HVAC Accessories Market Size, Share, Trends, Industry Analysis Report: By Product, Distribution Channel (Online and Offline), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM5509

- Base Year: 2024

- Historical Data: 2020-2023

HVAC Accessories Market Overview

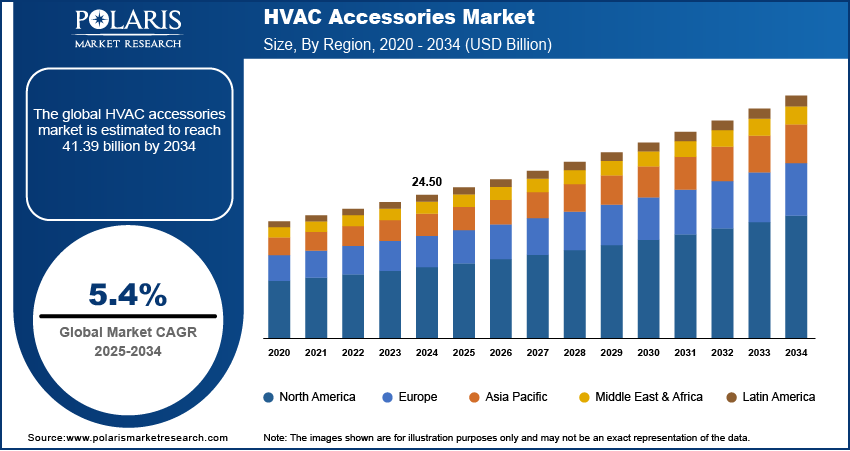

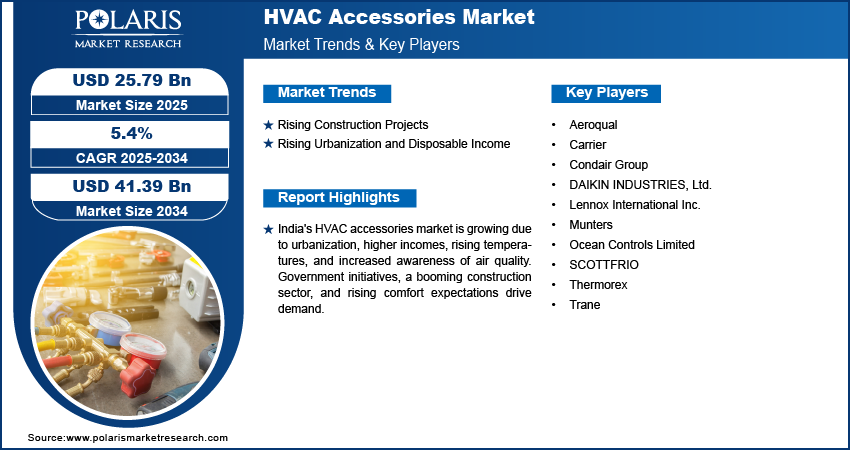

HVAC accessories market size was valued at USD 24.50 billion in 2024. The market is projected to grow from USD 25.79 billion in 2025 to USD 41.39 billion by 2034, exhibiting a CAGR of 5.4% during the forecast period. HVAC accessories are additional components or tools that enhance the functionality, installation, and maintenance of heating, ventilation, and air conditioning systems. These include items such as thermostats, air filters, dampers, vents, and insulation materials that improve system performance and energy efficiency.

Energy costs are rising, leading both consumers and businesses to seek ways to reduce utility bills, which makes energy-efficient HVAC systems increasingly popular. HVAC accessories such as smart thermostats, high-efficiency filters, and zoning systems help optimize energy use by adjusting the temperature based on occupancy or time of day. These accessories reduce energy waste, directly lowering heating and cooling costs. Additionally, growing environmental awareness is further driving consumers to choose solutions that lower energy consumption and minimize greenhouse gas emissions, driving the HVAC accessories market growth.

