Hydronic HVAC Systems Market Size, Share, Trends, Industry Analysis Report: By Product, Application (Commercial, Residential, and Industrial), Fuel Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5488

- Base Year: 2024

- Historical Data: 2020-2023

Hydronic HVAC Systems Market Overview

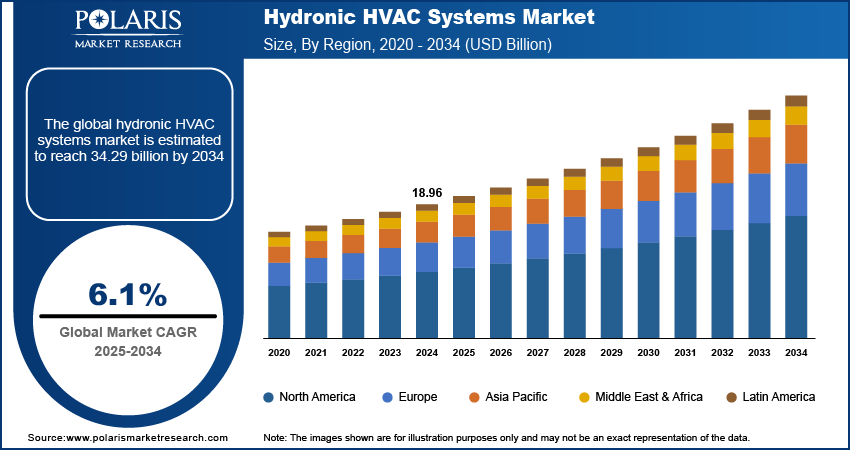

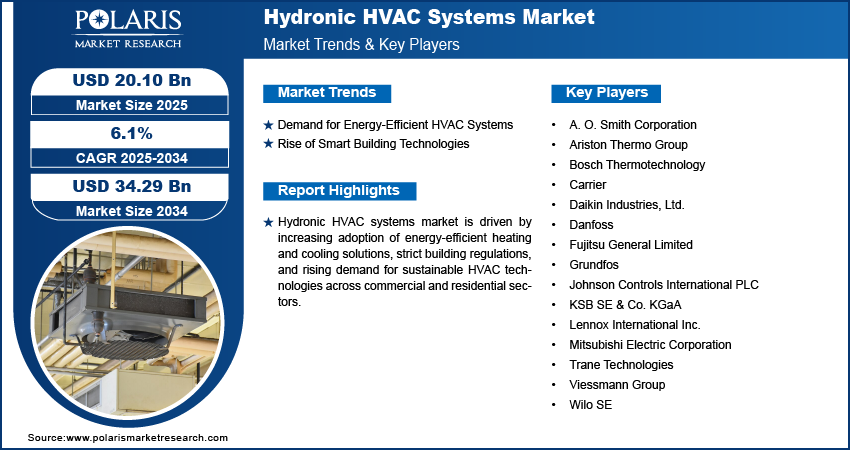

The global hydronic HVAC systems market was valued at USD 18.96 billion in 2024. It is expected to grow from USD 20.10 billion in 2025 to USD 34.29 billion by 2034, at a CAGR of 6.1% during the forecast period.

Hydronic HVAC systems, which utilize water as a heat transfer medium for heating and cooling applications, are gaining traction in the construction industry due to their energy efficiency and environmental benefits. The increasing emphasis on sustainability in modern construction practices is driving the hydronic HVAC systems market revenue. Architects and developers are prioritizing energy-efficient solutions that minimize carbon footprints as the demand for green buildings rises. For instance, in February 2025, Trane Technologies launched the Trane Hydronic Branch Conductor, enabling energy-efficient, decarbonized heating and cooling in retrofits and new buildings. It improves heating efficiency by over 35% and supports simultaneous heating/cooling. Hydronic systems, known for their ability to improve thermal comfort while reducing energy consumption, align with this shift toward sustainable infrastructure. Their compatibility with renewable energy sources, such as solar thermal and geothermal systems, further reinforces their appeal in eco-friendly building projects.

To Understand More About this Research: Request a Free Sample Report

Government regulations and incentives promoting energy efficiency are accelerating the adoption of hydronic HVAC systems. Strict energy codes and building standards require improved efficiency in heating and cooling systems, making hydronic solutions a preferred choice due to their superior performance and reduced operational costs. Many governments offer financial incentives, such as tax credits and subsidies, to encourage the implementation of energy-efficient technologies in residential and commercial buildings. These policies drive market growth and also support broader climate action goals by reducing overall energy consumption and greenhouse gas emissions. Thus, as regulatory frameworks continue to evolve, the hydronic HVAC systems market growth is expected to accelerate, fueled by a strong policy push toward sustainable energy use.

