Hydrochloric Acid Market Size, Share, Trends, Industry Analysis Report: By Grade (Synthetic Grade and By-Product Grade), Application, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM3179

- Base Year: 2024

- Historical Data: 2020-2023

Hydrochloric Acid Market Overview

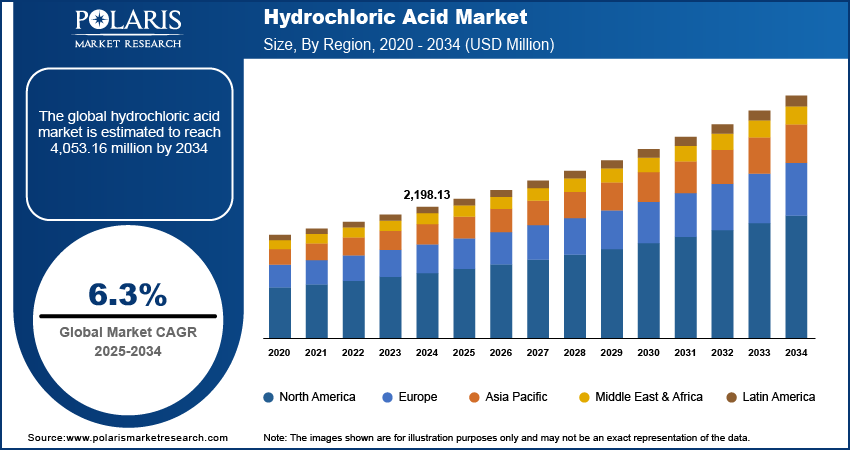

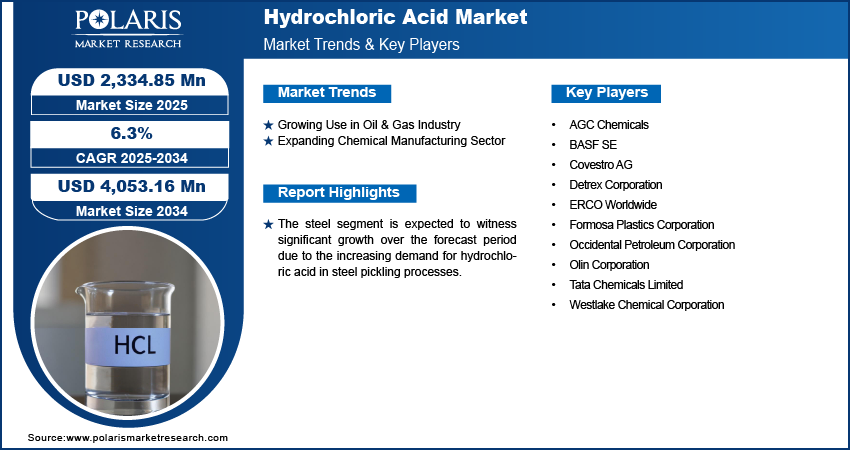

The global hydrochloric acid market size was valued at USD 2,198.13 million in 2024. The market is expected to grow from USD 2,334.85 million in 2025 to USD 4,053.16 million by 2034, exhibiting a CAGR of 6.3% from 2025 to 2034.

The hydrochloric acid market involves the global trade and production of hydrochloric acid (HCl). HCI is a highly versatile and widely used chemical in various industries, including chemical processing, steel production, food and beverage, pharmaceuticals, water treatment, and oil & gas.

The hydrochloric acid market growth is significantly driven by its extensive use in steel pickling, where it removes impurities and scale from steel surfaces, particularly in the automotive, construction, and manufacturing industries. Hydrochloric acid is also extensively used in pharmaceutical formulations, particularly in API synthesis, and as an acidifier in food processing, further supporting market growth.

To Understand More About this Research: Request a Free Sample Report

The increased demand for hydrochloric acid-based disinfectants, sanitizers, and cleaning agents, particularly in the post-pandemic era, is driving the hydrochloric acid market expansion. Furthermore, stringent environmental regulations and rising concerns about water pollution have increased the demand for hydrochloric acid, where it’s used in pH regulation, wastewater treatment, and desalination plants.

