Industrial Access Control Market Size, Share, Trends, Industry Analysis Report: By Component (Hardware, Software, and Services), End Use, and Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 131

- Format: PDF

- Report ID: PM5183

- Base Year: 2024

- Historical Data: 2020-2023

Industrial Access Control Market Overview

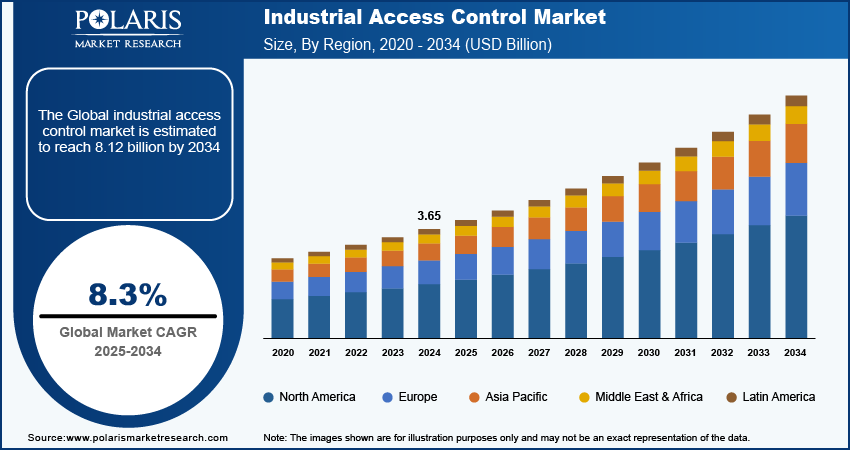

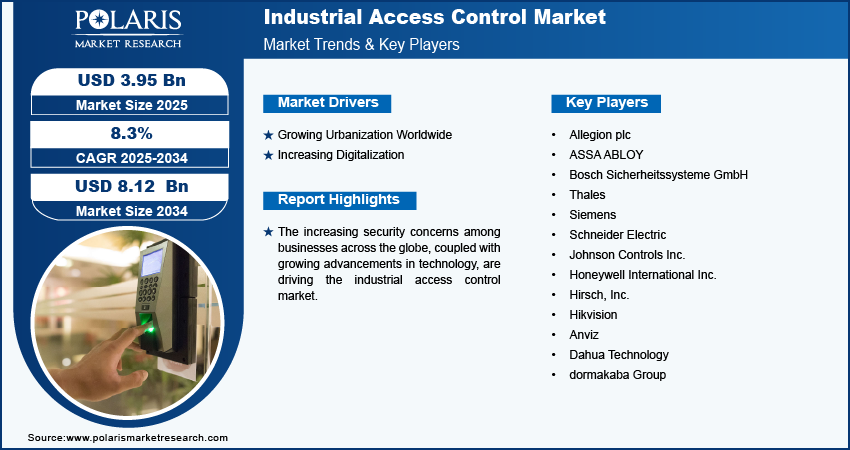

The industrial access control market size was valued at USD 3.65 billion in 2024. The market is projected to grow from USD 3.95 billion in 2025 to USD 8.12 billion by 2034, exhibiting a CAGR of 8.3% during 2025–2034.

Industrial access control systems are essential for ensuring the security and safety of facilities, especially as businesses grow and become complex. These systems regulate who can enter specific areas within an industrial setting, utilizing technologies such as card readers, biometric scanners, and keypads. The primary function of industrial access control systems is to manage physical access to buildings and restricted areas. This is crucial in environments where hazardous materials or sensitive operations are present.

The increasing security concerns among businesses across the world are driving the industrial access control market. Businesses are increasingly worried about unauthorized personnel entering their facilities, which encourages them to integrate access control systems such as biometrics, surveillance cameras, alarm systems, and others into their existing infrastructure to manage and restrict entry. Therefore, as the security concerns among businesses rise, the demand for industrial access control products increases.

To Understand More About this Research: Request a Free Sample Report

The industrial access control market is driven by growing advancements in technology. Advancements in biometric technologies, such as fingerprint sensors and facial recognition, provide higher levels of security and convenience, which facilitate businesses to implement these technologies to improve access control. Moreover, technological advancements allow for remote monitoring and management of access control systems, encouraging businesses to adopt these advanced access control systems to manage security from anywhere, especially in the context of remote work and decentralized operations.

Industrial Access Control Market Drivers Analysis

Growing Urbanization Worldwide

Growing urbanization worldwide is significantly driving the Industrial Access Control Market. As cities expand and industrial facilities increase, the need for enhanced security and efficient access management becomes crucial. Urban areas often face challenges like increased crime rates and the need for streamlined operations, prompting industries to invest in advanced access control systems. These systems not only safeguard facilities but also improve operational efficiency by ensuring that only authorized personnel can access sensitive areas. Additionally, technological advancements, such as biometrics and cloud-based solutions, further enhance the appeal of access control systems. The demand for robust industrial access control solutions is expected to grow as businesses recognize the importance of protecting assets and managing personnel movements effectively, supporting overall urban safety and efficiency in rapidly developing regions.