Hydronic HVAC Systems Market Dynamics

Demand for Energy-Efficient HVAC Systems

Hydronic systems, which utilize water as a heat transfer medium, are naturally more efficient than traditional air-based systems due to water's higher heat capacity and lower energy losses. Industries and building owners seek solutions that minimize energy consumption while maintaining optimal indoor climate control, which drives the hydronic HVAC systems market demand. Manufacturers are emerging to meet this growing demand while advancing technological capabilities. For instance, in December 2024, Daikin launched its Smart Control System (SCS), a solution for managing hydronic HVAC systems, such as chillers and heat pumps. SCS optimizes system performance, focusing on comfort in light commercial, office, and small to medium-hotel applications. This efficiency reduces operational costs and lower environmental impact, making hydronic HVAC solutions an attractive choice for commercial, residential, and industrial applications. The preference for high-performance, low-energy HVAC solutions continues to drive the adoption of hydronic systems as businesses and governments focus on reducing energy expenditures and carbon footprints.

Rise of Smart Building Technologies

Hydronic systems can seamlessly integrate with smart sensors, adaptive controls, and building management systems (BMS) to improve operational efficiency, provide real-time performance monitoring, and facilitate predictive maintenance. This connectivity improves user comfort and system reliability and it also aligns with the broader trend of digital transformation in the built environment. Modern infrastructure increasingly incorporates advanced automation and IoT-based controls for optimized energy management, further accelerating the market demand. For instance, in February 2023, Siemens introduced IoT-based smart building solutions designed to enhance sustainability and efficiency, leveraging advanced automation, energy optimization, and data-driven insights for improved building management and reduced environmental impact. Innovations, such as automation for small to medium buildings, cybersecurity-enhanced systems, and HVAC controllers for heat pumps, aim to optimize energy use and reduce carbon footprints. Thus, as smart buildings become the industry standard, the ability of hydronic HVAC systems to deliver precise temperature control and energy optimization through intelligent automation is expected to drive the hydronic HVAC systems market expansion.

Hydronic HVAC Systems Market Segment Analysis

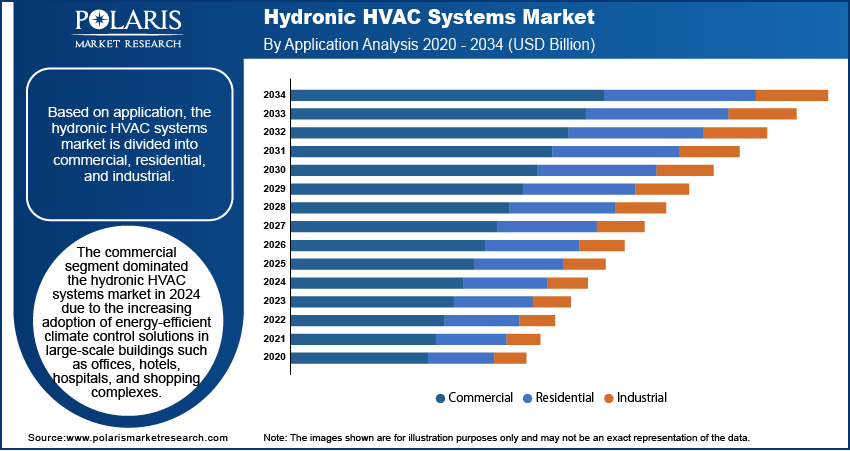

Hydronic HVAC Systems Market Assessment by Application Outlook

The global hydronic HVAC systems market segmentation, based on application, includes commercial, residential, and industrial. The commercial segment dominated the market in 2024 due to the increasing adoption of energy-efficient climate control solutions in large-scale buildings such as offices, hotels, hospitals, and shopping complexes. Commercial properties require highly efficient and scalable HVAC systems to maintain optimal indoor air quality and thermal comfort while minimizing energy consumption. Hydronic HVAC systems offer superior performance by leveraging water-based heat transfer, assuring consistent temperature regulation across expansive spaces. Additionally, strict energy efficiency standards and green building certifications have encouraged businesses to invest in sustainable heating and cooling solutions, further driving the dominance of the commercial segment.

Hydronic HVAC Systems Market Evaluation by Product Outlook

The global hydronic HVAC systems market segmentation, based on product, includes hydronic boilers, heat pumps, radiant heating systems, chillers, air conditioning units, fan coils, AHU, and cooling towers. The hydronic boilers segment is expected to witness the fastest growth during the forecast period due to their essential role in delivering efficient heating solutions across various applications. Hydronic boilers are preferred for their ability to provide consistent and evenly distributed heating while operating with lower energy consumption compared to conventional systems. Their integration with renewable energy sources, such as solar thermal and biomass, improves their sustainability appeal. Additionally, advancements in boiler technology, such as high-efficiency condensing models and smart control systems, are driving increased adoption. Therefore, as demand for energy-efficient and environmentally friendly heating solutions rises, hydronic boilers are expected to experience accelerated hydronic HVAC systems market development.

