Identity and Access Management in Healthcare Market Size, Share, Trends, Industry Analysis Report: By Component (Software and Services), Deployment, Type, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5117

- Base Year: 2023

- Historical Data: 2019-2022

Identity and Access Management in Healthcare Market Overview

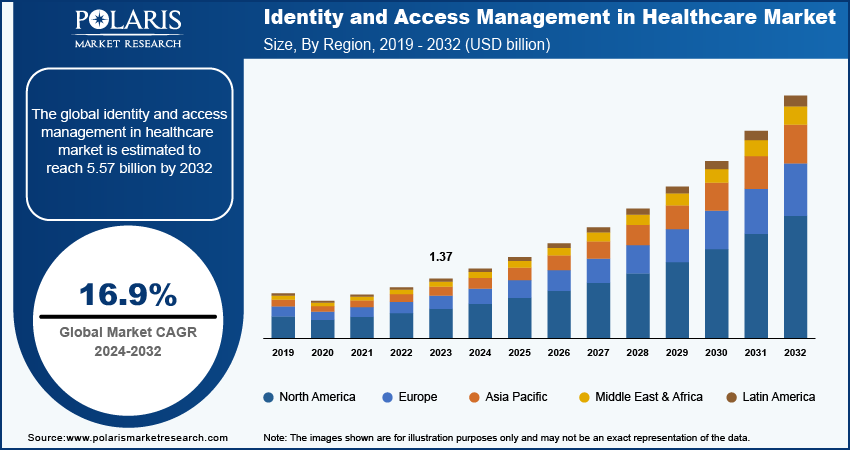

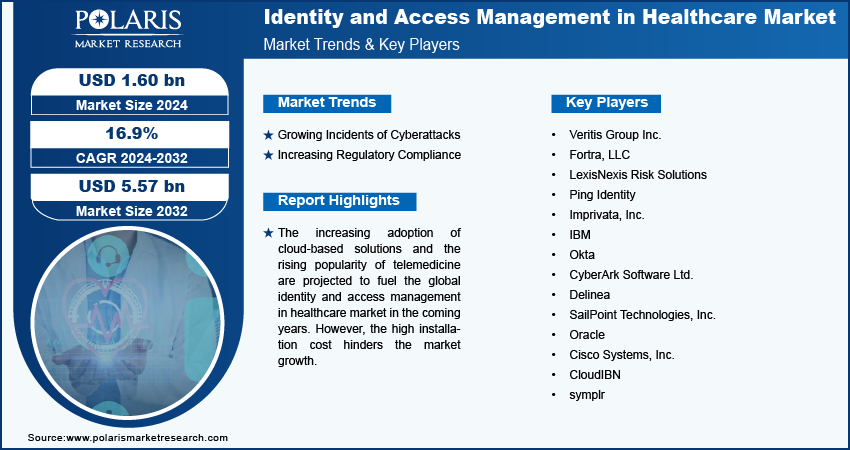

The identity and access management in healthcare market size was valued at USD 1.37 billion in 2023. The market is projected to grow from USD 1.60 billion in 2024 to USD 5.57 billion by 2032, exhibiting a CAGR of 16.9% during 2024–2032.

Identity and access management (IAM) in healthcare is a critical framework that ensures the security and privacy of sensitive patient data while facilitating efficient access for authorized personnel. There is a robust need for IAM systems to provide protection against unauthorized access and comply with regulatory requirements as healthcare organizations increasingly adopt digital solutions.

The increasing adoption of cloud-based solutions is driving the growth of the identity and access management in healthcare market. Cloud solutions handle sensitive patient data, making IAM crucial to ensure compliance with regulations such as HIPAA (Health Insurance Portability and Accountability Act). Healthcare organizations need to control unauthorized access and prevent data breaches, which drives the demand for IAM solutions.

