Inflight Catering Market Size, Share, Trends, Industry Analysis Report: By Food Offering Type, Flight Service Type (Full-Service Carriers and Low-Cost Carriers), Aircraft Seating Class, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 125

- Format: PDF

- Report ID: PM3535

- Base Year: 2024

- Historical Data: 2020-2023

Inflight Catering Market Overview

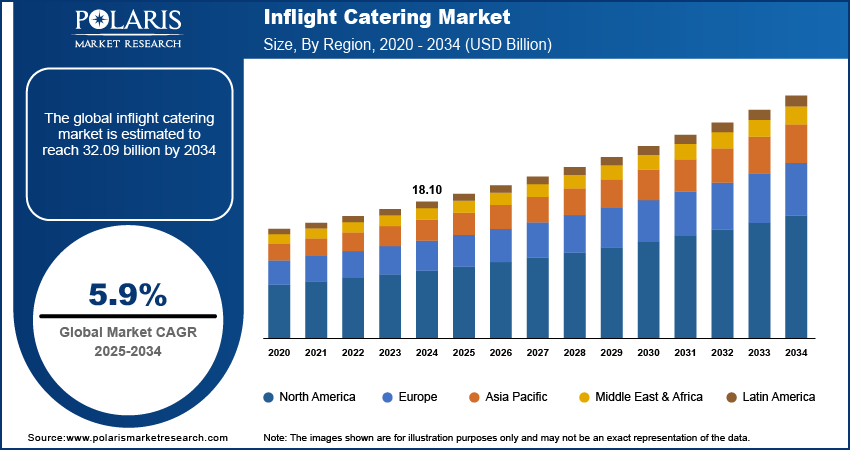

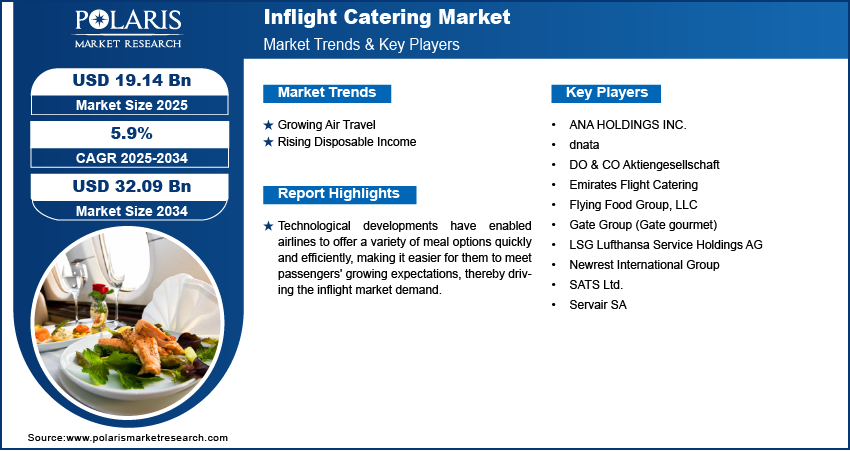

The global inflight catering market size was valued at USD 18.10 billion in 2024. The market is projected to grow from USD 19.14 billion in 2025 to USD 32.09 billion by 2034, exhibiting a CAGR of 5.9% from 2025 to 2034.

Inflight catering refers to the preparation, delivery, and serving of food and beverages to passengers during air travel. It includes a range of services such as meal planning, packaging, and ensuring that the food meets various quality, safety, and dietary standards.

Modern passengers expect a lot more than just basic service during their flights. The overall experience, including the food served, has become a key factor in customer satisfaction. Airlines are increasingly offering gourmet meals, special dietary options, and meals inspired by regional cuisines. Additionally, passengers now demand a variety of choices, including vegetarian, vegan, and gluten-free options. Consequently, airlines are investing more in inflight catering to meet these higher expectations, driving the inflight catering market growth.

