Injection Pen Market Size, Share, Trends, Industry Analysis Report: By Product (Disposable and Reusable), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 128

- Format: PDF

- Report ID: PM5213

- Base Year: 2024

- Historical Data: 2020-2023

Injection Pen Market Overview

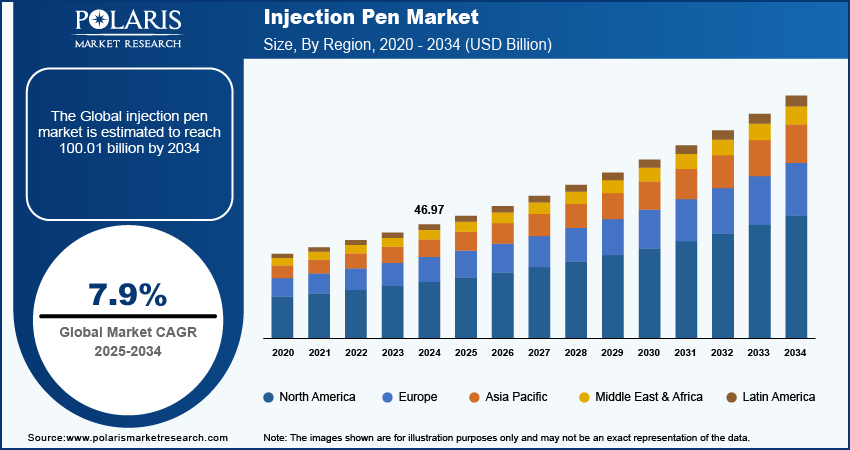

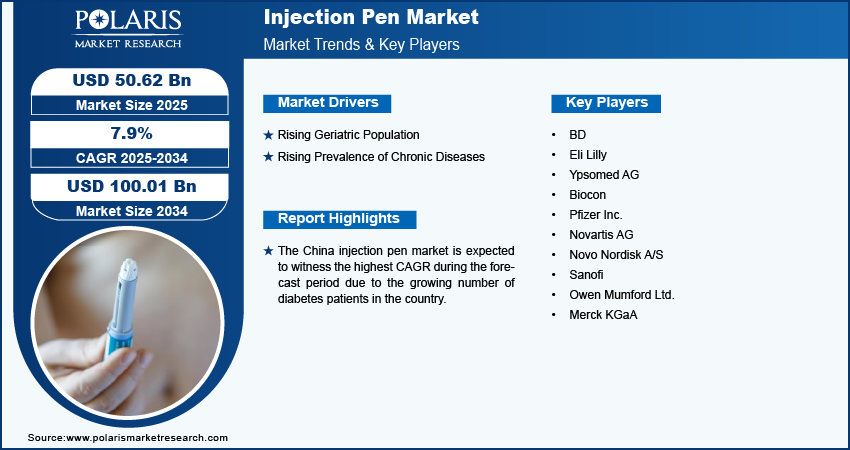

The injection pen market size was valued at USD 46.97 billion in 2024. The market is projected to grow from USD 50.62 billion in 2025 to USD 100.01 billion by 2034, exhibiting a CAGR of 7.9% during 2025–2034.

An injection pen, often referred to as an insulin pen or a prefilled pen, is a medical device designed to deliver a specific dose of medication via injection. Innovations in injection pen design, including features such as dose adjustment, retractable needles, and user-friendly interfaces, have made the pens more appealing to patients, thereby fueling the injection pen market growth. Furthermore, injection pens offer a convenient and discreet way to administer medications, making them popular among patients who require frequent injections. Their portable design facilitates easy use in various settings, enhancing patient adherence to treatment regimens.

Increased prevalence of chronic diseases and the importance of medication adherence has led to more patients seeking effective treatment options. Educational initiatives by healthcare providers are encouraging patients to utilize injection pens for self-administration. Moreover, the growing availability of biosimilar medications and biologics often need precise dosing and are ideally suited for delivery via pens, which is further contributing to the injection pen market growth.