The growing use of AI, big data, and IoT in healthcare is expected to fuel the global market during the forecast period. The use of artificial intelligence in healthcare requires different levels of access for various roles, such as clinicians, administrators, and researchers. IAM systems facilitate role-based access control, ensuring users have the right permissions based on their responsibilities. Moreover, IAM solutions are integrated with big data analytics to provide real-time monitoring of access patterns. This helps identify unusual activity that indicates security threats, allowing for prompt responses.

To Understand More About this Research: Request a Free Sample Report

The identity and access management in healthcare market is driven by increasing regulatory compliance. Regulatory frameworks require organizations to maintain detailed logs of access to sensitive data. IAM systems provide auditing capabilities that allow healthcare organizations to track user activities, ensuring they demonstrate compliance during audits.

Identity and Access Management in Healthcare Market Driver Analysis

Growing Incidents of Cyberattacks

There is a rising number of cyberattacks across the world. According to a published report by DNI.gov, worldwide ransomware attacks against the healthcare sector have steadily increased and nearly doubled since 2022, reaching a total of 389 claimed victims in 2023 compared with 214 in 2022. Increased cyberattacks have led healthcare organizations to prioritize cybersecurity practices, including employee training and access management. IAM systems support these initiatives by enforcing best practices around access control. Thus, the growing incidents of cyberattacks propel the identity and access management in healthcare market growth.

Increasing Popularity of Telemedicine

Telemedicine practice allows healthcare providers and patients to interact remotely, necessitating secure access to sensitive medical records and data. IAM solutions ensure that only authorized users access the systems from various locations, thereby enhancing security. This demand for improved security spurs the requirement for identity and access management in telemedicine.

Identity and Access Management in Healthcare Market Segment Insights

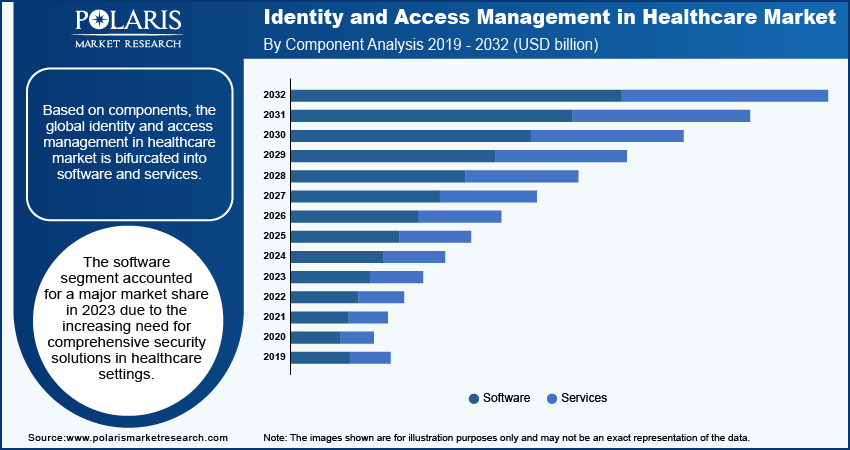

IAM in Healthcare Market Breakdown By Component

Based on components, the global identity and access management in healthcare market is bifurcated into software and services. The software segment accounted for a major share of the market in 2023 due to the increasing need for comprehensive security solutions in healthcare settings. Organizations prioritized robust software solutions that offer features such as multi-factor authentication, single sign-on, and role-based access control. These functionalities enhance data protection and streamline user access across various applications, addressing the growing threats of cyberattacks. Additionally, the rising adoption of cloud-based technologies propels the demand for IAM software as healthcare providers seek scalable and flexible solutions to manage user identities effectively.

The services segment is projected to grow at a robust pace in the coming years. This is attributed to the increased recognition and importance of managed services and consulting to navigate the complexities of identity and access management. Organizations seek expert guidance to implement and maintain effective IAM strategies as regulations tighten and cyber threats become sophisticated. Furthermore, the demand for ongoing support, training, and incident response services is rising as healthcare providers aim to enhance their security systems and ensure compliance with industry standards. This trend highlights the necessity for specialized services that adapt to the evolving landscape, making the services segment increasingly vital.

