Hydrogen Fueling Station Market Size, Share, Trends, Industry Analysis Report: By Size (Small Station, Medium Station, and Large Station), Type, Mobility, Pressure, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 128

- Format: PDF

- Report ID: PM5212

- Base Year: 2024

- Historical Data: 2020-2023

Hydrogen Fueling Station Market Overview

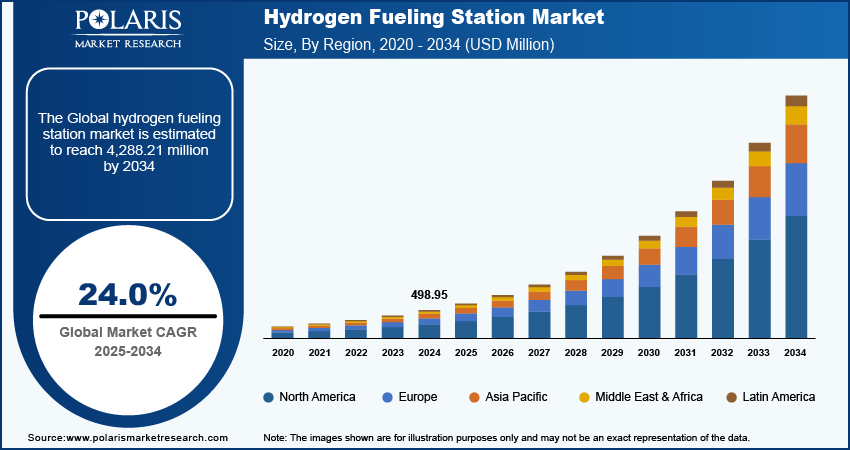

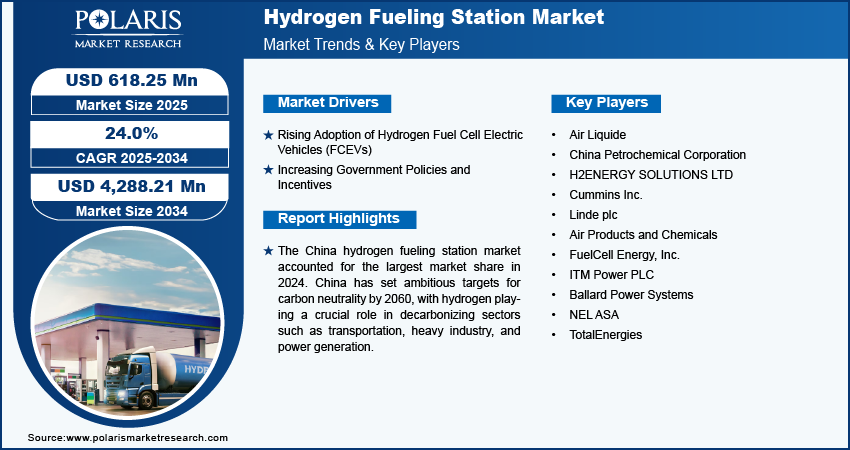

The hydrogen fueling station market size was valued at USD 498.95 million in 2024. The market is projected to grow from USD 618.25 million in 2025 to USD 4,288.21 million by 2034, exhibiting a CAGR of 24.0% during 2025–2034.

A hydrogen fueling station is a facility designed to refuel vehicles powered by hydrogen fuel cells, such as hydrogen fuel cell electric vehicles (FCEVs). Hydrogen fueling stations store, compress, and dispense hydrogen gas, providing an alternative to traditional gasoline or electric vehicle charging stations. Global initiatives, such as the Hydrogen Council and the European Clean Hydrogen Alliance, are promoting collaboration and accelerating hydrogen infrastructure development. These partnerships align public policies and private investments to expand the fueling network, thereby driving the hydrogen fueling station market growth. Furthermore, countries are investing in hydrogen infrastructure to cut fossil fuel reliance, boost energy security, and mitigate geopolitical risks, further contributing to market growth.

Industries, such as manufacturing and e-commerce, are adopting hydrogen fuel cell forklifts and equipment for warehouses and distribution centers. This adoption creates demand for on-site hydrogen fueling stations within industrial facilities, thereby contributing to the hydrogen fueling station market expansion. Moreover, hydrogen is increasingly used in aviation, maritime, and material handling industries beyond passenger vehicles. The establishment of multi-purpose hydrogen fueling hubs supports these sectors, boosting infrastructure demand. Thus, the increasing adoption of hydrogen fuel cells by aviation, maritime, and other industries is further driving the market growth.

