Industrial Lubricants Market Share, Size, Trends, Industry Analysis Report, By Product (Metalworking Fluids, Industrial Engine Oils, Process Oils, General Industrial Oils); By Base Oil; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM1122

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

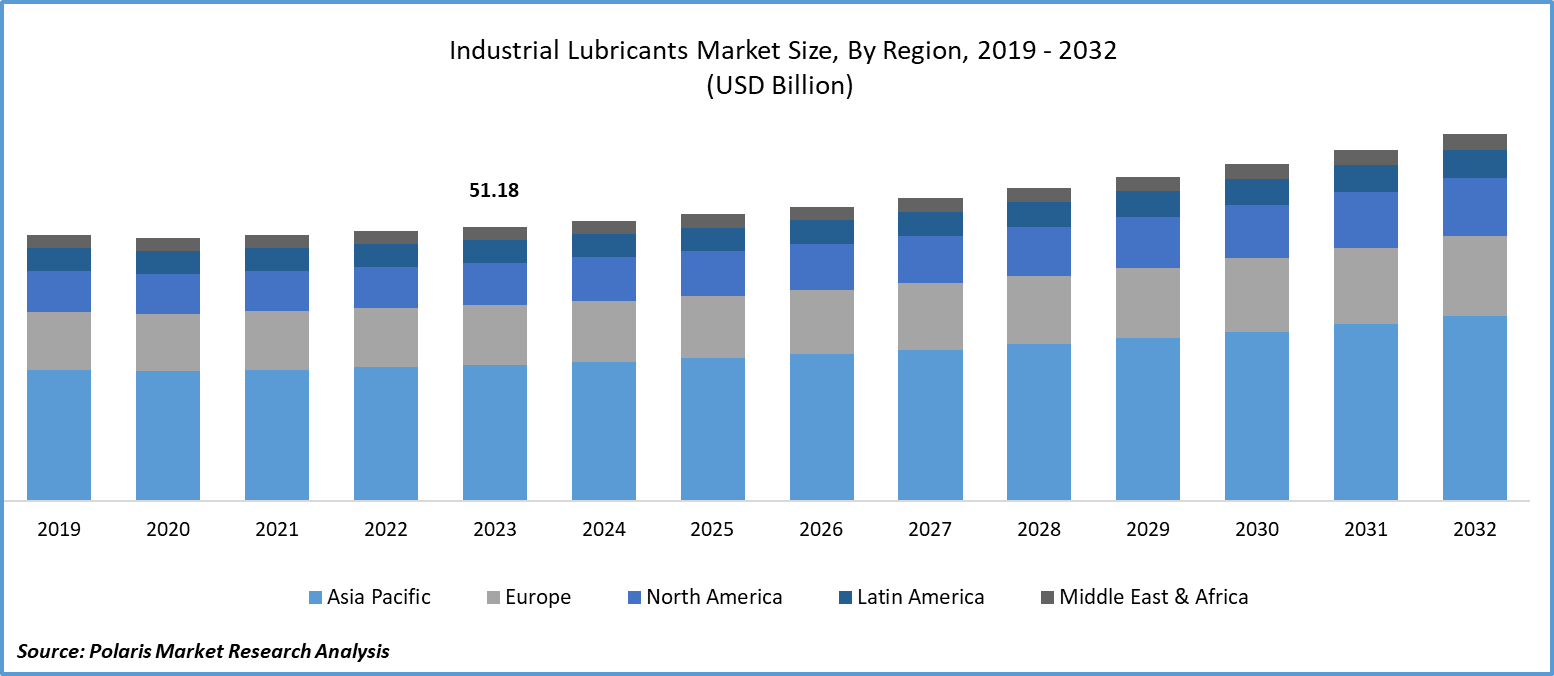

Global Industrial Lubricants Market Size was valued at USD 51.18 Billion in 2023. The Industrial Lubricants Industry is projected to grow from USD 52.23 Billion in 2024 to USD 68.42 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 3.4% during the forecast period (2024 - 2032).

