In Vitro Diagnostics Quality Control Market Share, Size, Trends, Industry Analysis Report

– By Product & Services, Technology, Manufacturing Type, End User, and Region; Segment Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 115

- Format: PDF

- Report ID: PM5143

- Base Year: 2023

- Historical Data: 2019-2022

IVD Quality Control Market Outlook

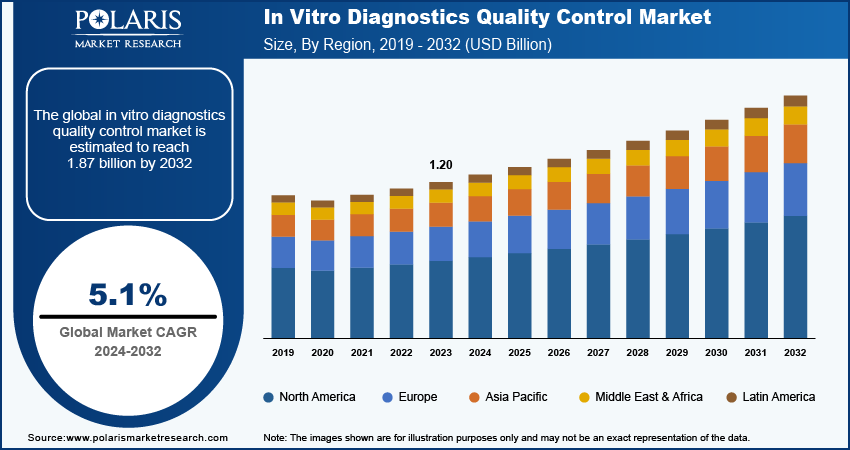

The in vitro diagnostics quality control market size was valued at USD 1.20 billion in 2023.

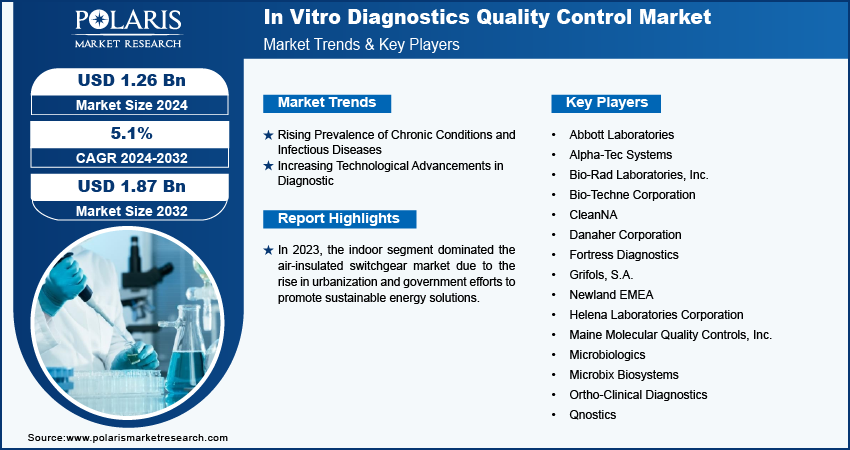

The market is anticipated to grow from USD 1.26 billion in 2024 to USD 1.87 billion by 2032, exhibiting a CAGR of 5.1% during 2024–2032.

IVD Quality Control Market Overview

The in vitro diagnostics quality control market growth is positively influenced by technological advancements, stringent regulatory requirements, and a commitment to upholding high-quality standards.

To Understand More About this Research: Request a Free Sample Report

The increasing need for accurate and reliable diagnostics is driving a stronger importance of rigorous quality control measures. The rising adoption of advanced technologies such as automated systems and sophisticated software streamlines the quality control process and enhances accuracy. Moreover, stringent guidelines prompt IVD manufacturers to invest in comprehensive quality control systems and certified reference materials to ensure high standards.

The integration of digital solutions, such as cloud-based platforms and data analytics, is improving the management of quality control data and performance tracking. The growing demand for multiple quality control solutions across various diagnostic tests highlights the necessity for adaptable and versatile quality control technologies. In January 2023, Bio-Rad Laboratories launched CFX Opus Deepwell Dx Real-Time PCR System, an accurate polymerase chain reaction integrated with the US Food and Drug Administration's (FDA) and European Union’s regulations to produce IVD testing. Additionally, growing advancements in the quality control guidelines by the nations are anticipated to propel market expansion in the coming years.

