Industrial Valve Market Size, Share, Trends, Industry Analysis Report: By Valve Type, Fluid Type, Function (On/Off Valve and Control Valve), Material, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM5366

- Base Year: 2024

- Historical Data: 2020-2023

Industrial Valve Market Overview

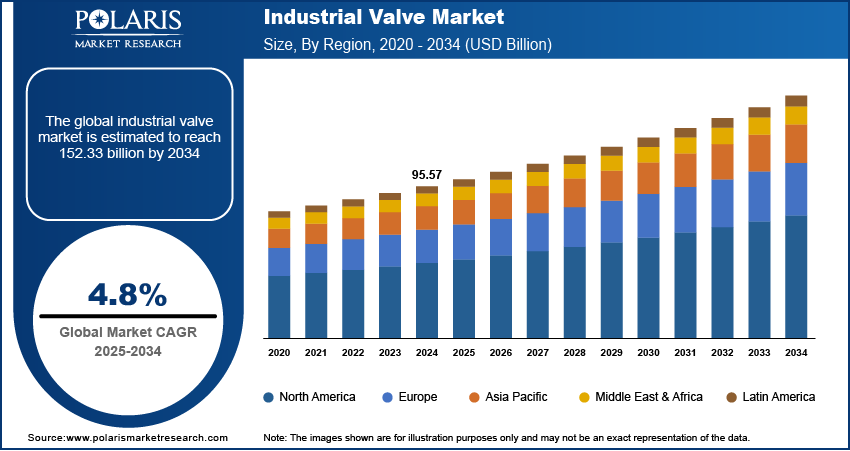

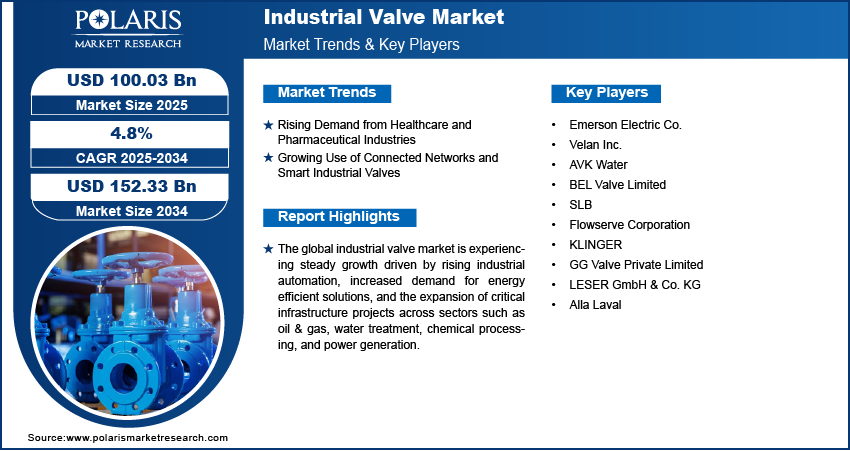

The global industrial valve market size was valued at USD 95.57 billion in 2024. The market is projected to grow from USD 100.03 billion in 2025 to USD 152.33 billion by 2034, exhibiting a CAGR of 4.8% from 2025 to 2034.

Industrial valve is a mechanical device used to regulate, direct, or control the flow of fluids, gases, or slurries through a system. Valves are critical components in various industries, including oil & gas, water treatment, chemical processing, and power generation, enabling safe and efficient operation under diverse conditions such as high pressure, temperature, and corrosive environments.

The global industrial valve market is experiencing steady growth driven by rising industrial automation, increased demand for energy efficient solutions, and the expansion of critical infrastructure projects across sectors such as oil & gas, water treatment, chemical processing, and power generation. Industries operating under high pressure and high temperature conditions are driving the demand for valves with enhanced safety, reliability, and performance. For instance, in February 2024, Valmet launched the Neles XH, a metal-seated ball valve in its X-series, aimed at high-pressure, high-cycle, and throttling applications. The valve is designed for industries such as power generation, chemical processing, and oil & gas, and is capable of supporting high-temperature and demanding environments, broadening its industrial applicability.

To Understand More About this Research: Request a Free Sample Report

The adoption of smart valve technologies, including IoT integration and automation, is optimizing the operational efficiency of valve systems and reducing maintenance expenses. Additionally, increasing focus on low-emission, sustainable solutions is driving innovations in valve manufacturing, with companies developing products that align with environmental standards and regulatory compliance.

