India Diagnostic Services Market Share, Size, Trends, Industry Analysis Report, By Application (Neurology, Orthopedics, Cardiovascular, Oncology, Ultrasound, Obstetrics & Gynecology, Other); By Type; By Test; By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Mar-2023

- Pages: 118

- Format: PDF

- Report ID: PM1386

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

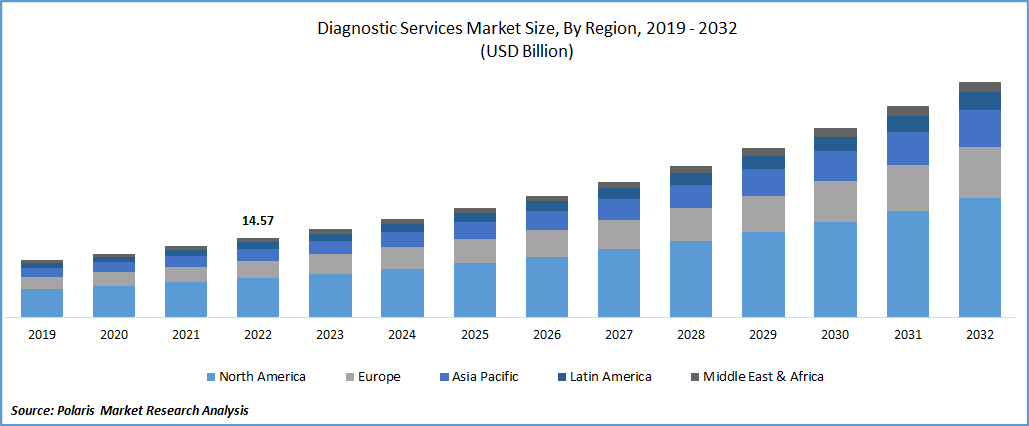

The India diagnostic services market was valued at USD 14.57 billion in 2022 and is expected to grow at a CAGR of 11.6% during the forecast period. The India Diagnostic Services refer to medical testing and examination services performed in order to diagnose and treat illnesses and medical conditions. These services can range from simple blood tests to complex imaging scans and can be provided by a variety of healthcare facilities, including hospitals, clinics, and diagnostic centers. The availability and quality of diagnostic services can vary widely across India, with some areas having highly developed and advanced services, while others may have limited access to even basic diagnostic tests.

Know more about this report: Request for sample pages

India has a vast and diverse range of diagnostic services available for its citizens. These services range from basic tests such as blood tests and X-rays, to advanced imaging techniques like MRI and CT scans. There are both government and private institutions that offer diagnostic services in India, and they are equipped with the latest technology and staffed by trained and experienced professionals. The cost of diagnostic services in India can vary depending on the type of test and the facility, but it is generally more affordable compared to many other countries.

The diagnostic services sector in India is expected to continue to grow in 2023 and beyond, driven by factors such as increasing healthcare spending, growing aging population, and an increasing burden of chronic diseases. In addition, advancements in medical technology are expected to lead to an increased demand for diagnostic services.

Increasing numbers of private hospitals and diagnostic centers are being established, particularly in urban areas. The government is also expected to invest in the development of public sector healthcare infrastructure, including diagnostic services, in an effort to improve access to healthcare for all citizens. However, the growth of the diagnostic services sector in India may also be challenged by issues such as a shortage of trained medical professionals, limited access to advanced medical technology in rural areas, and quality control concerns. Nevertheless, the overall outlook for the diagnostic services sector in India remains positive, and it is expected to continue to play a critical role in the delivery of quality healthcare services to the Indian population.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The diagnostic services industry in India has seen significant growth in recent years, driven by factors such as increasing awareness about preventive healthcare, rising disposable incomes, and improving access to healthcare services. The growing burden of chronic diseases has also led to an increase in demand for diagnostic services. Additionally, the Indian government's emphasis on strengthening the healthcare sector has led to increased investment in the industry. For instance, The Indian diagnostic market was expected to grow over US$32Billion by 2022 according to Ministry of External affairs.

The radiology market is growing rapidly due to the increasing demand for imaging services, while the clinical laboratory services market is also expanding due to the growing number of people undergoing preventive health check-ups. Overall, the diagnostic services industry in India is poised for continued growth in the coming years.

