Hypercharger Market Share, Size, Trends, Industry Analysis Report, By Vehicle Type; By Port Type; By Sales Channel (Aftermarket, Original Equipment Manufacturer); By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4403

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

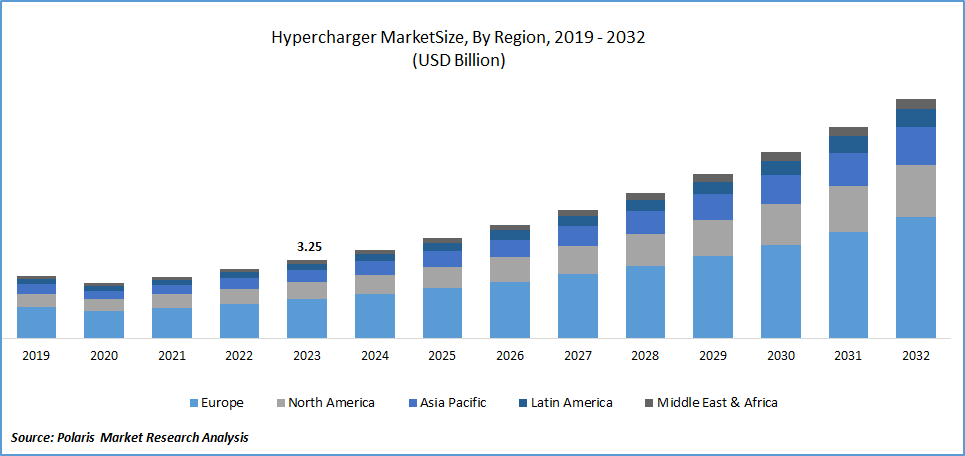

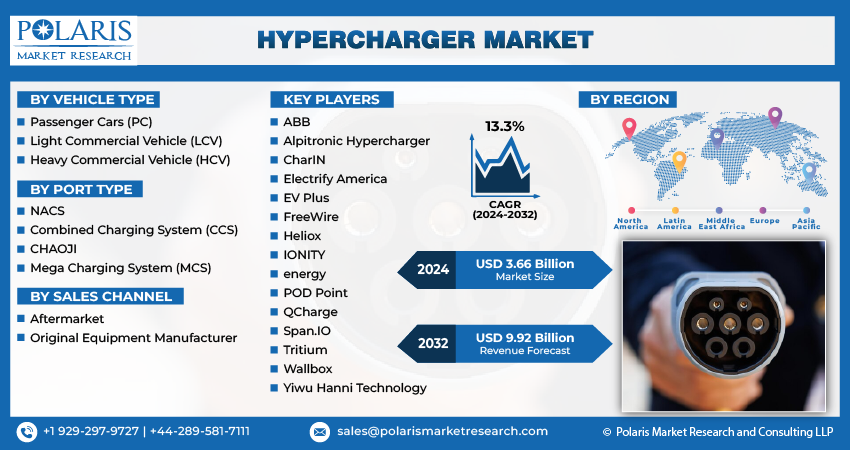

The global hypercharger market was valued at USD 3.25 billion in 2023 and is expected to grow at a CAGR of 13.3% during the forecast period.

Global emissions are increasing day by day, constituting 15% of the global energy-related emissions through road transport. This is enforcing the government to facilitate a favorable market for electric vehicle manufacturers and consumers to take part in a healthier environment. The increasing use of electric vehicles on a global scale is showing an optimistic outlook for the growth and demand of hyperchargers.

According to the latest IEA’s annual Global Electric Vehicle Outlook, in 2022, more than 10 million electric cars are sold worldwide and are projected to grow by 35% in 2023, reaching 14 million. The share of electric cars in the overall cars market registered 4% in 2021 to 14% in 2022 and is expected to grow 18% in 2023. This demonstrates the upward trend of electric car adoption in the countries. Hyperchargers and electric vehicles are establishing complementary relationships as both are required simultaneously in the electric mobility system.

To Understand More About this Research:Request a Free Sample Report

- For instance, in September 2023, Fastned, an electric service company, expanded its charging location with the addition of the latest Electronic hyperchargers at the Seed & Greet charging park in Hilden, Germany.

Moreover, the increasing awareness about the impact of utilizing traditional vehicles on climate change among the global population is driving the rapid transformation to the consumption of electric vehicles. As more people adopt electric vehicles, there will be a huge demand for electric vehicle charging stations in the market in the next few years.

However, the lower penetration of hyperchargers in rural areas, higher initial costs, and power problems are expected to restrict the growth of the market.

Growth Drivers

- Rising infrastructure expansion and financial investment activities

The increasing development activities among the countries with the adoption of infrastructural projects are widening the expansion of hyperchargers in the world. For instance, in December 2023, Hypercharge Networks Corp., a provider of smart electric vehicle charging solutions, announced the approval of up to 12 DC fast charging point deployments in Western Canada, with an approximate value of $2M–$3M. As governments facilitate favorable markets for private players, companies are likely to fuel research and development activities on new product innovations in various disciplines, including electric vehicle charging stations.

