Hot-Melt Adhesives Market Size, Share, Trends, Industry Analysis Report: By Type, Application (Automotive, Bookbinding, Furniture & Woodwork, Nonwoven Hygiene Products, Packaging Solutions, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 120

- Format: PDF

- Report ID: PM5361

- Base Year: 2024

- Historical Data: 2020-2023

Hot-Melt Adhesives Market Overview

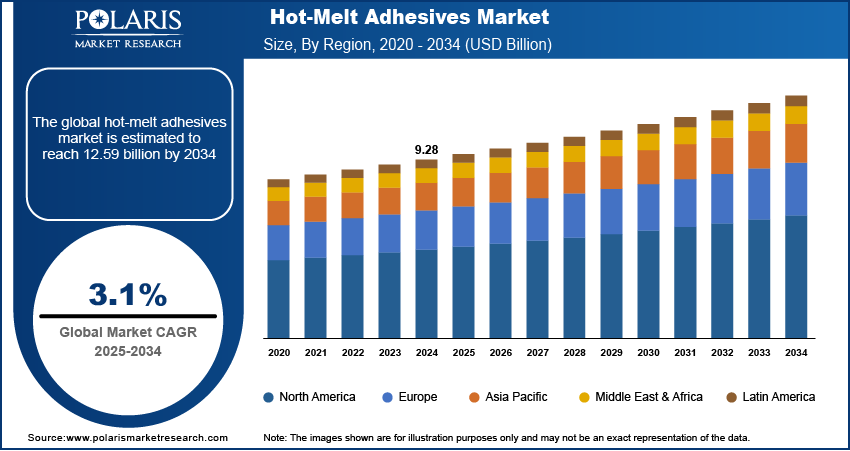

The global hot-melt adhesives market size was valued at USD 9.28 billion in 2024. The market is projected to grow from USD 9.56 billion in 2025 to USD 12.59 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 3.1% from 2025 to 2034.

Hot-melt adhesives are thermoplastic adhesives that are applied in a molten state and solidify upon cooling to form a strong bond. The hot-melt adhesives market expansion is being driven by significant growth in the electronics industry. Countries worldwide are experiencing increased sales of consumer electronics. For instance, according to IBEF, domestic electronics production in India reached USD 101.0 billion in the fiscal year 2022-23, with the electronics sector accounting for ∼3.4% of the country's gross domestic product (GDP). This growth has created the need for effective and efficient adhesive solutions, such as hot-melt adhesives, which are used in various applications, including securing components, assembling electronic housings, and providing moisture and vibration resistance.

To Understand More About this Research: Request a Free Sample Report

Rising construction activities are driving hot-melt adhesives market growth, as the demand for versatile and efficient bonding solutions increases across various construction applications. In the construction industry, hot-melt adhesives are used for laminating and bonding insulation materials due to their strong adhesion, quick setting times, and resistance to environmental factors. Therefore, the surge in global construction projects, including residential, commercial, and infrastructure developments, is creating a growing need for adhesives that meet the durability standards required in construction.

Hot-Melt Adhesives Market Dynamics

Innovative Product Launches Drive Market Growth

Companies are introducing advanced adhesive solutions to meet evolving industry needs and applications by developing new formulations with enhanced properties such as improved bonding strength, better thermal resistance, and reduced environmental impact. For instance, in March 2022, Conagen introduced debondable hot-melt adhesives made from high-performance, sustainable, and natural bio-molecules. The innovation provides manufacturers with an alternative solution for debondable structural adhesives, enabling cost savings and waste reduction in the manufacturing process. Such product launches are expanding the range of applications for hot-melt adhesives and catering to the needs of consumers seeking environment-friendly solutions. Thus, the introduction of new adhesive technologies and products is boosting the hot-melt adhesives market revenue.

Strategic Initiatives by Manufacturers Boost Market Demand

Manufacturers are employing strategic activities to enhance their product offerings and expand market reach. They are investing in research and development to innovate adhesive formulations and partnering with other companies to broaden their product portfolios and enter new markets. For instance, in March 2023, Pidilite Industries partnered with Jowat SE, a German supplier of industrial adhesives, to provide locally manufactured Jowat hot melts to customers in India. These strategic activities are optimizing production processes and supply chains, thereby reducing costs, improving efficiency, and enhancing market competitiveness. Thus, the increased focus of manufacturers on collaboration with other companies to produce and distribute adhesive solutions is driving the hot-melt adhesives market development.

