Industrial Gases Market Share, Size, Trends, Industry Analysis Report, By Product Type (Oxygen, Nitrogen, Hydrogen, Carbon Dioxide, Acetylene, Argon, Others); By Application; By Distribution; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4632

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

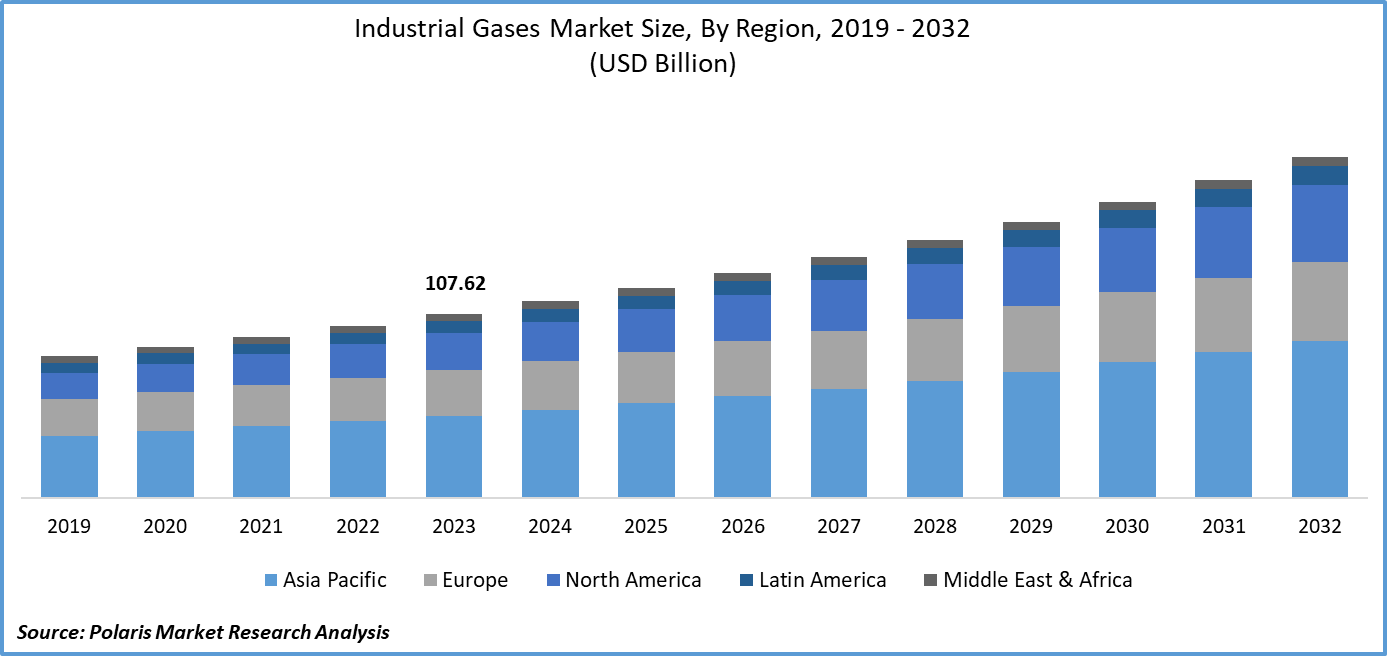

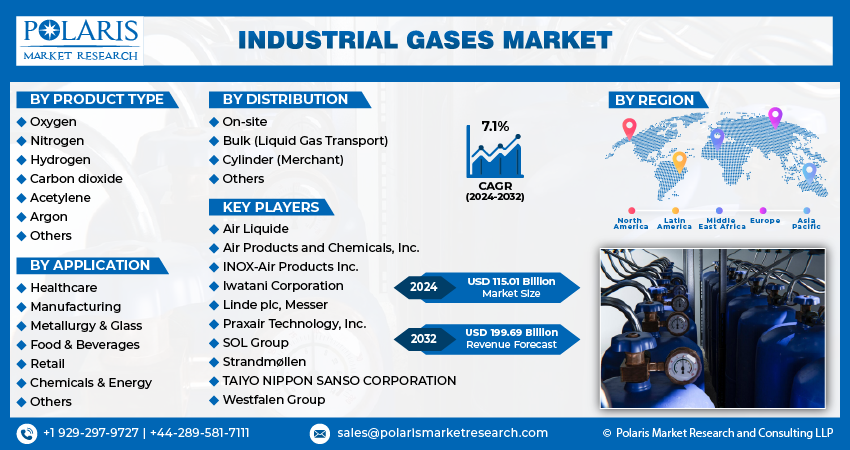

Global industrial gases market size was valued at USD 107.62 billion in 2023. The market is anticipated to grow from USD 115.01 billion in 2024 to USD 199.69 billion by 2032, exhibiting a CAGR of 7.1% during the forecast period.