To Understand More About this Research: Request a Free Sample Report

Increased awareness of the importance of indoor air quality is driving the market. People are becoming more conscious of how poor indoor air quality negatively affects health, especially in urban environments where pollution levels can be high. Accessories including air purifiers, humidity control systems, and advanced filtration systems help clean and maintain the air inside homes and buildings. This growing concern for respiratory health and overall well-being is encouraging consumers to invest in HVAC accessories that improve indoor air quality, thereby driving the growth of the HVAC accessories market demand.

HVAC Accessories Market Dynamics

Rising Construction Projects

The number of new construction and renovation projects is growing, particularly in residential, commercial, and industrial buildings. According to the US Census Bureau, in January 2025, 1,659,000 new construction projects were completed in the US alone. These new buildings require HVAC systems and the necessary accessories for optimal performance while existing structures are often upgraded to improve energy efficiency and comfort. For example, during renovations, homeowners may replace outdated thermostats or add air purifiers to enhance indoor air quality. The need for supporting accessories, such as air filters, dampers, and sensors, increases as the demand for modern HVAC systems grows in newly built and renovated properties, expanding the HVAC accessories market.

Rising Urbanization and Disposable Income

Rising urbanization globally is driving the demand for HVAC systems in both residential and commercial settings, due to which the demand for HVAC accessories is rising. For instance, according to the World Bank Group, in 2023, 57% of the total population lives in urban areas, showcasing the growth in the urban population. Additionally, the rising demand for HVAC systems in urban areas is driven by the rising disposable income of the general population. According to the US Bureau of Economic Analysis, in the US alone, disposable income rose by 0.1% every month in 2024. This growth in disposable income is supporting the general population to spend more on HVAC equipment.

HVAC Accessories Market Segment Analysis

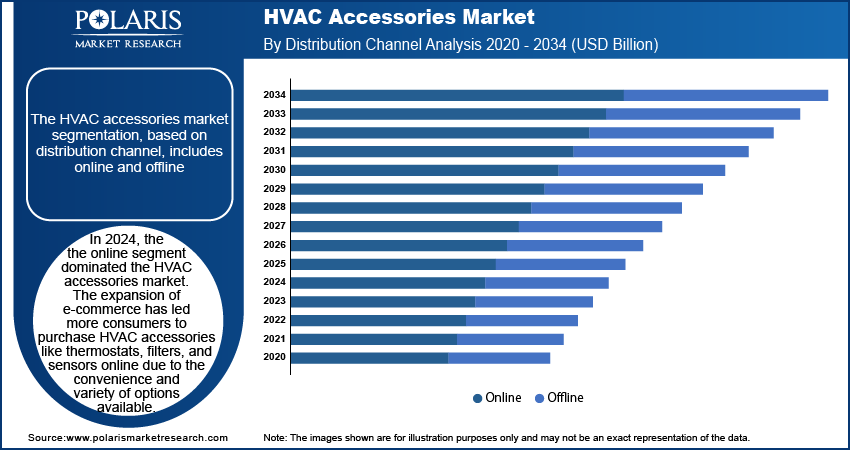

HVAC Accessories Market Assessment by Distribution Channel

The HVAC accessories market segmentation, based on distribution channel, includes online and offline. The online segment is expected to witness significant growth during the forecast period. E-commerce expansion has led more consumers to purchase HVAC accessories such as thermostats, filters, and sensors online due to the convenience and variety of options available. Online platforms offer detailed product information, customer reviews, and competitive pricing, helping consumers make informed purchasing decisions. The ability to compare different brands and models from the comfort of home has made online shopping the preferred choice, thereby driving the segmental growth in the market.

