Hotel Management Software Market Size, Share, Trends, Industry Analysis Report

: By Type, Deployment (On-Premises, Cloud, and Hybrid), End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1676

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

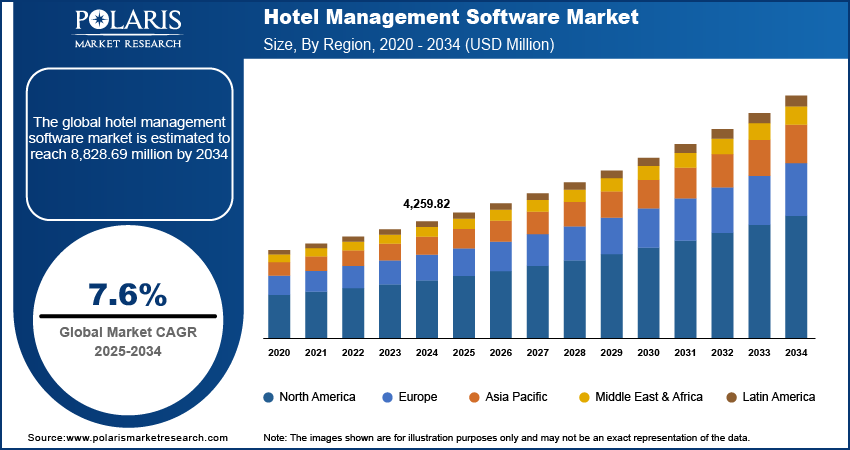

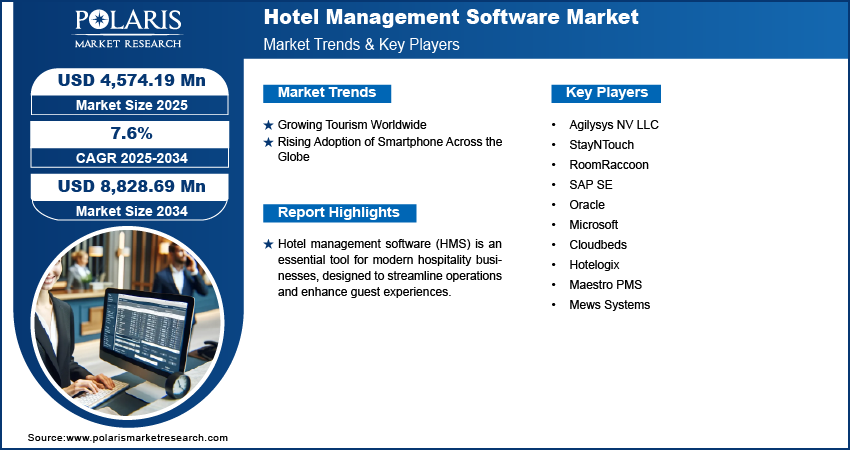

Hotel management software market size was valued at USD 4,259.82 million in 2024, growing at a CAGR of 7.6 % during the forecast period. The market is driven by rising automation in hospitality, increasing demand for personalized guest experiences, growing global tourism, and widespread smartphone adoption, enabling mobile-integrated hotel operations.

Key Insights

- The property management dominated the market in 2024 due to its role in streamlining operations such as housekeeping, room assignments, and maintenance across locations.

- The cloud sector led the market in 2024, offering cost-effective scalability, remote access, real-time updates, and seamless integration across hotel operations.

- North America held the largest market share in 2024 due to high tech adoption, strong hospitality infrastructure, and demand for personalized guest experiences.

- Asia Pacific is expected to grow at the highest rate, driven by tourism growth, digital transformation, and rising demand for modern hotel solutions.

Industry Dynamics

- Rising international tourist arrivals drive the need for hotels to streamline bookings, operations, and communication across multiple channels.

- The widespread use of smartphones drives demand for mobile-integrated HMS, enhancing booking, communication, and operational efficiency for hotels.

- Increased demand for mobile-compatible solutions opens opportunities for HMS providers to develop mobile-first platforms enhancing guest experience and operational efficiency.

- High initial investment costs for HMS software may limit adoption among smaller hotels and independent establishments with budget constraints.

Market Statistics

2024 Market Size: USD 4,259.82 million

2034 Projected Market Size: USD 8,828.69 million

CAGR (2025–2034): 7.6%

North America: Largest market in 2024

AI Impact on Hotel Management Software Market

- AI-powered chatbots enhance guest interaction, providing personalized service and instant responses, improving customer satisfaction and engagement.

