Industrial Starch Market Size, Share, Trends, Industry Analysis Report: By Source, Product, Application (Food & Beverage, Feed, Pharmaceuticals, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5325

- Base Year: 2024

- Historical Data: 2020-2023

Industrial Starch Market Overview

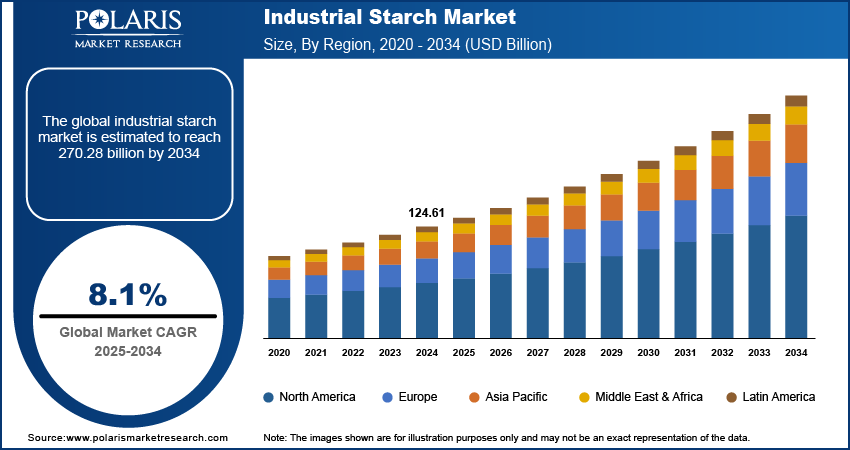

The industrial starch market size was valued at USD 124.61 billion in 2024. It is projected to grow from USD 134.53 billion in 2025 to USD 270.28 billion by 2034, exhibiting a CAGR of 8.1% during the forecast period.

Industrial starch is a versatile carbohydrate derived from agricultural sources, primarily from corn, potatoes, wheat, rice, and cassava. It is widely used across industries due to its ability to thicken, stabilize, bind, and texturize products. Industrial starch has two main molecular components, amylose and amylopectin, that determine its functionality and application, which vary depending on the source. The increasing demand for industrial starch across various sectors, including food, paper, and pharmaceuticals, is significantly contributing to the industrial starch market growth.

The food and beverage sector are also one of the largest consumers of industrial starch, which is used for thickening, gelling, stabilizing, and enhancing the texture of a wide range of products. The increasing consumption of processed foods, ready meals, snacks, and bakery items is a significant driver. Additionally, as consumers increasingly prefer clean-label, natural, and minimally processed ingredients, starches, especially native and modified varieties, are in high demand. Moreover, the trend towards plant-based and gluten-free diets is also boosting the consumption of starch-based ingredients, thereby contributing to the industrial starch market demand.

To Understand More About this Research: Request a Free Sample Report

Industrial Starch Market Dynamics

Growth in Paper and Packaging

The demand for industrial starch in the paper and packaging industry is growing due to its ability to improve the quality and strength of paper products. Starch is widely used in paper coating, sizing, and adhesives. Furthermore, the exponential growth of the e-commerce industry has led to a surge in packaging requirements as products are shipped to consumers globally. Packaging for e-commerce needs to be durable, protective, and cost-effective.

For instance, according to the International Trade Administration, global B2B e-commerce sales have shown consistent year-over-year growth over the past decade, with the market expected to reach a valuation of USD 36 trillion by 2026. Thus, the trend, particularly in packaging for e-commerce, has further accelerated the market for industrial starch.

Increasing Sustainability and Biodegradability Trends

Industries are increasingly adopting sustainable practices, which is driving demand for biodegradable and eco-friendly materials. Industrial starch, a renewable and biodegradable resource, has emerged as a key alternative to synthetic polymers and chemicals. The shift toward environmentally friendly products, particularly in packaging, automotive, and textiles, has led to a growing reliance on starch-based solutions, further propelling market growth. Additionally, governments worldwide are implementing stricter regulations and offering incentives to promote the use of sustainable materials, further driving the adoption of starch-based alternatives in various industries.