Industry Trends

Industrial gases are used in various industries for different purposes. These gases are usually manufactured and sold by gas companies, and they play a crucial role in many industrial processes. Some common examples of industrial gases include nitrogen, oxygen, argon, carbon dioxide, hydrogen, helium, and acetylene. These gases are usually transported in cylinders or tanks and can be stored on-site for convenient use.

The global industrial gas market is a rapidly growing sector that serves various industries, such as healthcare, manufacturing, and energy. The market is driven by increasing demand for industrial gases in emerging economies, advancements in technology, and environmental concerns. The growing industrial gases industry trends toward cleaner and more sustainable energy sources, such as hydrogen fuel cells, are also expected to drive the demand for industrial gases.

To Understand More About this Research: Request a Free Sample Report

For instance, in March 2023, Nikkiso Clean Energy & Industrial Gases Group, which is a unit of Nikkiso Co., Ltd and functions under the Cryogenic Industries, declared that it would be broadening its reach in terms of sales, service, and engineering facilities to cater to the South African market.

In addition, the increasing use of industrial gases in the healthcare industry for medical treatments and research also drives market growth. However, the industry gases market growth could be improved by the high cost of production and transportation of industrial gases. Another challenge faced by the market is the fluctuating prices of raw materials used in the production of industrial gases, which affects profitability. Despite these challenges, the market outlook for industrial gases remains positive due to its essential role in various applications.

Key Takeaways

- Asia Pacific dominated the market and contributed over 34% of industrial gases market share in 2023

- By product type category, the oxygen segment dominated the global industrial gases market share

- By application category, the healthcare segment is projected to grow with a lucrative CAGR over the industrial gases market forecast period

What are the Market Drivers Driving the Demand for the Industrial Gases Market?

The High Dependence by Several End-Use Industries Fuels the Industrial Gases Market Growth

The high dependence by several end-use industries is a significant driving factor for the industrial gas market. Industrial gases are essential raw materials for various industries such as manufacturing, healthcare, food and beverage, and energy. For instance, oxygen, nitrogen, and argon are used in steel production, while carbon dioxide is used in the food industry for carbonation in soft drinks. Similarly, hydrogen is used in oil refineries for hydrocracking, and helium is used in balloons and cryogenic applications. The growing demand from these end-use industries drives the demand for industrial gases, thereby propelling the market's growth.

In addition, advancements in technology and the development of new applications for industrial gases, such as in renewable energy sources like wind turbines and solar panels, also contribute to the market's growth. Overall, the high dependence on industrial gases across diverse industries ensures a steady demand, making it a crucial driver for the market's growth.

Which Factor Is Restraining the Demand for Industrial Gases?

The Stringent Regulations Imposed by the Government Hamper the Industrial Gases Market Growth

The strict regulations set forth by governments can significantly impede the expansion of the industrial gas industry. These regulations often pertain to safety, environmental impact, and quality control, which can limit the production, storage, transportation, and use of industrial gases. For instance, the US Environmental Protection Agency (EPA) has established rigorous guidelines for the handling and storage of hazardous chemicals, including industrial gases.

Similarly, the European Union's Seveso III Directive regulates the storage and handling of dangerous substances, including compressed gases. Compliance with these regulations can be costly and time-consuming, increasing operational expenses for manufacturers and discouraging investment in new projects. Also, non-compliance with this regulation can lead to severe complications which will limit the companies to expand their operations or enter new markets, thereby restricting the growth potential of the industrial gas market.

Report Segmentation

The market is primarily segmented based on product type, application, distribution, and region.

|

By Product Type |

By Application |

By Distribution |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Type Insights

Based on product type analysis, the market has been segmented on the basis of oxygen, nitrogen, hydrogen, carbon dioxide, acetylene, argon, and others. The oxygen segment is expected to dominate the global market in 2023 due to its wide range of applications across various industries. Oxygen is an essential gas used in various processes such as steel production, chemical synthesis, water treatment, and healthcare. The increasing demand for steel and chemicals, particularly in emerging economies, is driving the growth of the oxygen market. In addition, the growing emphasis on environmental protection and wastewater treatment is also boosting the oxygen demand.

