Iliac Stent Market Share, Size, Trends, Industry Analysis Report, By Type (Self-expandable Stents, Balloon-expandable Stents, Others); By Artery lesions; By End Use, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Apr-2024

- Pages: 118

- Format: pdf

- Report ID: PM4857

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

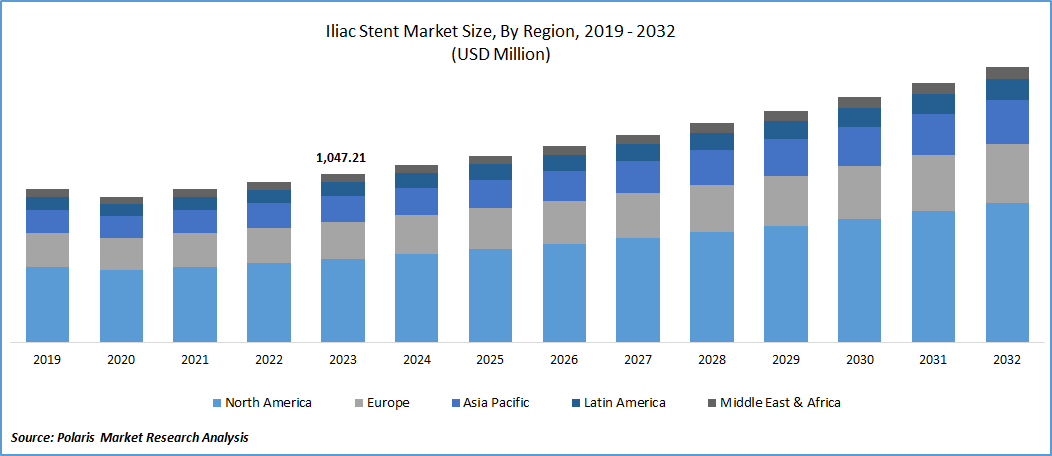

Iliac stent market size was valued at USD 1,047.21 million in 2023. The market is anticipated to grow from USD 1,101.56 million in 2024 to USD 1,708.54 million by 2032, exhibiting the CAGR of 5.6% during the forecast period.

Market Overview

Percutaneous transluminal angioplasty (PTA) and stenting are two less invasive endovascular surgeries commonly used to insert stents in the iliac arteries. The last stent (Advanta V12) serves as an example of a covered stent that is able to decrease the risk of relaxation in these arteries by acting as a defense against neointimal hyperplasia. In order to improve their effectiveness in the iliac arteries, these stents are frequently composed of stainless steel that may expand with balloons and have certain qualities, such as porosity.

To Understand More About this Research:Request a Free Sample Report

For instance, in October 2023, The FDA approved Getinge's iCast-covered stent system, which has become available in the US for the treatment of iliac artery occlusive disease. During medical conferences such as VEITHsymposium 2023 and VIVA 2023, the product is displayed by the company.

The effectiveness of covered stents in comparison to bare-metal stents for iliac arterial disease has been clarified by research, particularly the COBEST study. Results from studies indicate that covered stents provide enhanced clinical outcomes and higher rates of primary patency, especially in more complicated lesions such as those categorized as TASC C and D. A patient's physical condition, the type of disease being treated, and the experience of the medical professionals who are executing the treatment also serve a role in the decision between covered or bare-metal stents and the choice of particular stent types.

The most effective stent type and placement procedure for iliac artery stenting are determined substantially by technical parameters. Due to their specific deployment capacity, balloon-expandable stents are usually utilized for ostial and calcification lesions, but self-expanding stents are commonly selected for convoluted veins and prolonged lesions when flexibility is required. Compared to bare-metal stents, drug-eluting stents occasionally demonstrate benefits, particularly in regard to decreased relaxation rates. The choice of the most effective stent and technique is ultimately a customized choice that considers the unique anatomic and clinical characteristics of every single patient.

Growth Factors

Technological Advancements in Iliac Stent Designs

The market has grown substantially due to improvements in stent design. Conventional stent models presented issues due to restenosis and stent fractures. On the other hand, recent advancements have led to higher adaptability, scaffolding, and longevity in next-generation stents. In an effort to improve biocompatibility and lower the risk of thrombosis, these stents utilize advanced components and coatings. For instance, Boston Scientific achieved success with its Epic Vascular Self-Expanding Stent System, a Nitinol stent for the iliac arteries that has balanced radial force, excellent flexibility, and accurate deployment.

Moreover, the introduction of stents with drug-eluting properties has completely changed the profession by delivering medicine directly to stop restenosis and enhance patient outcomes over some time. Bioresorbable stents have also been developed, which could be used for short-term vascular support before fully absorbing. This might eliminate the demand for permanent implantation as well as lower the risks related to long-term stent insertion.

Increasing Prevalence of Peripheral Artery Disease (PAD)

The iliac stent market is growing due in substantial measure to the increasing prevalence of PAD, especially in the elderly population. The iliac arteries belong to those in the lower limbs that are frequently affected by PAD, which is defined as a narrowing or obstruction of an artery around the heart. The growing worldwide prevalence of PAD is attributed to a number of factors, including sedentary habits, obesity, smoking, and especially the rising incidence of diabetes. The incidence of PAD is predicted to rise with population aging, as well as the incidence of such diseases continuing to rise, creating a demand for treatments like iliac arterial stenting that improve blood circulation and reduce indications like critical limb ischemia and intermittent claudication.

In 2019, globally, 113 million people over the age of 40 were affected by peripheral artery disease, which has a 1.52% prevalence and is most common in low- to middle-income nations, according to the Socio-demographic Index (SDI). The frequency of peripheral artery disease was largest within high SDI nations and lower in nations with low SDI, with modifiable risk factors accounting for 69.4% of all DALYs. The death and DALY rates showed U-shaped curves among SDI categories.