For instance, according to the European Commission, the European Union has taken an initiative, namely the European Green Deal, which seeks to eliminate wasteful packaging by promoting reuse and recycling methods. The initiative is being promoted to encourage the adoption of sustainable, biodegradable materials such as starch-based solutions across industries.

Industrial Starch Market Segment Insights

Industrial Starch Market Assessment by Application Outlook

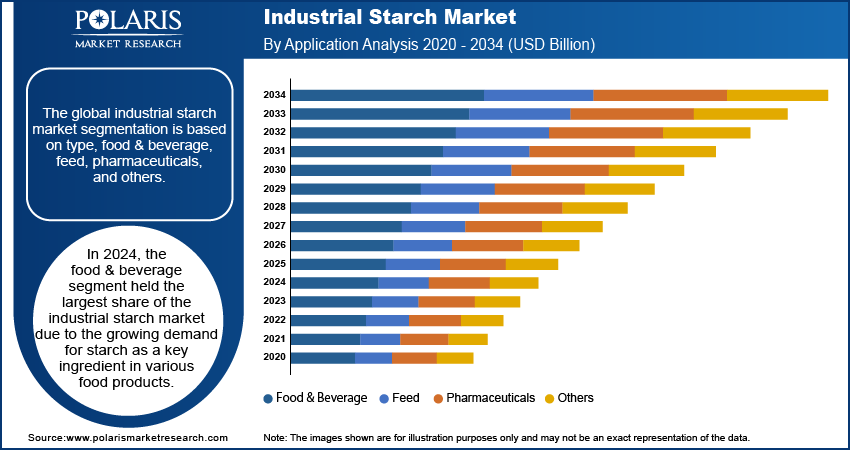

The global industrial starch market, based on application, is segmented into food & beverage, feed, pharmaceuticals, and others. In 2024, the food & beverage segment held the largest industrial starch market share due to the growing demand for starch as a key ingredient in various food products. Starch is widely used in the food industry as a thickening agent, stabilizer, and texture enhancer in products such as sauces, soups, bakery items, snacks, and beverages.

The shift toward clean-label, natural ingredients, along with an increasing preference for gluten-free and plant-based diets, has further boosted the demand for starch in food processing. Additionally, starch’s role in improving food shelf life and enhancing the consistency of processed foods contributes to its prominent application in the food & beverage industry.

Industrial Starch Market Evaluation by Source Outlook

The global industrial starch market, based on source, includes corn, wheat, cassava, potato, and others. The wheat starch segment is expected to witness the highest CAGR over the forecast period. Wheat starch, known for its versatility and cost-effectiveness, is increasingly used in a variety of industries, including food and beverages, pharmaceuticals, and textiles. The food industry, in particular, drives demand for wheat starch, as it is widely used as a thickening agent, stabilizer, and emulsifier in processed foods, sauces, and soups.

Wheat starch is gaining traction in the pharmaceutical industry as a binder and disintegrant in tablet formulations, spurred by its natural and safe profile. The increasing awareness of health-conscious consumers and the shift towards natural ingredients across multiple sectors are expected to propel the demand for wheat starch further.