HVAC Accessories Market Evaluation by Product

The HVAC accessories market segmentation, based on product, includes thermostats, sensors, control systems, vibration isolators, and others. The thermostats segment dominated the HVAC accessories market in 2024 driven by increasing consumer demand for energy efficiency and convenience. Smart thermostats, in particular, are becoming popular due to their ability to learn user preferences and adjust temperatures automatically, offering better control and energy savings. These devices allow users to remotely control their home’s heating and cooling systems, improving comfort while reducing energy consumption. The demand for advanced thermostats has surged as consumers are becoming more conscious of both their environmental impact and utility costs, thereby driving the segmental growth.

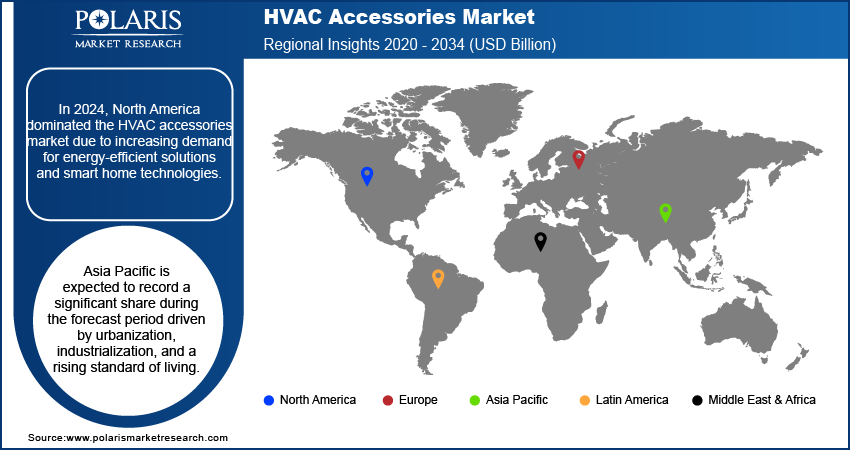

HVAC Accessories Market Regional Analysis

By region, the study provides the HVAC accessories market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to increasing demand for energy-efficient solutions and smart home technologies. Rising energy costs and a growing focus on sustainability have prompted both residential and commercial consumers to invest in advanced HVAC accessories such as smart thermostats, air quality monitors, and high-efficiency filters. Additionally, the region's strong construction and renovation sectors are further contributing to the rising demand for these accessories. Government incentives promoting energy-saving technologies support the adoption of HVAC accessories by the general population, thereby driving the growth of the HVAC accessories market in North America.

Asia Pacific is expected to record a significant HVAC accessories market share during the forecast period driven by urbanization, industrialization, and a rising standard of living. Countries such as China, Japan, and South Korea are leading the demand for energy-efficient HVAC solutions, as both residential and commercial sectors prioritize improving comfort and energy savings. Increasing temperatures in many parts of the region have led to a surge in demand for cooling systems and accessories such as air purifiers and smart thermostats. Additionally, government initiatives promoting sustainability, energy efficiency, and smart technology adoption further accelerate the growth of HVAC accessories, thereby driving the market growth in Asia Pacific.

The HVAC accessories market in India is experiencing substantial growth due to rapid urbanization, rising disposable incomes, and increased awareness of indoor air quality and energy efficiency. Rising temperatures have prompted both consumers and businesses to invest in advanced HVAC systems and accessories such as air purifiers, thermostats, and humidity controllers. The growing construction sector, particularly in commercial and residential buildings, further fuels demand for these products. A booming population and rising comfort expectations are further driving the demand for HVAC accessories.

HVAC Accessories Market Key Players & Competitive Analysis Report

The HVAC accessories market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. According to the market analysis, this competitive trend is amplified by continuous progress in product offerings. Major players in the market include Aeroqual; Carrier; Condair Group; Daikin Industries, Ltd.; Lennox International Inc.; Munters; Ocean Controls Limited; Scottfrio; Thermorex; and Trane.

