Immunoassay Market Size, Share, Trends, Industry Analysis Report: By Products (Reagents & Kits, Analyzers/Instruments, and Software & Services), Technology, Specimen, Application, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 209

- Format: PDF

- Report ID: PM5069

- Base Year: 2024

- Historical Data: 2020-2023

Immunoassay Market Overview

The global immunoassay market size was valued at USD 32.85 billion in 2024 and is expected to reach USD 34.46 billion by 2025 and 50.95 billion by 2034, exhibiting a CAGR of 4.4% during 2025–2034.

The immunoassay market demand is growing rapidly in the healthcare and diagnostic industry. Immunoassay is primarily used to detect specific proteins, lipids, nucleic acids, and other small molecules within biological samples. Immunoassays play a critical role in disease diagnosis, pharmaceutical research, and various scientific studies. The market is expected to experience substantial growth in the coming years, driven by the increasing prevalence of chronic diseases and the rising demand for advanced diagnostic technologies. The demand for immunoassay testing in the healthcare sector has resulted in ample immunoassay market growth opportunities to explore and expand their product offerings.

The rising incidence of infectious diseases, including HIV, hepatitis, and other viral infections, has significantly increased the demand for accurate and efficient diagnostic tools, which has propelled the immunoassay market demand. Immunoassays such as Enzyme-Linked Immunosorbent Assays (ELISA) provide a reliable method for early detection, which is essential in combating the spread of these diseases. Moreover, advancements in Technology, including label-free, rapid, and high-throughput systems such as surface plasmon resonance (SPR), are fueling growth opportunities within the market. These innovations provide faster, more accurate, and cost-effective solutions, thus improving healthcare outcomes globally.

To Understand More About this Research: Request a Free Sample Report

Factors such as wide application of multiplex assays, smartphone-based immunoassay formats, and point-of-care diagnostics are emerging as crucial immunoassay market trends, offering more accessible and real-time health monitoring solutions. In addition, the rising focus on personalized medicine and the increasing need for therapeutic drug monitoring in oncology and cardiology are driving the demand for more precise and specialized immunoassays. The involvement of both large-scale producers, such as Siemens Healthineers and BD, along with smaller players focusing on niche products, is expected to intensify competition and boost continued innovation within the immunoassay market.

Immunoassay Market Dynamics

Growing Prevalence of Chronic Diseases Globally

The prevalence of chronic conditions such as diabetes, cardiovascular diseases, cancer, and autoimmune disorders is growing due to aging populations, lifestyle changes, and environmental factors. According to the World Health Organization, noncommunicable diseases accounted for 43 million deaths in 2021, representing 75% of all non-pandemic-related fatalities. Chronic diseases require early and accurate diagnosis, along with continuous monitoring for effective management. Immunoassays play a critical role by detecting biomarkers and proteins linked to these conditions, enabling timely and precise diagnosis. Therefore, such factors highlight the growing need for reliable and advanced immunoassay technologies.

There is a rising preference for personalized medicine and precision treatments to manage chronic diseases. In these treatments, immunoassays are integral. By identifying specific biomarkers, these tests provide insights into a patient’s disease, genetic profile, and response to treatments. In cancer care, for instance, immunoassays detect proteins that reveal the type and stage of a tumor, guiding therapy selection. Similarly, in autoimmune disorders, they measure antibody levels to track disease progression and treatment efficacy, further emphasizing their importance in modern healthcare. Therefore, the rising prevalence of chronic diseases worldwide is driving the immunoassay market demand.

Expanding Healthcare Infrastructure in Emerging Economies

Countries such as India and Thailand are substantially investing in enhancing their healthcare infrastructure, including the construction of hospitals, diagnostic laboratories, and clinics. According to the Ministry of Health and Family Welfare of India, the government’s healthcare spending has increased over the years by 37% between 2020-21 and 2021-22, highlighting a growing commitment to improving healthcare access and infrastructure. Such efforts are aimed at improving healthcare access coupled with advanced diagnostic tools such as immunoassays to provide accurate testing for the detection and treatment of infectious and chronic diseases, including diabetes, cardiovascular diseases, and cancer.