To Understand More About this Research: Request a Free Sample Report

Hydrogen Fueling Station Market Driver Analysis

Rising Adoption of Hydrogen Fuel Cell Electric Vehicles (FCEVs)

The growing demand for hydrogen-powered vehicles, including passenger cars, buses, and trucks, is driving the need for fueling infrastructure. FCEVs provide advantages such as faster refueling times (3–5 minutes) and longer driving ranges, making them suitable for long-haul transportation and commercial applications. Owing to the increasing emphasis on clean mobility, governments are supporting FCEVs through subsidies, tax breaks, and zero-emission vehicle (ZEV) mandates, accelerating adoption for hydrogen fueling station. Leading automakers such as Toyota (Mirai), Hyundai (Nexo), and Honda (Clarity) are developing new models and extending hydrogen technology into trucks and public transportation. Public transit authorities are deploying hydrogen-powered buses for sustainable urban mobility, while logistics companies are integrating fuel cell trucks to decarbonize operations. These efforts are increasing demand for hydrogen fueling stations, building a supportive ecosystem for FCEVs. Thus, the increasing adoption of FCEVs propels the hydrogen fueling station market growth.

Increasing Government Policies and Incentives

Governments worldwide are launching subsidies, grants, and tax incentives to accelerate the development of hydrogen infrastructure and promote clean energy adoption. Financial incentives reduce the capital and operational costs associated with building and operating hydrogen fueling stations, encouraging investments from public and private sectors. Several countries offer direct subsidies for constructing hydrogen stations, such as Germany’s National Hydrogen Strategy and Japan’s Hydrogen Roadmap, which provide funding and operational support to expand fueling networks.

Owing to the rising adoption of zero-emission vehicles (ZEVs) and support for hydrogen-powered transportation, various regions have implemented ZEV mandates and carbon neutrality targets. According to the European Commission, the EU Green Deal aims for climate neutrality by 2050, with several member states rolling out hydrogen corridors and station networks. Such government policies and incentives boost the hydrogen fueling station market growth.

Hydrogen Fueling Station Market Segment Insights

Hydrogen Fueling Station Market Breakdown by Size Outlook

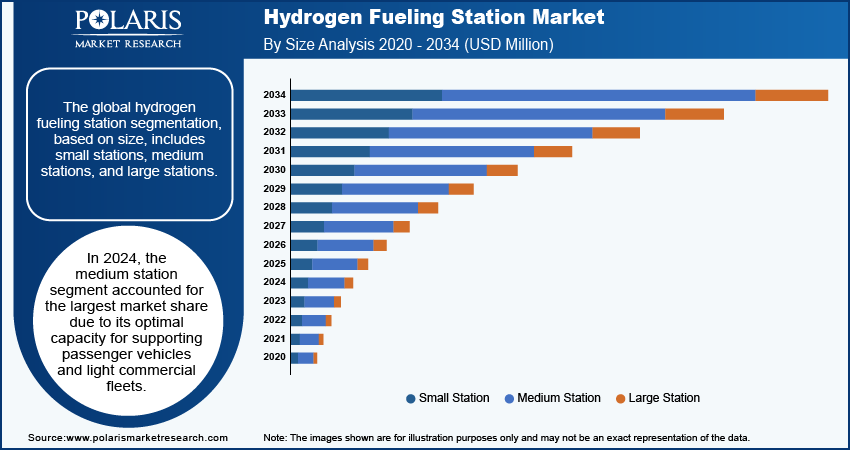

The global hydrogen fueling station segmentation, based on size, includes small station, medium station, and large station. In 2024, the medium station segment accounted for the largest market share due to its optimal capacity for supporting passenger vehicles and light commercial fleets. Medium stations strike a balance between cost-efficiency and service capability, making them ideal for urban areas, intercity routes, and logistics hubs. Governments and private companies are prioritizing medium-sized stations to meet growing demand from hydrogen fuel cell electric vehicles (FCEVs), including buses and delivery trucks, without suffering the higher costs associated with large-scale infrastructure. Additionally, medium stations often feature on-site hydrogen production and storage, enhancing operational flexibility and ensuring continuous fuel availability.

Hydrogen Fueling Station Market Breakdown by Type Outlook

The global hydrogen fueling station market segmentation, based on type, includes on site and off site. The onsite segment is expected to witness a higher CAGR during the forecast period due to the rising adoption of hydrogen as a fuel source for industries aiming to reduce carbon emissions and achieve energy independence. On-site hydrogen production, often utilizing electrolysis, offers a reliable and continuous supply, minimizing transportation costs and logistical challenges associated with off-site delivery. Additionally, the growing deployment of hydrogen-powered fleets, particularly in urban areas for public transport and logistics, necessitates convenient, immediate fueling solutions that on-site stations provide.