- AI-driven data analytics allows for better demand forecasting, dynamic pricing, and inventory management, optimizing hotel revenue.

- Machine learning algorithms optimize housekeeping schedules, reducing costs and ensuring efficient use of resources based on real-time data.

- AI-based recommendation systems improve guest experiences by suggesting personalized services, amenities, and activities tailored to individual preferences.

To Understand More About this Research: Request a Free Sample Report

Hotel management software (HMS) is an essential tool for modern hospitality businesses, designed to streamline operations and enhance guest experiences. This software encompasses a wide range of functionalities that facilitate the management of hotel activities, including reservations, front desk operations, housekeeping, billing, and financial reporting.

The rising trend of automation in the hospitality industry is driving the global hotel management software market. Automation technologies, such as self-check-in kiosks, automated booking systems, and AI-powered customer service tools, require centralized management, which HMS provides. HMS enables seamless coordination between various automated systems, including housekeeping, front desk operations, and revenue management, ensuring real-time data updates and improved decision-making.

The hotel management software market growth is driven by increasing demand for enhanced guest experiences. Travelers around the world expect convenience, customization, and efficiency, which HMS facilitates by integrating guest data, preferences, and interactions into a centralized system. HMS enables hotels to anticipate guest needs and deliver personalized experiences with features such as personalized booking options, automated communication, and real-time feedback management. Furthermore, the software supports advanced analytics and customer relationship management, helping hotels identify trends and implement improvements. This encourages hotels and resorts to adopt HMS software to provide tailored preferences.

Hotel Management Software Market Dynamics

Growing Tourism Worldwide

The growing tourism worldwide is projected to propel the global hotel management software market demand. According to the UN Tourism World Tourism Barometer, an estimated 1.1 million international tourist arrivals were recorded in January-September 2024, about 11% more than in the same period of 2023. Hotels face the challenge of handling diverse operational needs, such as managing bookings across multiple channels, streamlining check-ins and check-outs, and ensuring seamless communication with international guests as global travel rises. HMS provides the technological infrastructure to automate and optimize these processes, allowing hotels to scale operations without compromising service quality. Additionally, the software supports dynamic pricing, revenue management, and multilingual capabilities, enabling hotels to cater to a global clientele effectively.

Rising Adoption of Smartphone Across the Globe

The rising adoption of smartphones across the globe is estimated to fuel the global hotel management software market. According to GSMA’s annual State of Mobile Internet Connectivity Report 2023, over half (54%) of the global population, some 4.3 million people, owns a smartphone. 5G Smartphones have become a primary tool for travelers to search, book, and manage accommodations, making it essential for hotels to offer mobile-friendly solutions. Hotel management software enables seamless mobile booking experiences, automated confirmations, and digital check-ins and check-outs, catering to the convenience-focused needs of modern travelers. Moreover, smartphones allow hotel staff to use mobile apps for real-time updates, task management, and communication, improving operational efficiency. Therefore, as smartphone usage continues to grow, the need for hotel management software that supports mobile integration and enhances the guest experience is becoming a critical component of the hospitality industry.

Hotel Management Software Market Segment Analysis

Assessment by Type

Based on type, the hotel management software market is categorized into property management, customer relationship management (CRM), central reservation, channel management, event management, inventory management, point-of-sale, revenue management, and others. The property management segment held the largest market share in 2024 due to its pivotal role in streamlining hotel operations and ensuring efficient resource utilization. Hotels increasingly relied on property management solutions to handle core tasks such as room assignments, housekeeping schedules, and maintenance requests. These systems offered features for real-time inventory tracking, guest data management, and seamless integration with other software, which significantly enhanced operational efficiency. The surge in hotel construction and the growing adoption of cloud-based technologies also contributed to the dominance of this segment. Property managers preferred centralized systems that simplified operations across multiple locations, driving the widespread adoption of property management software.

The central reservation segment is also expected to grow at a rapid pace during the forecast period owing to the growing importance of real-time connectivity and streamlined booking processes. Central reservation systems (CRS) have become critical for managing room availability, pricing, and distribution across various channels with the rise in online travel agencies (OTAs) and the increasing preference for direct bookings. These systems allow hotels to maintain dynamic pricing strategies and ensure maximum occupancy, thereby optimizing revenue. Additionally, the integration of artificial intelligence and data analytics into CRS is enabling personalized guest experiences and improved forecasting, further driving demand.

