Industrial Safety Market Share, Size, Trends, Industry Analysis Report, By Offering; By Type; By End-Use (Oil & Gas, Power, Chemical, Water & Wastewater Treatment, Pharmaceuticals, Paper & Pulp, Mining & Metals, Food & Beverage); By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 119

- Format: PDF

- Report ID: PM2691

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

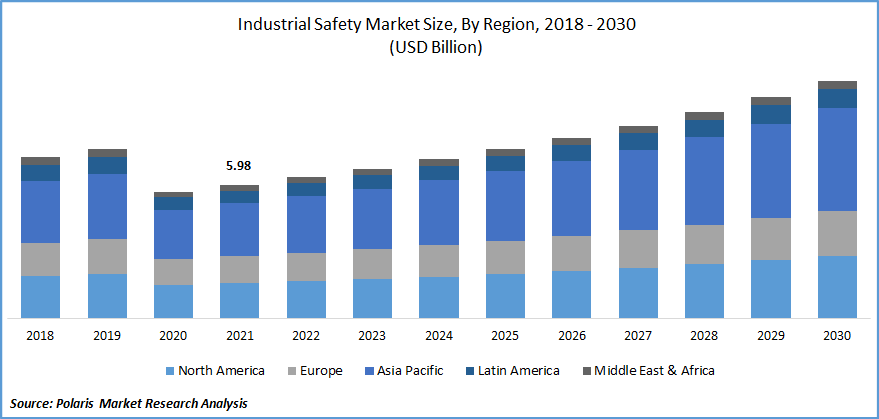

The global Industrial safety market was valued at USD 5.98 billion in 2021 and is expected to grow at a CAGR of 6.7% during the forecast period. Strict standards for workplace health and safety claim that the primary driver of the market growth for workplace safety systems is the mandatory usage of industrial safety systems in workplaces.

Know more about this report: Request for sample pages

The adoption of industrial safety solutions is expected to be sped up by initiatives done by various governments & regulatory authorities, such as the Department Of Occupational Safety & Health (NIOSH) and the Work Health and Safety Regulations (OSHA).

Intelligent clothing, smart personal protective equipment, smart safety, & autonomous cars are just a few of the new, developing trends that will likely present profitable prospects for the workplace safety sector to expand.

The need for industrial safety solutions is expected to increase throughout the projected period due to the remarkable growth that the surveillance sector is experiencing, particularly in North America and Europe. As the market for workplace safety has grown, several companies have begun using real-time location monitoring equipment (RTLMS), safety and environmental systems (EHS), and monitoring and surveillance solutions to protect their assets.

The COVID-19 epidemic has had a significant global influence on several businesses. Due to shifts in consumer behavior, poor output, and industrial closures, several industries saw a significant impact. However, because of consumer demand or the restart of production procedures, these industries are anticipated to rebound swiftly.

One of the major sectors that needs safety systems and parts is the oil and gas industry. Major users of valves include the energy and chemical & power sectors, both of which saw their demand for valves decline due to the worldwide pandemic. Due to the nationwide lockdown, there were limits on international trade, including the closure of international borders and operational distribution channels as well as additional public health and safety precautions.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Usually, the need for safety legislation in many businesses drives the expansion of a industrial safety sector. Governments in the US and Europe are attempting to avert disasters by enforcing regulations on worker and process safety & placing approved equipment in hazardous places, including actuators, switches, & explosion-proof sensors.

Companies such as the International Standard Organization (ISO), the Occupational Safety and Health Administration (OSHA), the American National Standards Institute (ANSI), as well as the International Electrotechnical Commission (IEC) have implemented safety standards and regulatory procedures to monitor and enhance the efficacy of industrial processes in a variety of industries. Machine safety legislation, such as the OSHA standards in North America and the EU Machinery Directives, have helped the industrial safety products business grow globally.

Report Segmentation

The market is primarily segmented based on type, offering, end-use, and region.

|

By Type |

By Offering |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Emergency shutdown type accounted for the largest market share in 2021

The market is anticipated to be dominated by the emergency shutdown system (ESD) in 2022. This industry's expansion is explained by the fact that more governments are implementing safety requirements, and demand is expanding in process sectors like oil & gas. Additionally, these systems are employed in the petrochemical, industrial, pharmaceutical, healthcare, and power sectors.

However, it is anticipated that throughout the projection period, the category for fire and gas monitoring systems would see the greatest CAGR. The requirement to detect, isolate, & reduce the uncontrolled discharge of hazardous and flammable liquids and gases across industrial and processing sectors is what is driving the growth of this market segment.

Hardware sector is expected to witness significant growth

Based on offering, the hardware sector is anticipated to hold the greatest market share in 2022. The strict workplace safety laws and the strong need for safety mechanisms in the oil and gas, electricity and power, & food & beverage industries are also responsible for this segment's significant market share. Although, the software category is anticipated to record the greatest CAGR. The industry expansion of workplace safety systems as a whole, as well as the increased deployment of technology, including cutting-edge technologies like IoT, AI, & cloud-based services, are both credited with the rise of this particular market sector.

Oil & gas sector accounted for the largest market

The oil and gas sector is anticipated to have the major share of the market due to the requirement for industrial safety systems to identify and manage dangers in order to prevent accidents and fatalities; this market is expected to develop. As a result of the ignition of volatile vapors or gases, employees in the oil and gas sectors run the danger of fire and explosion. This has prompted the oil and gas sector to deploy safety systems widely.

The demand in Asia Pacific is expected to witness significant growth

The Asia-Pacific region is anticipated to have the greatest market share for industrial safety systems worldwide in 2022. The rising nations like China and India are becoming more industrialized. Safety and health regulations have already been implemented in China and India in several industries, including power generation and oil and gas exploration. The Asia-Pacific manufacturing sectors have adopted more industrial safety systems as a result of rapid industrialization, which has boosted the market for industrial safety.

Competitive Insight

Some major global players operating in the global market include Siemens, Yokogawa, Hima Paul, Rockwell, Emerson, OMRON Corp, Honeywell, Johnson Controls, ABB, and Balluff GmbH.

Recent Developments

In Dec 2021: Honeywell acquired US Digital Designs, Inc. to expand public safety communications capabilities.

In Nov 2021: Compressor Controls LLC & Yokogawa Electric Corporation launched a jointly developed integrated solution for process and turbomachinery control.

Industrial safety Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 6.32 billion |

|

Revenue forecast in 2030 |

USD 10.63 billion |

|

CAGR |

6.7% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Offering, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Siemens, Yokogawa, Hima Paul, Rockwell, Emerson, OMRON Corp, Honeywell, Johnson Controls, ABB, and Balluff GmbH. |