Growth Drivers

Rising Prevalence of Chronic Conditions and Infectious Diseases

The increasing prevalence of chronic conditions and infectious diseases significantly increases the demand for diagnostic testing and monitoring. Chronic conditions such as diabetes, cardiovascular diseases, and cancer are becoming common due to factors such as rising geriatric populations, lifestyle changes, and urbanization. IVDs are valuable in precision medicine, as they are employed to identify patients who require therapies or specific treatments. The diagnostics include next-generation sequencing tests, which analyze an individual's DNA to detect genetic variations. Moreover, chronic diseases require continuous monitoring and frequent diagnostic tests to effectively manage patient health. For instance, diabetes patients rely on regular blood glucose testing, while cancer patients require advanced diagnostic tools for early detection and treatment monitoring. Monitoring the analytical quality of self-monitoring of blood glucose (SMBG) is recommended as a routine practice in managing diabetes. This monitoring process should be easily accessible to patients, convenient, quick, and provide a reliable evaluation of glucose meter performance. Therefore, IVDs necessitates the requirement of quality control for multiple chronic diseases such as diabetes, cancer, asthma, among others.

Infectious diseases such as COVID-19, HIV, and influenza continue to create public health challenges, further increasing the need for accurate and rapid diagnostic tests. The ongoing threat of emerging infectious diseases also contributes to the demand for scalable and efficient diagnostic solutions. The IVD market is rapidly expanding with a focus on developing tests that provide rapid, more accurate results to improve patient outcomes and support disease management. In October 2024, the World Health Organization (WHO) unveiled a new range of vital diagnostics, including hepatitis E-virus tests, to aid in the rapid detection and surveillance of the disease.

Increasing Technological Advancements in Diagnostic

Advancements in diagnostic technology improve the accuracy and speed of test results. Innovations such as molecular diagnostics allow for more precise detection of genetic and molecular markers, enabling earlier and more accurate diagnosis of diseases such as cancer and genetic disorders. Next-generation sequencing (NGS) has revolutionized genomics by providing detailed insights into a patient's genetic makeup, supporting personalized medicine approaches. Meanwhile, point-of-care testing (POCT) has brought diagnostic capabilities directly to patients, offering rapid results in non-laboratory settings, which is crucial for managing conditions such as diabetes and infectious diseases.

Technological advancements such as in vitro diagnostics (IVD), next-generation sequencing (NGS), and point-of-care testing are reducing turnaround times, enhancing test specificity, and widening the scope of detectable conditions, ultimately simplifying more timely and effective treatments. In November 2023, Roche launched LightCycler PRO System for performance and usability in the in-vitro diagnostics and translational research. This system complements Roche's molecular PCR testing portfolio for healthcare professionals conducting research and testing patients for various health challenges. Thus, increasing technological advancements in in vitro diagnostics propel the in vitro diagnostics quality control market growth.

Restraining Factors

Unfavorable Reimbursement Scenario for IVD Tests

An unfavorable reimbursement scenario leads to limited access to diagnostic tests, increasing out-of-pocket costs for patients and reducing incentives for healthcare providers to adopt advanced diagnostics. However, reimbursement policies do not fully cover the costs of expensive tests such as molecular diagnostics or genetic testing. As a result, patients may delay testing, leading to suboptimal treatment and higher long-term healthcare costs. Additionally, for healthcare providers, inadequate reimbursement lowers the profitability of adopting advanced diagnostic technologies, limiting their use. Complex reimbursement processes and inconsistent coverage also create uncertainty, further hindering the adoption of innovative IVD tools.

Next-generation sequencing (NGS) in genomics has faced significant reimbursement hurdles, especially in regions such as Europe and the US. Initially, healthcare systems were slow to introduce reimbursement codes for NGS-based tests, creating uncertainty. Without clear reimbursement policies, many laboratories and clinics hesitated to offer NGS tests, limiting their early adoption. Despite NGS's prospect to enhance personalized medicine and improve cancer treatment outcomes, these reimbursement delays restricted its broader use in clinical settings.

Report Segmentation

By Product & Service

Quality Control Products Segment to Witness Highest Growth During Forecast Period

The in vitro diagnostics (IVD) quality control market, by product & service, is segmented into quality control products, data management solutions, and quality assurance services. In 2023, the quality control products segment dominated the market. These products are essential for ensuring the accuracy and reliability of a wide variety of diagnostic tests, including clinical chemistry, immunoassays, and blood-based diagnostics.