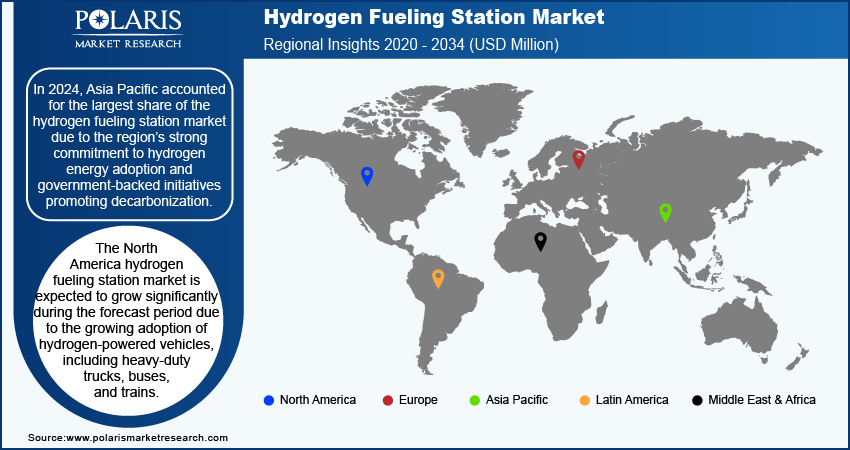

Hydrogen Fueling Station Market Breakdown, by Regional Outlook

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest hydrogen fueling station market share due to the region’s strong commitment to hydrogen energy adoption and government-backed initiatives promoting decarbonization. Countries such as Japan, South Korea, and China are leading with ambitious hydrogen roadmaps, substantial investments, and subsidies aimed at building hydrogen infrastructure. For instance, the Japanese government allocated 460 billion yen (USD 2,990 Million) for the advancement of hydrogen technology; 70% was directed toward the development of fuel cell vehicles and the infrastructure for hydrogen refueling stations between 2012 and 2021.

The China hydrogen fueling station market is expected to grow significantly during the forecast period due to the government's push toward hydrogen adoption as part of its clean energy strategy. China has set ambitious targets for carbon neutrality by 2060, with hydrogen playing a crucial role in decarbonizing sectors such as transportation, heavy industry, and power generation.

The North America hydrogen fueling station market is expected to grow significantly during the forecast period due to the growing adoption of hydrogen-powered vehicles. Hydrogen-powered heavy-duty trucks, buses, trains, and other vehicles drive the need for a wider network of fueling stations. The increasing government policies and investments aimed at accelerating the adoption of hydrogen as a clean fuel alternative is driving demand for hydrogen fueling station. The US and Canada are prioritizing hydrogen development as part of their broader decarbonization strategies, with hydrogen playing a crucial role in reducing emissions across transportation, energy, and industrial sectors.

The US hydrogen fueling station market is expected to grow significantly during the forecast period as states such as California are leading with mandates for zero-emission vehicles and the hydrogen highway network, which aims to establish an extensive network of hydrogen refueling stations.

Hydrogen Fueling Station Market – Key Players and Competitive Insights

The competitive landscape of the hydrogen fueling station market is marked by the presence of major global players, regional collaborations, and innovative startups, all competing to expand their footprint in this emerging sector. Key companies such as Air Liquide, Linde Plc, and Nel ASA leverage their expertise in gas production and distribution to develop extensive refueling networks, focusing on on-site hydrogen generations through electrolysis and off-site supply chains to ensure consistent availability. Energy giants such as Shell Plc and TotalEnergies are integrating hydrogen refueling capabilities into their existing service stations as part of their shift toward cleaner energy solutions.

Automotive companies such as Hyundai Motor Company, Toyota Motor Corporation, and Nikola Corporation are heavily investing in hydrogen-powered vehicles, driving the demand for a wider refueling infrastructure to support their growing fleets. Automotive companies often collaborate with governments and energy providers to establish strategically located stations. Additionally, the market is seeing the emergence of new players specializing in modular and mobile refueling solutions to meet the needs of smaller fleets and remote locations. The intense focus on zero-emission mobility, supported by favorable government policies and subsidies, further accelerates competition, making innovation and strategic partnerships critical for market players to secure a competitive edge. A few key major hydrogen fueling station market players are Air Liquide; China Petrochemical Corporation; H2ENERGY SOLUTIONS LTD; Cummins Inc.; Linde plc; Air Products and Chemicals; FuelCell Energy, Inc.; ITM Power PLC; Ballard Power Systems; NEL ASA; and TotalEnergies.