The industrial lubricants market is influenced by several driving factors such as expanding manufacturing sector, particularly in automotive and machinery industries, which demand efficient lubrication for enhanced performance and longevity of equipment. For instance, according to India brand equity foundation, India's manufacturing sector is set to achieve a milestone of reaching US$ 1 trillion by 2025-26, driven by robust growth in states like Gujarat, Maharashtra, and Tamil Nadu. This growth is primarily fueled by significant investments pouring into industries such as automobiles, electronics, and textiles. Government initiatives such as Make in India and Production-Linked Incentive (PLI) schemes are playing pivotal roles in accelerating this expansion, attracting substantial foreign direct investment (FDI) and bolstering industrial infrastructure across the country. Additionally, stringent regulations promoting sustainability and energy efficiency are pushing industries towards high-performance lubricants that reduce friction and wear.

To Understand More About this Research: Request a Free Sample Report

Moreover, the growing emphasis on predictive maintenance in industrial operations is boosting the adoption of advanced lubricants to optimize equipment performance and minimize downtime. Furthermore, the rise of industrial automation and smart manufacturing practices is driving the need for specialized lubricants that can withstand high temperatures and extreme conditions. These factors collectively propel innovation and market expansion in the industrial lubricants sector globally.

Industrial Lubricants Market Trends:

Rising Usage in Construction and Automobile Industry

Market CAGR for industrial lubricants is being driven by the increasing demand for lubricants in construction and automobile industry in the forecasted period. The construction sector is the largest consumer of industrial lubricants. The increasing infrastructure development in emerging economies is expected to boost the industrial lubricants market demand gradually. Hydraulic fluid, being more cost-effective than other lubricants, is the preferred product type for lubricating heavy machinery in the construction sector. Further, the rising automotive industry has significantly increased the demand for industrial lubricants. This trend from the industry's growing adoption of industrial lubricants, driven by their benefits like high electrical resistance, durability, and effective corrosion protection. As vehicles become more advanced and efficient, industrial lubricants play a crucial role in ensuring optimal performance and extending the lifespan of automotive components under demanding operational conditions driving the market outlook industry. For instance, Sales of electric two-wheelers, which stood at 53,258 units in April 2022, surged to 86,194 units by March 2023, marking substantial exponential growth, as reported by the Society of Manufacturers of Electric Vehicles.

Rapid Industrialization, Along with the Influence of Western Culture

The industrial lubricants market growth is expected to rise in the coming years, driven by rapid industrialization and increased trade, especially in developing countries. The growth of various industrial processes and increased investments in Research & Development (R&D) are supporting this expansion. Industries such as mining, chemicals, and unconventional energy are expected to see significant growth during this period. The demand for industrial lubricants market development in applications such as bearings, hydraulics, compressors, centrifuges, and industrial engines is also expected to increase as a result of these trends.

Moreover, the lifestyle in emerging nations has been significantly impacted by western culture, leading to an increased demand for processed and frozen meals in recent years. This trend is expected to drive the growth of industrial lubricants, as many packaging industries are adopting automation and artificial intelligence (AI) to enhance production. Consequently, the industrial lubricants market development is expected to expand in the coming years as automation and robotic processing become increasingly integral.

Industrial Lubricants Market Segment Insights:

Industrial Lubricants Product Insights:

The global industrial lubricants market segmentation, based on product, includes metalworking fluids, industrial engine oils, process oils, general industrial oils, and others. The metalworking fluids segment is projected to grow at a CAGR during the industrial lubricants market forecast period. Their rising popularity stems from their ability to enhance surface finish quality. These fluids find extensive use in specialized fields such as medical machining. To extend tool lifespan and reduce downtime, manufacturers often augment metal removal fluids with antioxidants and emulsifiers.