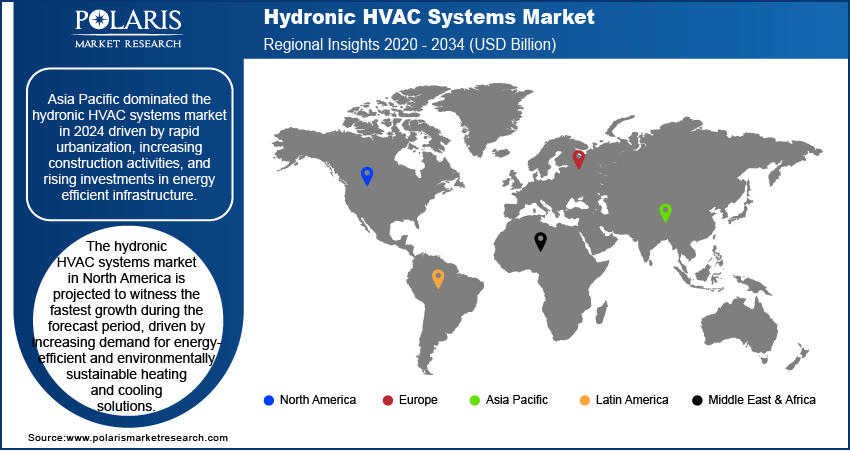

Hydronic HVAC Systems Market Outlook by Region

By region, the report provides the hydronic HVAC systems market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market in 2024 driven by rapid urbanization, increasing construction activities, and rising investments in energy efficient infrastructure. For instance, in January 2024, IFC invested USD 15 million in SEACEF II, a fund managed by Clime Capital, to support early-stage clean energy projects in Southeast Asia. Focused on solar, wind, energy storage, and efficiency, it targets Indonesia, Vietnam, and the Philippines. Countries such as China, Japan, and India are witnessing substantial demand for advanced HVAC solutions due to expanding commercial and residential developments. Additionally, government initiatives promoting energy efficiency and sustainability have accelerated the adoption of hydronic HVAC systems in new construction and retrofit projects. For instance, in March 2021, BCA launched the Singapore Green Building Masterplan (SGBMP) to promote sustainability in the Built Environment. In June 2022, a USD 63 million incentive scheme was launched to support energy efficiency retrofits, aiming to green 80% of buildings by 2030. The region's strong manufacturing base, coupled with technological advancements in heating and cooling solutions, further reinforces its leadership in the global market. Thus, as the focus on sustainable urban development continues to grow, Asia Pacific is expected to maintain its dominant market position.

The hydronic HVAC systems market in North America is projected to witness the fastest growth during the forecast period. This growth is driven by increasing demand for energy-efficient and environmentally sustainable heating and cooling solutions. Stricter building energy codes and government incentives promoting the adoption of high-performance HVAC systems are major factors fueling market expansion. For instance, in August 2024, DOE allocated USD 240 million from the Inflation Reduction Act to 19 states and localities for updating building energy codes, aiming to improve energy efficiency and support innovative standards. This commitment to energy efficiency is further exemplified by Standard 90.1-2022, which updated US commercial building energy codes by introducing requirements for on-site renewable energy, addressing thermal bridging, and establishing HVAC efficiency trade-offs. The scope was expanded to include sites, new energy metrics were offered, and efficiency standards for HVAC systems were increased. Additionally, the region's growing focus on smart building technologies and IoT-based HVAC controls is improving the appeal of hydronic systems due to their compatibility with advanced automation solutions. The rise in commercial and residential construction projects, along with the adoption of renewable energy-integrated heating solutions, is further contributing to the market growth in North America.

Key Companies in Hydronic HVAC Systems Market

- A. O. Smith Corporation

- Ariston Thermo Group

- Bosch Thermotechnology

- Carrier

- Daikin Industries, Ltd.

- Danfoss

- Fujitsu General Limited

- Grundfos

- Johnson Controls International PLC

- KSB SE & Co. KGaA

- Lennox International Inc.

