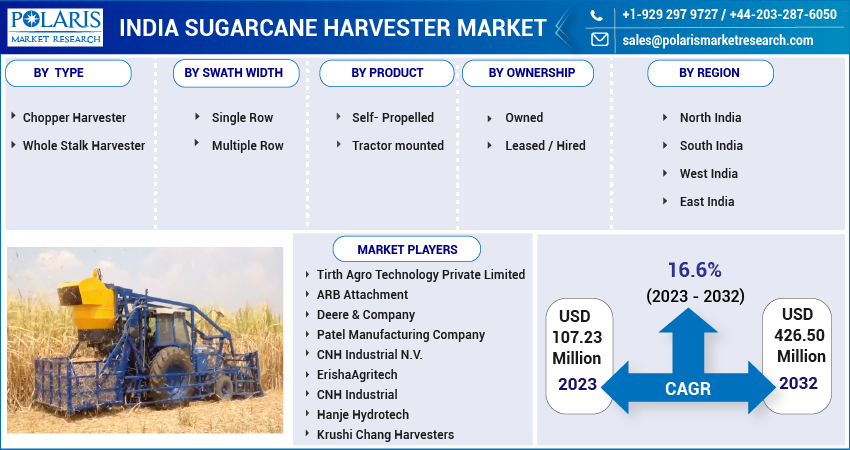

India Sugarcane Harvester Market Share, Size, Trends, Industry Analysis Report by Type (Chopper Harvester, Whole Stalk Harvester); By Swath Width; By Product; By Ownership; By Region, Segment Forecast, 2023 - 2032

- Published Date:Mar-2023

- Pages: 115

- Format: PDF

- Report ID: PM1645

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

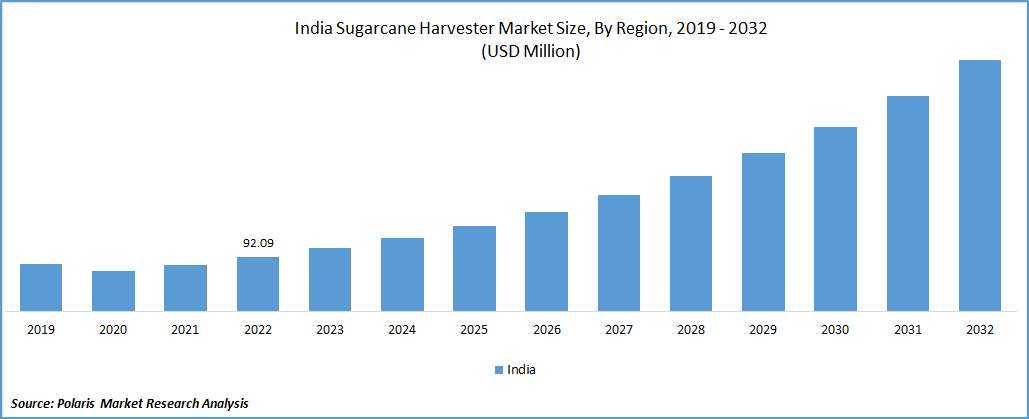

The india sugarcane harvester market was valued at USD 92.09 million in 2022 and is expected to grow at a CAGR of 16.6 % during the forecast period. The increasing sugarcane production and growing use of harvesters among farmers are the primary growth factors of the sugarcane harvester market in India. In addition, favorable government policies and a shortage of manual labor in certain regions are reasons for increasing use of harvesters over manual sugarcane harvesting in India in last few years.

Know more about this report: Request for sample pages

A Sugarcane harvester is a large machinery that cuts the stalks at the base, removes the leaves from the stalk, and cuts the sugarcane stalks into pieces of desired sizes. Unlike manual harvesting, the mechanized process enables the farmers to save labor and time and aids in the easy and clean processing of harvesting the canes. In manual sugarcane harvesting, manual works utilize hand blades and cutting-edge tools, which take time and lose the sugar yield and juice quality.

India is the second largest producer of sugarcane across the globe after Brazil and produced more than 500 million tons sugarcane in the year 2021 – 22, as per Press Information Bureau, Government of India. Sugarcane is mainly cultivated for synthesizing various end products such as sugar, jaggery, ethanol, and fodder for feeding livestock. The rising consumption of sugar by consumers and the food & beverage industry demanded by India's huge population has increased the demand for sugarcane in the domestic market.

Farmers in a developing country like India have depended on manual sugarcane harvesting techniques for decades. The high machinery cost and lack of awareness in the rural pockets of India have been the major factors in the low adoption of harvesters for a long time. But, the improvement in farmers' income in the last few years has increased the use of harvesters in sugarcane farming.

The COVID outbreak has impacted the adoption of sugarcane harvesters in India. The fear of getting infected with the virus has restricted migrant laborers from farming and harvesting in India. At the same time, various landowners had shifted to the mechanized harvesting process in the pandemic period for harvesting their sugarcanes and increasing the first-time users of the harvesters. Further, higher wages and labor scarcity in many parts of India have pushed the adoption of cane harvesters in recent years.

