India Diamond Cutting and Polishing Market Share, Size, Trends, Industry Analysis Report, By Category (Cutting, Polishing); By Product Type (Automated, Semi-automated); By Technology; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 113

- Format: PDF

- Report ID: PM2505

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

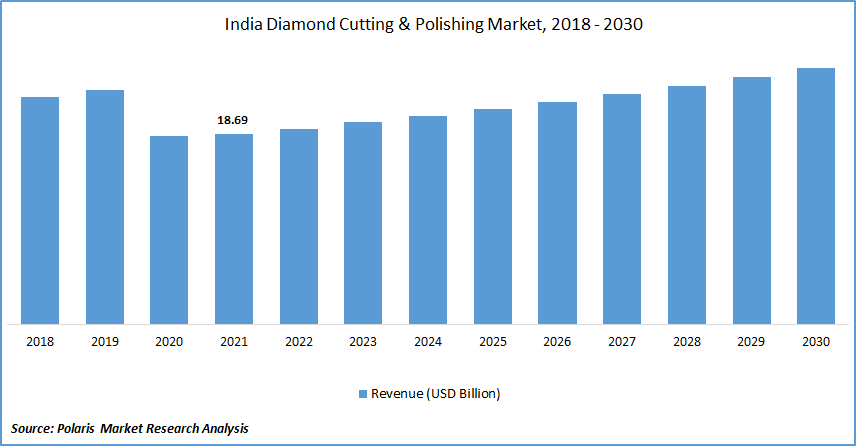

The India diamond cutting and polishing market was valued at USD 18.69 billion in 2021 and is expected to grow at a CAGR of 3.4% during the forecast period. The drivers that are driving this market's growth are rising living standards and evolving fashion trends. The growing desire for branded and luxury jewelry, as well as rising disposable income and technological improvements, are all contributing to the market's expansion.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The market would see various growth prospects if established players expanded into emerging markets and jewelry sales increased through internet channels. Leading players are also introducing innovative technology for cutting and polishing diamonds and optimizing yields, including automated cutting procedures and enhanced digital mapping and modeling.

Further, due to increased environmental concerns, the market's biggest brands are embracing sustainable cutting and polishing procedures. For the sake of sustainability, several non-profit organizations are collaborating with these players. For instance, in December 2019, The Diamond Empowerment Fund announced that it would rename Diamonds Do Good®, based on the simplicity, relevance, and resonance of its tagline.

The non-profit group's logo has been reimagined to reflect the transition, and its iconic Las Vegas event, hosted on the eve of the JCK Show's launch, will be reimagined as well. The objective of the Empowerment Fund has been to support projects that help people in diamond populations around the globe develop and empower themselves. However, the worldwide market is being hampered by the fast development of lab-grown diamonds and the expensive cost of equipment.

Industry Dynamics

Growth Drivers

Due to technical developments, the market is gaining traction. Grinding is a method of diamond cutting, which involves pressing the diamond to be cut against a diamond-covered steel wheel spinning at the speed of 3,000 rpms. During the cutting and polishing procedure, most of the diamonds release 40 to 45% of their rough value. To cut diamonds effectively and select the most profitable cuts, advanced computer systems with three-dimensional photographs are used. Computer-driven equipment that can cut 24-carat diamonds at ease is already available in the market, thanks to technological breakthroughs.

To give diamonds their distinctive sharp-edged forms, lasers have been utilized in the bruiting and beveling processes. On the other side, cutting advances are seeing the introduction of robots like Fenix, which is utilized by the Baunat. As a result, big and small businesses in the market can plan investments in cutting robots to virtually cut any diamond that isn't beyond the reach of manual cutting to benefit from additional prospects.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on category, technology, and product type.

|

By Category |

By Technology |

By Product Type |

|

|

|

Know more about this report: Request for sample pages

Insight by Product Type

Based on the product type segment, the automated segment is expected to be the most significant revenue contributor in the market. This segment requires less labor, and also advancements in technology are making automated processing are driving the market growth during the forecast period.

The full automated factories development is the major factor driving the market. For instance, in May 2021, the DaVinci Diamond Factory was the world's first fully automated diamond faceting laser device. In a single operation, the DaVinci Diamond Factory converts raw diamonds into superb cut diamonds having up to 57 facets.

Competitive Insight

Some of the major players operating in the market include Blue Star Diamonds, Bonas Group, KGK Group, Kristall Production Corporation, Moshe Namdar Diamonds LTD, among others.

India Diamond Cutting and Polishing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 18.69 billion |

|

Revenue forecast in 2030 |

USD 25.25 billion |

|

CAGR |

3.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Category, By Technology, By Product Type |

|

Key companies |

Blue Star Diamonds, Bonas Group, KGK Group, Kristall Production Corporation, Moshe Namdar Diamonds LTD, among others |