The demand for quality control products in diagnostic laboratories is primarily driven by the need for consistent quality management, alongside the growing prevalence of chronic diseases such as diabetes and cardiovascular conditions, which require frequent monitoring and testing. Furthermore, the continuous advancement in diagnostic instruments and the requirement for specific controls to ensure their accurate functioning are significant factors driving the growth of the quality control products segment. While data management and quality assurance solutions gain importance, especially with the integration of digital platforms, quality control products remain the core focus of this market.

By Technology Analysis

The clinical chemistry segment led the in vitro diagnostics (IVD) quality control market in 2023 due to its wide-ranging applications and crucial role in diagnosing and monitoring various health conditions. Clinical chemistry tests measure chemical substances in blood and other body fluids. Thus, they are essential for routine patient care and account for a high volume of testing in hospitals and outpatient settings. The extensive use of these tests, along with well-established quality control standards and regulations, drives significant demand for reliable quality control (QC) products. Furthermore, advancements in clinical chemistry technologies, such as automation and integration with electronic health records (EHR), necessitate sophisticated quality control solutions to ensure consistent performance. The large market size and high adoption rate of clinical chemistry tests further support its dominance in the IVD QC market.

The clinical chemistry segment is projected to witness the fastest growth during the forecast period due to its role in analyzing biochemical components in bodily fluids such as blood, serum, plasma, and urine. It covers a broad range of substances, including glucose, electrolytes, enzymes, proteins, lipids, hormones, and drugs, which are essential for diagnosing and managing various medical conditions. For instance, in July 2023, Siemens Healthineers launched Atellica Solution at the AACC annual meeting, offering advanced clinical chemistry and immunoassay capabilities. This high-performance analyzer enhances efficiency and accuracy, catering to a range of healthcare settings. The introduction of the Atellica Solution is expected to accelerate growth in the clinical chemistry segment by meeting the rising demand for reliable and efficient diagnostic testing.

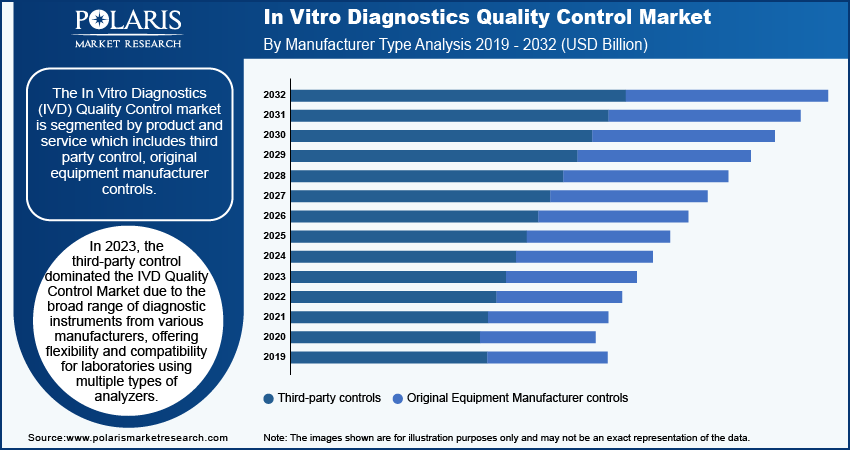

By Manufacturer Type

The in vitro diagnostics (IVD) quality control market, by manufacturer type, is segmented into third party control and original equipment manufacturer controls. In 2023, the third-party control segment dominated the IVD quality control market due to the availability of a broad range of diagnostic instruments from various manufacturers, offering flexibility and compatibility for laboratories using multiple types of analyzers. Third party control provides an unbiased performance assessment, independent of the equipment manufacturer, ensuring consistent and accurate testing quality. Additionally, third-party controls often come at a lower cost than OEM controls, making them an attractive option for budget-conscious labs. They are also recognized for meeting regulatory standards, which helps laboratories comply with strict quality assurance requirements. Furthermore, the investments in research and development by third-party manufacturers lead to high-quality, innovative control products, enhancing their performance and reliability. These factors collectively drive the dominance of the third-party controls segment in the IVD quality control market.