To Understand More About this Research: Request a Free Sample Report

Innovations in food technology and packaging have made inflight catering more efficient and safer. Advances in food preservation methods, such as vacuum sealing and modified atmosphere packaging, have allowed meals to stay fresh longer without compromising quality. Additionally, improvements in logistics and delivery systems ensure that meals are served at the optimal temperature and in the best condition. These technological developments have enabled airlines to offer a variety of meal options quickly and efficiently, making it easier for them to meet passengers' growing expectations, thereby driving the inflight market demand.

Inflight Catering Market Dynamics

Growing Air Travel

The global rise in air travel, especially after the pandemic recovery, has significantly boosted the demand for inflight catering. According to the Airport Council International, in 2024, the air travelers number reached 9.5 billion, highlighting the growth in air travel demand. More people are taking flights for business, tourism, and leisure, prompting airlines to accommodate more passengers. This increase in passengers directly impacts the need for more catering services, as airlines strive to ensure passengers are well-fed and satisfied during their journeys. The demand for varied and high-quality inflight meals is growing as the airline industry continues to expand, thereby driving the inflight catering market development.

Rising Disposable Income

Disposable income is rising globally. According to the US Bureau of Economic Analysis, in 2024 alone, disposable income in the US increased by 0.1% every month. This rise in disposable income has led more people to be willing to pay for premium services, including better-quality inflight meals. Airlines are responding to this demand by offering upgraded meals, special dietary options, and more diverse menu choices. This shift in passenger expectations is driving the evolution of the inflight catering market, catering to a more affluent clientele who desire superior meal options and personalized choices during their flights.

Inflight Catering Market Segment Analysis

Inflight Catering Market Assessment by Food Offering Type Outlook

The inflight catering market assessment, based on food offering type, includes meal, bakery & confectionery, beverages, and others. The meal segment is expected to witness significant growth from 2025 to 2034. Passengers are increasingly seeking better and more diverse food options, prompting airlines to focus on offering high-quality meals. These meals include gourmet options, region-specific dishes, and special dietary choices such as vegan, gluten-free, and low-calorie options. Rising passenger expectations for improved culinary experiences during flights are driving this demand. To meet these demands, airlines are investing more in their meal offerings, which is leading to a higher demand for premium and diverse inflight meals, thereby driving segmental growth in the global market.

Inflight Catering Market Evaluation by Flight Service Type Outlook

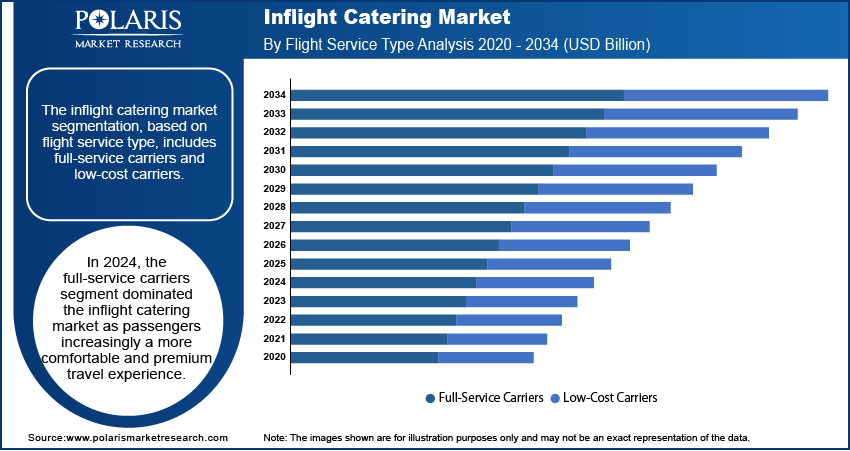

The inflight catering market evaluation, based on flight service type, includes full-service carriers and low-cost carriers. The full-service carriers segment dominated the inflight catering market in 2024. These airlines offer a wide range of services, including meals, snacks, and beverages, as part of the ticket price, which attracts passengers looking for a more comfortable and premium travel experience. Full-service carriers are able to provide a diverse menu with higher-quality meals, including special dietary options, which cater to a variety of passenger preferences. Their strong reputation for delivering superior services, along with the growing demand for enhanced inflight experiences, contributes to the segment’s leading position in the market.