Hot-Melt Adhesives Market Segment Insights

Hot-Melt Adhesives Market Assessment Based on Type

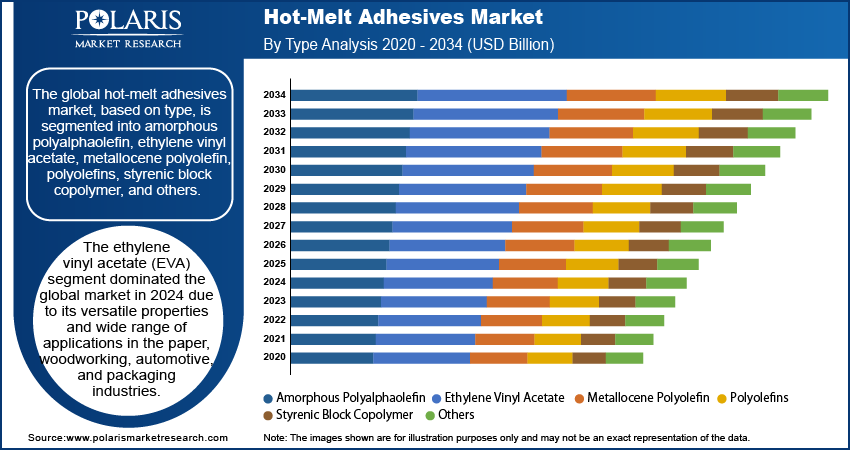

The global hot-melt adhesives market, based on type, is segmented into amorphous polyalphaolefin, ethylene vinyl acetate, metallocene polyolefin, polyolefins, styrenic block copolymer, and others. The ethylene vinyl acetate (EVA) segment dominated the global market in 2024 due to its versatile properties and wide range of applications in the paper, woodworking, automotive, and packaging industries. EVA-based hot-melt adhesives are known for heat resistance, durability, and flexibility, making them suitable for a variety of bonding needs in several industries. Moreover, an EVA-based hot-melt adhesives formulation possesses high VA content that results in higher transparency, more polarity, extended flexibility, and enhanced wettability to substrates. EVA adhesives also offer favorable processing characteristics, such as easy melting at relatively low temperatures. Thus, all the aforementioned factors have contributed to the segment’s dominance in the global market.

Hot-Melt Adhesives Market Evaluation Based on Application

The global hot-melt adhesives market, based on application, is segmented into automotive, bookbinding, furniture & woodwork, nonwoven hygiene products, packaging solutions, and others. The packaging solutions segment held the largest revenue share in 2024, driven by global growth in the packaging industry and increased demand for various types of packaging across multiple sectors. For instance, the Packaging Industry Association of India stated that the industry is growing at a CAGR of 22% to 25%. Further, the Indian Institute of Packaging reported that packaging consumption in India has increased by 200% over the period of the last ten years, rising from 4.3 kg to 8.6 kg per person per annum as of fiscal year 2020. This growth in the industry created a demand for efficient, secure, and attractive packaging. As a result, hot-melt adhesives have become essential for reliable sealing, bonding, and labeling solutions, contributing to the dominance of packaging solutions in the hot-melt adhesives market.

Hot-Melt Adhesives Market Regional Analysis

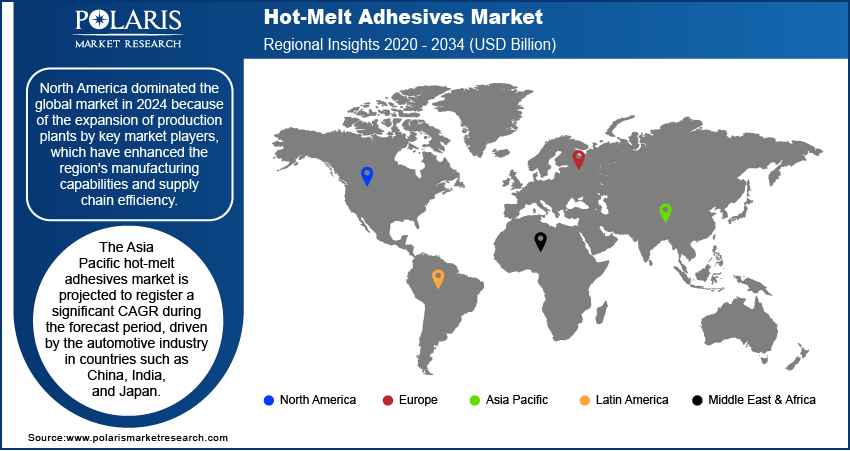

By region, the study provides the hot-melt adhesives market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024 because of the expansion of production plants by key market players, which have enhanced the region's manufacturing capabilities and supply chain efficiency. The establishment and upgradation of production facilities in North America have also boosted local production capacities. For instance, in January 2021, Colquímica Adhesives, a global player in the industrial hot melt adhesives sector with its headquarters in Portugal, opened its new subsidiary, Colquímica Adhesives Inc., and its facilities in North Carolina, United States. Therefore, the presence of advanced manufacturing technologies and strong distribution networks have led to the region’s dominance in the global market.

The Asia Pacific hot-melt adhesives market is projected to register a significant CAGR during the forecast period, driven by the automotive industry in countries such as China, India, and Japan. For instance, according to IBEF, the combined production of two-wheelers, three-wheelers, passenger vehicles, and quadricycles in India rose from 2,328,329 units in January 2024 to 2,358,041 units in April 2024. This growth in automotive production is creating the demand for advanced adhesive solutions that meet the industry's durability requirements. Hot-melt adhesives are extensively used in automotive applications for bonding trim, assembly parts, and interior components. Thus, the increasing demand for adhesives is contributing to the significant growth of the hot-melt adhesives market in the region.

