Influenza Diagnostics Market Share, Size, Trends, Industry Analysis Report, By Product (Instruments, Test Kit and Reagents, Others); By Test Type; By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4663

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

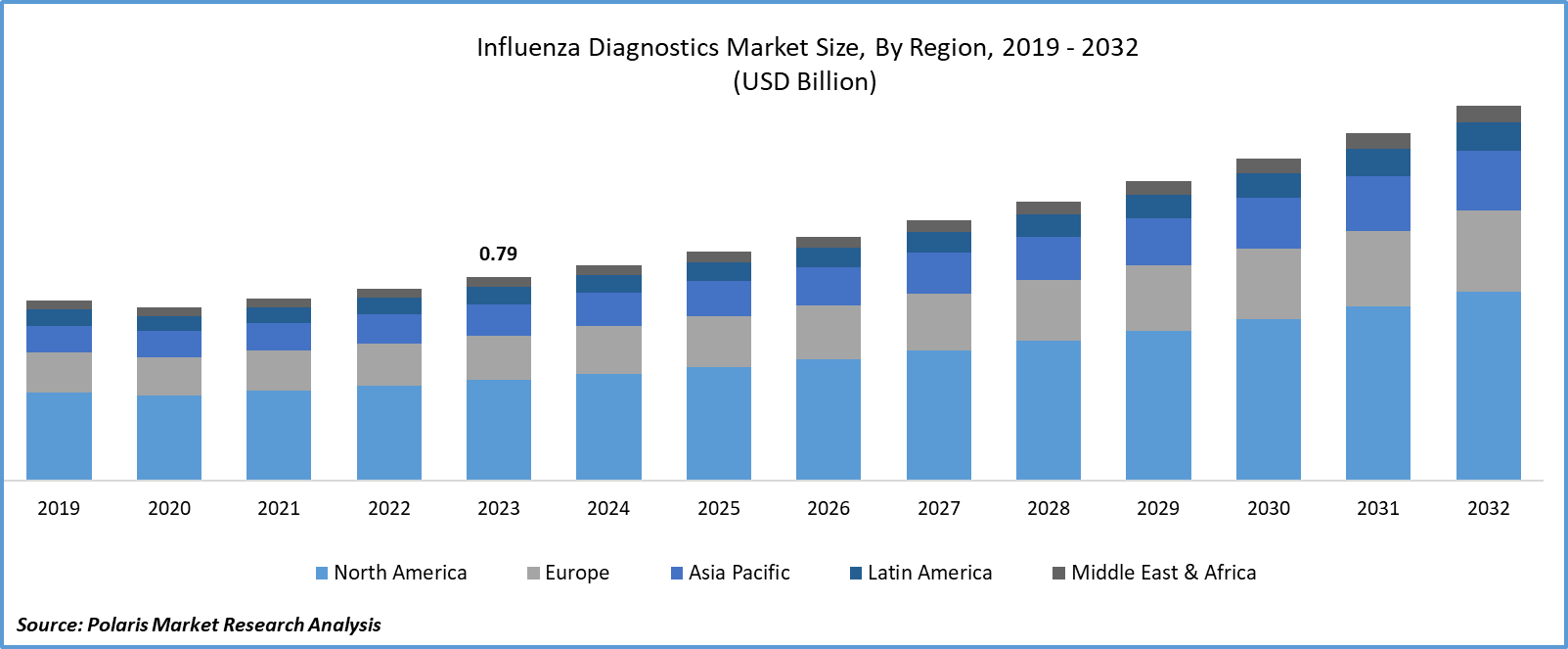

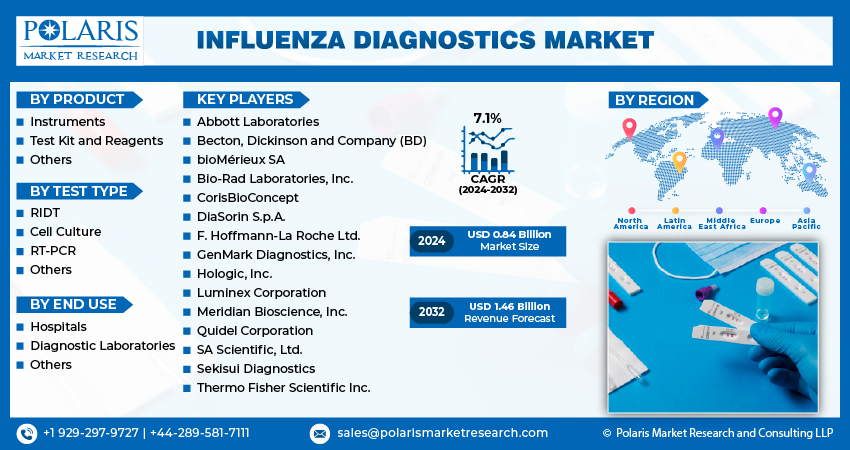

- Influenza Diagnostics Market size was valued at USD 0.79 billion in 2023.

