Hyperscale Data Center Market Size, Share, Trends, Industry Analysis Report: By Component, Deployment Type (Greenfield and Brownfield), Power Capacity, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM5382

- Base Year: 2024

- Historical Data: 2020-2023

Hyperscale Data Center Market Overview

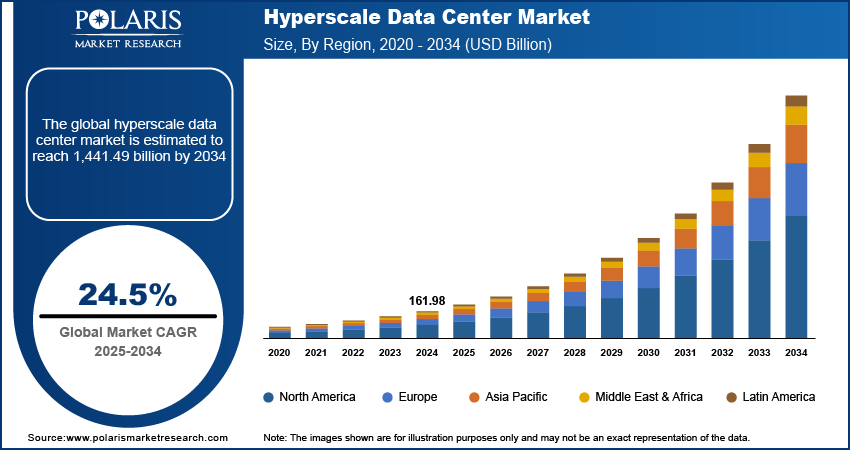

The global hyperscale data center market was valued at USD 161.98 billion in 2024. The market is expected to grow from USD 200.88 billion in 2025 to USD 1,441.49 billion by 2034, exhibiting a CAGR of 24.5% from 2025 to 2034.

A hyperscale data center is a facility designed to support massive data processing, storage, and scalability demands through high-density infrastructure and automation. The hyperscale data center market is expanding due to the critical need for disaster recovery and business continuity. A report by the WEF in January 2024 stated that there are around 2,220 cyberattacks each day, which equates to more than 800,000 attacks annually, highlighting the urgent need for strong hyperscale data centers to ensure data security, resilience and uninterrupted operations in the face of growing digital threats. Organizations rely on these data centers to reduce risks associated with cyber threats, natural disasters, and operational failures, ensuring seamless data availability and resilience. Hyperscale data centers provide the redundancy and failover capabilities necessary to maintain uninterrupted operations as businesses increasingly adopt cloud services and distributed computing. This growing dependence on robust IT infrastructure is driving hyperscale data center market expansion worldwide.

To Understand More About this Research: Request a Free Sample Report

Additionally, increasing spending on hyperscale data center technology is accelerating market growth as enterprises and cloud service providers prioritize advanced computing capabilities to support data-intensive applications. The rising adoption of artificial intelligence (AI), big data analytics, and edge computing is pushing companies to improve their infrastructure with high-performance servers, energy-efficient cooling, and network automation. For instance, in December 2024, Equinix partnered with Dell Technologies to help enterprises deploy flexible AI infrastructure, allowing them to train models efficiently in both public and private clouds while ensuring control, security, and low-latency on-premises deployment. This increased investment aims to improve operational efficiency, reduce latency, and meet the evolving needs of digital transformation. As a result, hyperscale data centers are becoming the backbone of modern IT ecosystems, supporting the exponential growth of data-driven business models.

Hyperscale Data Center Market Dynamics

Rising Adoption of Multi-Cloud

Organizations are leveraging multi-cloud architectures to avoid vendor lock-in, optimize performance, and ensure regulatory compliance across different regions, as enterprises increasingly distribute workloads across multiple cloud environments to improve flexibility, security, and cost efficiency. This shift requires scalable, high-performance infrastructure, which hyperscale data centers provide through advanced networking, automation, and storage solutions. For instance, in July 2024, F5 enhanced its technology partnerships for multi-cloud networking, simplifying connectivity and ensuring consistent application security. The 2024 State of Application Strategy Report reveals that 90% of enterprises use multi-cloud strategies, with over one-third managing applications across six or more environments. Thus, as businesses manage complex hybrid and multi-cloud deployments, the hyperscale data center market demand continues to rise, allowing seamless collaboration and workload balancing across cloud platforms.