Air Liquide offers gases-related technologies and services. The company is operating by three business segment—gas and services, engineering and construction, and global markets and technologies. The gas and services segment provides operation management and performance monitoring services. While, the engineering and construction segment develops industrial gas production plants for the plants in the renewable, traditional, and alternative energy sectors. In June 2023, Air Liquide and Iveco Group partnered to build Europe's first high-pressure hydrogen refueling station for trucks in Marseille, France. This collaboration aims to enhance hydrogen's role in the transportation sector's energy transition, combining Air Liquide's expertise in the hydrogen value chain with Iveco's experience in alternative fuel vehicles.

Linde plc is a global industrial gases and engineering company serving customers across various industries. The company was formed through the merger of German-based Linde AG and US-based Praxair, Inc. in 2018 and is now headquartered in Dublin, Ireland. It has since become one of the largest industrial gas companies in the world, with a presence in over 100 countries. In August 2022, Linde launched the first hydrogen refueling infrastructure specifically designed for passenger trains in Bremervörde, Germany. This innovative system enhances the operational capabilities of hydrogen-powered trains, facilitating a shift toward more sustainable rail transport by providing a reliable and efficient refueling solution.

Key Companies in the Hydrogen Fueling Station Industry Outlook

- Air Liquide

- China Petrochemical Corporation

- H2ENERGY SOLUTIONS LTD

- Cummins Inc.

- Linde plc

- Air Products and Chemicals

- FuelCell Energy, Inc.

- ITM Power PLC

- Ballard Power Systems

- NEL ASA

- TotalEnergies

Hydrogen Fueling Station Industry Developments

In October 2023, FirstElement Fuel Inc. launched a high-capacity hydrogen station in Oakland, California, expanding its True Zero network to 41 locations. Featuring four dispensers with a daily capacity of 1,600 kg for H70 fills, this station was developed in partnership with Hyundai Motor for the deployment of 30 XCIENT fuel cell trucks. It will become the world’s largest heavy-duty hydrogen fueling station, supporting various hydrogen-powered commercial vehicles.

In November 2023, Calvera Hydrogen launched two refueling hydrogen stations in Poland, located in Katowice and Poznań, designed for cars and buses. Each station features compression modules, dispensers, storage systems, tube trailers, and a control system for efficient refueling.

In December 2021, Cummins Inc. and Sinopec Group have formed a 50:50 joint venture. This partnership aims to enhance the cost-effectiveness and accessibility of green hydrogen via increased technological innovation and expanded R&D and manufacturing capabilities.

Hydrogen Fueling Station Market Segmentation

By Size Outlook (Revenue, USD Million; Volume, Units; 2020–2034)

- Small Station

- Medium Station

- Large Station

By Type Outlook (Revenue, USD Million; Volume, Units; 2020–2034)

- On Site

- Off Site

By Mobility Outlook (Revenue, USD Million; Volume, Units; 2020–2034)

- Fixed Hydrogen Station

- Mobile Hydrogen Station

By Pressure Outlook (Revenue, USD Million; Volume, Units; 2020–2034)

- Low Pressure

- High Pressure

By End Use Outlook (Revenue, USD Million; Volume, Units; 2020–2034)

- Marine

- Railways

- Commercial Vehicles

- Aviation

By Regional Outlook (Revenue, USD Million; Volume, Units; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hydrogen Fueling Station Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 498.95 million |

|

Market Size Value in 2025 |

USD 618.25 million |

|

Revenue Forecast by 2034 |

USD 4,288.21 million |

|

CAGR |

24.0% from 2024 to 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million in Units and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global hydrogen fueling station market size was valued at USD 498.95 million in 2024 and is projected to grow to USD 4,288.21 million by 2034.

The global market is projected to register a CAGR of 24.0% during the forecast period.

In 2024, Asia Pacific dominated the market due to the region’s strong commitment to hydrogen energy adoption and government-backed initiatives promoting decarbonization.

A few key players in the market are Air Liquide; China Petrochemical Corporation; H2ENERGY SOLUTIONS LTD; Cummins Inc.; Linde plc; Air Products and Chemicals; FuelCell Energy, Inc.; ITM Power PLC; Ballard Power Systems; NEL ASA; and TotalEnergies.

In 2024, the medium station segment dominated the market share due to its optimal capacity for supporting passenger vehicles and light commercial fleets.

The on-site segment is expected to witness a higher CAGR during the forecast period due to the rising adoption of hydrogen as a fuel source for industries aiming to reduce carbon emissions and achieve energy independence.