- The market is anticipated to grow from USD 0.84 billion in 2024 to USD 1.46 billion by 2032, exhibiting the CAGR of 7.1% during the forecast period.

Market Introduction

Government initiatives and funding for influenza surveillance are catalysts for the influenza diagnostics market growth. Globally, governments invest in surveillance programs to monitor outbreaks, track virus strains, and implement public health measures. These initiatives aim to detect and respond to influenza epidemics promptly, reducing healthcare burdens and mitigating public health impacts. Additionally, governments allocate funds for innovative diagnostic technologies and vaccines. Collaborations between government agencies, research institutions, and diagnostic companies drive innovation in advanced diagnostic solutions, like rapid point-of-care testing (POCT) devices. Government-sponsored vaccination programs and awareness campaigns further promote influenza prevention, boosting demand for diagnostics.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

To Understand More About this Research:Request a Free Sample Report

- For instance, in January 2023, 2San introduced a combined kit for detecting SARS-CoV-2 and Influenza A+B. This single-use test kit provides results in just ten minutes, identifying the viruses responsible for COVID-19 and Influenza A and B. It offers individuals the convenience of testing at home and receiving prompt and precise diagnoses.

Technological advancements in diagnostic techniques are transforming the influenza diagnostics market. Traditional methods like viral culture and serological assays are being replaced by molecular techniques such as PCR and NAATs, offering enhanced sensitivity and rapidity. Point-of-care testing devices allow swift on-site detection, expediting patient management. Biosensor technology and microfluidics offer further miniaturization and automation, improving portability. Integration of AI and machine learning enhances data analysis, boosting diagnostic accuracy. These advancements enhance influenza diagnostics, offering more effective, precise, and accessible testing methods that advance patient care and public health responses.

Industry Growth Drivers

Increasing incidence of influenza is projected to spur product demand

The influenza diagnostics market is expanding due to the rising incidence of influenza globally. Influenza, caused by influenza viruses, experiences seasonal outbreaks influenced by viral strain variations, increased travel, and urbanization. Healthcare providers prioritize early diagnosis for prompt patient management and infection control, fueling demand for influenza diagnostic tools like rapid antigen tests and molecular assays. Ongoing research focuses on enhancing diagnostic accuracy and speed, with advancements such as nucleic acid amplification techniques driving innovation. Public health initiatives promoting vaccination and influenza prevention also contribute to market growth.

Increasing adoption of point-of-care testing is expected to drive influenza diagnostics market growth

The influenza diagnostics market is on the rise due to increasing adoption of point-of-care testing (POCT). POCT offers rapid and accurate results, aiding prompt treatment decisions and outbreak containment. Healthcare facilities, including clinics and pharmacies, are integrating POCT devices to streamline diagnostics and improve patient care, especially in remote areas. The COVID-19 pandemic has further accelerated POCT adoption for influenza testing. Technological advancements in POCT devices, such as improved sensitivity, are also driving market growth.

Industry Challenges

Regulatory challenges and compliance requirements are likely to impede the market growth

Regulatory challenges and compliance requirements pose hurdles for the influenza diagnostics market. Stringent guidelines ensure the safety and efficacy of diagnostic tests, necessitating extensive testing and documentation for regulatory approval. Adapting to evolving regulatory standards adds complexity and demands continual updates by manufacturers. Additionally, navigating diverse regulatory frameworks across regions complicates market entry and expansion efforts.

Report Segmentation

The influenza diagnostics market analysis is primarily segmented based on product, test type, end use, and region.

|

By Product |

By Test Type |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

Test kit and reagents segment held a significant market revenue share in 2023

The test kit and reagents segment held a significant revenue share in 2023 owing to its vital role in diagnosing influenza infections. During flu seasons, these kits experience consistent demand across healthcare settings due to their accuracy and ease of use. Technological advancements enhance their sensitivity and specificity, while government initiatives and pandemic preparedness efforts drive investment. The global disease burden of influenza underscores the continual need for effective diagnostic solutions.

