Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software Market Size, Share, Trends, Industry Analysis Report: By Component (Software and Services), Organization Size, Deployment Type, Functionality, End User, and Country – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 102

- Format: PDF

- Report ID: PM5359

- Base Year: 2024

- Historical Data: 2020-2023

Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software Market Overview

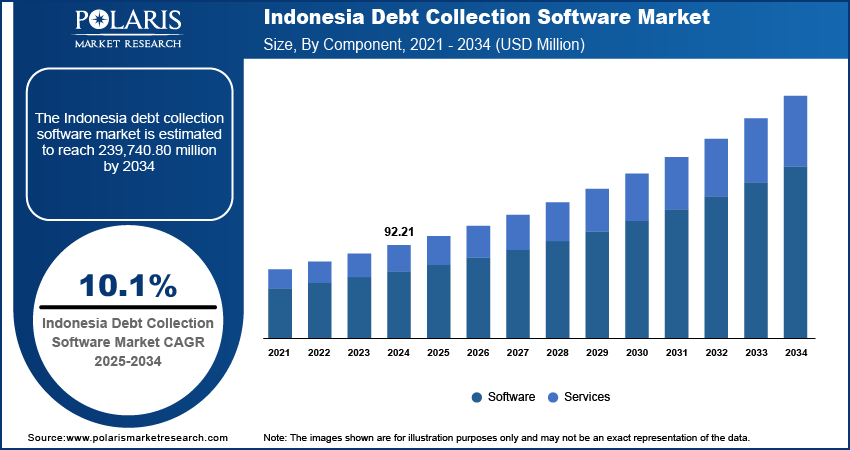

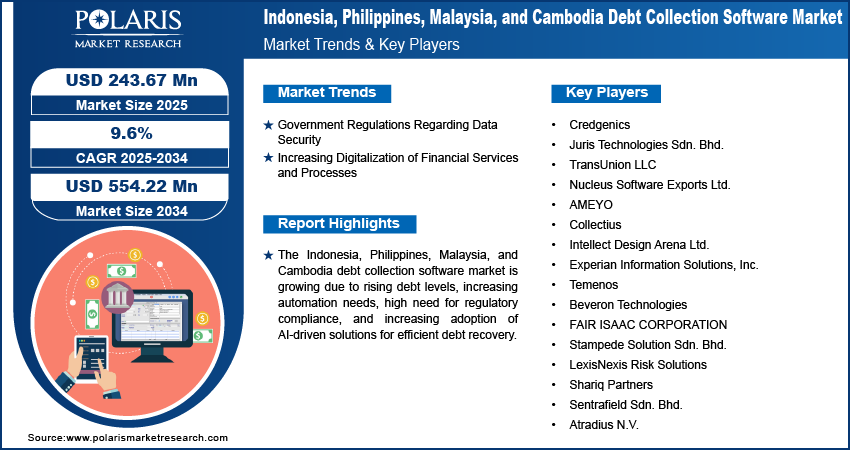

The Indonesia, Philippines, Malaysia, and Cambodia debt collection software market size was valued at USD 222.82 million in 2024. The market is projected to grow from USD 243.67 million in 2025 to USD 554.22 million by 2034, exhibiting a CAGR of 9.6% during 2025–2034.

The Indonesia, Philippines, Malaysia, and Cambodia debt collection software market focuses on tools that help businesses and financial institutions manage and recover outstanding debts efficiently. These systems automate processes such as customer communication, repayment scheduling, payment tracking, and legal compliance, reducing human error and improving recovery rates. Indonesia, Malaysia, the Philippines, and Cambodia are experiencing significant growth in private debt, creating a demand for such debt collection software.

To Understand More About this Research: Request a Free Sample Report

The demand for debt collection software is surging in Indonesia, Philippines, Malaysia, and Cambodia due to increasing private debt levels. According to the International Monetary Fund, private debt is significant in Indonesia (38.27%), Malaysia (131.06%), the Philippines (61.57%), and Cambodia (181.09%), emphasizing the growing need for efficient debt management solutions driven by loans and securities. Rapid digitalization in these economies further boosts demand as businesses increasingly adopt cloud-based debt collection software for scalability and easy integration.

The rise in private debts is partially attributed to accessible loan programs with simplified processes, such as digital applications, quick approvals, and minimal documentation. These programs lead to higher debt accumulation and repayment challenges as they make borrowing easier. Debt collection software assists in automating repayment reminders and follow-ups, tracking overdue payments, reducing delinquencies, and enhancing recovery efficiency.