Industrial Starch Market Regional Insights

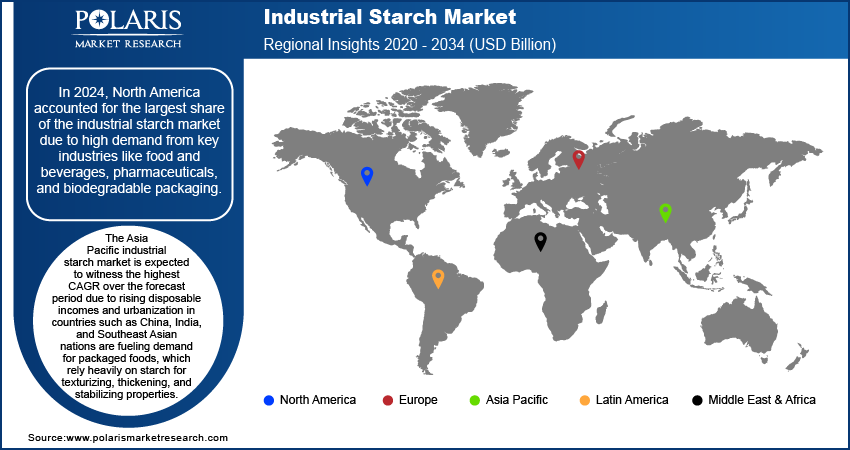

By region, the study provides industrial starch market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to high demand from key industries such as food and beverages, pharmaceuticals, and biodegradable packaging. The growing trend towards healthier and sustainable food products has significantly increased the use of industrial starch in processed foods, as it is an essential ingredient in food formulations such as sauces, dressings, and snack foods. Additionally, the growing digital transformation within the F&B industry, such as the rise of e-commerce, virtual restaurants, and food traceability through blockchain, further fuels the demand for industrial starch as manufacturers adapt to meet evolving consumer preferences.

For instance, according to the US Department of Agriculture (USDA), consumers, businesses, and government entities have collectively spent approximately USD 2.6 trillion on food and beverages in 2023. Therefore, the rising trend towards spending on packaged food products is generating the demand for industrial starch across the globe.

The US industrial starch market accounted for the largest market share due to the strong presence of major food and beverage, paper, and textile manufacturing companies. The high demand for environmentally sustainable materials and starch-based bioplastics has further stimulated market growth in the country.

Asia Pacific industrial starch market is expected to witness the highest CAGR over the forecast period due to rising disposable incomes and urbanization in countries such as China, India, and Southeast Asian nations. These factors are driving the demand for packaged foods, which rely heavily on starch for its texturizing, thickening, and stabilizing properties. Moreover, the region’s expanding paper and packaging industry is pushing the adoption of industrial starch for use in adhesives and paper coating applications. This trend aligns with the global shift toward eco-friendly and biodegradable packaging materials, which is being actively supported by government policies promoting sustainable production.

The industrial starch market in China is expected to witness the highest CAGR over the forecast period due to the expanding packaging sector, combined with increasing environmental awareness, is pushing the demand for starch-based, biodegradable materials to replace synthetic alternatives. For instance, according to the Pacific Environment, China has implemented crucial measures to address food and beverage packaging waste, including the 2018 ban on importing plastic recyclables to strengthen domestic recycling.

Industrial Starch Market – Key Players and Competitive Analysis Report

The competitive landscape of the industrial starch industry is marked by strategic market development initiatives, collaborations, and mergers among key players. Companies are expanding their portfolios and production capacities to capture growing demand, particularly in food, beverage, and biodegradable packaging sectors. Market leaders are also engaging in collaborations with local producers to strengthen their supply chains and leverage regional growth opportunities.

Mergers and acquisitions are further reshaping the industry, with major firms consolidating resources to enhance R&D capabilities, innovate in starch-based bioplastics, and improve production efficiencies. These strategies support a diversified product offering, enabling companies to stay competitive in an evolving market driven by sustainability and eco-friendly material preferences. A few key major players are Cargill, Incorporated; BASF; Archer Daniels Midland Compan; Ingredion Incorporated; Tate & Lyle PLC; AGRANA Beteiligungs-AG; Grain Processing Corporation; Roquette Frères; Tereos Group; Royal Cosun; Altia Industrial; Global Bio-chem Technology Group Company Limited; General Starch Limited; Eiamheng, Coöperatie Koninklijke Avebe U.A.; and Galam Group.