By Test Type Analysis

Rapid influenza diagnostics test (RIDT) segment held a significant market revenue share in 2023

The RIDT segment held significant a revenue share in 2023. Rapid results, accessibility, and ease of administration make RIDT invaluable in healthcare settings requiring immediate diagnosis. Its cost-effectiveness compared to molecular methods also contributes to its popularity, particularly in resource-limited settings. Additionally, the established trust among healthcare professionals and regulatory approval further drive its adoption.

By End Use Analysis

Hospitals segment held a significant market revenue share in 2023

The hospitals segment held a significant revenue share in 2023. They attract a large influx of patients seeking treatment for respiratory illnesses like influenza, driving the demand for diagnostic tests. Hospitals offer comprehensive healthcare services, including diagnostic testing, making them a convenient choice for patients. Equipped with advanced laboratory facilities and diagnostic equipment, hospitals can perform various tests accurately and efficiently. Moreover, in critical care settings such as intensive care units (ICUs), rapid and accurate influenza diagnosis is crucial for timely patient management. Furthermore, hospitals adhere to regulatory standards for diagnostic testing, ensuring the quality and accuracy of influenza diagnostic procedures.

Regional Insights

North America region dominated the global market in 2023

In 2023, the North America region dominated the global market due to its advanced healthcare infrastructure, stringent regulatory standards, and high disease burden. The region's healthcare facilities and research institutions drive innovation in diagnostic technologies, meeting the demand for rapid and accurate influenza detection. With significant investments in healthcare, North America maintains a robust market for diagnostic solutions. Government initiatives and funding support bolster influenza surveillance efforts, while the presence of key market players ensures widespread adoption and distribution of diagnostic products.

Asia-Pacific is expected to experience significant growth during the forecast period. With its dense population and high incidence of influenza, there's a pressing need for effective diagnostic solutions. Improved healthcare infrastructure and rising awareness further boost demand, while urbanization and increased travel facilitate virus spread, necessitating robust diagnostic capabilities. Government initiatives and investments in healthcare bolster market expansion. Advancements in diagnostic technologies, such as NAATs and POCTs, offer rapid and accurate testing options. Additionally, the aging population's susceptibility to influenza fuels the demand for better monitoring and management solutions.

Key Market Players & Competitive Insights

The influenza diagnostics market includes various players, with the expected arrival of new contenders intensifying competition. Leading companies continuously enhance their technologies to maintain a competitive advantage, emphasizing efficiency, reliability, and safety. They prioritize strategic actions such as forging partnerships, improving product portfolios, and participating in collaborative ventures to outperform rivals. Their ultimate goal is to secure a significant influenza diagnostics market share.

Some of the major players operating in the global influenza diagnostics market include:

- Abbott Laboratories

- Becton, Dickinson and Company (BD)

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- CorisBioConcept

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd.

- GenMark Diagnostics, Inc.

- Hologic, Inc.

- Luminex Corporation

- Meridian Bioscience, Inc.

- Quidel Corporation

- SA Scientific, Ltd.

- Sekisui Diagnostics

- Thermo Fisher Scientific Inc.

Recent Developments

- In June 2022, BD (Becton, Dickinson and Company) announced that its new molecular diagnostic combination test, the BD MAX Respiratory Viral Panel (RVP), obtained CE marking under the IVD directive 98/79/EC. This test is capable of detecting SARS-CoV-2, Influenza A + B, and Respiratory Syncytial Virus (RSV).

- In May 2023, Hologic Inc. declared that the U.S. Food and Drug Administration (FDA) provided 510(k) clearance for its Panther Fusion SARS-CoV-2/Flu A/B/RSV assay. This molecular diagnostic test identifies and distinguishes four of the most common respiratory viruses that may present similar clinical symptoms: influenza A (flu A), influenza B (flu B), severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), and respiratory syncytial virus (RSV).

- In August 2023, Cue Health disclosed that it secured a new contract worth around $28 million from the Biomedical Advanced Research and Development Authority (BARDA). This contract is aimed at developing a molecular multiplex test for Flu A/B, RSV, and COVID-19, intended for use both over-the-counter (OTC) and at point-of-care (POC).

Report Coverage

The influenza diagnostics market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, products, test types, end uses, and their futuristic growth opportunities.

Influenza Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 0.84 billion |

|

Revenue forecast in 2032 |

USD 1.46 billion |

|

CAGR |

7.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global Influenza Diagnostics market size is expected to reach USD 1.46 billion by 2032

Key players in the market are Abbott Laboratories, Becton, Dickinson and Company (BD), bioMérieux SA

North America contribute notably towards the global Influenza Diagnostics Market

Influenza Diagnostics Market exhibiting the CAGR of 7.1% during the forecast period.

The Influenza Diagnostics Market report covering key segments are product, test type, end use, and region.