the trend towards smaller print runs and the need for customized content within short lead times.

By Technology Analysis

- The solvent-based segment accounted for the largest market share in 2023 and is likely to retain its position throughout the ink additives market forecast period. Flexographic and gravure printing processes are known for their use of low-cost, easily evaporated solvent-based technology. This printing method enhances the resilience of printed substrates to humidity and refrigeration. Solvent-based technology is particularly effective on plastic, outperforming its performance on paper or canvas. As a result, solvent-based technology is widely used in ink additives, making plastic materials ideal for outdoor printing presentations.

By Type Analysis

- The dispersing and wetting agents segment held the largest revenue share in 2023. Dispersing and wetting agents are prevalent components in nearly all ink formulations and serve similar purposes. Wetting agents reduce the ink's surface tension, initiating the dispersion process. Dispersants, conversely, work to prevent flocculation. They are more commonly used in various ink compositions compared to other additives, contributing to their increasing demand. Their versatility across different types of inks further drives their popularity.

By Application Analysis

- The packaging segment dominates the ink additives market in terms of application. The ink additives market opportunity is poised for significant growth, driven by strong demand in various packaging applications such as corrugated cardboard, flexible packaging, and folding cartons. This surge in demand is primarily fueled by the increasing need for inks across diverse packaging industries, including food packaging (with a notable emphasis on seafood), beverage packaging, cigarette packaging, pouches, bags, and lamination patterns. The packaging segment's expansion is further supported by the rising demand for ink additives from tag, label printing and narrow web segments.

Ink Additives Market Regional Insights

The Asia Pacific Region Dominated the Global Market with the Largest Market Share in 2023

The Asia Pacific region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. The rapid growth of the packaging sector in countries such as India and Indonesia is a key driver for the dominance of the ink additives market development in the Asia Pacific region. In recent years, there has been a significant increase in the consumption of packaged goods spurred by urbanization, changing lifestyles, and the rise of e-commerce. This surge in packaging consumption is fueled by the growing demand for secure packaging of food products to ensure safety and hygiene. With consumers becoming increasingly aware of food safety issues, there is a greater emphasis on packaging that can effectively protect products from contamination and spoilage.

Additionally, there is a trend towards more appealing product packaging, influenced by the rising impact of social media and online shopping. Companies are investing in packaging designs that not only safeguard their products but also captivate consumers with innovative designs and vibrant colors.

The North America region is expected to hold a significant share in revenue share during the ink additives market forecast period. North America's significant revenue share in the ink additives market is attributed to its well-established and advanced printing industry, characterized by a strong presence of ink manufacturers. This sector necessitates top-quality ink additives to meet diverse printing needs, spanning packaging, publishing, and commercial printing. Moreover, the region exhibits a heightened consumer awareness and demand for innovative and eco-friendly packaging solutions, underscoring the necessity for ink additives that can enhance both aesthetics and functionality, ensuring product safety and prolonging shelf life.

Competitive Landscape

The ink additives market is characterized by fragmentation and intense competition among numerous players. Key service providers in the industry are continuously enhancing their technologies to maintain a competitive edge, ensuring efficiency, integrity, and safety in their products. These companies prioritize partnerships, product enhancements, and collaborations to strengthen their market position and secure a substantial share of the market.

Some of the major players operating in the global market include:

- Atlanta AG

- BASF SE

- Dow, Inc.

- Elementis Plc

- Evonik Industries AG

- Harima Chemicals Group

- Munzing Chemie GmbH

- Shamrock Technologies

- Solvay S.A

- Lubrizol

Recent Developments

- In June 2023, Lubrizol, a Berkshire Hathaway company, plans to enhance its additives business by installing a 100,000-metric-tonne CPVC resin line at its Vilayat site in partnership with Grasim Industries. Additionally, it will double its compounding capability at its Dahej plant.

- In March 2023, Evonik will showcase its newest solutions for the coatings, inks, and adhesives industry in Nuremberg, Germany.

Report Coverage

The Ink Additives market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, process, technology, type, application, and their futuristic growth opportunities.

Ink Additives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.26 billion |

|

Revenue forecast in 2032 |

USD 3.30 billion |

|

CAGR |

4.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Process, By Technology, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Ink Additives Market report covering key segments are process, technology, type, application, and region.

The global ink additives market size is expected to reach USD 3.30 billion by 2032

Ink Additives Market exhibiting the CAGR of 4.8% during the forecast period

Asia Pacific is leading the global market

key driving factors in Ink Additives Market are • Increased utilization of ink additives for inkjet technology