Hydrochloric Acid Market Dynamics

Growing Use in Oil & Gas Industry

Hydrochloric acid is widely used in the oil & gas industry for enhanced oil recovery (EOR) and well acidizing processes. The acid is injected into underground formations to dissolve limestone, dolomite, and other carbonate-based rocks, improving permeability and allowing for greater oil and gas extraction. This process significantly enhances production efficiency, making hydrochloric acid a key component in unconventional oil and gas exploration, particularly in shale gas extraction. Additionally, hydrochloric acid is utilized in oil and gas descaling and cleaning pipelines, refining crude oil, and maintaining petrochemical processing units, boosting its industrial significance. The rising global energy demand and increasing investments in deepwater and offshore drilling projects have created market opportunities in the energy sector. For instance, in December 2024, Shell Nigeria Exploration and Production Company Limited, a subsidiary of Shell plc, announced a final investment decision (FID) for the Bonga North deepwater project in Nigeria. Thus, the hydrochloric acid market dynamics are heavily influenced by its essential role in the oil & gas industry.

Expanding Chemical Manufacturing Sector

Hydrochloric acid has widespread applications in the chemical manufacturing industry, where it serves as a fundamental raw material in the production of chlorides, fertilizers, dyes, and various inorganic compounds. The acid plays a crucial role in chemical synthesis, pH control, and catalyst regeneration, making it indispensable for numerous industrial processes. The increasing demand for chlorinated compounds, such as polyvinyl chloride (PVC), calcium chloride, and pharmaceutical-grade salts, has contributed to the market growth. Additionally, the agricultural sector's reliance on hydrochloric acid for the production of fertilizers, particularly ammonium chloride, is strengthening its market position. Furthermore, the push toward sustainable chemical processes and green manufacturing initiatives is driving research into hydrochloric acid recycling and recovery technologies. For instance, in Oct 2023, the Biden-Harris Administration awarded approximately USD 51 million to Ohio's Sustainable Polymers Tech Hub through its Tech Hubs Program. This funding aims to enhance advanced manufacturing capabilities. As a result, the expanding chemical manufacturing sector is propelling the hydrochloric acid market revenue.

Hydrochloric Acid Market Segment Insights

Hydrochloric Acid Market Assessment by Product Outlook

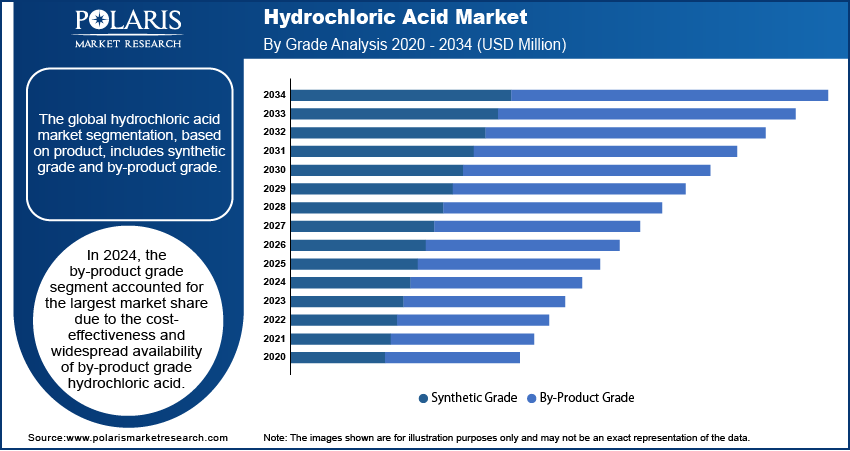

The global hydrochloric acid market segmentation, based on product, includes synthetic grade and by-product grade. In 2024, the by-product grade segment accounted for the largest market share due to the cost-effectiveness and widespread availability of by-product grade hydrochloric acid. By-product grade hydrochloric acid is generated as a secondary product during chemical manufacturing processes such as chlorinated solvents, polyurethane production, and vinyl chloride monomer (VCM) synthesis. Industries prefer by-product grade hydrochloric acid due to its suitability for various industrial applications, including steel pickling, water treatment, and chemical synthesis. The rising emphasis on resource optimization and waste reduction in the chemical industry has strengthened the adoption of by-product grade hydrochloric acid, enhancing market opportunities and promoting sustainable industrial practices.