To Understand More About this Research: Request a Free Sample Report

Injection Pen Market Trends Analysis

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases, including cancer, diabetes, rheumatoid arthritis, and multiple sclerosis, has significantly increased the demand for injectable medications. For instance, according to the World Health Organization (WHO), there were an estimated 20 million cancer cases in 2022. Projections indicate that the number of new cancer cases will surpass 35 million by 2050, signifying a substantial 77% increase from 2022. This trend is particularly evident in the diabetes segment, where insulin pens have emerged as the preferred method of administration. As many individuals are diagnosed with these conditions, the need for effective and convenient delivery systems for medication has grown. Thus, the rising prevalence of chronic conditions is expected to drive the popularity of injection pens in managing chronic illnesses in the coming years.

Rising Geriatric Population

The rising geriatric population plays a critical role in driving the demand for injection pens, as older adults are more prone to developing multiple chronic health conditions that require regular medication. The population of England and Wales, with Census 2021, indicates a higher number of individuals in older age groups. Over 11 million people, accounting for 18.6% of the total population, were aged 65 years and above, compared to 16.4% in 2011. Diseases such as diabetes, osteoporosis, cardiovascular disorders, and arthritis are particularly prevalent among the elderly, many of which necessitate injectable treatments. Injection pens, with their user-friendly designs, adjustable dosing, and ergonomic features, offer a more practical solution for this demographic. Thus, the increasing geriatric population is expected to boost the injection pen market expansion during the forecast period.

Injection Pen Market Segment Analysis

Injection Pen Market Breakdown by Product Outlook

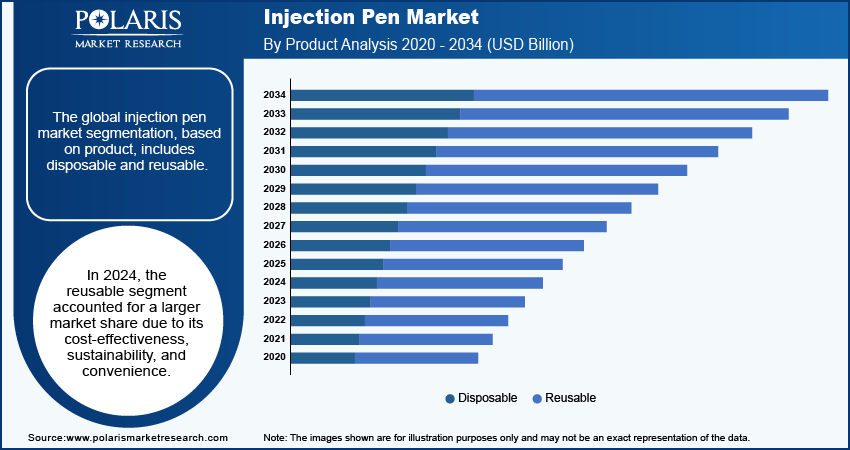

The global injection pen segmentation, based on product, includes disposable and reusable. In 2024, the reusable segment accounted for a larger market share due to its cost-effectiveness, sustainability, and convenience. Unlike disposable pens, reusable pens allow patients to replace only the medication cartridges, reducing waste and making them environmentally friendly. This feature has become increasingly attractive as healthcare systems and consumers prioritize eco-conscious solutions. Additionally, reusable pens offer long-term affordability, particularly for patients requiring frequent injections, such as those managing diabetes or chronic autoimmune conditions. The ability to personalize doses with reusable pens, along with their durable design and compatibility with a wide range of medications, further enhances patient adherence and satisfaction.

Injection Pen Market Breakdown by End Use Outlook

The global injection pen market segmentation, based on end use, includes hospital, clinics, and home care settings. The clinics segment is expected to witness the highest CAGR during the forecast period due to the increasing preference for outpatient care and the growing number of specialized clinics offering chronic disease management. Clinics provide a more accessible and cost-effective alternative to hospitals, making them a popular choice for patients seeking routine treatments, including injectable therapies. Additionally, the rising burden of chronic conditions has led to an increased demand for injectable medications administered in clinic settings.

