Hydrogen Peroxide Market Share, Size, Trends, Industry Analysis Report, By Grade; By Function (Disinfectant, Bleaching, Oxidant, Others); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 123

- Format: PDF

- Report ID: PM1961

- Base Year: 2023

- Historical Data: 2019-2022

Hydrogen Peroxide Market Overview

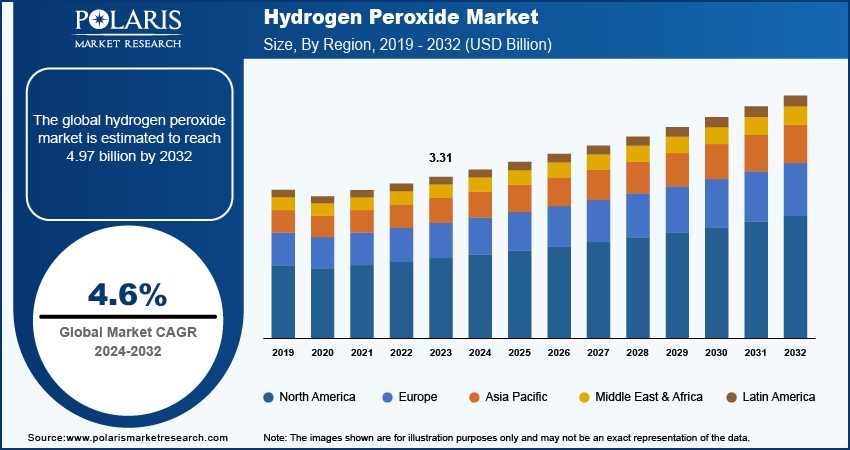

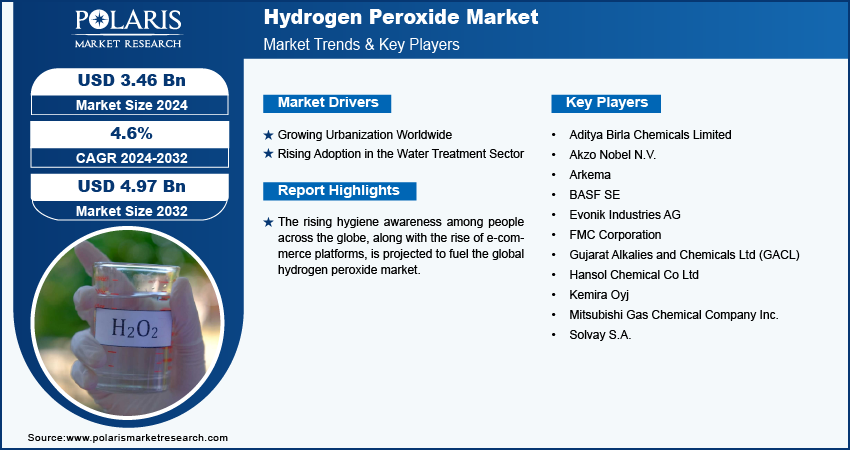

The hydrogen peroxide market size was valued at USD 3.31 billion in 2023. The market is projected to grow from USD 3.46 billion in 2024 to USD 4.97 billion by 2032, exhibiting a CAGR of 4.6 % during 2024–2032.

Hydrogen peroxide (H₂O₂) is a versatile chemical compound recognized for its unique properties and wide-ranging applications. It is the simplest member of the peroxide family, characterized by an oxygen-oxygen single bond, which makes it a reactive oxygen species. In its pure form, hydrogen peroxide appears as a pale blue liquid that is slightly more viscous than water. This compound decomposes readily into water and oxygen, especially in the presence of heat or catalysts, making it both useful and potentially hazardous.

The rising hygiene awareness among people across the globe is propelling the global hydrogen peroxide market. Awareness of hygiene increases the adoption of disinfectant products, leading to rising demand for hydrogen peroxide as it is used in various disinfectant formulations for homes, healthcare facilities, and food processing.

The rise of e-commerce platforms is projected to fuel the global hydrogen peroxide market. E-commerce platforms often feature a diverse range of hydrogen peroxide formulations, including different concentrations and combinations with other cleaning agents. This variety allows consumers to find products that best suit their specific needs, driving higher sales. Moreover, E-commerce sites frequently offer promotions, discounts, and bundled deals, which can attract price-sensitive customers. Special offers can stimulate interest and encourage bulk buying, further increasing overall demand for hydrogen peroxide products.