Hydrochloric Acid Market Evaluation by End-Use Industry Outlook

The global hydrochloric acid market segmentation based on end-use industry, includes food and beverages, pharmaceuticals, textile, steel, oil & gas, and chemical industry. The steel segment is expected to witness significant growth during the forecast period. The segment’s growth is primarily driven by the increasing demand for hydrochloric acid in steel pickling processes, which remove oxide layers and scale from carbon steel, stainless steel, and alloy steel surfaces. The expansion of the construction, automotive, and infrastructure sectors has led to a surge in steel production, further driving segmental growth. Additionally, advancements in metal processing technologies and the increasing adoption of high-performance steel products in various industries are strengthening the role of hydrochloric acid in steel manufacturing and treatment.

Hydrochloric Acid Market Regional Analysis

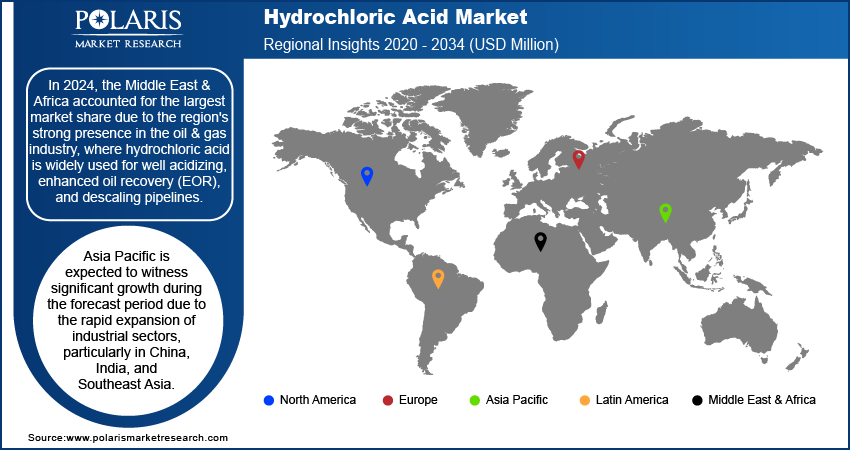

By region, the study provides the hydrochloric acid market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the Middle East & Africa accounted for the largest share of the global market due to the region's strong presence in the oil & gas industry, where hydrochloric acid is widely used for well acidizing, EOR, and descaling pipelines. For instance, according to the International Energy Agency, the Middle East & Africa is home to five of the world's top ten oil producers – the United Arab Emirates, Iraq, Saudi Arabia, Iran, and Kuwait – and three of the top twenty gas producers. In 2022, the region accounted for over 40% of global oil exports, highlighting its significance in the energy sector. Additionally, the growing chemical manufacturing sector, along with increased investments in water treatment facilities and industrial processing, has contributed to market expansion in the region.

The Asia Pacific hydrochloric acid market is expected to witness significant growth during the forecast period due to the rapid expansion of industrial sectors, particularly in China, India, and Southeast Asia. The region's growing steel industry, driven by large-scale construction, infrastructure development, and automotive manufacturing, is a major factor fueling market growth. For instance, according to the World Steel Association, in 2023, India was the second-largest crude steel producer, with 140.8 million metric tons (MT), following China, which led with 1,019.1 MT. Japan ranked third at 87.0 MT. Additionally, increasing demand for hydrochloric acid in the chemical, pharmaceutical, and food & beverage industries is contributing to market expansion. The rising population, urbanization, and economic growth have also led to a surge in water treatment initiatives, further driving regional market demand.

Hydrochloric Acid Market – Key Players and Competitive Insights

The hydrochloric acid market is characterized by intense competition, with key players focusing on capacity expansion, strategic partnerships, product innovation, and sustainability initiatives to strengthen their market position. Major companies operating in the market include Olin Corporation, BASF SE, Dow Inc., Westlake Chemical Corporation, Covestro AG, Tata Chemicals Ltd., AGC Inc., and Detrex Corporation.