Cargill, Inc. offers agriculture-related products. It has a presence in more than 125 countries and is a trusted partner for customers in the food, agriculture, finance, and industrial sectors. The company has a geographic presence in regions including North America, Europe, the Middle East & Africa, Asia Pacific, and Latin America. In February 2024, Cargill financed USD 100 million in its PT, a Sorini Agro Asia Corporindo sweetener plant in Pandaan, Indonesia. The funds will support the development of a corn wet mill and a starch dryer to enhance production capacity for sweeteners, corn-based starches, and animal feed ingredients.

BASF SE is a chemical manufacturing company that operates all over the world. It operates through seven segments, including chemicals, industrial solutions, materials, surface technologies, nutrition & care, and agricultural solutions, and others. The nutrition & care sector provides nutrition and care ingredients for pharmaceutical as well as food and feed producers, detergent, cleaner industries, and cosmetics. The agricultural solutions segment offers seeds and crop protection products, such as insecticides, herbicides, fungicides, biological crop production products, and seed treatment products. BASF plant science has engineered Amflora, a genetically modified potato that exclusively produces amylopectin starch, optimized for industrial applications.

Key Companies in Industrial Starch Market Outlook

- Cargill, Incorporated

- BASF

- Archer Daniels Midland Company

- Ingredion Incorporated

- Tate & Lyle PLC

- AGRANA Beteiligungs-AG

- Grain Processing Corporation

- Roquette Frères

- Tereos Group

- Royal Cosun

- Altia Industrial

- Global Bio-chem Technology Group Company Limited

- General Starch Limited

- Eiamheng

- Coöperatie Koninklijke Avebe U.A.

- Galam Group

Industrial Starch Market Developments

February 2024: Ingredion Incorporated launched NOVATION Indulge 2940, the first non-GMO functional native corn starch in their clean-label texturizers line.

November 2021: Ingredion Incorporated launched FILMKOTE 2030, a new fluorochemical-free barrier starch for the US and Canadian markets. This addition enhances their portfolio, enabling paper and packaging manufacturers to meet the growing demand for sustainable, high-performance Oil and Grease Resistant (OGR) packaging.

January 2021: Tate & Lyle is expanding its tapioca-based starch portfolio with the launch of REZISTA MAX thickening starches and BRIOGEL gelling starches. These advanced starches enhance process tolerance, mouthfeel, fluidity, and texture, making them ideal for applications in dairy, soups, sauces, dressings, and confectionery.

Industrial Starch Market Segmentation

By Source Outlook (Revenue, USD Billion; 2020–2034)

- Corn

- Wheat

- Cassava

- Potato

- Others

By Product Outlook (Revenue, USD Billion; 2020–2034)

- Native Starch and Starch Derivatives & Sweeteners

- Cationic Starch

- Ethylated Starch

- Oxidized Starch

- Acid Modified Starch

- Unmodified Starch

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Food & Beverage

- Feed

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Convenience Foods

- Others

- Pharmaceuticals

- Others

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Starch Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 124.61 billion |

|

Market Size Value in 2025 |

USD 134.53 billion |

|

Revenue Forecast by 2034 |

USD 270.28 billion |

|

CAGR |

8.1% from 2025 to 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global industrial starch market size was valued at USD 124.61 billion in 2024 and is projected to grow to USD 270.28 billion by 2034.

The global market is projected to register a CAGR of 8.1% during the forecast period.

In 2024, North America dominated the market due to high demand from key industries like food and beverages, pharmaceuticals, and biodegradable packaging.

A few key players in the market are Cargill, Incorporated; BASF; Archer Daniels Midland Company; Ingredion Incorporated; Tate & Lyle PLC; AGRANA Beteiligungs-AG; Grain Processing Corporation; Roquette Frères; Tereos Group; Royal Cosun; Altia Industrial; Global Bio-chem Technology Group Company Limited; General Starch Limited; Eiamheng; Coöperatie Koninklijke Avebe U.A.; Galam Group.

In 2024, the food & beverage segment held the largest share of the industrial starch market due to the growing demand for starch as a key ingredient in various food products.

The wheat starch segment is expected to witness the highest CAGR over the forecast period due to its versatility and cost-effectiveness, which is increasingly used in a variety of industries.