Industrial Valve Market Dynamics

Rising Demand from Healthcare and Pharmaceutical Industries

The healthcare and pharmaceutical industry rely on precise, contamination-free fluid handling. Valves in these industries are crucial for maintaining strict sterilization standards, making them essential for processes involving medications, chemicals, and purified water. For instance, in June 2023, Alfa Laval expanded its valve portfolio with a new hygienic control valve designed to meet stringent demands in pharmaceutical and biotech applications. The valve provides precision in fluid handling, supporting the industry's requirements for sterile production environments. Thus, the growing demand for industrial valves from healthcare and pharmaceutical industries is driving the industrial valve market expansion.

Growing Use of Connected Networks and Smart Industrial Valves

Smart industrial valves integrate sensors and communication technologies, enabling real-time data exchange and remote monitoring, which is especially valuable in complex and hazardous environments. For instance, Schneider Electric launched the EcoStruxure Control Valve in 2021. This smart valve solution combines built-in diagnostics and Bluetooth connectivity, which helps monitor valve performance and provides real-time status updates, making it ideal for energy and utility applications. The connectivity also enables predictive maintenance, reducing downtime and operational costs by identifying potential issues before they result in failures. Additionally, the use of IoT and automation in industries like water treatment, manufacturing, and oil & gas is increasing, and smart valves play a crucial role in optimizing these applications. This aligns with the broader shift in industrial sectors towards Industry 4.0 and digital transformation. Thus, the growing adoption of connected networks and smart valves, which improve efficiency, monitoring, and control capabilities in industrial processes, is boosting the industrial valve market revenue.

Industrial Valve Market Segment Insights

Industrial Valve Market Evaluation Based on Valve Type Insights

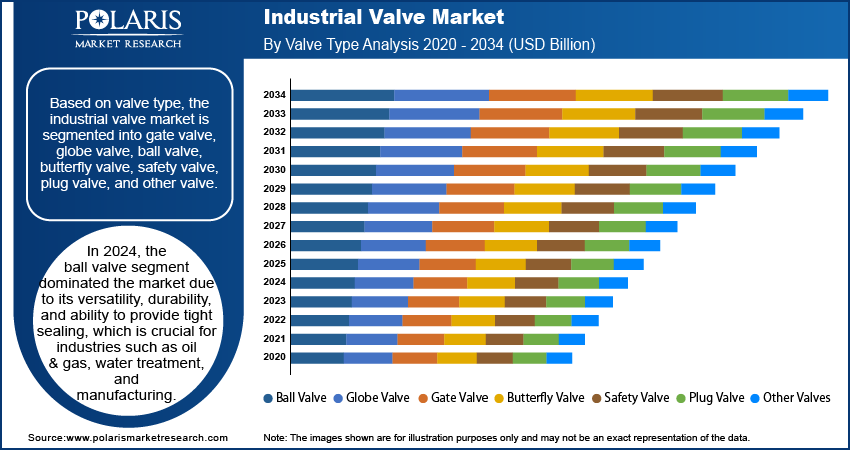

The global industrial valve market segmentation, based on valve type, includes gate valve, globe valve, ball valve, butterfly valve, safety valve, plug valve, and other valve. In 2024, the ball valve segment dominated the industrial valve market due to its versatility, durability, and ability to provide tight sealing, which is crucial for industries such as oil & gas, water treatment, and manufacturing. Ball valves are well suited for applications requiring quick shut off and minimal leakage, performing strongly in high-pressure and high temperature environments. Additionally, their detailed design facilitates ease of maintenance, an essential factor for industries aiming to minimize downtime and optimize efficiency. The widespread demand across various sectors further solidified the segment’s leading position in the market.

Industrial Valve Market Assessment Based on End Use Insights

The global industrial valve market segmentation, based on end use, includes oil & gas, water & wastewater treatment, energy & power, pharmaceutical, food & beverage, chemical, building & construction, paper & pulp, metal & mining, agriculture, semiconductor, and others. The water & wastewater treatment segment is expected to experience growth in the industrial valve market due to the increasing global demand for clean water and improved sanitation. Rising urbanization, industrialization, and population growth are driving investments in water infrastructure and wastewater management systems to meet the increasing demand for clean water and efficient waste disposal. Industrial valve plays a crucial role in maintaining the flow of water, controlling pressure, and preventing leaks in these systems. Additionally, environmental regulations pushing for better water quality standards and efficient treatment processes are driving the demand for reliable and high-performance valve in the sector. These factors collectively contribute to the expansion of the water & wastewater treatment segment.