Rising private debt across Southeast Asia, fueled by accessible loan offerings, is driving the adoption of debt collection software. The software enables financial institutions to mitigate repayment risks, optimize debt recovery processes, and adapt to growing portfolios, particularly in rapidly digitizing economies.

Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software Market Drivers

Government Regulations Regarding Data Security

Governments of Indonesia, the Philippines, Malaysia, and Cambodia are implementing stringent data protection laws to protect consumer information, aligning with global privacy standards. Indonesia’s Personal Data Protection Law (2022) and the Philippines’ Data Privacy Act (2012) necessitate organizations to adopt robust data security measures, compelling debt collection agencies to invest in compliant software solutions. Malaysia’s Personal Data Protection Act (PDPA) also pushes firms to upgrade software to meet regulatory standards. Meanwhile, Cambodia is preparing for enhanced data privacy laws, prompting agencies to adopt secure debt collection tools proactively. Data security frameworks are becoming stricter, and the demand for compliant, advanced debt collection software is growing significantly. Thus, government regulations on data security are driving the Indonesia, Philippines, Malaysia, and Cambodia debt collection software market demand.

Increasing Digitalization of Financial Services and Processes

Digital payments, fintech solutions, and e-wallets have simplified access to credit, leading to a surge in outstanding debts that require efficient management. Fintech transaction values in Indonesia are rising by 39% annually, and Malaysia’s Budget 2023 initiatives encourage digital finance growth through incentives and tax exemptions.

Debt collection software enhances debt recovery by automating processes and utilizing advanced analytics for greater efficiency. Initiatives such as Malaysia’s JENDELA and 5G expansion improve connectivity and financial access for unbanked populations, amplifying the need for streamlined debt management. These developments position debt collection software as vital to support digital economic growth in these countries. Therefore, the increasing digitalization of financial services drives Indonesia, Philippines, Malaysia, and Cambodia debt collection software market expansion.

Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software Market Segment Analysis

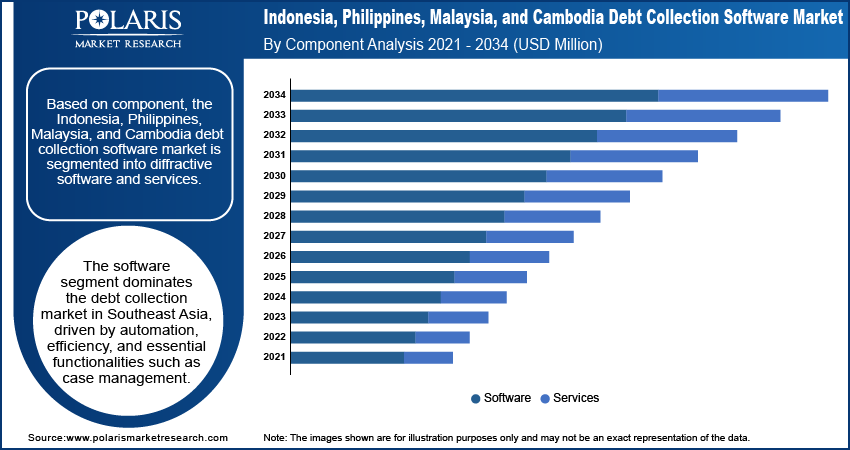

Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software Market Assessment by Component Outlook

The Indonesia, Philippines, Malaysia, and Cambodia debt collection software market segmentation, based on component, includes software and services. The software segment held ∼70% of the market share in 2024 and will continue to dominate during the forecast period. This growth is driven by the rising need for automation and efficiency in the debt recovery process across industries. Essential functionalities such as case management, automated workflows, payment processing, analytics, and compliance management optimize collection efforts effectively. The surge in automation demand for accounts receivable processes fuels the segment growth. In 2022, Credgenics expanded its debt collection software business to Indonesia to address the region’s growing need for technology-driven debt recovery solutions.

Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software Market Evaluation by Organization Size Outlook

The Indonesia, Philippines, Malaysia, and Cambodia debt collection software market segmentation, based on organization size, includes large enterprises and SMEs. The SMEs segment is projected to register a higher CAGR of 9.9% during the market forecast period. This growth is driven by the increasing adoption of CRM-enabled debt collection software, as the software allows SMEs to efficiently manage client interactions, personalize communications, and maintain a positive customer experience during debt recovery. SMEs enhance operational efficiency, foster customer loyalty, and safeguard their reputation by automating accounts receivable processes, leading to long-term success. In Malaysia and Indonesia, many SMEs, including e-commerce platforms such as Lazada and Shopee, are leveraging CRM and debt collection software to optimize debt recovery and enhance customer engagement. Such factors are fueling the SMEs segment expansion.

Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software Market Analysis, by Country

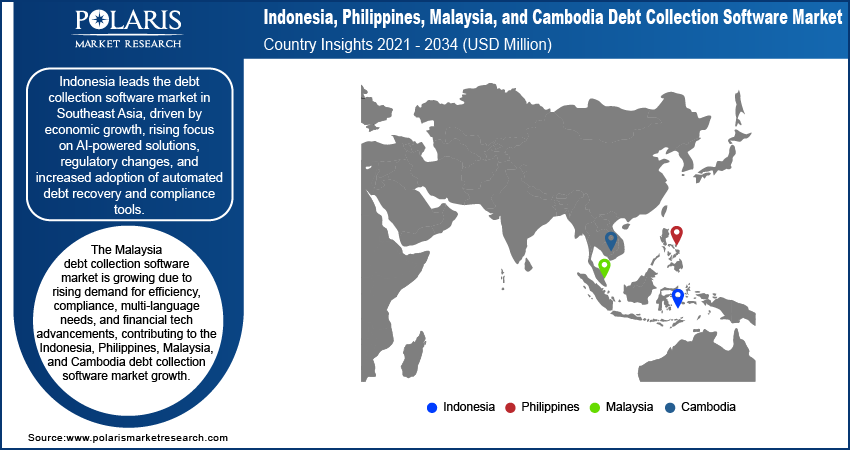

By region, the study provides Indonesia, Philippines, Malaysia, and Cambodia debt collection software market insights into Indonesia, Philippines, Malaysia, and Cambodia. Indonesia dominated the Indonesia, Philippines, Malaysia, and Cambodia debt collection software market revenue share in 2024, driven by domestic consumption, business investment, and government spending. According to The World Bank projects Indonesia's economy to grow at an average annual rate of 5.1% from 2024 to 2026. . Indonesia's debt collection industry is shifting from traditional manual processes to tech-driven solutions such as AI-powered tools and automation, which assist in improving efficiency and communication. The regulatory landscape is evolving, and businesses are increasingly outsourcing debt collection from specialized agencies for better management of non-performing loans (NPLs). Financial institutions are adopting debt collection software to automate tasks, ensuring compliance and improving recovery rates. The Indonesian debt collection software market is anticipated to experience significant growth during the forecast period as consumer and business debts increase. Companies such as Experian and FICO are providing tailored solutions.

The Malaysia debt collection software market is experiencing significant growth, driven by the need for efficiency, compliance, and effective debt recovery strategies among financial institutions and businesses. The country's diverse linguistic landscape has increased the demand for multi-language software, enabling better communication with customers. Compliance with regulations such as the Personal Data Protection Act (PDPA) is crucial, and software solutions are increasingly designed to fulfill these legal requirements. Factors such as increased credit access, rising failure rates, and the growing emphasis on financial technology are propelling the Malaysia debt collection software market expansion. The market in Malaysia is poised for substantial growth with established players and emerging local solutions.

Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software Market – Key Players and Competitive Analysis Report

The competitive landscape of the Indonesia, Philippines, Malaysia, and Cambodia debt collection software market is characterized by a mix of global and domestic players competing for market share through innovation, strategic partnerships, and regional expansion. Key players such as Credgenics, Ameyo, and others in the market leverage their robust research and development (R&D) capabilities along with extensive distribution networks to offer advanced debt collection software solutions tailored for various applications. These major companies focus on continuous product innovation to improve efficiency, reliability, and scalability to meet the evolving needs of industries that require advanced power management solutions. At the same time, smaller firms in Indonesia, the Philippines, Malaysia, and Cambodia are entering the market with specialized software solutions targeting local market demands, often focusing on customized and cost-effective applications. The competitive strategies in the Indonesia, Philippines, Malaysia, and Cambodia debt collection software market include mergers and acquisitions, collaborations with technology firms, and expanding product portfolios to enhance market presence. A few key major players are Credgenics; Juris Technologies Sdn. Bhd.; TransUnion LLC; Nucleus Software Exports Ltd.; AMEYO; Collectius; Intellect Design Arena Ltd.; Experian Information Solutions, Inc.; Temenos, Beveron Technologies; FAIR ISAAC CORPORATION; Stampede Solution Sdn. Bhd.; Shariq Partners; LexisNexis Risk Solutions; Sentrafield Sdn. Bhd.; and Atradius N.V.