The process oils segment led the industry market with a substantial revenue share in 2023. Process oils are extremely adaptable and have a wide range of uses, such as tire manufacturing, rubber processing, and polymer processing. They are invaluable in many industries because of their adaptability. Process oils are made expressly to improve material processing. Better processing efficiency and higher-quality products are the result of their improved flow characteristics, decreased friction, and improved additive dispersion.

Industrial Lubricants Base Oil Insights:

The global Industrial Lubricants Market segmentation, based on base oil, includes bio-based oil, mineral oil, and synthetic oil. The synthetic oil segment is expected to grow at the fastest CAGR over the industrial lubricants market forecast period. When it comes to performance, synthetic oils outperform traditional mineral oils. Their superior viscosity index, oxidation resistance, and thermal stability result in increased equipment life and efficiency. Many industrial industries, such as the automobile, manufacturing, and energy sectors, can employ synthetic oils. Their adaptability makes them a well-liked option in many sectors.

Industrial Lubricants Application Insights:

The global Industrial Lubricants Market segmentation, based on application, includes metalworking, textiles, energy, chemical manufacturing, food processing, and hydraulic. The chemical manufacturing segment dominates the industrial lubricants market growth in context to the applications in 2023. Chemical manufacturing and processing plants encounter various challenges, such as extreme temperatures, continuous operation, and the risk of contamination from particles, water, and chemicals. Using lubricants in these plants helps to extend lubricant and equipment lifespan, maintain lower oil temperatures, increase production output, reduce friction, heat, wear, and energy consumption, and extend oil drain intervals.

The metalworking segment is expected to grow at the fastest CAGR during the industrial lubricants market forecast period. This segment’s growth will be driven by the increase in industrial activity and the demand for metal in construction and equipment applications. Additionally, the expansion will be fueled by the requirement for metalworking processes, including cutting, welding, and shaping, in various applications such as foundries, ships, airplanes, milling, and industrial machinery.

Global Industrial Lubricants Market, Segmental Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Industrial Lubricants Regional Insights:

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East Africa. The Asia Pacific region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. The region's industrial lubricants market development is experiencing strong demand from various vital industries. This demand is largely driven by the superior qualities of industrial lubricants, such as enhanced performance, adhesion, damage protection, and prolonged machinery lifespan, particularly in the automotive sector. In a notable contrast to the decline seen in the past three years, the China Association of Automobile Manufacturers (CAAM) has reported a year-over-year increase in automotive production and sales, reaching 26.08 million and 26.27 million units, respectively. This growth is fueled by the rise in automobile production in key Asia-Pacific (APAC) regions, further driving the China industrial lubricants market.

Moreover, the Japan Automobile Manufacturers Association (JAMA) has reported an increase in motor vehicle manufacturing in Japan, with production rising from 344,875 units in December 2019 to 360,103 units in January 2020. Furthermore, the expanding residential building and infrastructure development in the Asia-Pacific region offer opportunities for market expansion. For instance, the Made in India campaign aims to attract US$965.5 million in investments for India's infrastructure by 2040. As a result, the booming demand for lubricants in automobile production, construction, and other industries in the Asia-Pacific region is driving the expansion of the India industrial lubricants market opportunity. The Asia-Pacific region is expected to maintain its dominant position throughout the industrial lubricants market forecast period.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, and Others.

GLOBAL INDUSTRIAL LUBRICANTS MARKET, REGIONAL COVERAGE, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Industrial Lubricants Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Industrial Lubricants Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Industrial Lubricants industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Industrial Lubricants industry to benefit clients and increase the market sector. In recent years, the Industrial Lubricants industry has offered some technological advancements. Major players in the Industrial Lubricants Market, including ExxonMobil Corp, Fuchs Group, The Lubrizol Corporation, Royal Dutch Shell, Phillips 66, Lucas Oil Products, Inc., Amsoil, Inc., Bel-Ray Co., Inc., BASF SE, Total Energies, Kluber Lubrication, Valvoline International, Inc., Chevron Corp., Clariant, and Quaker Houghton.