Governments of Asia Pacific are boosting healthcare budgets and introducing initiatives to enhance diagnostic capabilities, which are making immunoassays more widely accessible and affordable. These initiatives promote the use of immunoassay technologies in routine medical check-ups and early disease detection. The increasing number of trained healthcare professionals and laboratory technicians supports the adoption of these technologies. Additionally, the growing healthcare infrastructure in the emerging economic landscape is facilitating research and development, increasing local production and innovation in immunoassay technologies. Thus, the expanding healthcare infrastructure in emerging economies and the rising investments in healthcare are expected to offer lucrative immunoassay market opportunities during the forecast period.

Immunoassay Market Segment Insights

Immunoassay Market Assessment by Products Outlook

The global immunoassay market segmentation, based on products, includes reagents & kits, analyzers/instruments, and software & services. In 2024, the reagents & kits segment held the largest market share due to the increasing prevalence of chronic and infectious diseases. Laboratories and hospitals are largely dependent on these ready-to-use kits due to their ease of use, standardized protocols, and high sensitivity, which enable them to obtain consistent results across testing applications. Kits such as ELISA are widely used in key end-user areas such as clinical diagnostics, research, and drug development, owing to their high sensitivity and ability to provide quantitative results. Moreover, the increasing demand for precise diagnostics in diseases such as infectious diseases, cancer, and autoimmune conditions boosts the requirement for ELISA reagents and kits, fueling the segment growth.

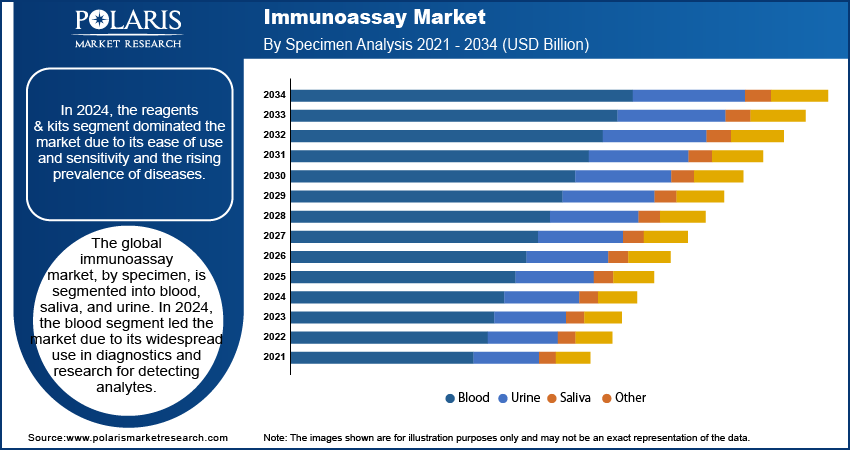

Immunoassay Market Evaluation by Specimen Outlook

The global immunoassay market, based on specimen, is segmented into blood, saliva, urine, and others. In 2024, the blood segment witnessed significant market growth due to its wide application as a specimen in various end-user industries such as hospitals, clinics, and laboratories. Immunoassays using blood as a specimen type are employed in areas such as medical and research fields to detect and measure various analytes. The key factor that prompts the usage of blood specimens in immunoassays is the presence of biological content, such as macro and micro molecules that reflect the physiological and pathological state of the body. Additionally, key factors such as increasing demand for rapid and accessible diagnostics at the point of care have driven the use of blood as a specimen in immunoassays. Also, the advancement in microfluidic technology, which allows precise collection, processing, and analysis of blood, is gaining popularity among areas such as point of care and clinics, which would fuel its demand during the forecast period. Hemaxis, a medical device company, has developed the HemaXis micro blood sampling platform. The device uses microfluidic technology to collect and prepare precise, controlled amounts of whole blood, plasma, and serum to provide a final result in a shorter time frame.