Report Segmentation

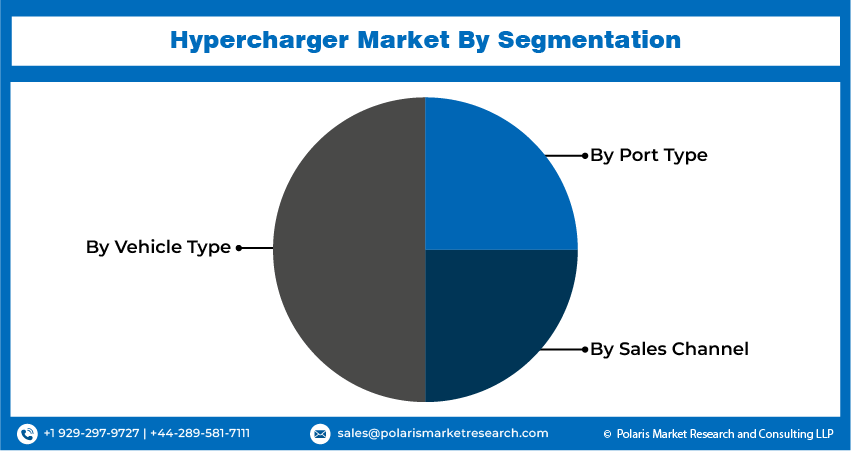

The market is primarily segmented based on vehicle type, port type, sales channel, and region.

|

By Vehicle Type |

By Port Type |

By Sales Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Vehicle Type Analysis

- Heavy Commercial Vehicle (HCV) segment is expected to witness the highest market growth during the forecast period.

The heavy commercial vehicle segment will grow at the fastest pace, mainly driven by the adoption of electric buses and trucks in the transportation system. The increasing demand for charging stations for heavy commercial vehicles is motivating electric companies to deploy new HCV hyperchargers in the marketplace. For instance, PowerX introduced Hypercharger for Fleet, a scalable and smart electric vehicle fleet charging technology fueled by clean energy. This is used to power commercial vehicles, including trucks, taxis, and buses. The presence of charging stations suitable for commercial vehicles is driving the adoption of electric vehicles, which is likely to stimulate the demand for charging stations soon.

The passenger cars segment led the industry market with a substantial revenue share in 2023, largely attributable to the rising demand for environmentally friendly vehicles in the global market. Electric vehicle manufacturers are adopting the latest technologies in their passenger car production to meet the ongoing consumer preferences for environmental sustainability and convenience with lower anxiety by adopting hyperchargers, as they are known to reduce the amount of time required to charge a vehicle.

By Port Type Analysis

- Combined Charging System segment accounted for the largest market share in 2023

The combined charging system segment accounted for the largest market share. This is highly influenced by its ability to provide standardized power to the Alternating Current (AC) and Direct Current (DC) vehicle types. Companies are showing profound interest in these charging stations due to their adaptability, compatibility, and higher charging speeds. These factors together are projected to foster the market share of combined charging systems in the coming years.

By Sales Channel Analysis

- The aftermarket segment held a significant market share in 2023

The aftermarket segment held a significant share due to the continuous rise in electric vehicle user issues related to outdated battery charging capacity. The continuous rise in research and innovation activities to improve battery capacity and fuel charging speed is likely to motivate users to update their existing charging systems with the latest hyperchargers at repair shops, online retailers, and more. The rising symmetry of information about the new technology evolution with increased access to the internet is one of the main factors driving the revenue of the hypercharge aftermarket sales segment.

Regional Insights

- Europe region registered the largest share of the global market in 2023

The Europe Region held the global market with the largest market share in 2023 and is expected to continue its dominance over the study period. The growth of the segment market can be largely attributed to the rising infrastructure projects in electrical and management solutions. The presence of major players and rising expansion activities in the region are expected to fuel the growth of the market in the coming years. In November 2023, Pod Point, an EV charging network company, entered into a strategic partnership with an electric services company, Centrica. This advances the company closer to its goal of managing flexible energy resources to optimize grid-wide electricity generation and consumption. These expansion activities are expected to stimulate the growth of the hypercharger market by the end of 2030.

The Asia Pacific Region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to increasing government initiatives and the existence of developing countries such as China and India. According to the International Energy Agency, global fast chargers have increased by 330,000, with 90% of the growth coming from China in 2022. It witnessed a fast charger stock of 77,000, while 70% of the total public fast charger pile is limited to ten provinces. As the countries actively work to shift towards electric vehicles, there is likely to be a drive for the deployment of electric vehicle charging stations in the region.

Key Market Players & Competitive Insights

The hypercharge market is moderately consolidated and is anticipated to witness significant competition due to the presence of larger market players. The increasing expansion activities, such as partnerships, collaborations, and acquisitions, in the market are driving the growth of the global market. Additionally, the increasing demand for hyperchargers in numerous applications is expected to foster the growth of the market. For instance, Hypercharge Networks Corp. was chosen by Harlo Capital to supply ten Level 2 charging stations for their residential development in Vancouver.

Some of the major players operating in the global market include:

- ABB

- Alpitronic Hypercharger

- CharIN

- Electrify America

- EV Plus

- FreeWire

- Heliox

- IONITY

- energy

- POD Point

- QCharge

- Span.IO

- Tritium

- Wallbox

- Yiwu Hanni Technology

Recent Developments

- In November 2023, Hypercharge Networks Corp., a smart charger solutions provider for electric vehicles, unveiled Hypercharge Home, its new residential Level 2 EV charging station.

- In November 2023, ChargePoint introduced an updated mobile app to reach one million quarterly active drivers in its EV charging network.

Hypercharger Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.66 billion |

|

Revenue Forecast in 2032 |

USD 9.92 billion |

|

CAGR |

13.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Vehicle Type, By Port Type, By Sales Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

Hypercharger Market Size Worth 9.92 Billion By 2032

The top market players in Hypercharger Market players include Alpitronic Hypercharger, ABB, CharIN, Electrify America

Europe is the region contribute notably towards the Hypercharger Market.

The global hypercharger market is expected to grow at a CAGR of 13.3% during the forecast period.

Hypercharger Market report covering key segments are vehicle type, port type, sales channel, and region.