To Understand More About this Research: Request a Free Sample Report

The market for hydrogen peroxide is expected to grow at a significant CAGR in the coming years, owing to the rising industrialization across the globe. Various industries, including textiles, pulp and paper, and chemicals, utilize hydrogen peroxide as a bleaching and oxidizing agent. Hence, the expansion of these industries drives increased consumption of hydrogen peroxide in production processes, enhancing its demand.

Hydrogen Peroxide Market Driver Analysis

Rising Adoption in the Water Treatment Sector

The hydrogen peroxide market growth is driven by strong demand from the water and effluent treatment sectors. Hydrogen peroxide serves as a powerful oxidizing agent, effectively breaking down contaminants, organic matter, and pollutants in water. Its ability to treat both municipal and industrial wastewater makes it an attractive choice for water treatment facilities aiming to meet regulatory standards. Moreover, increasing regulatory pressures on water quality management compel many facilities to adopt more sustainable and effective treatment methods. Hydrogen peroxide, being environmentally friendly and breaking down into water and oxygen, aligns well with these compliance requirements, leading to its increased usage in water treatment plants.

Growing Urbanization Worldwide

The growing urbanization worldwide is estimated to fuel the global hydrogen peroxide market. According to data published by the World Bank, 56% of the world’s population, which is 4.4 billion inhabitants, live in cities, and this is expected to double by 2050. Urban areas experience higher population density, leading to greater demands for sanitation and hygiene. This heightened focus on cleanliness in public spaces, residential areas, and commercial establishments drives the use of effective disinfectants, including hydrogen peroxide, to maintain safe environments. Moreover, urbanization often leads to the establishment of new healthcare facilities and services. These institutions require reliable disinfectants for patient safety and infection control. Hydrogen peroxide's strong antimicrobial properties make it a preferred choice in hospitals, clinics, and laboratories.

Hydrogen Peroxide

Hydrogen Peroxide Market Breakdown By Function Insights

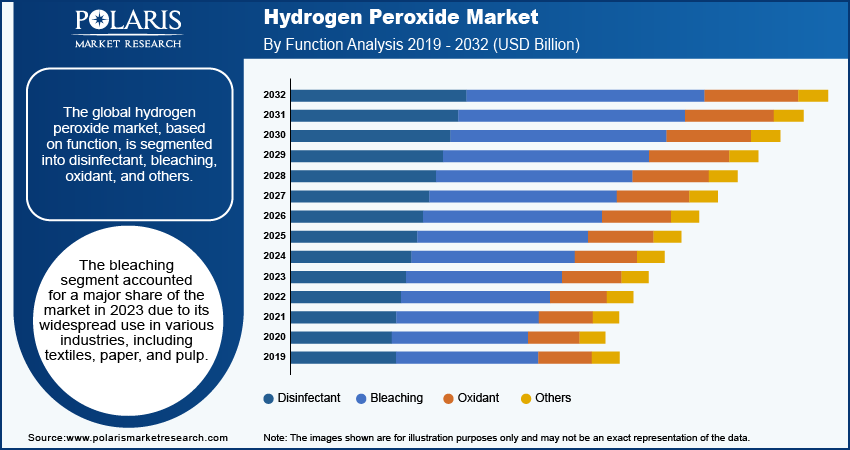

The global hydrogen peroxide market, based on function, is segmented into disinfectant, bleaching, oxidant, and others. The bleaching segment accounted for a major share of the market in 2023 due to its widespread use in various industries, including textiles, paper, and pulp. This segment benefits from the chemical’s effectiveness as a bleaching agent, offering superior performance in achieving bright, white products while minimizing environmental impact. The textile industry, in particular, relies heavily on this function to produce high-quality fabrics. Additionally, innovations in bleaching processes that incorporate this compound enhance its appeal, driving further adoption across multiple sectors.

The disinfectant segment is projected to grow at a robust pace in the coming years owing to the growing health and safety concerns, especially in light of recent global health crises. The rising awareness of hygiene practices in both residential and commercial settings propels the demand for effective cleaning solutions. This chemical's potent antimicrobial properties make it a preferred choice for disinfecting surfaces, particularly in healthcare facilities, food processing plants, and public spaces. Businesses increasingly incorporate disinfectants into their cleaning protocols as regulations around sanitation become more stringent and consumers prioritize cleanliness.