By End User

The in vitro diagnostics (IVD) quality control market is dominated by the clinical laboratories segment. Clinical laboratories are the main users of IVD quality control products. The labs conduct numerous diagnostic tests daily, necessitating strict quality control measures to ensure accurate and reliable results, which has a direct impact on patient care and treatment decisions. The high testing volume and the requirement for regular, consistent quality checks significantly increase the demand for quality control solutions in these settings. Clinical laboratories utilize a wide range of diagnostic equipment and tests, necessitating comprehensive and reliable quality control products to maintain high standards across different types of analyses. Additionally, regulatory requirements and accreditation standards mandate regular quality control to ensure compliance and patient safety. This makes clinical laboratories a major segment of the market.

Regional Insights

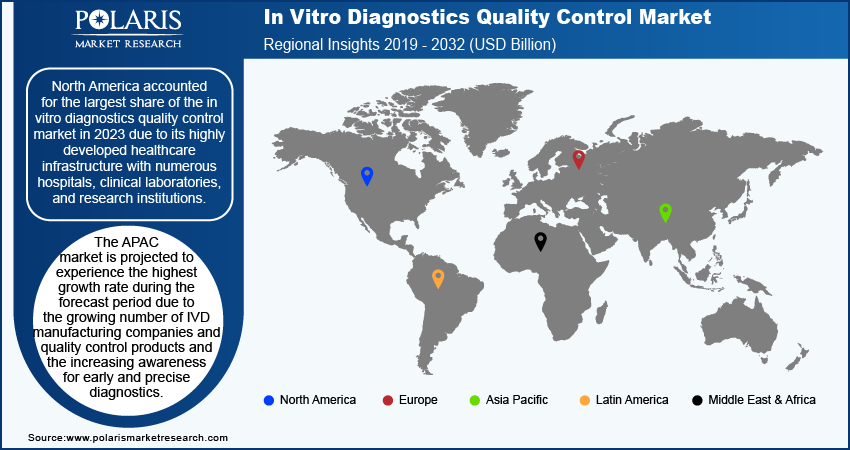

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the in vitro diagnostics quality control market in 2023 due to the presence of highly developed healthcare infrastructure comprising numerous hospitals, clinical laboratories, and research institutions that drive substantial demand for quality control products.

The high prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer in North America increases the need for frequent and reliable diagnostic testing. Furthermore, active research and development by academic and research institutions in the region contribute to the advancement and adoption of new quality control methods. These combined factors solidify North America's dominant position in the IVD quality control market.

The APAC market is projected to experience the fastest growth during the forecast period due to the growing number of IVD manufacturing companies and quality control products and the increasing awareness for early and precise diagnostics, propelling the demand for IVD. Also, the growth of IVD quality control in the region is expected to be promoted by activities such as agreements between government and non-government organizations in the pharmaceutical sector to address health problems. For instance, in January 2023, Cipla launched Cippoint, a point-of-care device for noncommunicable diseases, infectious diseases, and other health conditions.

Key Market Players and Competitive Insights

The competitive landscape of the medical disposable market is characterized by a diverse array of global and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Major players in the market, such as Bio-Rad Laboratories, Inc.; Beckman Coulter, Inc.; and Siemens Healthineers, leverage their extensive R&D capabilities and broad distribution networks to offer a wide range of advanced products. These companies focus on product innovation, including improvements in safety, functionality, and cost-efficiency, to meet the evolving needs of healthcare providers. Additionally, smaller and regional companies are increasingly entering the market, offering specialized and niche products that cater to specific healthcare needs or local market demands. Competitive strategies often include mergers and acquisitions, partnerships with healthcare institutions, and investments in emerging markets to expand reach and enhance market presence. Major players are Abbott Laboratories; Alpha-Tec Systems; Bio-Rad Laboratories, Inc.; Bio-Techne Corporation; Danaher Corporation; Fortress Diagnostics; Grifols S.A.; Helena Laboratories Corporation; Maine Molecular Quality Controls, Inc.; Microbiologics; Microbix Biosystems; Ortho-Clinical Diagnostics; and Qnostics.

CleanNA is a reagent manufacturer based near Gouda, the Netherlands. The company launched CE-IVD product namely, Clean Quick Viral DNA/RNA in March 2024, the solution for extraction of viral DNA and RNA from nasopharyngeal or oropharyngeal swab samples. The reagent is compatible with swabs preserved in an inactivating viral transport medium with its CE-IVD marking and efficient protocol. The Clean Quick Viral DNA/RNA serves as an ideal starting point for virus identification workflows.