Digital Transformation Initiatives

The rapid integration of artificial intelligence (AI), the Internet of Things (IoT), and big data analytics necessitates high-compute power, low-latency processing, and scalable storage solutions as enterprises modernize their AI infrastructure to support evolving business models and data-driven decision-making. Hyperscale data centers serve these demands by offering advanced computing capabilities, high-speed connectivity, and energy-efficient architectures. For instance, in July 2024, iXAfrica Data Centres and Schneider Electric launched East Africa’s largest AI-ready data center in Nairobi, aimed at attracting global hyper-cloud customers. The data center is backed by a resilient power infrastructure and Schneider Electric’s EcoStruxure solutions for enhanced efficiency and sustainability. Thus, as organizations continue to invest in digital transformation, the reliance on hyperscale infrastructure grows, reinforcing its role as a foundation for next-generation enterprise applications and cloud-driven ecosystems.

Hyperscale Data Center Market Segment Insights

Hyperscale Data Center Market Assessment by Component Outlook

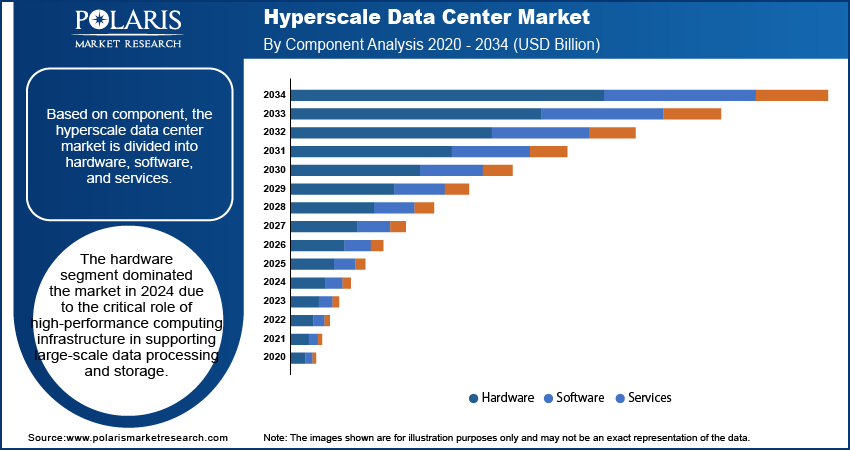

The global hyperscale data center market segmentation, based on component, includes hardware, software, and services. The hardware segment dominated the market in 2024 due to the critical role of high-performance computing infrastructure in supporting large-scale data processing and storage. Hyperscale facilities require advanced servers, networking equipment, and power management solutions to handle the increasing demand for cloud services, AI, and big data analytics. The growing need for efficient cooling systems and high-density racks further drives investment in advanced hardware. Thus, as enterprises and cloud service providers scale their operations, the demand for robust and energy-efficient hardware solutions continues to rise.

Hyperscale Data Center Market Evaluation by Deployment Type Outlook

The global hyperscale data center market evaluation, based on deployment type, includes greenfield and brownfield. The greenfield segment is expected to witness the fastest growth during the forecast period, driven by the increasing demand for purpose-built, energy-efficient facilities. Organizations are investing in greenfield projects to leverage the latest advancements in cooling technologies, modular infrastructure, and sustainable energy solutions. These data centers are designed from the ground up to optimize performance, reduce operational costs, and meet evolving regulatory requirements. Therefore, with the rising adoption of cloud services and AI-driven applications, companies prefer greenfield deployments to ensure scalability, flexibility, and long-term efficiency in hyperscale infrastructure.