Inflight Catering Market Regional Analysis

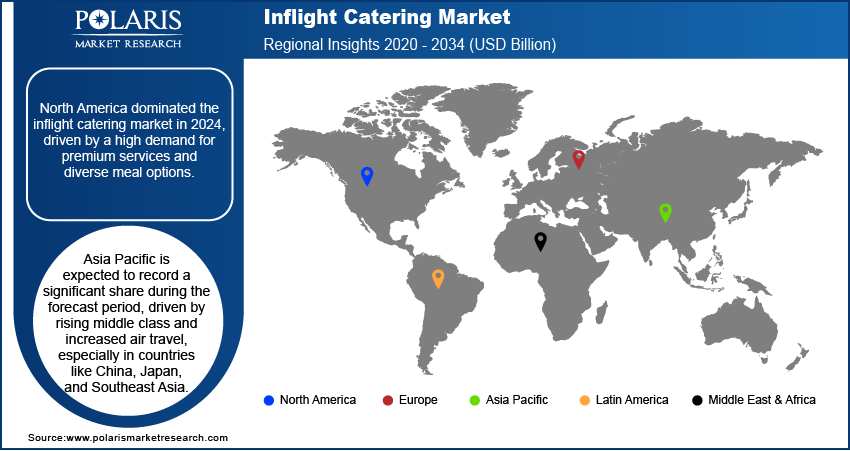

By region, the study provides the inflight catering market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the inflight catering market in 2024, driven by a high demand for premium services and diverse meal options. Major airlines in the region, including full-service carriers, offer a wide range of gourmet meals, special dietary options, and regional cuisines to cater to both business and leisure travelers. Airlines are increasingly offering healthier and organic food and beverages choices as passengers are becoming more health-conscious. Additionally, the region also sees significant competition between legacy carriers and low-cost airlines, pushing for innovative catering solutions and strengthening the region’s leading position in the global market.

Asia Pacific is expected to record a significant share during the forecast period. The rising middle class and increased air travel, especially in countries like China, Japan, and Southeast Asia, are driving the demand for inflight catering. Airlines in the region are focusing on providing both traditional and innovative meal options to cater to diverse cultural tastes and dietary preferences. Additionally, the demand for health-conscious meals is on the rise, with airlines offering vegetarian, vegan, and gluten-free choices, further driving regional market growth.

The India inflight catering market is experiencing substantial growth, driven by the growing middle class, increasing air travel, and rising disposable incomes. Both full-service carriers and low-cost airlines are catering to a wider range of passengers, offering diverse meal options that reflect regional tastes and dietary preferences. The growing demand for quality food, along with efforts to enhance the overall passenger experience, is driving market growth in the country.

Inflight Catering Market – Key Players and Competitive Insights

The inflight catering market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. According to the inflight catering market analysis, these companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific sectors. This competitive trend is amplified by continuous progress in product offerings. Major players in the inflight catering market include ANA HOLDINGS INC.; dnata; DO & CO Aktiengesellschaft; Emirates Flight Catering; Flying Food Group, LLC; Gate Group (Gate gourmet); LSG Lufthansa Service Holdings AG; Newrest International Group; SATS Ltd.; and Servair SA