Abbott develops, produces, and markets a wide and diverse range of medical products. It functions through the following divisions, including pharmaceutical, diagnostic, pharmaceutical, and medical device products. Pharmaceutical products include a series of branded generic pharmaceutical medicines sold internationally. The Nutritional Products section serves the global sales of adult and pediatric nutritional products. Abbott offers an ARCHITECT i1000SR immunoassay analyzer that helps in meeting the laboratory’s standards by providing STAT results and allowing achieving the required results.

The in vitro diagnostics quality control market is moderately fragmented and expected to register significant competition during the forecast period. This is mainly attributable to the rising number of companies showing interest in developing effective quality evaluation tools to promote the availability of proficient devices.

Key Companies in Global In Vitro Diagnostics Quality Control Market

- Abbott Laboratories

- Alpha-Tec Systems

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- CleanNA

- Danaher Corporation

- Fortress Diagnostics

- Grifols, S.A.

- Newland EMEA

- Helena Laboratories Corporation

- Maine Molecular Quality Controls, Inc.

- Microbiologics

- Microbix Biosystems

- Ortho-Clinical Diagnostics

- Qnostics

Recent Developments in Industry

In September 2023, NeoDx Biotech Labs, a startup based in Bengaluru, launched a real-time PCR-based diagnostic kit for Ankylosing Spondylitis, improving healthcare testing capabilities. The kit detects Human Leukocyte Antigen B27 in whole blood, aiding in early identification and treatment of related inflammatory disorders.

In May 2024, Waters introduced a new software system, “Waters Connect,” for in-vitro diagnostics to fuel data integrity, accessibility, security, and compliance, which enables researchers to innovate effective medical tools in the market. It has the potential to reduce review time by around 50%, in line with its Waters TargetLynx software.

In Vitro Diagnostics Quality Control Market Segmentation

By Product & Service

- Quality Control Products

- Serum/Plasma Based Control

- Whole Blood-Based Control

- Urine Based Control

- Other Control

- Data Management Solutions

- Quality Assurance Services

By Technology

- Immunochemistry

- Clinical Chemistry

- Molecular Diagnostics

- Microbiology

- Hematology

- Coagulation/Hemostasis

- Other Technologies

By Manufacturer Type

- Third-Party Controls

- Independent Controls

- Instrument Specific Controls

- Original Equipment Manufacturer Controls

By End User

- Hospitals

- Clinical Laboratories

- Academic and Research Institutes

- Other End users

By Region

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

- Report Coverage

The in vitro diagnostics quality control market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, it covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product & services, technology, manufacturing type, end user, and their futuristic growth opportunities.

In Vitro Diagnostics Quality Control Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.26 billion |

|

Revenue Forecast by 2032 |

USD 1.87 Billion |

|

CAGR |

5.1% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product & Services By Technology By Manufacturing Type By End User

|

|

Regional Scope |

North America Europe Asia Pacific Latin America Middle East & Africa |

|

Competitive Landscape |

In Vitro Diagnostics Quality Control Industry Trend Analysis (2023) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global in vitro diagnostics quality control market size was valued at USD 1.20 billion in 2023 and is projected to grow to USD 1.87 billion by 2032.

The global market is projected to register a CAGR of 5.1% during the forecast period.

North America accounted for the largest market share in 2023 due to the region's well-established healthcare infrastructure.

A few key players in the market are Abbott Laboratories; Alpha-Tec Systems; Bio-Rad Laboratories, Inc.; Bio-Techne Corporation; Danaher Corporation; Fortress Diagnostics; Grifols S.A.; Helena Laboratories Corporation; LGC Limited; Maine Molecular Quality Controls, Inc.; Microbiologics; Microbix Biosystems; Ortho-Clinical Diagnostics; and Qnostics.

The hospital segment dominated the market in 2023, driven by the daily high usage of IVD quality control products and numerous diagnostic tests due to the rising number of patients and the growing requirement for rigorous quality control to ensure the accuracy and reliability of their test results.

The quality control products dominate the market. These products are essential for ensuring the accuracy and reliability of a wide variety of diagnostic tests, including clinical chemistry, immunoassays, and blood-based diagnostics