Daikin Industries, Ltd. is a Japanese multinational company based in Osaka, Japan. Established in 1924, it is a major manufacturer of air conditioners and provides various air conditioning and refrigeration Accessories. Daikin operates globally, offering a range of products, including air conditioning systems, refrigerants, chemicals, oil hydraulics, defense systems, and medical equipment. Its product portfolio includes residential and commercial air conditioners, air purifiers, large-sized chillers, and marine vessel air conditioners. Additionally, Daikin produces chemicals such as fluorocarbons, fluoroplastics, and fluoroelastomers, as well as pharmaceutical intermediates. The company also manufactures industrial hydraulic equipment and mobile hydraulic systems and produces home-use oxygen therapy equipment and rebreathers in its medical equipment division. Furthermore, it manufactures components for guided missiles in its defense systems segment. Daikin is involved in the development and manufacturing of both air conditioners and refrigerants, which is a notable aspect of its operations. The company operates in multiple regions, including Asia, where it has significant operations in Japan, China, Southeast Asia, and India. In Europe, Daikin has a presence with various subsidiaries and manufacturing facilities. It entered the North American market and expanded through acquisitions such as McQuay International. Daikin also operates in Africa, with operations in Egypt and other regions, and maintains a presence in Latin America and Oceania. The company's global operations are supported by a network of over 349 consolidated subsidiaries and a sales and service network across more than 150 countries.

Munters is a Swedish company established in 1955 by Carl Munters, specializing in climate control solutions. It operates globally, with a presence in over 30 countries. Munters provides air treatment and climate control solutions across various industries, including agriculture, pharmaceuticals, and data centers. The company operates within three main business areas: AirTech, FoodTech, and Data Center Technologies. AirTech involves air treatment solutions for precise humidity and temperature control. FoodTech focuses on optimizing food production and supplies climate systems for farming and greenhouses. Data Center Technologies provides cooling solutions for data centers. Munters' product range includes air intakes, coolers, humidifiers, dehumidifiers, climate controllers, fans, heaters, heat exchangers, and mist eliminators. These products are designed to meet the specific needs of different industries, ensuring appropriate environmental conditions for production and operation. Munters operates across several regions, including the Americas, Europe, the Middle East, and Africa (EMEA), and Asia Pacific.

Key Companies in HVAC Accessories Market

- Aeroqual

- Carrier

- Condair Group

- DAIKIN INDUSTRIES, Ltd.

- Lennox International Inc.

- Munters

- Ocean Controls Limited

- SCOTTFRIO

- Thermorex

- Trane

HVAC Accessories Market Development

January 2025: The ecobee Smart Thermostat Essential was launched at CES 2025. It offers energy savings, ease of use, and enhanced comfort. It was designed to provide affordable smart home solutions to customers.

HVAC Accessories Market Segmentation

By Product Outlook (Revenue USD Billion, 2020–2034)

- Thermostats

- Sensors

- Control Systems

- Vibration Isolators

- Others

By Distribution Channel Outlook (Revenue USD Billion, 2020–2034)

- Online

- Offline

By Application Outlook (Revenue USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

HVAC Accessories Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 24.50 billion |

|

Market Size Value in 2025 |

USD 25.79 billion |

|

Revenue Forecast in 2034 |

USD 41.39 billion |

|

CAGR |

5.4% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The HVAC accessories market size was valued at USD 24.50 billion in 2024 and is projected to grow to USD 41.39 billion by 2034.

The global market is projected to register a CAGR of 5.4% during the forecast period, 2025-2034.

North America had the largest share of the global market in 2024.

The key players in the market are Aeroqual; Carrier; Condair Group; Daikin Industries, Ltd.; Lennox International Inc.; Munters; Ocean Controls Limited; Scottfrio; Thermorex; and Trane.

The thermostats segment dominated the HVAC accessories market in 2024 driven by increasing consumer demand for energy efficiency and convenience.

The online segment is expected to witness significant growth in the forecast period. E-commerce expansion has led more consumers to purchase HVAC accessories like thermostats, filters, and sensors online due to the convenience and variety of options available.