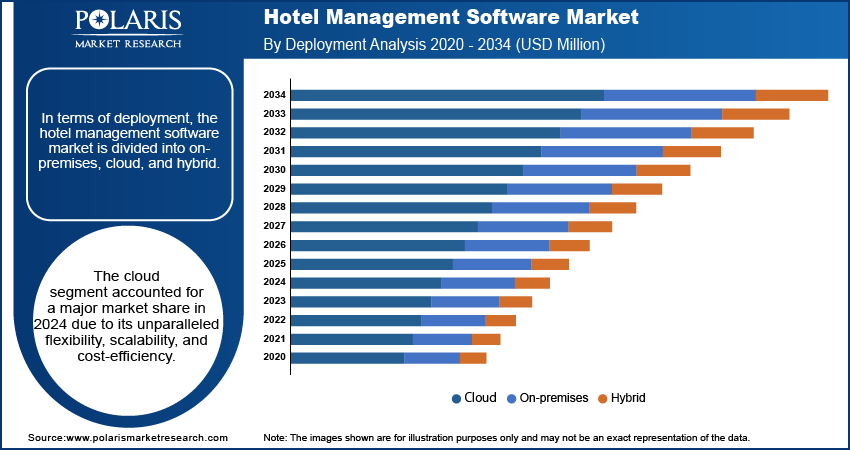

Evaluation by Deployment

In terms of deployment, the hotel management software market is divided into on-premises, cloud, and hybrid. The cloud segment accounted for a major market share in 2024 due to its unparalleled flexibility, scalability, and cost-efficiency. Cloud-based systems enabled hotels to manage operations seamlessly from any location, which proved especially valuable for chains with multiple properties and remote teams. These solutions eliminated the need for heavy upfront investments in infrastructure, allowing small and mid-sized hotels to adopt advanced tools without financial strain. Additionally, cloud platforms offered real-time updates, data security, and seamless integration with other applications, which enhanced operational efficiency and decision-making. The rising adoption of mobile devices and increasing internet penetration further boosted demand for cloud deployment, as it allowed hoteliers to access and manage their systems on the go.

Market Share by Region

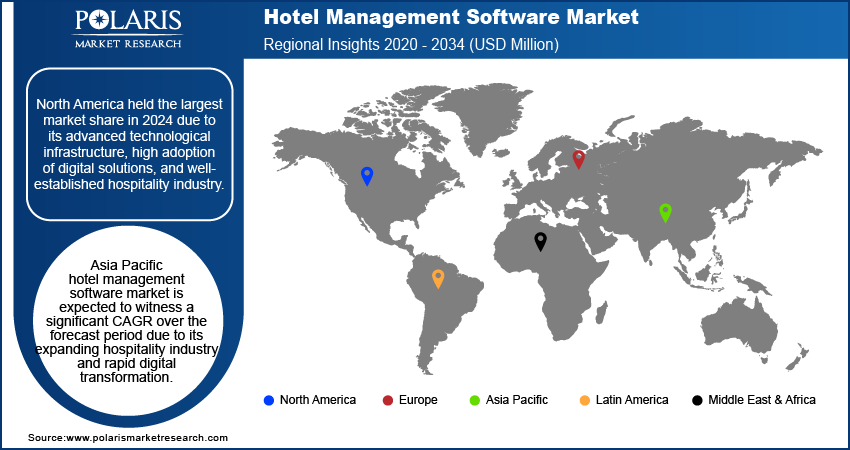

By region, the study provides the hotel management software market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to its advanced technological infrastructure, high adoption of digital solutions, and well-established hospitality industry. The US emerged as the major country within this region, contributing the highest revenue share. Hotels in North America extensively implemented modern systems to improve operational efficiency, enhance guest experiences, and maintain competitiveness. The widespread availability of cloud-based solutions, coupled with the region's robust internet connectivity, further accelerated the adoption rates of HMS. Additionally, strong consumer demand for personalized services and seamless booking experiences drove investment in innovative software solutions. The presence of prominent technology providers and a mature tourism sector contributed to hotel management software market expansion in the region.