- Mitsubishi Electric Corporation

- Trane Technologies

- Viessmann Group

- Wilo SE

Hydronic HVAC Systems Key Market Players & Competitive Analysis Report

The competitive landscape combines global leaders and regional players competing to capture hydronic HVAC systems market share through innovation, strategic alliances, and regional expansion. Global players such as Carrier Corporation, Johnson Controls, Trane Technologies, and others leverage robust R&D capabilities and extensive distribution networks to deliver advanced heating and cooling solutions, smart controls, and energy-efficient system components. Hydronic HVAC systems market trends indicate rising demand for solutions, such as variable flow systems and heat pump integration, reflecting advancements in building technology and sustainable design practices. According to market statistics, the market is projected to grow, driven by increasing focus on energy efficiency, de-carbonization initiatives, and stricter building regulations. Regional companies capitalize on localized needs by offering cost-effective and tailored solutions, especially in emerging markets.

Hydronic HVAC systems competitive strategy includes mergers and acquisitions, partnerships with construction firms and engineering consultants, and the introduction of innovative hydronic technologies to address the growing demand for sustainable and high-performance building systems. A few key major players are A. O. Smith Corporation; Ariston Thermo Group; Bosch Thermotechnology; Carrier; Daikin Industries, Ltd.; Danfoss; Fujitsu General Limited; Grundfos; Johnson Controls International PLC; KSB SE & Co. KGaA; Lennox International Inc.; Mitsubishi Electric Corporation; Trane Technologies; Viessmann Group; and Wilo SE.

Daikin Industries, Ltd., founded in 1924 and headquartered in Osaka, Japan, is recognized as a manufacturer of air conditioning systems. The company specializes in a diverse range of HVAC solutions, such as residential and commercial air conditioners, heat pumps, and air purifiers. Daikin has made advancements in hydronic HVAC systems, which utilize water as a heat transfer medium to provide efficient heating and cooling solutions. These systems are particularly valued for their energy efficiency and ability to integrate with renewable energy sources. Daikin's commitment to innovation is clear in its development of advanced technologies, such as inverter compressors and eco-friendly refrigerants such as HFC-32, which aim to reduce environmental impact while improving system performance. The company operates globally with a strong presence in North America, Europe, and Asia.. Daikin's focus on sustainability and customer satisfaction drives its mission to deliver high-quality products that improve indoor air quality and comfort across various applications.

Johnson Controls International PLC specializes in smart building technologies, design, manufacturing, and marketing of advanced HVAC systems, including hydronic solutions. Founded in 1885 and headquartered in Cork, Ireland, the company provides a wide range of products and services aimed at improving building efficiency and sustainability. Its hydronic HVAC systems utilize water as a heat transfer medium, offering effective heating and cooling solutions for various applications, from residential to large commercial buildings. The company's innovative approach includes integrating digital capabilities through its OpenBlue platform, which improves building management by connecting various systems for improved operational efficiency. Johnson Controls serves diverse sectors such as healthcare, education, and manufacturing, assuring that its solutions are tailored to meet specific industry needs. Johnson Controls continues to push the boundaries of technology in building management while focusing on creating safe and sustainable environments for its customers worldwide.

Hydronic HVAC Systems Market Developments

February 2025: ACCA collaborated with Tekmar Control Systems to improve HVACR industry standards. Tekmar’s innovative HVACR controls and energy management solutions aim to improve system efficiency, comfort, and reliability, supporting contractors in delivering high-performance solutions.

April 2024: Mitsubishi Electric acquired AIRCALO, a French air-conditioning company, through its subsidiaries. Mitsubishi Electric aims to improve its hydronic HVAC systems in Europe by utilizing AIRCALO's product line and customization capabilities to meet the demand for custom products and environmental awareness.

Hydronic HVAC Systems Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020 - 2034)

- Hydronic Boilers

- Heat Pumps

- Radiant Heating System

- Chillers

- Air Conditioning Units

- Fan coils

- AHU

- Cooling Tower

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Commercial

- Residential

- Industrial

By Fuel Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Natural Gas

- Oil

- Electricity

- Biomass

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hydronic HVAC Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.96 billion |

|

Market Size Value in 2025 |

USD 20.10 billion |

|

Revenue Forecast in 2034 |

USD 34.29 billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation |

FAQ's

The global hydronic HVAC systems market size was valued at USD 18.96 billion in 2024 and is projected to grow to USD 34.29 billion by 2034.

The global market is projected to grow at a CAGR of 6.1% during the forecast period.

Asia Pacific dominated the hydronic HVAC systems market in 2024.

Some of the key players in the market are A. O. Smith Corporation; Ariston Thermo Group; Bosch Thermotechnology; Carrier; Daikin Industries, Ltd.; Danfoss; Fujitsu General Limited; Grundfos; Johnson Controls International PLC; KSB SE & Co. KGaA; Lennox International Inc.; Mitsubishi Electric Corporation; Trane Technologies; Viessmann Group; and Wilo SE.

The commercial segment dominated the hydronic HVAC systems market in 2024.