Immunoassay Market Regional Analysis

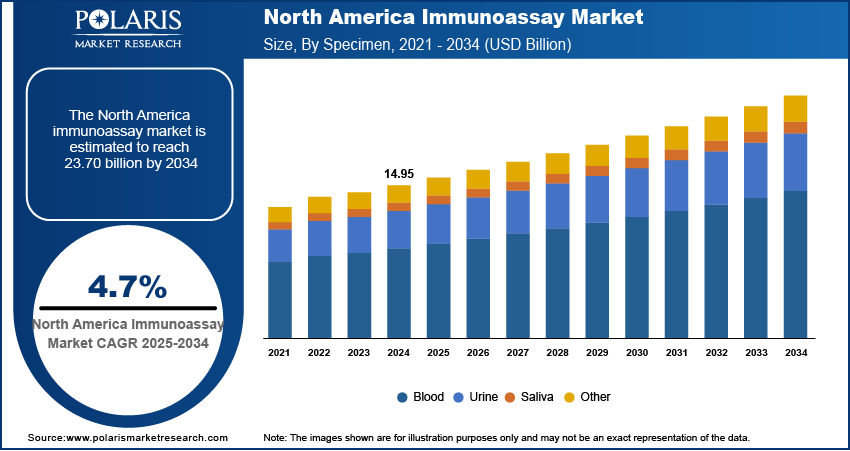

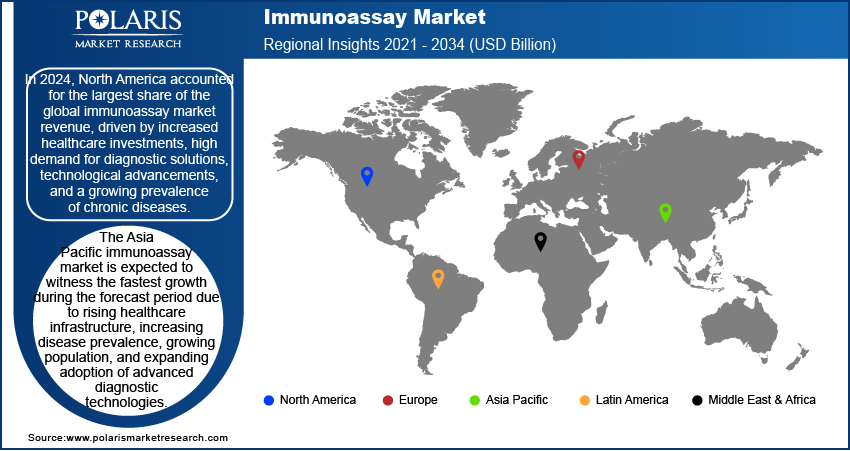

Based on region, the study provides immunoassay market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest immunoassay market share, driven by the increased prevalence of chronic and infectious diseases that increasingly require accurate and reliable diagnostic methods. Moreover, companies operating in the region are consistently innovating to offer high-sensitivity assays, multiplex testing capabilities, and automated systems to improve the efficiency and accuracy of reagents and kits. In December 2024, BIO-TECHNE launched the ESR1 Mutation Monitoring Assay to detect mutations in hormone receptor-posaxitive metastatic breast cancer, which are crucial for patients on endocrine therapy. Thus, the growing product advancements, combined with the growing demand for precision diagnostics, promote the growth of immunoassay in the region.

Asia Pacific is expected to witness the fastest growth over the forecast period due to rising healthcare expenditure, increasing prevalence of chronic diseases, and advancements in diagnostic technologies. The growing aging population and a focus on earlier diagnosis are driving the immunoassay market expansion in the region. According to the WHO (World Health Organization), Southeast Asia is witnessing a rapid demographic shift, with the proportion of individuals aged 60 and above rising from 9.8% in 2017 to 13.7% by 2030 and 20.3% by 2050. Thus, a large segment of the population in the region will be in the geriatric age during the forecast period, thereby boosting the demand for immunoassay.

Immunoassay Market – Key Players & Competitive Analysis Report

The competitive landscape of the immunoassay market is characterized by a mix of established players and emerging companies striving to capture market share in a rapidly growing industry. Key players focus on product innovation, strategic partnerships, and investments in research and development to expand their offerings and meet diverse consumer demands. The rising demand for accurate and rapid diagnostic tools across healthcare applications, including disease diagnosis, therapeutic drug monitoring, and biotechnology research, propels the immunoassay market development. Advancements in assay technologies, such as high-sensitivity platforms and multiplexing capabilities, are driving adoption, particularly in regions with increasing healthcare investments and rising prevalence of chronic and infectious diseases. However, the immunoassay market faces intensifying competition as new entrants introduce innovative solutions, leveraging breakthroughs in biomarkers and automation. While opportunities are abundant, challenges such as stringent regulatory requirements, high development costs, and competition from alternative diagnostic methods necessitate agility and innovation from immunoassay market players.