ANA Holdings Inc. is a Japanese airline group headquartered in Tokyo, Japan. It was originally founded in December 1952 as All Nippon Airways Co., Ltd. and transitioned to a holding company structure in April 2013. The company operates through several business segments, including air transportation, airline-related, travel services, trade & retail, and others. The air transportation segment provides domestic and international passenger, cargo, and mail services. The airline-related segment offers airport passenger and ground handling services, as well as maintenance services. The travel services segment develops and sells travel packages combining air transportation with lodging and other travel options. The trade & retail segment is involved in aircraft parts procurement, import/export, leasing, sales, and retail operations at airports. It also imports and sells various goods such as paper, pulp, food products, semiconductors, and electronic components. ANA Holdings Inc. operates in Japan and internationally, with subsidiaries like All Nippon Airways, Air Japan, ANA Wings, Peach, and AirJapan. The company has a presence in Asia, with operations in countries like Vietnam and the Philippines through minority stakes in Vietnam Airlines and PAL Holdings, respectively. ANA offers a wide range of in-flight meals, including special dietary, religious, and allergen-free options. First and Business class passengers can pre-order meals created by renowned chefs.

Emirates Flight Catering (EKFC) is a major in-flight catering service provider based in Dubai, United Arab Emirates. It is a subsidiary of The Emirates Group, with Emirates Airlines owning 90% of the company and the remaining 10% held by Dubai Airports Corporation. The company employs staff from diverse backgrounds and operates from the Emirates Flight Catering Centre, where it produces more than 225,000 meals daily. EKFC provides in-flight catering for Emirates Airlines and over 100 other airlines operating at Dubai International Airport. Additionally, it offers services such as events and VIP catering, laundry, and airport lounge food and beverage services. EKFC's operations include a facility known as Food Point, which produces food solutions for airlines, hotels, restaurants, and retail operators across the GCC. This allows the company to cater to various customer needs, from standard airline meals to customized event catering. EKFC has also been involved in supporting SMEs in the UAE and has received recognition in the industry. The company primarily operates in the Middle East, with its main base in Dubai.

List of Key Companies in Inflight Catering Market

- ANA HOLDINGS INC.

- dnata

- DO & CO Aktiengesellschaft

- Emirates Flight Catering

- Flying Food Group, LLC

- Gate Group (Gate gourmet)

- LSG Lufthansa Service Holdings AG

- Newrest International Group

- SATS Ltd.

- Servair SA

Inflight Catering Industry Developments

In July 2024, Alaska Airlines launched a new seasonal First-Class menu and premium beverage line-up, featuring chef-curated dishes with seasonal ingredients. The company stated the new line-up is aimed at enhancing the travel experience for all passengers.

In February 2024, Alaska Airlines introduced its first-ever custom craft beer, "Cloud Cruiser" IPA, brewed exclusively by Fremont Brewing. According to Alaska Airlines, the beer is offered complimentary in First and Premium Class, and available for purchase in the Main Cabin.

Inflight Catering Market Segmentation

By Food Offering Type Outlook (Revenue, USD Billion, 2020–2034)

- Meal

- Bakery & Confectionery

- Beverages

- Others

By Flight Service Type Outlook (Revenue, USD Billion, 2020–2034)

- Full-Service Carriers

- Low-Cost Carriers

By Aircraft Seating Class Outlook (Revenue, USD Billion, 2020–2034)

- Economy Class

- Business Class

- First Class

- Premium Economy Class

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Inflight Catering Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.10 billion |

|

Market Size Value in 2025 |

USD 19.14 billion |

|

Revenue Forecast by 2034 |

USD 32.09 billion |

|

CAGR |

5.9% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The inflight catering market size was valued at USD 18.10 billion in 2024 and is projected to grow to USD 32.09 billion by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period, 2025–2034.

North America had the largest share of the global market in 2024.

A few of the key players in the market are ANA HOLDINGS INC.; dnata; DO & CO Aktiengesellschaft; Emirates Flight Catering; Flying Food Group, LLC; Gate Group (Gate gourmet); LSG Lufthansa Service Holdings AG; Newrest International Group; SATS Ltd.; and Servair SA.

The full-service carriers segment dominated the inflight catering market in 2024 as passengers increasingly seek a more comfortable and premium travel experience.

The meal segment is expected to witness significant growth during the forecast period as passengers are increasingly looking for better and more diverse food options, prompting airlines to focus on offering high-quality meals.