Industrial Valve Market Breakdown Regional Analysis

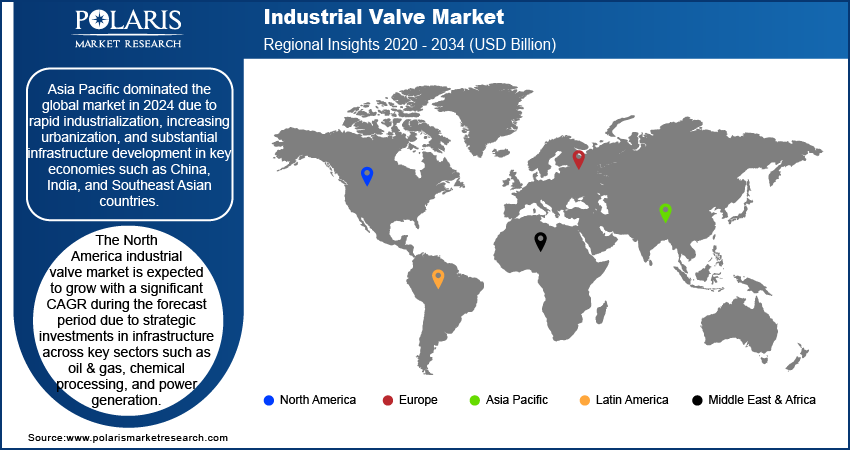

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the industrial valve market in 2024 due to rapid industrialization, increasing urbanization, and substantial infrastructure development in key economies such as China, India, and Southeast Asian countries. The region's growth in industries such as oil & gas, chemical processing, power generation, and water treatment has fueled demand for industrial valves. Furthermore, the ongoing adoption of smart technologies and automation in the manufacturing sector, along with government investments in large scale infrastructure projects, continues to drive market expansion. For instance, in 2022, AIIB approved two major projects: The Bukhara Region Water Supply and Sewerage Project, Phase II in Uzbekistan, and the Second Dam Rehabilitation and Improvement Project in India. As a result, Asia Pacific is expected to maintain its dominance in the global industrial valve market.

The North America industrial valve market is expected to grow with a significant CAGR during the forecast period due to strategic investments in infrastructure across key sectors such as oil and gas, chemical processing, and power generation. This region is prioritizing the modernization of its aging infrastructure, which, along with a rising demand for automation and advanced smart valve technologies, is catalyzing market expansion. Furthermore, the implementation of strict regulations focused on energy efficiency and environmental sustainability is driving industries to opt for sophisticated valve solutions. The increasing integration of digital technologies for predictive maintenance and real time monitoring is also a crucial factor underpinning this market growth.

Industrial Valve Market – Key Players and Competitive Insights

The competitive landscape of the industrial valve market is characterized by a mix of global industry leaders and regional players striving for market share through innovation, strategic partnerships, and regional expansion. Major companies in the market, such as Emerson Electric Co., Flowserve Corporation, and Velan Inc., leverage their strong R&D capabilities and extensive distribution networks to deliver advanced valve solutions for critical sectors, including oil and gas, water treatment, power generation, and chemical processing. These companies focus on product innovation, improving performance, durability, and energy efficiency to meet the growing demand for automation and smart technologies in industrial applications. On the other hand, smaller regional firms are carving out niches with specialized valve products that cater to local market needs, often focusing on customized solutions for specific industries or geographic areas. Competitive strategies include mergers and acquisitions, partnerships with technology firms, and expanding product portfolios to strengthen market presence in emerging markets. A few key major players are Emerson Electric Co.; Velan Inc.; AVK Water; BEL Valve Limited; SLB; Flowserve Corporation; KLINGER; GG Valve Private Limited; LESER GmbH & Co. KG; and Alfa Laval.

