In Vitro Diagnostics Market Size, Share, Trends, Industry Analysis Report: By Product & Service (Reagents & Kits, Instruments, and Data Management Software and Services), Technology, Specimen, Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 - 2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5250

- Base Year: 2024

- Historical Data: 2020-2023

In Vitro Diagnostics Market Overview

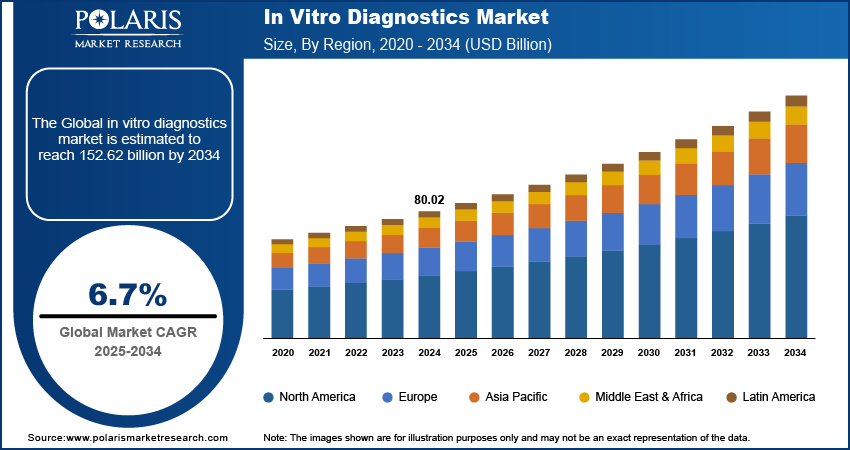

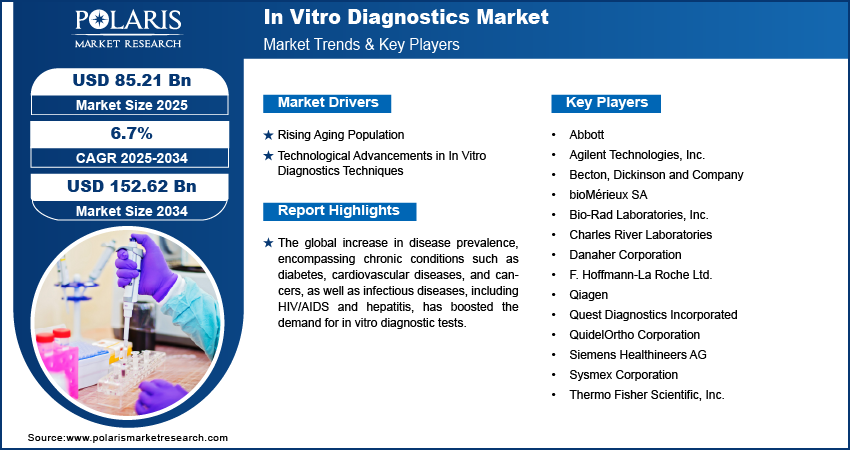

Global in vitro diagnostics market size was valued at USD 80.02 billion in 2024. The market is projected to grow from USD 85.21 billion in 2025 to USD 152.62 billion by 2034, exhibiting a CAGR of 6.7% during the forecast period.

In Vitro Diagnostics (IVD) comprises medical devices and tests that analyze bodily samples such as blood, tissue, and urine outside the body to diagnose diseases and infections and monitor treatments. This sector includes a variety of products such as reagents, instruments, and systems used in clinical labs, point-of-care settings, and healthcare facilities.

The global increase in disease prevalence, encompassing chronic conditions such as diabetes, cardiovascular diseases, and cancers, as well as infectious diseases including HIV/AIDS and hepatitis and emerging viruses such as COVID-19, has boosted the demand for in vitro diagnostic tests.

According to the World Health Organization (WHO), Noncommunicable diseases (NCDs) cause 41 million deaths annually, 74% of global deaths, with 17 million premature deaths before age 70, mostly in low- and middle-income countries. Cardiovascular diseases lead to 17.9 million deaths, followed by cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2.0 million).

In vitro diagnostics play a crucial role in early detection, monitoring disease progression, and guiding treatment decisions. Early diagnosis improves patient outcomes and also reduces healthcare costs by initiating timely interventions and preventing complications.

To Understand More About this Research: Request a Free Sample Report

IVD market continues to innovate, developing tests that offer greater sensitivity, specificity, and speed. In vitro diagnostics technologies such as molecular diagnostics, biomarker assays, and point-of-care testing (POCT) are becoming increasingly pivotal in delivering rapid and accurate results, thereby supporting healthcare providers in managing disease burdens more effectively. As healthcare systems worldwide face mounting pressure to enhance diagnostic capabilities, the IVD market remains poised for robust growth driven by the imperative for early and precise disease detection.