In parallel, the use of oxygen in healthcare services, especially in respiratory care, is another significant factor contributing to its large industrial gases market share. Advancements in technology have made it possible to produce oxygen at a lower cost, making it more accessible to various industries, thereby increasing its adoption rate. All these factors combined are expected to contribute to the dominant position of the oxygen segment in the global market in 2023.

By Application Insights

Based on application industry category analysis, the market has been segmented on the basis of healthcare, manufacturing, metallurgy and glass, food and beverages, retail, chemicals and energy, and others. The healthcare segment is anticipated to grow with a substantial CAGR over the forecast period due to the increasing demand for medical gases, such as oxygen, nitrogen, and argon, which are essential for various medical procedures and treatments. The rising prevalence of chronic diseases, such as cancer, cardiovascular disease, and respiratory disorders, is leading to an increased demand for medical gases in hospitals, clinics, and the home healthcare industry. Also, the growing industry trends toward home healthcare and remote patient monitoring are driving the demand for portable and compact medical gas cylinders. Along with this, the development of new medical technologies and therapies that require specialized gases, such as helium and xenon, is further expanding the scope of the market in healthcare.

Regional Insights

Asia Pacific

The Asia Pacific region emerged as the dominant region in the global market in 2023 due to the region's rapidly growing demand for energy, transportation, and infrastructure development, which in turn has driven the demand for industrial gases such as nitrogen, oxygen, and argon. Also, the region's expanding manufacturing sector, particularly in countries like China, India, and South Korea, has created a significant need for industrial gases in various applications such as welding, cutting, and surface treatment. The favorable government policies and investments in infrastructure projects have also supported the growth of the industrial gas market in the Asia Pacific region.

North America

The North American region, which includes the United States and Canada, has been witnessing a substantial expansion of its industrial gas market due to the increasing demand from various end-use industries such as healthcare, manufacturing, and energy. The growing need for advanced technologies and processes that require specialty gases, such as renewable energy production, is also driving the market's expansion. The rising importance of environmental sustainability has led to an increased focus on reducing carbon emissions and improving air quality, further boosting the demand for industrial gases used in pollution control and waste management applications.

Competitive Landscape

The market is dominated by a few large players, including Air Liquide, Linde Group, Praxair, and Messer Group, who together account for a significant share of the global market. These market key companies have established strong presence across diverse regions and offer a wide range of products and services to cater to the varying needs of their customers. They are constantly investing in research and development to introduce new and innovative products, improve efficiency, and reduce costs. Additionally, they are also focusing on expanding their reach through strategic acquisitions and partnerships with local players, particularly in emerging markets.

Some of the major players operating in the global market include:

- Air Liquide

- Air Products and Chemicals, Inc.

- INOX-Air Products Inc.

- Iwatani Corporation

- Linde plc

- Messer

- Praxair Technology, Inc.

- SOL Group

- Strandmøllen

- TAIYO NIPPON SANSO CORPORATION

- Westfalen Group

Recent Developments

- In October 2023, Linde plc, an industrial gas supplier, entered into long-term supply agreements with Indian Oil Corporation's Panipat refinery to supply industrial gases in Northern India.

- In September 2023, Westfalen Group, a manufacturer and supplier of industrial gases, inaugurated a plant in Arzal, located on the Atlantic coast of Brittany. The new plant expanded the company’s presence in France.

- In October 2023, Air Liquide announced its plans to invest more than 140 million Euros in the establishment of a low-carbon industrial gas platform. The platform will supply a range of gases such as hydrogen, oxygen, nitrogen, and argon.

- In June 2022, Air Products revealed its plan to set up a new complex for industrial gases in Bihar, India. The objective of this project was to provide Indian Oil Corporation Limited (IOCL) with essential gases such as hydrogen, nitrogen, and steam.

Report Coverage

The industrial gases market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, application, distribution, and futuristic growth opportunities.

Industrial Gases Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 115.01 billion |

|

Revenue Forecast in 2032 |

USD 199.69 billion |

|

CAGR |

7.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product Type, By Application, By Distribution, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Navigate through the intricacies of the 2024 Industrial Gases Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

FAQ's

The Industrial Gases Market report covering key segments are product type, application, distribution, and region.

Industrial Gases Market Size Worth USD 199.69 Billion By 2032

Industrial Gases Market exhibiting a CAGR of 7.1% during the forecast period.

Asia Pacific is leading the global market

key driving factors in Industrial Gases Market are the increasing use of industrial gases in the healthcare industry