Abbott, a global healthcare company, discovers, develops, manufactures, and sells a wide range of healthcare products worldwide. The company operates in four segments—established pharmaceutical products, diagnostic products, nutritional products, and medical devices. The diagnostic products segment provides laboratory and transfusion medicine systems, point-of-care testing, molecular diagnostics, and informatics solutions for clinical laboratories.

The immunoassay under diagnostic products segment focuses on advanced diagnostic platforms, such as Abbott’s ARCHITECT i1000SR, offering high-throughput and accurate detection of biomarkers for disease diagnosis, monitoring, and management. It supports various applications, including infectious diseases, oncology, endocrinology, and cardiology, enhancing clinical decision-making.

BD (Becton, Dickinson, and Company) is a global player in developing and manufacturing medical supplies, devices, laboratory equipment, and diagnostic products. The company serves a diverse range of clients, including healthcare institutions, physicians, life science researchers, clinical laboratories, and the pharmaceutical industry, ensuring its solutions impact healthcare delivery worldwide. The company operates across three segments—medical, life sciences, and interventional. Each segment contributes significantly to advancing healthcare.

BD life sciences segment enhances advancements in diagnostic testing and laboratory automation. The Products under the segment encompass diagnostic solutions such as ELISA kits for detecting specific biomarkers in biological samples. These assays provide high sensitivity and accuracy, enabling advancements in disease diagnosis, therapy monitoring, and research applications.

List of Key Companies in Immunoassay Market

- Abbott

- BD

- Beckman Coulter, Inc.

- BIOMÉRIEUX

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd

- QuidelOrtho Corporation

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Immunoassay Industry Developments

October 2024: Bio-Rad launched the EQAS Specialty Immunoassay program, consolidating 13 analytes for enhanced clinical utility, cost reduction, and streamlined proficiency testing.

July 2024: Beckman Coulter introduced the DxC 500i Analyzer, a compact, integrated clinical chemistry and immunoassay solution offering scalability, efficiency, intuitive workflows, and Six Sigma performance.

September 2023: Thermo Fisher announced FDA clearance of the first automated Chromogranin A test. The test enables labs to assess tumor progression in gastroenteropancreatic neuroendocrine tumor patients, improving patient management and treatment evaluation.

Immunoassay Market Segmentation

By Products Outlook (Revenue, USD Billion, 2021–2034)

- Reagents & Kits

- ELISA Reagents & Kits

- Rapid Test Reagents & Kits

- ELISPOT Reagents & Kits

- Western Blot Reagents & Kits

- Other Reagents & Kits

- Analyzers/Instruments

- Open Ended Systems

- Closed Ended Systems

- Software & Services

By Technology Outlook (Revenue, USD Billion, 2021–2034)

- Radioimmunoassay (RIA)

- Enzyme Immunoassays (EIA)

- Chemiluminescence Immunoassays (CLIA)

- Fluorescence Immunoassays (FIA)

- Rapid Tests

- Others

By Specimen Outlook (Revenue, USD Billion, 2021–2034)

- Blood

- Saliva

- Urine

- Others

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Therapeutic Drug Monitoring

- Oncology

- Cardiology

- Endocrinology

- Infectious Disease Testing

- Autoimmune Diseases

- Others

By End Users Outlook (Revenue, USD Billion, 2021–2034)

- Hospitals

- Laboratories

- Others

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Immunoassay Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 32.85 billion |

|

Market Size Value in 2025 |

USD 34.46 billion |

|

Revenue Forecast by 2034 |

USD 50.95 billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global immunoassay market size was valued at USD 32.85 billion in 2024 and is projected to grow to USD 50.95 billion by 2034.

The global market is projected to register a CAGR of 4.4% during the forecast period.

In 2024, North America accounted for the largest market share, driven by the rising prevalence of cardiovascular and infectious diseases.

A few of the key players in the market are Abbott; BD; Beckman Coulter, Inc.; Bio-Rad Laboratories, Inc.; BIOMÉRIEUX; F. Hoffmann-La Roche Ltd; Thermo Fisher Scientific Inc; Siemens Healthineers AG; QuidelOrtho Corporation; and Sysmex Corporation.

In 2024, the reagents & kits segment held the largest market share due to their essential role in accurate, high-throughput diagnostics.

In 2024, the blood segment experienced significant growth due to the increasing demand for diagnostic testing, advancements in blood-based assays, and the rising prevalence of chronic diseases requiring regular blood monitoring.