In Vitro Diagnostics Market Growth Factors and Trends Analysis

Rising Aging Population

The rising aging population globally, especially in developed nations, is a significant driver of the in vitro diagnostics (IVD) market. According to the World Population Prospects 2022, the proportion of the global population aged 65 years and above is projected to increase from 10% in 2022 to 16% by 2050.

The aging population drives a higher incidence of age-related diseases such as Alzheimer's disease and osteoporosis. These conditions necessitate frequent monitoring and early detection, which drives the in vitro diagnostics market demand. IVD technologies play a crucial role in providing accurate and timely assessments of disease progression and treatment efficacy in elderly populations. Thus, the aging demographic trend is amplifying the demand for advanced IVD solutions tailored to the specific needs of aging populations worldwide.

Technological Advancements in In Vitro Diagnostics Techniques

Technological advancements in diagnostics, including molecular diagnostics, next-generation sequencing (NGS), and point-of-care testing (POCT), have brought about a transformative shift in healthcare. Molecular diagnostics enable the detection of genetic and biochemical markers at a molecular level, facilitating earlier and more precise disease diagnosis. NGS has revolutionized genomic analysis by allowing rapid sequencing of DNA and RNA, essential for personalized medicine and understanding genetic predispositions to diseases.

Point-of-care testing has made diagnostic procedures more accessible and efficient, providing immediate results at or near the patient's location, thereby enhancing treatment decisions and patient outcomes. Their integration into clinical practice fosters innovation and expands diagnostic capabilities, driving market growth as healthcare systems worldwide increasingly adopt these advanced tools to meet the growing demand for faster and more effective diagnostics.

In Vitro Diagnostics Market Segment Analysis

In Vitro Diagnostics Market Assessment by Technology

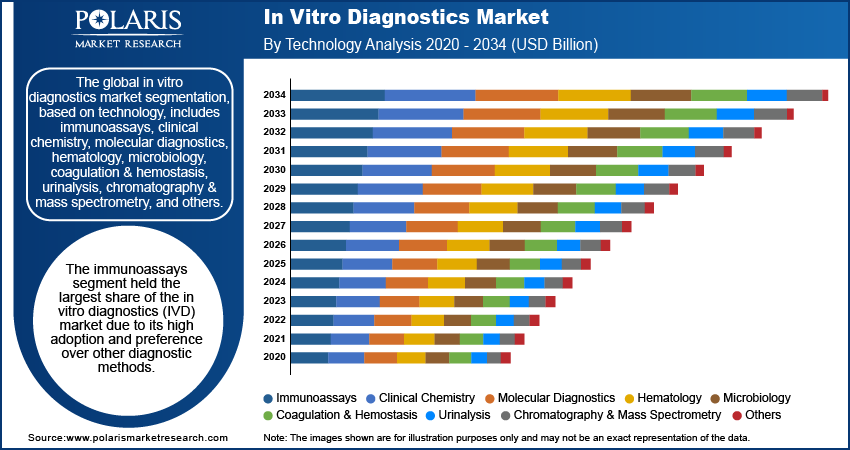

The global in vitro diagnostics market segmentation, based on technology, includes immunoassays, clinical chemistry, molecular diagnostics, hematology, microbiology, coagulation & hemostasis, urinalysis, chromatography & mass spectrometry, and others. The immunoassays segment held the largest share of the in vitro diagnostics (IVD) market due to its high adoption and preference over other diagnostic methods. This dominance can be attributed to the reliability and accuracy of immunodiagnostic techniques, which include tests such as enzyme-linked immunosorbent assays (ELISA) and lateral flow assays. These tests provide rapid results with minimal sample preparation, making them highly efficient for clinical use where timely diagnosis is crucial. In July 2023, Siemens Healthineers launched the Atellica CI Analyzer, which offers compact, advanced immunoassay and clinical chemistry testing with improved turnaround times, reporting, and workflow efficiency for labs.

The immunoassay segment continues its growth, driven by trends such as the rise of point-of-care testing and the integration of digital health technologies. Innovations in test formats, including microfluidics and lab-on-a-chip technologies, are likely to enhance sensitivity and specificity, further solidifying the role of immunoassays in the modern in vitro diagnostics market.