Restraining Factors

Limited Awareness and Underdiagnosis

The underdiagnosis and low knowledge of the condition known as peripheral artery disease (PAD) across patients as well as healthcare professionals is a major barrier to the iliac stent business. In its early stages, PAD frequently shows no symptoms at all or exhibits mild signs that are misdiagnosed as other diseases or natural aging. Because of this, a large number of PAD patients remain undiagnosed and untreated until their conditions progress, missing chances for iliac stent intervention. Furthermore, the underdiagnosis of PAD is made worse by healthcare inequalities, which impedes the demand for iliac stent surgeries. These disparities are especially evident in impoverished communities and places with restricted access to healthcare services.

Report Segmentation

The market is primarily segmented based on type, artery lesions, end use, and region.

|

By Type |

By Artery Lesions |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Insights

Self-expandable Stents Segment Accounted for the Largest Market share in 2023

Self-expandable stents segment accounted for the largest revenue share in 2023. Multiple trials have demonstrated encouraging outcomes when self-expanding stents are used to treat iliac artery occlusions. Selecting self-expanding stents over balloon-expandable stents is preferred due to the former's flexibility, capacity to conform to vessel walls, and possibility for improved healing. Research such as the ICE trial has shown that self-expanding stents when used to treat iliac artery blockages, offer superior protection against restenosis after 12 months without sacrificing safety. However, it's crucial to remember that some lesion subgroups may continue to profit from balloon-expandable stents, emphasizing the need for more study to identify the best kind of stent to use depending on individual patient traits and lesion types.

By Artery Lesions Insights

Common Iliac Artery Lesions Segment Held the Majority share in 2023

The common iliac artery lesions segment accounted for held maximum market share in 2023. The management of iliac arterial lesions, especially common iliac artery lesions, includes deciding between balloon-expandable (BE) and self-expanding (SE) stents and working through stent placement. According to studies, several benefits and uses for both types of stents for managing iliac artery occlusive disorder. Selecting SE vs. BE stents is an important decision when dealing with common iliac artery lesions. When it comes to ostial common iliac lesions in particular, BE stents are preferable due to their strong radial outward force and accurate stent insertion capabilities, even if SE stents have occasionally demonstrated better clinical results.

The complete obstructive lesion segment is expected to grow substantially over the forecast period. The rising incidence of peripheral artery disorders, technological developments in medicine, and growing recognition of surgeries that are minimally invasive as viable therapies for cardiovascular illnesses are some of the reasons driving the expansion of this market segment. Aortoiliac occlusive disease symptoms are relieved, and normal blood flow is restored with the help of iliac stents, which are employed in the complete obstructive lesion segment, among other treatments for iliac artery constriction or blockages.

Regional Insights

North America Region Dominated the Global Market in 2023

North America region dominated the global market. The incidence of PAD is rising due to a growing older population and an increase in risk factors, including obesity and diabetes, leading to demand for treatments such as iliac stenting. Moreover, expanding R&D for innovative treatments, rising disease awareness, and the rising prevalence of artery disorders are complementing the region’s growth.

The CDC estimates that coronary artery disease causes 610,000 fatalities each year, or 25% of all deaths in the United States.

The Asia Pacific region is anticipated to hold a significant CAGR during the forecast period. The region’s growth is due to the rise in elderly people, increased incidence of cardiovascular illnesses, and improvements in less-invasive surgical methods. In addition, the demand for less-invasive operations is rising in countries such as China and Japan, which is driving up the cost of iliac stents. For instance, Terumo Corporation unveiled a Self-expanding Peripheral Stent such as MISAGO RX for iliac arteries in Japan to expand therapy options for peripheral artery disease (PAD) patients.

Key Market Players & Competitive Insights

Product Innovations to Drive the Competition

The Iliac stent market is characterized by intense competition and is primarily dominated by a handful of key players in terms of market share. Additionally, several prominent players are actively engaging in product developments, collaborations, acquisitions, and partnership with other companies to strengthen their market positions worldwide.

Some of the major players operating in the global market include:

- Abbott

- BD

- Biotronik SE & Co KG

- Boston Scientific Corporation

- Cook

- Getinge AB

- iVascular

- Medtronic

- Terumo Corporation

- W. L. Gore & Associates, Inc.

Recent Developments in the Industry

- In March 2024, Getinge and Cook Medical entered into a US commercial distribution agreement for the iCast covered stent, recently FDA-approved for treating symptomatic iliac arterial occlusive disease, with Cook assuming sales and distribution rights in the USA.

- In February 2024, Gore's Viabahn VBX stent graft, with FDA approval for its lower-profile version, will gradually enter the US market. The lower-profile device offers an improved delivery system without altering stent design, enhancing accessibility and reducing access site complications for physicians treating complex cases of iliac artery disease. The device will maintain trusted performance.

Report Coverage

The Iliac Stent market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, artery lesions, end user, and their futuristic growth opportunities.

Iliac Stent Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,101.56 million |

|

Revenue forecast in 2032 |

USD 1,708.54 million |

|

CAGR |

5.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Iliac Stent Market Size Worth $ 1,708.54 Million By 2032

The top market players in Iliac Stent Market are Abbott, BD, Biotronik SE & Co KG, Boston Scientific Corporation, Cook, Getinge AB

North America is the region contribute notably towards the Iliac Stent Market

Iliac stent market exhibiting the CAGR of 5.6% during the forecast period.

Iliac Stent Market report covering key segments are type, artery lesions, end use, and region.