KLINGER is a company specializing in sealing solutions, fluid control, and fluid monitoring, with a global presence across over 60 countries and 45 operating companies. KLINGER initially gained recognition for its innovations in leakage-free transport solutions, such as the reflex level gauge and Klingerit gasket material. The company expanded its manufacturing capabilities over time, introducing products like large industrial ball valves and asbestos-free jointing materials such as KLINGERSIL. During the late 20th century, KLINGER focused on advancements in high-temperature sealing materials. In recent years, the company has pursued both organic growth and strategic acquisitions, broadening its reach beyond Europe. KLINGER’s products serve industries including oil and gas, chemicals, energy, automotive, and pharmaceuticals, with a strong emphasis on product reliability and technological advancements in fluid management. Additionally, KLINGER provides comprehensive maintenance and repair services, including leak detection and repair, maintenance and dry dock services, integrity services, repair and overhaul, shutdown services, and energy audits.

Emerson is a provider of industrial valves, specializing in process control and automation solutions for industries such as energy, chemical, life sciences, and mining. Based in Ferguson, Missouri, the company is well-known for its Fisher brand. Emerson offers control valves, actuators, and regulators that improve process availability, reduce maintenance costs, and enhance safety through advanced diagnostics with FIELDVUE technology. Emerson’s products are designed to handle severe conditions, with innovations such as Whisper noise reduction and anti-cavitation trims. The company emphasizes sustainability and provides digital solutions to help clients improve operational efficiency, ensuring reliable and low-emission fluid and gas management across complex industrial applications.

List of Key Companies in Industrial Valve Market

- Emerson Electric Co.

- Velan Inc.

- AVK Water

- BEL Valve Limited

- SLB

- Flowserve Corporation

- KLINGER

- GG Valve Private Limited

- LESER GmbH & Co. KG

- Alfa Laval

Industrial Valve Industry Developments

In July 2024, Emerson launched the AVENTICS Series XV pneumatic valve, developed for flexibility and compatibility across diverse factory automation and machine building applications. These valves have universal threads and support for regional standards, making them suitable for machine builders and operators working in global markets.

In January 2023, KLINGER launched the Ballostar KHA, a ball valve designed for extreme industrial conditions with a wide operational temperature range, from -196°C to +400°C. It also features options for easy maintenance and various configurations to suit different industrial applications.

In October 2024, TLX introduced a 4-Way Switching Valve engineered for high-flow fluid control with minimal leakage and low pressure drop, supporting both 12 and 24 Vdc operations. The valve accommodates various communication protocols and customizable port sizes, offering flexibility for thermal management applications in diverse vehicle systems.

Industrial Valve Market Segmentation

By Valve Type Outlook (Revenue – USD Billion, 2020–2034)

- Gate Valve

- Globe Valve

- Ball Valve

- Butterfly Valve

- Safety Valve

- Plug Valve

- Other Valve

By Fluid Type Outlook (Revenue – USD Billion, 2020–2034)

- Liquid

- Gas

- Natural Gas

- Compressed Air

- Industrial Gases

- Slurry Valve

By Function Outlook (Revenue – USD Billion, 2020–2034)

- On/Off Valve

- Control Valve

By Material Outlook (Revenue – USD Billion, 2020–2034)

- Steel

- Cast Iron

- Aluminum

- Alloy Based

- Plastic

- Other Materials

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Oil & Gas

- Water & Wastewater Treatment

- Energy & Power

- Pharmaceutical

- Food & Beverage

- Chemical

- Building & Construction

- Paper & Pulp

- Metal & Mining

- Agriculture

- Semiconductor

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Valve Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 95.57 billion |

|

Market Size Value in 2025 |

USD 100.03 billion |

|

Revenue Forecast by 2034 |

USD 152.33 billion |

|

CAGR |

4.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Valve Type By Fluid Type By Function By Material By End Use |

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global industrial valve market size was valued at USD 95.57 billion in 2024 and is projected to grow to USD 152.33 billion by 2034.

The global market is projected to register a CAGR of 4.8% from 2025 to 2034.

Asia Pacific dominated the industrial valve market in 2024.

A few key players in the market are Emerson Electric Co.; Velan Inc.; AVK Water; BEL Valve Limited; SLB; Flowserve Corporation; KLINGER; GG Valve Private Limited; LESER GmbH & Co. KG; and Alfa Laval.

In 2024, the ball valve segment dominated the industrial valve market.

The water & wastewater treatment segment is expected to experience growth in the industrial valve market.