Report Segmentation

The market is primarily segmented based on test, application, type, and end-user

|

By Test |

By Application |

By Type |

By End-User |

|

|

|

|

Know more about this report: Request for sample pages

The Complete Blood Count Segment is Expected to Witness the Fastest Growth

In 2022, complete blood count is expected to witness the fastest growth. Complete Blood Count (CBC) is a common diagnostic test used to evaluate a patient's overall health and detect a wide range of conditions, including anemia, infections, leukemia, and many others. The CBC test provides information about the different components of the blood, including red blood cells, white blood cells, and platelets. In the diagnostic services the CBC is a significant part of the clinical laboratory testing services market. Clinical laboratories perform CBC tests as a routine part of many medical examinations and are often one of the first tests prescribed by healthcare providers to diagnose and monitor various medical conditions.

The CBC diagnostic services are growing as the demand for laboratory testing services increases. Advances in medical technology have also led to the development of automated CBC analyzers, which have improved the accuracy and speed of CBC testing.

The CBC is a critical part of the diagnostic services market, providing crucial information to healthcare providers to diagnose and monitor a wide range of medical conditions.

The Diagnostic Centers Segment Accounted for the Largest Market Share in 2022

The largest market for diagnostic centers in India in 2022 was likely to be the medical diagnostic imaging segment, which includes services such as X-rays, MRI, CT scans, and ultrasound. Other growing segments in the Indian diagnostic services market include clinical laboratory services and molecular diagnostics. The market is highly fragmented and is composed of a large number of players, ranging from small standalone diagnostic centers to large chain diagnostic providers. However, some of the key players in the Indian diagnostic services market include Dr. Lal PathLabs, SRL Limited, Thyrocare Technologies Limited, and Metropolis Healthcare Limited, among others. These companies have a significant presence in the Indian market and offer a wide range of diagnostic services, including medical imaging, clinical laboratory services, and molecular diagnostics.

The Hospitals are Expected to Hold the Significant Revenue Share

The india diagnostic services market is a rapidly growing sector, and is expected to continue to grow in the coming years. The industry's revenue is generated through a variety of services, including clinical laboratory services, imaging services, and genetic testing.

Hospitals account for a significant portion of the industry's revenue, as this segment offers a wide range of tests and is in high demand due to the growing burden of chronic diseases. Additionally, the increasing awareness about preventive healthcare and the growing number of people undergoing regular health check-ups has also driven the demand for clinical laboratory services.

Imaging services, such as X-rays and CT scans, also generate considerable revenue for the industry, as they are widely used for the diagnosis and treatment of a variety of conditions.

Overall, the diagnostic services industry in India generates a significant amount of revenue, as there is a growing demand for a wide range of diagnostic services due to the increasing burden of chronic diseases and the growing emphasis on preventive healthcare.

Competitive Insight

Thyrocare Technologies Limited, Lal Pathlabs, Metropolis Healthcare Limited, Srl Diagnostics, Max India, Apollo Hospitals, Oncquest Laboratories Ltd, Pathcare Labs Pvt. Ltd, Quest Diagnostics India Private Limited, Super Religare Laboratories.

Recent Developments

- In February 2023, The Centre for Cellular and Molecular Platforms (C-CAMP) started a program to develop the diagnostics services for infectious diseases and improve India's prepared for current and forecasted period.

India Diagnostic Services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 16.23 billion |

|

Revenue forecast in 2032 |

USD 43.57 billion |

|

CAGR |

11.6% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Test, By Application, By Type, By End-Use |

|

Key companies |

Thyrocare Technologies Limited, Lal Pathlabs, Metropolis Healthcare Limited, Srl Diagnostics, Max India, Apollo Hospitals, Oncquest Laboratories Ltd, Pathcare Labs Pvt. Ltd, Quest Diagnostics India Private Limited, Super Religare Laboratories |

FAQ's

Key companies in india diagnostic services market are Thyrocare Technologies Limited, Lal Pathlabs, Metropolis Healthcare Limited, Srl Diagnostics, Max India, Apollo Hospitals, Oncquest Laboratories Ltd, Pathcare Labs Pvt. Ltd, Quest Diagnostics India Private Limited.

The india diagnostic services market expected to grow at a CAGR of 11.6% during the forecast period.

The india diagnostic services market report covering key segments are test, application, type, and end-user.

Key driving factor in india diagnostic services market are increasing awareness about preventive healthcare.

The India Diagnostic Services Market size is expected to reach USD 43.57 billion by 2032.