Identity and Access Management in Healthcare Market Breakdown By Deployment

In terms of deployment, the global identity and access management in healthcare market is bifurcated into on-premise and cloud. The cloud segment held a larger market share in 2023 due to the increasing preference for flexible and scalable solutions. Cloud-based systems offer significant advantages such as reduced infrastructure costs and easier updates, allowing providers to implement IAM solutions without the heavy burden of maintaining on-premise hardware. The rise of telemedicine and remote work has further accelerated the adoption of cloud-based solutions, as they facilitate secure access to critical data from anywhere. Additionally, the ongoing need for interoperability among various healthcare applications appeals to cloud-based IAM, which simplifies integration and enhances collaboration across different systems.

The on-premise segment is expected to register a significant CAGR during the forecast period, owing to its ability to offer greater data control and security. Large healthcare providers and institutions often manage sensitive patient information and must comply with stringent regulatory requirements. They prefer on-premise solutions to maintain direct oversight of their security infrastructure, minimizing exposure to potential vulnerabilities associated with cloud environments. Furthermore, these organizations invest in customized configurations tailored to their specific needs, which boosts the demand for on-premise deployments.

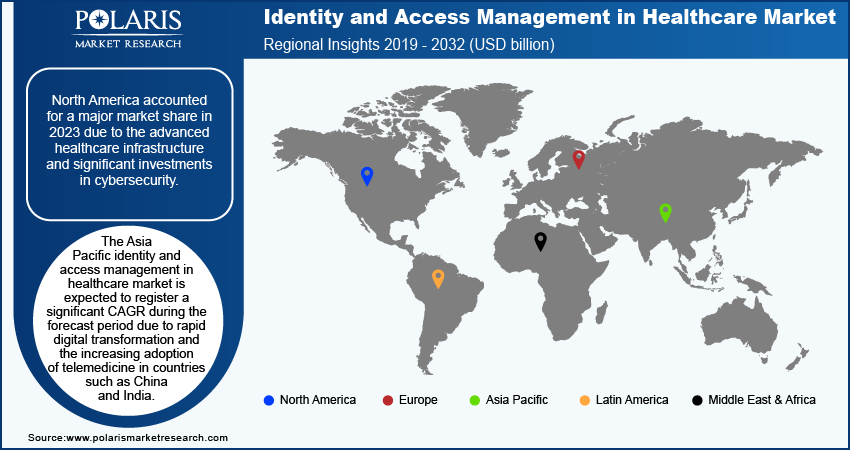

Identity and Access Management in Healthcare Market – Regional Insights

By region, the study provides the identity and access management in healthcare market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for a major market share in 2023 due to the advanced healthcare infrastructure and significant investments in cybersecurity. The US emerged as the dominant country in the regional market, owing to strict regulatory requirements such as HIPAA and increasing incidents of cyberattacks targeting healthcare organizations. Healthcare providers in the US prioritize robust identity and access management solutions to ensure compliance, protect sensitive patient information, and enhance overall security. The presence of major technology companies such as Oracle, IBM, and Microsoft and a strong emphasis on innovation further contribute to the growth of this segment, as healthcare organizations increasingly adopt advanced solutions to address their security challenges.

The Asia Pacific identity and access management in healthcare market is expected to register a significant CAGR during the forecast period due to rapid digital transformation and the increasing adoption of telemedicine in countries such as China and India. These nations are investing heavily in healthcare technologies to improve access and quality of care, leading to a greater need for effective identity management solutions. Additionally, the rising awareness of data privacy and security among healthcare providers in these countries highlights the urgency of implementing robust IAM systems. The combination of growing healthcare expenditures and an expanding patient population in Asia Pacific positions it as a key region in the evolving environment of access management solutions.

Identity and Access Management in Healthcare Market – Key Players and Competitive Insights

Prominent market players are investing heavily in research and development to expand their offerings, which will propel the identity and access management in healthcare market growth in the coming years. Market participants are undertaking a variety of strategic activities, including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations, to expand their global footprint. To expand and survive in a more competitive and rising market environment, identity and access management in healthcare market players must offer innovative solutions.