The market for hot-melt adhesives in China is anticipated to grow significantly due to the rapid expansion of the furniture industry within the country. For instance, according to the China National Furniture Association, China's furniture industry had a total of 6647 large-scale enterprises in 2021, generating a cumulative revenue of USD 122.43 billion, marking a 13.5% increase from 2020. This growth in the furniture industry has generated the need for hot-melt adhesives that have fast-setting properties and superior adhesion to materials such as wood, laminates, and textiles.

Hot-Melt Adhesives Market – Key Players and Competitive Insights

The global hot-melt adhesives market is dominated by several key market players competing for revenue share through innovation, strategic partnerships, and expansive product portfolios. The established players lead the market by offering advanced adhesive solutions tailored for diverse applications across industries, including packaging, automotive, and construction. The companies are investing in research and development to introduce high-performance products and maintain technological leadership.

The regional players and local manufacturers are increasingly focusing on emerging markets and specialized formulations to capture specific industry needs. The dynamic and evolving competitive environment fosters continuous improvement and innovation in the market. Major players in the hot-melt adhesives market include 3M, Arkema, Ashland, Avery Dennison Corporation, Dow, Exxon Mobil Corporation, H.B. Fuller Company, Henkel AG & Co. KGaA, Jowat SE, and Sika AG.

Henkel AG & Co. KGaA is a multinational company that is primarily involved in the designing, manufacturing, and sale of home care & laundry, and beauty care products along with adhesive technologies. In June 2022, Henkel opened a hot melt adhesives facility in Nuevo Leon, Mexico, to produce both pressure-sensitive and non-pressure-sensitive hot melt under the Technomelt brand.

H.B. Fuller Company is a chemical manufacturing company that specializes in the formulation, manufacturing, and distribution of a wide range of sealants, adhesives, coatings, and other specialty chemical products. The company operates in over 34 countries in North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa. The company operates in three business segments: Engineering Adhesives, Hygiene, Health and Consumable Adhesives, and Construction Adhesives. The Engineering Adhesives segment offers high-performance adhesives, including light cure, reactive, two-part liquids, polyurethane, film, silicone, and fast cure products, for applications in appliances and windows, filters, doors and wood flooring, transportation, textile, electronics, medical, appliance, aerospace and defense, heavy machinery, clean energy, and insulating glass markets. In June 2021, H.B. Fuller entered into a distribution agreement with Jubilant Agri and Consumer Products Limited, a subsidiary of Jubilant Industries Limited. The agreement aims to cater to the increasing need for adhesive applications in the B2B woodworking segment.

List of Key Companies in Hot-Melt Adhesives Market

- 3M

- Arkema

- Ashland

- Avery Dennison Corporation

- Dow

- Exxon Mobil Corporation

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Jowat SE

- Sika AG

Hot-Melt Adhesives Industry Developments

April 2024: VPF introduced HM302, a high-bonding hot-melt adhesive made from organic rubber, to its adhesive portfolio. According to VPF, the adhesive is mineral oil-free, is bio-based with an organic content of at least 45%, and has a lower carbon footprint.

November 2021: Henkel’s Adhesive Technologies business unit launched the Technomelt Supra ECO range that surpassed 80% bio-based raw material input while maintaining high-performance levels.

October 2022: Henkel and LyondellBasell collaborated to create a hot-melt adhesive specifically designed for resealing APET and polyolefin trays used to package food products.

Hot-Melt Adhesives Market Segmentation

By Type Outlook

- Amorphous Polyalphaolefin

- Ethylene Vinyl Acetate

- Metallocene Polyolefin

- Polyolefins

- Styrenic Block Copolymer

- Others

By Application Outlook

- Automotive

- Bookbinding

- Furniture & Woodwork

- Nonwoven Hygiene Products

- Packaging Solutions

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hot-Melt Adhesives Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.28 billion |

|

Market Size Value in 2025 |

USD 9.56 billion |

|

Revenue Forecast by 2034 |

USD 12.59 billion |

|

CAGR |

3.1% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, volume kiloton, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market was valued at USD 9.28 billion in 2024 and is projected to grow to USD 12.59 billion by 2034.

The market is projected to register a CAGR of 3.1% from 2025 to 2034.

North America had the largest share of the global market in 2024.

A few of the key players in the market are 3M, Arkema, Ashland, Avery Dennison Corporation, Dow, Exxon Mobil Corporation, H.B. Fuller Company, Henkel AG & Co. KGaA, Jowat SE, and Sika AG.

The ethylene vinyl acetate segment dominated the market in 2024 due to its multifaceted properties and extensive utilization across the paper, woodworking, automotive, and packaging industries.

In 2024, the packaging solutions segment held the highest share of the market in terms of revenue, primarily due to the global expansion of the packaging industry.