BASF SE is a chemical corporation that operates all over the world. It operates through seven segments including chemicals, industrial solutions, materials, surface technologies, nutrition & care, and agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the Materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries. In January 2024, BASF and Lubrizol entered into a license agreement for the production and distribution of selected industrial lubricants.

Clariant is a manufacturer for specialty chemical with three core business areas including care chemicals, natural resources, and catalysis. Care chemicals segment has a distinct focus on highly appealing, high-margin, and low-cyclicality categories, with around two-thirds of the business, are consumer-facing in consumer care and industrial applications. This segment focus on personal care, home care, crop solutions, paints & coatings, aviation, construction chemicals, industrial lubricants. In sept, 2022, Clariant launches additives for fully synthetic metalworking fluids, enhancing efficiency, sustainability, and performance in aluminum cutting operations with biodegradable options.

Key Companies in the Industrial Lubricants Market include:

- Amsoil, Inc.

- BASF SE

- Bel-Ray Co., Inc.

- Chevron Corp.

- Clariant

- Exxonmobil Corp

- Fuchs Group

- Kluber Lubrication.

- Lucas Oil Products, Inc.

- Phillips 66

- Quaker Houghton

- Royal Dutch Shell

- The Lubrizol Corporation

- Total Energies

- Valvoline International, Inc.

Industrial Lubricants Industry Developments

- September 2023: TotalEnergies and Automotive Parts Services Group (The Group) announced a strategic partnership to deliver enhanced value to their customers. Under this agreement, TotalEnergies Marketing USA will supply The Group's network of over 5,500 locations across North America with a range of high-quality lubricants and technical support.

- May 2023: Shell aims to elevate its lubricants business in India to a top-three position globally within the next five years, up from its current 10th position.

- March 2023: • In March 2023, ExxonMobil is investing INR 900 crore to construct a lubricants production plant in Maharashtra.

Industrial Lubricants Market Segmentation:

Industrial Lubricants Product Outlook

- Metalworking Fluids

- Industrial Engine Oils

- Process Oils

- General Industrial Oils

- Others

Industrial Lubricants Base Oil Outlook

- Bio-Based Oil

- Mineral Oil

- Synthetic Oil

- Group III (Hydro cracking)

- Polyalphaolefins (PAO)

- Polyalkylene Glycol (PAG)

- Esters

Industrial Lubricants Application Outlook

- Metalworking

- Industrial Heat Exchangers

- Metal Forming

- Metal Cutting

- Metal Joining

- Metalworking Electronics

- Others

- Textiles

- Textile Weaving

- Non-woven Textiles

- Textile Finishing

- Textile Composites

- Others

- Energy

- Transformers

- Pipelines

- Liquefied Natural Gas (LNG)

- Ocean Energy

- Others

- Chemical Manufacturing

- Industrial gases

- Fertilizers

- Polymers

- Others

- Food Processing

- Beverages

- Frozen Food

- Canned Food

- Processed Potatoes

- Bakery

- Cocoa & Chocolate

- Others

- Hydraulic

- Compressors

- Bearings

- Others

Industrial Lubricants Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Lubricants Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 51.18 billion |

|

Market size value in 2024 |

USD 52.23 billion |

|

Revenue Forecast in 2032 |

USD 68.42 Billion |

|

CAGR |

3.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global Industrial Lubricants market size is expected to reach USD 68.42 billion by 2032

Key players in the market are Exxonmobil Corp, Fuchs Group, The Lubrizol Corporation, Royal Dutch Shell, Phillips 66, Lucas Oil Products, Inc

Asia Pacific contribute notably towards the global Industrial Lubricants Market

Industrial Lubricants Market exhibiting the CAGR of 3.4% during the forecast period

The Industrial Lubricants Market report covering key segments are product, base oil, application, and region.

The synthetic oil is expected to grow at fastest CAGR in the industrial lubricants market.