Injection Pen Market Breakdown, by Regional Outlook

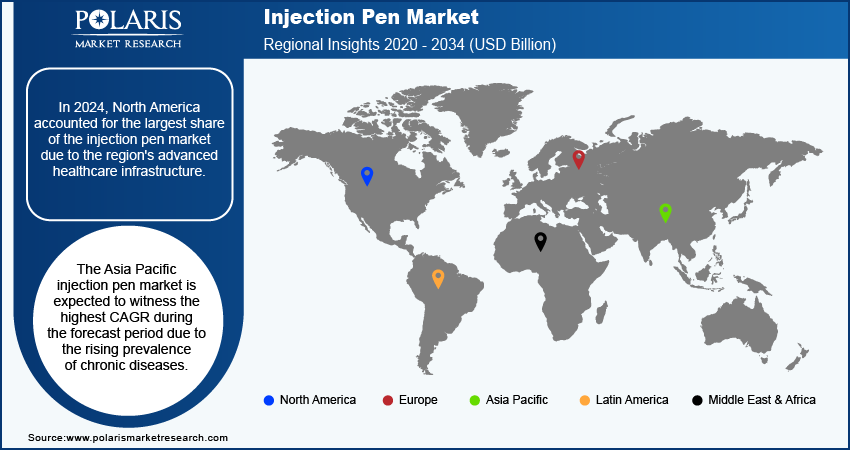

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest injection pen market share. The region's advanced healthcare infrastructure, combined with the strong adoption of innovative drug delivery technologies, has accelerated the demand for injection pens. Additionally, growing patient awareness, an increasing shift toward self-administration of medications, and the rising popularity of home care solutions have contributed to the widespread use of injection pens in North America.

The US accounted for the largest market share due to the increasing prevalence of diabetes in the country, which propels the demand for injection pens for regular medication delivery. In the US, 38.4 million people of all ages, or 11.6% of the population, had diabetes. Additionally, 38.1 million adults aged 18 years and above, or 14.7% of all US adults, had diabetes.

The Asia Pacific injection pen market is expected to register the highest CAGR during the forecast period due to the rising prevalence of chronic diseases. According to the World Economic Forum, Asia accounts for a staggering 45% of all global breast cancer cases and 58% of cervical cancer deaths worldwide, and cases of both cancers are expected to rise faster in the region than in the Rest of the world. In Asia, breast cancer cases are anticipated to rise by 21% , and cervical cancer incidence is expected to increase by 19% between 2020 and 2030.

Governments and healthcare organizations in countries such as China, India, and Japan are actively promoting self-care and home-based treatments, encouraging the adoption of user-friendly drug delivery devices.

The China injection pen market is expected to register the highest CAGR during the forecast period due to the growing number of diabetes patients in the country. According to the International Diabetes Federation (IDF), in 2021, around 1.08 billion diabetes cases were reported in China. Among them, ∼13% of the population were adults.

Injection Pen Market – Key Players and Competitive Insights

The competitive landscape of the injection pen market is characterized by the presence of several key players, including global pharmaceutical companies, medical device manufacturers, and emerging regional firms. Market competition is driven by continuous innovation in product design, strategic partnerships, and mergers and acquisitions to enhance market reach. Leading companies focus on developing advanced injection pens with features such as precise dose delivery, ease of use, and digital connectivity to meet the growing demand for self-administration and home healthcare solutions. Global players such as Novo Nordisk, Sanofi, Eli Lilly, and Ypsomed dominate the market due to their strong portfolios of insulin pens and biological drug delivery devices. Major companies benefit from well-established distribution networks and long-term collaborations with healthcare providers. In addition, they invest heavily in R&D to introduce next-generation injection pens, such as smart pens equipped with Bluetooth technology, dose tracking, and mobile app integration.

The injection pen market is experiencing competition from regional players, particularly in emerging markets such as Asia Pacific, where companies are introducing cost-effective and customizable injection pen solutions tailored to local needs. A few key market players are BD, Eli Lilly, Ypsomed AG, Biocon, Pfizer Inc., Novartis AG, Novo Nordisk A/S, Sanofi, Owen Mumford Ltd., and Merck KGaA.