Increasing Digitalization

Business handles more sensitive information and critical assets as they digitize their operations. This shift raises the need for robust access control systems to protect against unauthorized access and data breaches. Furthermore, digitalization often involves remote work and access to systems from various locations. Industrial access control solutions enable secure remote access, ensuring that only authorized users can connect to critical systems and facilities. Therefore, the increasing digitalization fuels the global industrial access control market.

Industrial Access Control Market Segment Insights

Industrial Access Control Market Breakdown By Component

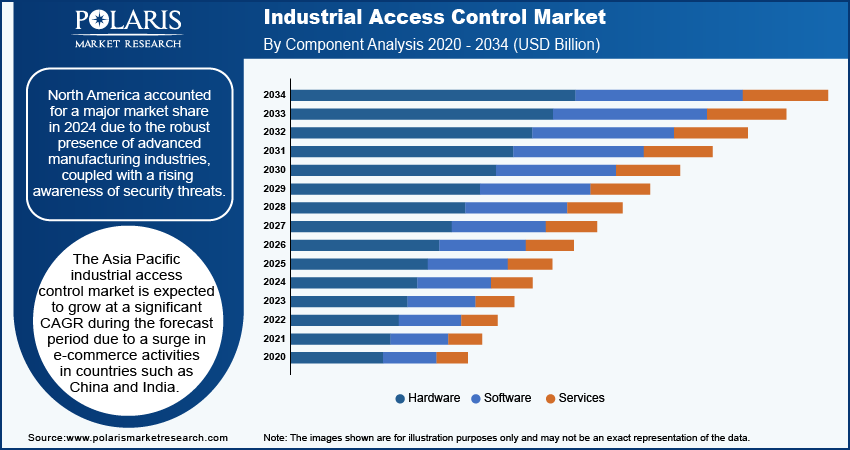

Based on component, the global industrial access control market is segmented into hardware, software, and services. The hardware segment accounted for a major market share in 2024 due to the rise in security concerns across various industries, especially in manufacturing and logistics. Manufacturers increasingly focus on producing advanced physical security devices, such as smart locks, biometric readers, and card access systems, driving segment dominance. Additionally, the integration of hardware with advanced technologies such as the Internet of Things (IoT) has led to the development of smart access control systems that offer improved functionality and user experience. This technological evolution has solidified the prominent position of the hardware segment.

The services segment is expected to grow at a robust pace in the coming years as the industries are increasingly recognizing the importance of ongoing support and maintenance for their security systems. Organizations are now more inclined to invest in managed services, including installation, system integration, and monitoring, to ensure optimal performance and compliance with evolving security standards. Furthermore, the increasing complexity of security threats necessitates expert services that provide tailored solutions, risk assessments, and timely updates.

Industrial Access Control Market Breakdown By End Use

In terms of end use, the global industrial access control market is segmented into manufacturing, energy & utilities, warehouse & logistics, transportation, pharmaceuticals & healthcare, and others. The manufacturing segment dominated the market in 2024 due to the rising focus on safeguarding facilities and sensitive production processes. Manufacturers increasingly prioritize security measures to protect their assets, intellectual property, and workforce from unauthorized access and potential threats. The rise in automation and the integration of smart technologies in manufacturing environments further fueled the demand for advanced access solutions. The need for robust access controls that seamlessly integrate with IoT technologies becomes crucial as factories adopt connected devices and IoT applications.

The warehouse & logistics segment is estimated to grow at a rapid pace during the forecast period owing to the rapid expansion of e-commerce and the increasing demand for efficient supply chain management. Businesses are investing in sophisticated access control systems that manage employee access and visitor interactions as they seek to streamline their operations while ensuring the safety of goods and personnel. The need for real-time tracking and monitoring of inventory also drives the adoption of advanced solutions in warehouses. Furthermore, as companies implement automation and robotics in their logistics processes, the demand for integrated access control systems that adapt to these advancements continues to rise.

Industrial Access Control Regional Insights

By region, the study provides the industrial access control market insights into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America accounted for a major market share in 2023 due to the robust presence of advanced manufacturing industries, coupled with a heightened awareness of security threats. Businesses across various sectors in the region, including healthcare, finance, and manufacturing, increasingly recognized the importance of protecting their facilities and sensitive data, thereby driving demand for access control systems. The integration of advanced technologies, such as biometrics and IoT-enabled devices, further enhanced the effectiveness of security measures in this region. Additionally, stringent regulatory requirements regarding data protection and workplace safety motivated organizations to invest in sophisticated access solutions, ensuring compliance and mitigating potential risks.