Hydrogen Peroxide Market Breakdown By Application

The global hydrogen peroxide market, by application, is categorized into pulp & paper, chemical synthesis, wastewater treatment, mining, food & beverages, personal care, healthcare, textiles, and others. The pulp & paper segment dominated the market in 2023 due to the essential role of hydrogen peroxide in bleaching processes and the production of high-quality paper products. Hydrogen peroxide acts as an effective and environmentally friendly bleaching agent, enabling manufacturers to achieve bright, white paper without relying on harmful chlorine-based chemicals. Furthermore, advancements in paper production technologies enhance the efficiency of bleaching processes, encouraging more manufacturers to adopt hydrogen peroxide.

The healthcare segment is expected to grow at a rapid pace during the forecast period owing to the heightened focus on hygiene and infection control. The recent global health crises have heightened awareness of the importance of maintaining clean and safe environments in medical facilities. Hydrogen peroxide disinfectant properties make it a crucial choice for sanitizing surfaces, medical equipment, and personal protective equipment. Hospitals and clinics increasingly incorporate effective cleaning solutions such as hydrogen peroxide to safeguard patient health and comply with stringent health regulations. Additionally, the trend toward environmentally friendly disinfectants aligns well with the healthcare sector’s commitment to sustainability, thus driving the market.

Hydrogen Peroxide

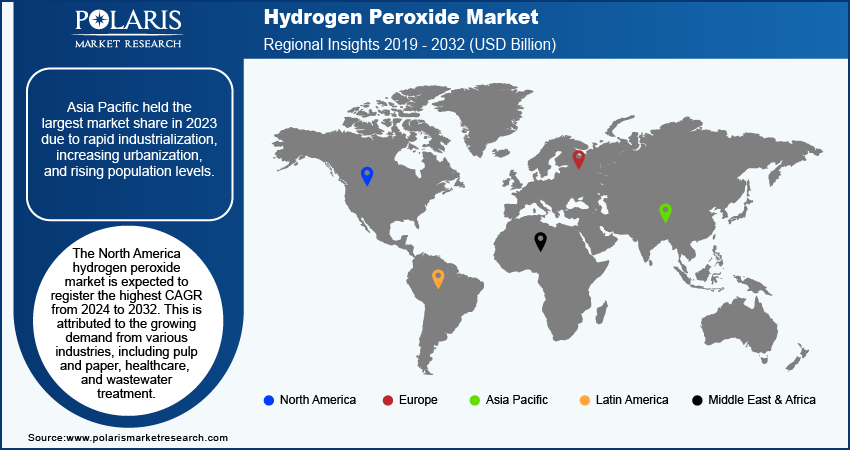

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia pacific held the largest market share in 2023 due to the rapid industrialization, increasing urbanization, and rising population levels. The healthcare sector in countries like China and India is expanding rapidly, which propels the demand for hydrogen peroxide as this chemical compound is widely used in healthcare sector as a surface disinfectant. Moreover, the rise of the textile and food processing industries in Asia-Pacific highlights the need for efficient bleaching and disinfecting agents, thereby driving demand for hydrogen peroxide.

The North America hydrogen peroxide market is expected to register the highest CAGR from 2024 to 2032. This is attributed to the growing demand from various industries, including pulp and paper, healthcare, and wastewater treatment. The region benefits from a well-established industrial base and stringent regulatory frameworks that emphasize safety and environmental sustainability. The US emerged as the major country within this region, capitalizing on its advanced manufacturing capabilities and a strong focus on innovative applications. The expansion of healthcare facilities and heightened awareness of hygiene practices further support demand, positioning North America as a growing region in the market.

Hydrogen Peroxide Market – Key Players and Competitive Insights

The hydrogen peroxide market has been highly competitive due to the presence of numerous established brands. This increased competition has resulted in numerous new product launches, process reforms by patented technologies, and project expansions. Most major industry players involved in manufacturing hydrogen peroxide have established long-term agreements with regional healthcare, waste-water treatment, textile, and chemical synthesis companies. These agreements aim to build sustainable businesses within the ecosystem and expand their market share.