Novo Nordisk A/S and its subsidiaries specialize in the research, manufacturing, development, and distribution of pharmaceutical products across various regions worldwide. The company has established 10 research and development centers across 5 countries, and it boasts 16 production facilities located in 9 countries. The company operates in two primary segments—diabetes and obesity care and rare diseases. The diabetes and obesity care segment provides an extensive range of products for obesity, cardiovascular disease, diabetes, and other emerging therapy areas. The rare disease segment provides products for endocrine disorders, rare blood disorders, and hormone replacement therapy. The NovoPen 6 and NovoPen Echo Plus represent the latest advancements in smart insulin delivery systems. These devices are equipped with integrated dose-logging capabilities that automatically capture insulin administration data with each use. When synchronized with compatible applications, users gain comprehensive insights into their dosing patterns and overall treatment compliance.

Eli Lilly and Company, founded in 1876 by Eli Lilly (a Civil War veteran and pharmaceutical chemist), is a prominent American multinational pharmaceutical corporation based in Indianapolis, Indiana, with a global presence in 18 countries and products sold in ∼125 nations. The company has significantly impacted the diabetes treatment landscape with its development of insulin products, including the widely used Humalog (insulin lispro) and various insulin delivery devices such as the HumaPen series. The HumaPen LUXURA HD and HumaPen SAVVIO are notable injection pens designed for ease of use, allowing patients to self-administer insulin with precision. These pens accommodate Lilly's 3 mL insulin cartridges, enabling users to dial their doses accurately, from as little as 0.5 units up to 60 units, depending on the model. In August 2024, Eli Lilly and Company launched Zepbound (tirzepatide) in 2.5 mg and 5 mg single-dose vials for self-pay patients with on-label prescriptions, effectively increasing supply to meet rising demand.

Key Companies in Injection Pen Market

- BD

- Eli Lilly

- Ypsomed AG

- Biocon

- Pfizer Inc.

- Novartis AG

- Novo Nordisk A/S

- Sanofi

- Owen Mumford Ltd.

- Merck KGaA

Injection Pen Industry Developments

In September 2023, Sanofi partnered with Eli Lilly, Novo Nordisk, and Merck KGaA to create the first cross-industry recycling initiative for injection pens, launched in Denmark due to its strong recycling infrastructure. Together, these companies distribute around 6 million injection pens annually, aiming to recycle 25% within the first year, equating to a reduction of 25 tons of plastic waste.

In September 2021, BIOCORP and Merck partnered to develop a specialized version of the Mallya device for monitoring treatment adherence in HGH therapy. Mallya is a Bluetooth-enabled clip for pen injectors that records the dosage and timing of injections, transmitting this data in real time to companion software for enhanced treatment tracking.

Injection Pen Market Segmentation

By Product Outlook (Revenue, USD Billion; 2020–2034)

- Disposable

- Reusable

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Diabetes

- Anaphylaxis

- Osteoporosis

- Growth Hormone Deficiency

- Arthritis

- Others

By End Use Outlook (Revenue, USD Billion; 2020–2034)

- Hospital

- Clinics

- Home Care Settings

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Injection Pen Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 46.97 billion |

|

Market Size Value in 2025 |

USD 50.62 billion |

|

Revenue Forecast by 2034 |

USD 100.01 billion |

|

CAGR |

7.9% from 2024 to 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global injection pen market size was valued at USD 46.97 billion in 2024 and is projected to grow to USD 100.01 billion by 2034.

The global market is projected to register a CAGR of 7.9% during the forecast period.

In 2024, North America dominated the market due to the region's advanced healthcare infrastructure.

A few key players in the market are BD, Eli Lilly, Ypsomed AG, Biocon, Pfizer Inc., Novartis AG, Novo Nordisk A/S, Sanofi, Owen Mumford Ltd., and Merck KGaA.

In 2024, the reusable segment dominated the market share due to its cost-effectiveness, sustainability, and convenience.

The clinics segment is expected to record the highest CAGR during the forecast period due to the increasing preference for outpatient care