Credgenics is a FinTech company providing advanced debt resolution and loan collection solutions, specializing in SaaS for NPA resolution, digital payments, and dispute resolution, enhancing collections and efficiency globally. In December 2023, Credgenics launched an updated debt recovery platform for ARCs, successfully onboarded by Reliance Asset Reconstruction Company.

JurisTech provides enterprise-class lending and recovery software, specializing in credit management, digital banking, AI, debt collection, loan origination, and customer onboarding solutions for financial institutions and the telecom industry. In April 2022, JurisTech and Mambu partnered to propel innovation in Malaysia's digital banking ecosystem. This collaboration aims to expand the industry and enhance support for underbanked and underserved markets in Malaysia, ultimately boosting financial inclusion. By integrating their products, they seek to streamline the credit and financing application lifecycle, offering a holistic credit management platform to the digital banking sector.

List of Key Companies in Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software Market

- Credgenics

- Juris Technologies Sdn. Bhd.

- TransUnion LLC

- Nucleus Software Exports Ltd.

- AMEYO

- Collectius

- Intellect Design Arena Ltd.

- Experian Information Solutions, Inc.

- Temenos

- Beveron Technologies

- FAIR ISAAC CORPORATION

- Stampede Solution Sdn. Bhd.

- LexisNexis Risk Solutions

- Shariq Partners

- Sentrafield Sdn. Bhd.

- Atradius N.V.

Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software Market Development

In May 2024, Temenos and Validata expanded their partnership to enhance cash and nostro reconciliation using Temenos core banking. Temenos core banking solution, designed for banks and EMIs, streamlines payment investigations and case management while incorporating intelligent matching and exception management features to boost operational efficiency.

In March 2024, CARS24 Financial Services partnered with Credgenics to integrate their SaaS platform, which provides data insights and strategy recommendations and automates customer communications for collections.

Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software Market Segmentation

By Component Outlook (Revenue, USD Million, 2021–2034)

- Software

- Services

By Organization Size Outlook (Revenue, USD Million, 2021–2034)

- Large Enterprises

- SMEs

By Deployment Type Outlook (Revenue, USD Million, 2021–2034)

- On-Premises

- Cloud

By Functionality Outlook (Revenue, USD Million, 2021–2034)

- Self-Service Payment Plans

- Automated Notices

- Reporting and Analytics

- Compliance Management

- Customer Relationship Management (CRM) Integration

- Others

By End User Outlook (Revenue, USD Million, 2021–2034)

- Financial Institutions

- Bank

- Commercial Bank

- Retail Bank

- Central Bank

- NBFC

- Insurance Companies

- Investments Companies

- Fintech Companies

- Multi-Finance Companies

- Others

- Bank

- Healthcare

- Government

- Collection Agencies

- Brokerage Firms

- Retail

- Telecommunication

- Energy & Utilities

- Others

By Country Outlook (Revenue, USD Million, 2021–2034)

- Indonesia

- Malaysia

- Philippines

- Cambodia

Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 222.82 million |

|

Market Size Value in 2025 |

USD 243.67 million |

|

Revenue Forecast by 2034 |

USD 554.22 million |

|

CAGR |

9.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market is projected to register a CAGR of 9.6% during the forecast period.

The market size was valued at USD 222.82 million in 2024 and is projected to grow to USD 554.22 million by 2034.

Indonesia dominated the Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software market revenue share in 2024.

A few key players in the market are Credgenics; Juris Technologies Sdn. Bhd.; TransUnion LLC; Nucleus Software Exports Ltd.; AMEYO; Collectius; Intellect Design Arena Ltd.; Experian Information Solutions, Inc.; Temenos; Beveron Technologies; FAIR ISAAC CORPORATION; Stampede Solution Sdn. Bhd.; Shariq Partners; LexisNexis Risk Solutions; Sentrafield Sdn. Bhd.; and Atradius N.V.

The software segment dominated the market in 2024.

The SMEs segment is anticipated to grow at a higher rate during the forecast period.