In Vitro Diagnostics Evaluation by Application

The global in vitro diagnostics market segmentation, based on application, includes infectious diseases, oncology, endocrinology, cardiology, blood screening, genetic testing, autoimmune diseases, allergy diagnostics, drug monitoring & testing, bone & mineral disorders, coagulation testing, blood group typing, and others. The infectious diseases segment held the largest share in the in vitro diagnostics (IVD) market due to the rising prevalence of infectious diseases worldwide. These diseases include COVID-19, HIV, hepatitis, influenza, and sexually transmitted infections, which is significantly driving the demand for in vitro diagnostics (IVD) tests and the growing challenge of multi-drug-resistant (MDR) pathogens. The surge in cases of infectious diseases, combined with the emergence of strains resistant to conventional treatments, underscores the urgent need for advanced and effective diagnostic tools.

Regulatory authorities have also intensified their focus on mandatory testing to control the spread of infectious diseases, further amplifying the demand for IVD devices. Moreover, major players in the IVD market, such as Abbott, Roche, Danaher, and Becton Dickinson, are making substantial investments in research and development to innovate and enhance infectious disease testing solutions. For instance, In August 2022, Becton Dickinson collaborated with Accelerate Diagnostics to provide rapid antibiotic resistance testing, showcasing the industry's advancing diagnostic capabilities. These factors collectively underscore the robust growth trajectory of the infectious diseases segment within the IVD market.

In Vitro Diagnostics Market Breakdown by Regional Insights

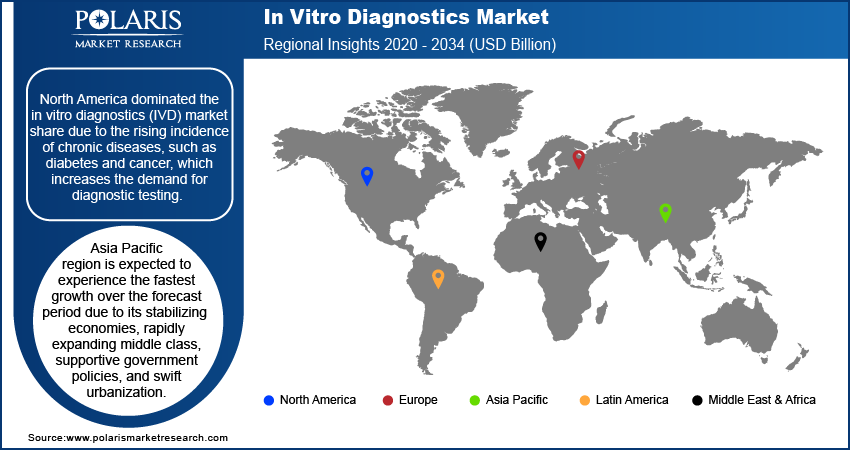

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the in vitro diagnostics (IVD) market, capturing the largest revenue share, and is expected to maintain this leading position throughout the forecast period. This dominance is largely due to the rising incidence of chronic diseases, such as diabetes and cancer, which increases the demand for diagnostic testing. Also, the region's strong market presence, with numerous established players and the introduction of innovative tests, contributes to its leading position. For instance, in January 2023, BD and CerTest Biotec received FDA Emergency Use Authorization for a PCR assay for the detection of the Mpox virus, highlighting the region's proactive approach to new health challenges.

The substantial government funding and the increasing demand for genetic testing for personalized healthcare are significant drivers of market growth in North America. The growing emphasis on genetic testing for personalized healthcare further propels market growth as patients and healthcare providers increasingly seek tailored solutions for managing chronic conditions.

Asia Pacific region is expected to experience the fastest growth over the forecast period due to its stabilizing economies, rapidly expanding middle class, supportive government policies, and swift urbanization. Economic stability in major countries fosters a favorable business environment, while the growing middle class drives increased demand for products and services. Supportive government policies and rapid urban development further accelerate market opportunities, particularly in emerging economies within the region.

Collaborations between global leaders and regional players are enhancing market reach and adapting to local needs, positioning Asia Pacific as a key area for future industry expansion. For instance, in October 2023, the recent partnership between Fapon and Halodoc aimed to boost in vitro diagnostic product sales and services in Indonesia, highlighting the strategic efforts to penetrate and expand within this high-growth market.