The Asia Pacific industrial access control market is expected to register a significant CAGR during the forecast period due to a surge in e-commerce activities in countries such as China and India. The growing emphasis on smart city initiatives and the integration of technology in public infrastructure foster a favorable environment for the adoption of advanced access control systems in the region. Furthermore, rapid urbanization, coupled with an expanding middle-class population, demands enhanced security measures across various sectors, including manufacturing, transportation, logistics & warehousing, and others, driving the market revenue. As per a report published by the United Nations, the urban population in Asia is expected to grow by 50% by 2050. Thus, the rising urban population necessitates advanced access control solutions to ensure safety and security in increasingly populated industrial environments, which drives the demand for industrial access control.

Industrial Access Control Market – Key Players & Competitive Insights

Prominent market players are investing heavily in research and development to expand their offerings, which will boost the industrial access control market growth in the coming years. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the market players must offer innovative solutions.

The industrial access control market is fragmented, with the presence of numerous global and regional market players. A few major players in the industrial access control market include Allegion plc; ASSA ABLOY; Bosch Sicherheitssysteme GmbH; Thales; Siemens; Schneider Electric; Johnson Controls Inc.; Honeywell International Inc.; Hirsch, Inc.; Hikvision; Anviz; Dahua Technology; and dormakaba Group.

Honeywell International Inc., established through the merger of Honeywell Inc. and AlliedSignal in 1999, is an American multinational conglomerate headquartered in Charlotte, North Carolina. The company operates across four primary business sectors—aerospace, building automation, performance materials and technologies (PMT), and safety and productivity solutions (SPS). It offers a comprehensive suite of security solutions designed to enhance safety and operational efficiency across diverse industries. Their products include advanced surveillance systems, access control hardware, and integrated software solutions that facilitate real-time monitoring and management of facilities. In February 2021, Honeywell announced the expansion of capabilities of its MAXPRO Cloud portfolio with the launch of MPA1 and MPA2, access control panels that offer cloud, web-based, or on-premise hosting options.

dormakaba Group, formed from the merger of Dorma and Kaba in 2015, is a global security provider headquartered in Rümlang, Switzerland. The company has over 15,000 employees across more than 50 countries and specializes in access solutions. dormakaba offers a comprehensive array of products designed to enhance security and streamline access management in various industries. Their portfolio includes mechanical locks, electronic access systems, door hardware, and advanced entrance solutions that integrate seamlessly into existing infrastructures. This versatility allows businesses to implement tailored security measures that meet their operational needs while ensuring compliance with industry regulations.

Key Companies in Industrial Access Control Market

- Allegion plc

- ASSA ABLOY

- Bosch Sicherheitssysteme GmbH

- Thales

- Siemens

- Schneider Electric

- Johnson Controls Inc.

- Honeywell International Inc.

- Hirsch, Inc.

- Hikvision

- Anviz

- Dahua Technology

- dormakaba Group

Industrial Access Control Industry Developments

February 2024: Hikvision, a China-based company that manufactures video surveillance equipment and other products and solutions for a variety of industries, announced the launch of its second-generation professional access control products to bring upgraded access management experience.

July 2024: Dahua Technology, a video-centric IoT solution and service provider, announced the launch of DSS Professional V8.5, the latest upgrade of its industry-leading security management software. This new version is designed to simplify security management with advancements in user interface, interactive AR monitoring, deeper integration, enhanced access management, and more, tailored to meet the evolving demands of various industries.

July 2023: Anviz, a professional and converged intelligent security solutions company, announced the launch of its next-generation access control solutions powered by Open Supervised Device Protocol (OSDP) for setting new industry standards.

Industrial Access Control Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Manufacturing

- Energy & Utilities

- Warehouse & Logistics

- Transportation

- Pharmaceuticals & Healthcare

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Access Control Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.65 billion |

|

Market Size Value in 2025 |

USD 3.95 billion |

|

Revenue Forecast by 2034 |

USD 8.12 billion |

|

CAGR |

8.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global industrial access control market size was valued at USD 3.65 billion in 2024 and is projected to grow to USD 8.12 billion by 2034.

The global market is projected to record a CAGR of 8.3% during the forecast period

North America accounted for the largest share of the global market in 2024.

A few key players in the market are Allegion plc; ASSA ABLOY; Bosch Sicherheitssysteme GmbH; Thales; Siemens; Schneider Electric; Johnson Controls Inc.; Honeywell International Inc.; Hirsch, Inc.; Hikvision; Anviz; Dahua Technology; and dormakaba Group.

The services segment is projected for significant growth in the global market during the forecast period.

The manufacturing segment dominated the market in 2024.