Arkema, Evonik Industries, Solvay, BASF, Akzo Nobel, Kemira Oyj, Hansol Chemical, Mitsubishi Gas Chemical Company, Aditya Birla Chemicals, Gujarat Alkalies and Chemicals, and FMC Corporation are among the major players in the hydrogen peroxide market.

Arkema, founded in 2004 as a spin-off from the French oil and gas company Total, is a global player in specialty chemicals and advanced materials. The company has established a significant presence in the hydrogen peroxide market, positioning itself as one of the largest producers worldwide. Arkema's hydrogen peroxide production facilities are strategically located across the globe, with significant operations in Shanghai, China, and Jarrie, France. The Shanghai facility operates as a joint venture with Shanghai Huayi Energy Chemical Corporation (HYECC), producing high-quality hydrogen peroxide with an annual capacity of 77,000 tons.

Evonik Industries AG, founded in 2007 as a result of the restructuring of RAG AG, is a prominent specialty chemicals company with a strong global presence. The company is headquartered in Essen, Germany, and has grown to become one of the largest specialty chemicals producers in the world, operating in over 100 countries and employing approximately 37,000 people. The company focuses on developing innovative and sustainable solutions across various sectors, including agriculture, automotive, pharmaceuticals, and consumer goods. Among its diverse product offerings, hydrogen peroxide (H₂O₂) plays a crucial role in Evonik's portfolio, reflecting the company's commitment to providing high-quality chemical solutions.

Key Companies in the Hydrogen Peroxide Market

- Aditya Birla Chemicals Limited

- Akzo Nobel N.V.

- Arkema

- BASF SE

- Evonik Industries AG

- FMC Corporation

- Gujarat Alkalies and Chemicals Ltd (GACL)

- Hansol Chemical Co Ltd

- Kemira Oyj

- Mitsubishi Gas Chemical Company Inc.

- Solvay S.A.

Hydrogen Peroxide

August 2024: DCM Shriram opened its hydrogen peroxide (H2O2) facility in Jhagadia, Gujarat, India. The plant, with a production capacity of 52,500 tons per year, is part of the company's chemicals complex and utilizes hydrogen produced on-site.

January 2024: Solvay & Huatai announced their plans to increase their hydrogen peroxide production capacity in China. This expansion decision comes in response to the rising demand for H2O2 as a cleaning agent in the manufacture of PV cells in the photovoltaic (PV) sector.

December 2023: Evonik Industries AG completed the acquisition of Thai Peroxide Co., a Thai manufacturer of the peroxide products. This acquisition increased Evonik's production capacity for various peroxide products, including hydrogen peroxide.

Hydrogen Peroxide Market Segmentation

By Grade Outlook (Volume, Kilotons; Revenue, USD Billion, 2024 - 2032)

- 90% H₂O₂

- 5% H₂O₂

- 6% to 10% H₂O₂

- 3% H₂O₂

By Function Outlook (Volume, Kilotons; Revenue, USD Billion, 2024 - 2032)

- Disinfectant

- Bleaching

- Oxidant

- Others

By Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2024 - 2032)

- Pulp & Paper

- Chemical Synthesis

- Wastewater Treatment

- Mining

- Food & Beverages

- Personal Care

- Healthcare

- Textiles

- Others

By Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2024 - 2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hydrogen Peroxide Market

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 3.31 Billion |

|

Market Size Value in 2024 |

USD 3.46 Billion |

|

Revenue Forecast in 2032 |

USD 4.97 Billion |

|

CAGR |

4.6% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Volume–Kilotons; Revenue–USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global hydrogen peroxide market size was valued at USD 3.31 billion in 2023 and is projected to grow to USD 4.97 billion by 2032

The global market is projected to register a CAGR of 4.6 % during 2024–2032.

Asia Pacific held the largest share of the global market in 2023.

Arkema, Evonik Industries, Solvay, BASF, Akzo Nobel, Kemira Oyj, Hansol Chemical, Mitsubishi Gas Chemical Company, Aditya Birla Chemicals, Gujarat Alkalies and Chemicals, and FMC Corporation are a few of the key players in the market.

The bleaching segment dominated the market in 2023.

The pulp and paper segment accounted for the largest share of the global market in 2023.