The major restraining factors for the sugarcane harvester in India can result in low awareness of benefits among small farmers. In India, many marginal farmers need adequate resources and understanding regarding the government subsidies for sugarcane harvesters and are still depending on manual harvesting techniques for sugarcane and other agricultural commodities.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The supportive government policies for the sugarcane farming market are the major growth factor driving the demand for sugarcane harvesters in the forecast period. The Indian government has approved the highest-ever fair and remunerative price (FRP) of 3.68 USD for the sugar season in 2022-23. India's government has increased the FRP by more than 34% in the past eight years to bolster the sugarcane farmer’s income. Further, the state government of Maharashtra has also announced a subsidy scheme for purchasing sugarcane harvesters to cooperative sugar mills and farmers to tide the acute labor shortage in harvesting seasons. The favorable subsidy scheme by various state and central governments has been working as a catalyst for adopting the harvester machines in sugarcane farming in India.

The increasing product innovations in the context of sugarcane harvesters for Indian farmlands have also affected the usage of harvesting machines in the last few years. Various players such as Deere & Company and CNH Industrial have launched different sugarcane harvesters specially designed for small landholdings and narrow rows. For instance, New Holland Agriculture a brand of CNH Industrial has introduced Austoft 4000 sugarcane harvesters that can harvest sugarcane fields of about 1.1 and 11.2 meters of narrow space. One of the major advantages of mechanized harvesting in sugarcane farming is that the machine gathers the bottom node, which provides the farmers a better ratoon and avoids

additional operation for stubble shaving, which is to be carried out in case of manual harvesting.

Report Segmentation

The market is primarily segmented based on form, product, application, and region.

|

By Type |

By Swath Width |

By Product |

By Ownership |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The Chopper Harvester segment is anticipated to witness a significant growth rate in 2022

The primary factors driving the chopper harvester segment can be attributable to its various advantages over the whole stalk harvesters. Some of the essential functionalities of chopper harvesters include bundling, dressing & sizing the cut cane into cane bits, carrying, and gathering & loading the cane bundles into cane trucks. Multi-purpose usage of the equipment will increase sales of the Indian sugarcane harvester market during the study period.

The Single row sugarcane harvester segment witnessed the fastest growth over the forecast period.

Major factors driving the fastest growth of the segment can be attributed to superior cost benefits compared to the conventional model. Also, the maintenance of the single row is comparatively easy, and the parts are easily available. Streamlining the product's preventive care to ensure high productivity of harvesters by companies is expected to drive the product demand.

The self-Propelled segment is projected for the largest market share in 2022

Primary factors fueling the segment are easy to operate, highly efficient, and can work on adverse climatic and soil conditions of Indian farmland. Industry participants also promote them through aggressive marketing strategies. Significant investments have been made to develop a self-propelled type in the past few years. These technological innovations offer high productivity, efficient fuel consumption, better operation, effectiveness in harsh conditions, greater comfort, and maintenance. Moreover, the recent equipment is incorporated with a smart cruise intelligent engine to optimize fuel usage.

The leased / Hired segment is anticipated to witness the fastest growth rate in 2022

The number of small farms owned in India is comparatively higher than that of larger farms. The leased harvester machines have a high potential for improving market share for leased or hired sugarcane harvesters. The government is also promoting hiring where the expensive equipment is offered on a lease or hire basis. The concept involves agricultural equipment as a part of ''Farming as a Service'' (FaaS). It provides easy access to a farmer for the required machinery ensuring high yield and boosting overall agricultural productivity, this also involves offering sugarcane harvesters to farmers on lease. Under the Custom Hiring Centers concept, a minimum of one per gram panchayat or one per village meeting the required demand is fulfilled by providing machinery on rent.

In addition, the leasing facility can generate higher profits as the machinery will not be a dead investment and can reduce the payback period for the harvesters. All the above factors are expected to drive the leased market segment demand over the coming years.

Competitive Insight

Some of the major players operating in the india sugarcane harvester market include Tirth Agro Technology Private Limited, ARB Attachment, Deere & Company, Patel Manufacturing Company, CNH Industrial N.V., ErishaAgritech, CNH Industrial, Hanje Hydrotech, Krushi Chang Harvesters

Recent Developments

- In March 2022, New Holland Agriculture, a brand of CNH Industrial has expanded its dealership network by appointing 12 new dealers across multiple locations to supply advanced mechanization for farmers in India.

- In February 2020, CASE IH, registered company under CNH Industrial America LLC. received orders for Austoft 4000 Series from Maharashtra sugar mills in the awake of covid-19 pandemic.

India Sugarcane Harvester Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 107.23 million |

|

Revenue forecast in 2032 |

USD 426.50 million |

|

CAGR |

16.6 % from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Swath Width, By Product, By Ownership, By Region |

|

Regional scope |

North India, South India, West India, East India |

|

Key companies |

Tirth Agro Technology Private Limited, ARB Attachment, Deere & Company, Patel Manufacturing Company, CNH Industrial N.V., ErishaAgritech, CNH Industrial, Hanje Hydrotech, Krushi Chang Harvesters |

FAQ's

The india sugarcane harvester market report covering key segments are form, product, application, and region.

India Sugarcane Harvester Market Size Worth $426.50 Million By 2032.

The india sugarcane harvester market expected to grow at a CAGR of 16.6 % during the forecast period.

North America region is leading the global market.

Key driving factors in india sugarcane harvester market are rising consumption of sugar by consumers and the food & beverage industry and Supportive government policies.