In Vitro Diagnostics Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their product lines, which will help the in vitro diagnostics market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the in vitro diagnostics market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global in vitro diagnostics market to benefit clients and increase the market sector. In recent years, the market has offered some technological advancements. Major players in the in vitro diagnostics market include Abbott; Agilent Technologies, Inc.; Becton; Dickinson and Company; bioMérieux SA; Bio-Rad Laboratories, Inc.; Charles River Laboratories; Danaher Corporation; F. Hoffmann-La Roche Ltd.; Qiagen; Quest Diagnostics Incorporated; QuidelOrtho Corporation; Siemens Healthineers AG; Sysmex Corporation; and Thermo Fisher Scientific, Inc.

Becton Dickinson is a medical technology which was founded in the year 1897 and is headquartered in New Jersey, United States. The company’s primary business divisions include BD Medical, BD Lifesciences, and BD Interventional. It also provides solutions in conjunction with drug development companies, laboratories, pharmacies, surgery, medical device manufacturers, administrators, distributors, and clinicians. The company provides pharmacy automation products under the brand name BD Pyxis and Criticore. In July 2024, BD and Quest Diagnostics are collaborating to develop companion diagnostics for cancer and other diseases, combining BD’s flow cytometry expertise with Quest’s diagnostic capabilities to advance personalized medicine.

Agilent Technologies, Inc. specializes in providing application-focused solutions to various markets, including life sciences, diagnostics, and applied chemicals. Agilent operates through three main segments: Diagnostics and Genomics, Life Sciences and Applied Markets, and Agilent CrossLab. In April 2024, Agilent Technologies’ GenetiSure Dx Postnatal Assay received European IVDR Class C Certification, affirming its compliance with stringent EU standards for diagnostic accuracy and safety.

Key Companies in In Vitro Diagnostics Market

- Abbott

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Charles River Laboratories

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Qiagen

- Quest Diagnostics Incorporated

- QuidelOrtho Corporation

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific, Inc.

In Vitro Diagnostics Market Developments

January 2024: ELITechGroup launched the CE-IVDR certified GI Bacterial PLUS ELITe MGB Kit for in vitro diagnostics of gastrointestinal bacterial infections. It plans to expand its portfolio with three additional kits for parasitic and viral pathogens.

November 2023: Roche launched the LightCyclerPRO System, an advanced qPCR platform designed to enhance clinical diagnostics and research with superior performance and flexibility.

September 2023: NeoDx Biotech Labs launched a Real-time PCR-based in vitro diagnostic kit for detecting HLA-B27, enhancing early identification of autoimmune disorders like Ankylosing Spondylitis.

In Vitro Diagnostics Market Segmentation

By Product & Service Outlook (Revenue - USD Billion, 2020-2034)

- Reagents & Kits

- Instruments

- Data Management Software and Services

By Technology Outlook (Revenue - USD Billion, 2020-2034)

- Immunoassays

- Clinical Chemistry

- Molecular Diagnostics

- Hematology

- Microbiology

- Coagulation & Hemostasis

- Urinalysis

- Chromatography & Mass Spectrometry

- Others

By Specimen Outlook (Revenue - USD Billion, 2020-2034)

- Blood, Serum, and Plasma

- Saliva

- Urine

- Other

By Application Outlook (Revenue - USD Billion, 2020-2034)

- Infectious Diseases

- Oncology

- Endocrinology

- Cardiology

- Blood Screening

- Genetic Testing

- Autoimmune Diseases

- Allergy Diagnostics

- Drug Monitoring & Testing

- Bone & Mineral Disorders

- Coagulation Testing

- Blood Group Testing

- Others

By End User Outlook (Revenue - USD Billion, 2020-2034)

- Hospital & Clinics

- Clinical Laboratories

- Blood Banks

- Home Care Settings

- Pharmaceutical & Biotechnology Companies

- Academic Institutes

- Others

By Regional Outlook (Revenue - USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

In Vitro Diagnostics Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 80.02 billion |

|

Market Size Value in 2025 |

USD 85.21 billion |

|

Revenue Forecast in 2034 |

USD 152.62 billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The in vitro diagnostics market size was valued at USD 80.02 billion in 2024 and is anticipated to reach USD 152.62 billion by 2034.

The market registers a CAGR of 6.7% during the forecast period, 2025-2034.

North America had the largest share of the global market

The key players in the market are Abbott; Agilent Technologies, Inc.; Becton; Dickinson and Company; bioMérieux SA; Bio-Rad Laboratories, Inc.; Charles River Laboratories; Danaher Corporation; F. Hoffmann-La Roche Ltd.; Qiagen; Quest Diagnostics Incorporated; QuidelOrtho Corporation; Siemens Healthineers AG; Sysmex Corporation; and Thermo Fisher Scientific, Inc.

The immunoassays category dominated the market in 2024.

Infectious diseases had the largest share of the global market.