The identity and access management in healthcare market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Veritis Group Inc.; Fortra, LLC; LexisNexis Risk Solutions; Ping Identity; Imprivata, Inc.; IBM; Okta; CyberArk Software Ltd.; Delinea; SailPoint Technologies, Inc.; Oracle; Cisco Systems, Inc.; CloudIBN; and symplr.

LexisNexis Risk Solutions offers comprehensive identity and access management (IAM) solutions tailored for the healthcare sector, emphasizing security, compliance, and user experience. The IAM systems of LexisNexis Risk Solutions are designed to protect sensitive patient data while ensuring that healthcare organizations can efficiently manage user access across various platforms. In October 2021, the company announced that its LexisNexis Healthcare Identity Management platform is available through the Epic App Orchard, a marketplace for applications integrated with the epic electronic health record (EHR).

Imprivata Inc., founded in 2004, is a digital identity security company based in Waltham, Massachusetts, primarily serving the healthcare sector. The company specializes in IAM solutions that enhance security while streamlining workflows for healthcare professionals. In February 2024, Imprivata launched a new biometric patient identity solution to protect patient privacy and address the misidentification crisis.

Key Companies in Identity and Access Management in Healthcare Market

- Veritis Group Inc.

- Fortra, LLC

- LexisNexis Risk Solutions

- Ping Identity

- Imprivata, Inc.

- IBM

- Okta

- CyberArk Software Ltd.

- Delinea

- SailPoint Technologies, Inc.

- Oracle

- Cisco Systems, Inc.

- CloudIBN

- symplr

Identity and Access Management in Healthcare Industry Developments

April 2022: Imprivata, a digital identity company that offers solutions for secure access and collaboration in the healthcare industry, acquired SecureLink, the major player in critical access management with elite patient privacy monitoring. The acquisition uniquely addresses the rapidly growing need for a single source to enable and protect all digital identities.

March 2024: Fortra, a global company that provides IT security, operations management, and analytics solutions, announced a strategic integration partnership with Lookout, Inc., a data-centric cloud security company, to provide customers with comprehensive security coverage that protects data in the modern threat landscape.

December 2022: CloudIBN, a managed cloud hosting services and solutions provider specialized in cloud infrastructure and cybersecurity consulting, announced the launch of its identity and access management offerings. This suite of IAM products will help businesses ensure that their data remains secure, while also providing an efficient way to manage user access control across the organization.

Identity and Access Management in Healthcare Market Segmentation

By Component Outlook (Revenue, USD billion, 2019–2032)

- Software

- Services

By Deployment Outlook (Revenue, USD billion, 2019–2032)

- On-Premise

- Cloud

By Type Outlook (Revenue, USD billion, 2019–2032)

- Single Sign On

- Multifactor Authentication

- Provisioning

- Directory Service

- Audit & Compliance Management

By End User Outlook (Revenue, USD billion, 2019–2032)

- Healthcare Payers

- Hospitals & Clinics

- Life Sciences Companies

- Other

By Regional Outlook (Revenue, USD billion, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Identity and Access Management in Healthcare Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1.37 billion |

|

Market Size Value in 2024 |

USD 1.60 billion |

|

Revenue Forecast by 2032 |

USD 5.57 billion |

|

CAGR |

16.9% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global identity and access management in healthcare market size was valued at USD 1.37 billion in 2023 and is projected to grow to USD 5.57 billion by 2032.

The global market is projected to register a CAGR of 16.9% during 2024–2032.

North America held the largest share of the global market

A few key players in the market are Veritis Group Inc.; Fortra, LLC; LexisNexis Risk Solutions; Ping Identity; Imprivata, Inc.; IBM; Okta; CyberArk Software Ltd.; Delinea; SailPoint Technologies, Inc.; Oracle; Cisco Systems, Inc.; CloudIBN; and symplr.

The software segment is projected for significant growth in the global market during the forecast period.

The cloud segment dominated the market in 2023.