Hyperscale Data Center Market Regional Analysis

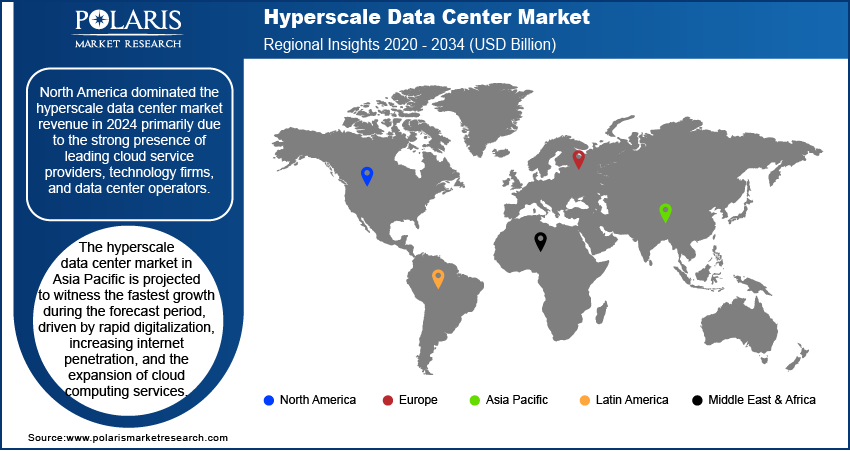

By region, the report provides the hyperscale data center market insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominated the global market in 2024 primarily due to the strong presence of leading cloud service providers, technology firms, and data center operators. The region benefits from a well-established digital ecosystem, high investments in AI and cloud computing, and a growing demand for high-performance infrastructure. Additionally, North America's robust network connectivity, availability of skilled workforce, and favorable regulatory environment support market expansion. For instance, in January 2025, The US government issued an administrative order to accelerate clean-energy-powered AI data centers on federal land, ensuring US leadership in AI, national security, and climate resilience while mandating clean energy offsets and environmental responsibility. Enterprises in the region are continuously upgrading their hyperscale data centers to enhance efficiency, security, and scalability, further solidifying North America’s leadership in the market.

The Asia Pacific hyperscale data center market is projected to witness the fastest growth during the forecast period, driven by rapid digitalization, increasing internet penetration, and the expansion of cloud computing services. The region is experiencing substantial investments in hyperscale infrastructure to support the growing adoption of AI, big data analytics, and IoT applications. For instance, in October 2024, Oracle invested over USD 6.5 billion to establish a cloud region in Malaysia, offering 150+ AI and cloud services to improve digital innovation and boost the country's competitiveness in these technologies. Additionally, favorable policies, improving network connectivity, and the expansion of technology-driven industries contribute to the market growth in Asia Pacific.

List of Key Companies in Hyperscale Data Center Market

- ABB

- Adani Group

- Amazon Web Services, Inc.

- Arista Networks, Inc.

- Cisco Systems, Inc.

- Dell Inc.

- Eaton.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Microsoft

- NVIDIA Corporation

- Oracle

- Quanta Cloud Technology

- Vertiv Group Corp.

Hyperscale Data Center Market – Key Players and Competitive Insights

The competitive landscape features global leaders and regional players competing for market share through innovation, strategic partnerships, and geographic expansion. Key players such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Oracle leverage advanced R&D capabilities and extensive infrastructure networks to deliver scalable, high-performance data center solutions. Market trends highlight rising demand for energy-efficient designs, AI-driven automation, and modular data center technologies, reflecting advancements in cloud computing and sustainability. According to hyperscale data center market statistics, the market is projected to grow, driven by increasing data consumption, AI adoption, and the need for disaster recovery and business continuity.