Asia Pacific hotel management software market is expected to witness a significant CAGR over the forecast period due to its expanding hospitality industry and rapid digital transformation. Increasing urbanization, rising disposable incomes, and a growing middle class are driving demand for international and domestic tourism, prompting hotels in the region to adopt advanced solutions such as hotel management software to manage operations effectively. The region's thriving e-commerce and online booking platforms further contribute to this trend, as HMS necessitates streamlined reservation and channel management systems. Government initiatives promoting tourism and infrastructure development are also key factors fueling growth in Asia Pacific, making it a critical region for future market expansion.

Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the hotel management software industry grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The hotel management software market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Agilysys NV LLC, StayNTouch, RoomRaccoon, SAP SE, Oracle, Microsoft, Cloudbeds, Hotelogix, Maestro PMS, and Mews Systems.

Mews Systems is a major cloud-based hotel management software company that has been transforming the hospitality industry since its inception in 2012. Mews has become a trusted platform for over 5,000 properties across more than 70 countries, including renowned brands such as Accor and Generator-Freehand. The software is particularly notable for its intuitive user interface, which allows hotel staff to quickly adapt and utilize its features effectively. This ease of use is complemented by a comprehensive e-library that supports staff training, ensuring that even those new to hospitality learn the system in just a day. In March 2024, Mews announced that it raised fresh funding of USD 110 million to accelerate cloud technology in the hospitality industry.

Oracle provides products and services that address enterprise information technology environments globally. Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain, manufacturing management, enterprise resource planning (ERP), Oracle Advertising, NetSuite applications suite, Oracle Fusion cloud human capital management, and Oracle Fusion Sales, Service, and Marketing, are few of the cloud software programs included in the company's Oracle software as a service.

Oracle also provides licensed cloud-based business infrastructure solutions, middleware (which contains tools for development and other purposes), and enterprise databases including Oracle and Java. Also, company provides Generative AI powered by LLMs from Cohere, ensuring unparalleled data security, trusted performance, and versatile deployment options for text generation.

The Oracle company provides its services to various industries such as automotive, communications, consumer goods, construction and engineering, energy and water, government and education, food and beverage, financial services, health, high technology, life sciences, hospitality, media and entertainment, industrial manufacturing, oil and gas, retail, public safety, wholesale distribution, travel and transportation, and professional services among others.

LIst Of Key Companies

- Agilysys NV LLC

- StayNTouch

- RoomRaccoon

- SAP SE

- Oracle

- Microsoft

- Cloudbeds

- Hotelogix

- Maestro PMS

- Mews Systems

Hotel Management Software Market Developments

August 2024: Agilysys, Inc., a major global provider of hospitality software solutions and services, announced it had acquired Book4Time, Inc., the global leader in spa management SaaS software, serving more Forbes 5-star-rated spas.

May 2024: Mews, a major player in hospitality technology and cloud-native property management systems (PMS) expands its market presence with the acquisition of German hotel technology solution provider HS3 Hotel software.

Hotel Management Software Market Segmentation

By Type Outlook (Revenue, USD Million, 2020 - 2034)

- Property Management

- Customer Relationship Management (CRM)

- Central Reservation

- Channel Management

- Event Management

- Inventory Management

- Point-of-Sale

- Revenue Management

- Others

By Deployment Outlook (Revenue, USD Million, 2020 - 2034)

- On-premises

- Cloud

- Hybrid

By End Users Outlook (Revenue, USD Million, 2020 - 2034)

- Hotels

- Resorts

- Hostels

- Restaurants and Bars

- Others

By Regional Outlook (Revenue, USD Million, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hotel Management Software Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4,259.82 million |

|

Market Size Value in 2025 |

USD 4,574.19 million |

|

Revenue Forecast in 2034 |

USD 8,828.69 million |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global hotel management software market size was valued at USD 4,259.82 million in 2024 and is projected to grow to USD 8,828.69 million by 2034.

The global market is projected to grow at a CAGR of 7.6% during the forecast period.

North America had the largest share of the global market in 2024

Some of the key players in the market are Agilysys NV LLC, StayNTouch, RoomRaccoon, SAP SE, Oracle, Microsoft, Cloudbeds, Hotelogix, Maestro PMS, and Mews Systems.

The central reservation segment is projected for significant growth in the global market.

The cloud segment dominated the hotel management software market in 2024.