Companies are increasing production capacities to meet the rising hydrochloric acid market demand, particularly in sectors like steel, oil & gas, chemicals, and pharmaceuticals. Additionally, players are investing in technological advancements for the recovery and recycling of hydrochloric acid, aligning with growing environmental regulations and sustainability trends. Strategic mergers and acquisitions are also shaping the market expansion, as companies aim to strengthen supply chain efficiencies and enhance their presence in high-growth regions like Asia Pacific and the Middle East. Fluctuations in raw material prices, energy costs, and stringent environmental regulations pose challenges to market players, driving a shift toward green chemistry and sustainable manufacturing practices.

BASF SE is engaged in the production and marketing of chemicals, plastics, and performance products, specializing in a wide array of industrial applications. Founded in 1865 and headquartered in Ludwigshafen, Germany, BASF's product portfolio includes solvents, adhesives, surfactants, and agricultural solutions. The company is a significant player in the hydrochloric acid market, producing this chemical for various applications such as metal processing and pH regulation in industrial processes. BASF operates globally with a presence in multiple regions including Europe, Asia Pacific, and North America, leveraging its extensive network of manufacturing facilities to meet diverse customer needs.

Olin Corporation is engaged in the manufacturing of chemical products and ammunition, specializing in chlor-alkali products and epoxy resins. The company was founded in 1892 and headquartered in Missouri, US. Olin's product portfolio includes hydrochloric acid used primarily in water treatment, oilfield services, and chemical synthesis. The company has a strong presence in the North American market and operates several production facilities that support its chemical manufacturing operations.

List of Key Companies in Hydrochloric Acid Market

- AGC Chemicals

- BASF SE

- Covestro AG

- Detrex Corporation

- ERCO Worldwide

- Formosa Plastics Corporation

- Occidental Petroleum Corporation

- Olin Corporation

- Tata Chemicals Limited

- Westlake Chemical Corporation

Hydrochloric Acid Industry Developments

In January 2025, Jones-Hamilton Co. acquired Nexchlor LLC, enhancing its hydrochloric acid portfolio and solidifying its position as a leading North American supplier in the sector.

In March 2021, ProPetro Holding Corp., Solnexus Chemical, and Fluid Energy Group formed a partnership to advance Modified Acid, Enviro-Syn, and Synthetic Acid technologies in the Permian Basin. This collaboration focuses on improving efficiency and sustainability in acidizing operations, utilizing innovative formulations that enhance reservoir performance while minimizing environmental impact.

In May 2024, Wynnchurch Capital, L.P. announced the acquisition of Reagent Chemical & Research, LLC. Reagent is a key specialty distributor of hydrochloric acid in North America.

Hydrochloric Acid Market Segmentation

By Grade Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Synthetic Grade

- By-Product Grade

By Application Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Steel Pickling

- Oil Well Acidizing

- Ore Processing

- Food Processing

- Pool Sanitisation

- Calcium Chloride

- Biodiesel

By End-Use Industry Outlook (Volume, Kilotons; Revenue, USD Million; 2020– 2034)

- Food and Beverages

- Pharmaceuticals

- Textile

- Steel

- Oil & Gas

- Chemical Industry

By Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hydrochloric Acid Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,198.13 million |

|

Market Size Value in 2025 |

USD 2,334.85 million |

|

Revenue Forecast by 2034 |

USD 4,053.16 million |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million, Volume in kilotons, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global hydrochloric acid market size was valued at USD 2,198.13 million in 2024 and is projected to grow to USD 4,053.16 million by 2034.

• The global market is projected to register a CAGR of 6.3% during the forecast period.

• In 2024, the Middle East & Africa accounted for the largest market share due to the region's strong presence in the oil & gas industry, where hydrochloric acid is widely used for well acidizing, enhanced oil recovery (EOR), and descaling pipelines.

• Some of the key players in the market are BASF SE, Covestro AG Olin Corporation, Westlake Chemical Corporation, Occidental Petroleum Corporation, Formosa Plastics Corporation, Tata Chemicals Limited, AGC Chemicals, ERCO Worldwide, and Detrex Corporation.

• In 2024, the by-product grade segment accounted for the largest market share due to the cost-effectiveness and widespread availability of by-product grade hydrochloric acid.

• The steel segment is expected to witness significant growth during the forecast period due to the increasing demand for hydrochloric acid in steel pickling processes.