Regional players focus on addressing localized demands by offering cost-effective and tailored solutions, particularly in emerging markets. Hyperscale data center market competitive strategies include mergers and acquisitions, collaborations with technology providers, and the introduction of innovative solutions to meet the growing demand for scalable, secure, and sustainable data center infrastructure. These developments highlight the importance of technological innovation, market adaptability, and strategic investments in driving market expansion. A few key major players are ABB; Adani Group; Amazon Web Services, Inc.; Arista Networks, Inc.; Cisco Systems, Inc.; Dell Inc.; Eaton; Google; Hewlett Packard Enterprise Development LP; IBM Corporation; Microsoft; NVIDIA Corporation; Oracle; Quanta Cloud Technology; and Vertiv Group Corp.

Amazon Web Services, Inc. (AWS), a subsidiary of Amazon, is a vast and evolving cloud computing platform that provides on-demand cloud computing platforms and APIs to individuals, companies, and governments on a metered, pay-as-you-go basis. It offers a broad set of global cloud-based products, such as computing, storage, databases, analytics, networking, mobile, developer tools, management tools, IoT, security, and enterprise applications. AWS was one of the first companies to introduce a pay-as-you-go cloud computing model that scales to provide users with compute, storage, and throughput as needed. AWS is separated into different services, each configurable based on user needs. Clients are freed from managing, scaling, and patching hardware and operating systems. The company markets itself as a way for subscribers to obtain large-scale computing capacity more quickly and cheaply than building an actual physical server farm. AWS services are delivered to customers via a network of AWS server farms, and dozens of data centers spread across 105 availability zones (AZes) globally.

Cisco Systems, Inc. is a technology company headquartered in San Jose, California. Founded in December 1984, Cisco specializes in networking hardware, software, telecommunications equipment, and high-technology services and products. Cisco is known for its Internet Protocol (IP)-based networking technologies. It develops and sells a wide range of products and services, focusing on three primary market segments: enterprise, service provider, and mid-size and small businesses. Their offerings span five major technology areas: networking, security, collaboration, data centers, and the Internet of Things (IoT). Cisco has a global presence with business operations in the Americas, Europe, the Middle East, Africa, and Asia Pacific. Cisco plays a role in hyperscale data centers by providing essential components such as switches, routers, and networking solutions that facilitate the high-speed, low-latency connections required for these environments. Their technologies enable efficient data processing, storage, and distribution, supporting the massive scalability and performance demands of hyperscale applications and services. Cisco's solutions for data centers also include security and cloud management tools.

Hyperscale Data Center Industry Developments

May 2024: Microsoft launched its first hyperscale data center region in Mexico, called Mexico Central, to improve local access to cloud services. This initiative is projected to generate USD 70.7 billion in new global revenues over the next four years.

September 2024: Prometheus Hyperscale launched to revolutionize data centers with advanced liquid cooling, 100% renewable energy, and strategic partnerships.

Hyperscale Data Center Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Deployment Type Outlook (Revenue, USD Billion, 2020–2034)

- Greenfield

- Brownfield

By Power Capacity Outlook (Revenue, USD Billion, 2020–2034)

- 10-50 MV

- 51-100 MV

- Above 101 MV

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Cloud Service Providers

- Colocation Service Providers

- Enterprises

- BFSI

- Government & Defense

- Retail & Commerce

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hyperscale Data Center Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 161.98 billion |

|

Market Size Value in 2025 |

USD 200.88 billion |

|

Revenue Forecast by 2034 |

USD 1,441.49 billion |

|

CAGR |

24.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global hyperscale data center market size was valued at USD 161.98 billion in 2024 and is projected to grow to USD 1,441.49 billion by 2034.

• The global market is projected to register a CAGR of 24.5% during the forecast period.

• North America dominated the global market in 2024.

• Some of the key players in the market are ABB; Adani Group; Amazon Web Services, Inc.; Arista Networks, Inc.; Cisco Systems, Inc.; Dell Inc.; Eaton; Google; Hewlett Packard Enterprise Development LP; IBM Corporation; Microsoft; NVIDIA Corporation; Oracle; Quanta Cloud Technology; and Vertiv Group Corp.

• The hardware segment dominated the market in 2024.