Hormonal Contraceptive Market Size, Share, Trends, Industry Analysis Report: By Product, By Hormone (Progestin Only and Combined Hormone Contraceptives), By Distribution Channel, and By Region (North America, Europe, Asia-Pacific, Latin America and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 126

- Format: PDF

- Report ID: PM2570

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

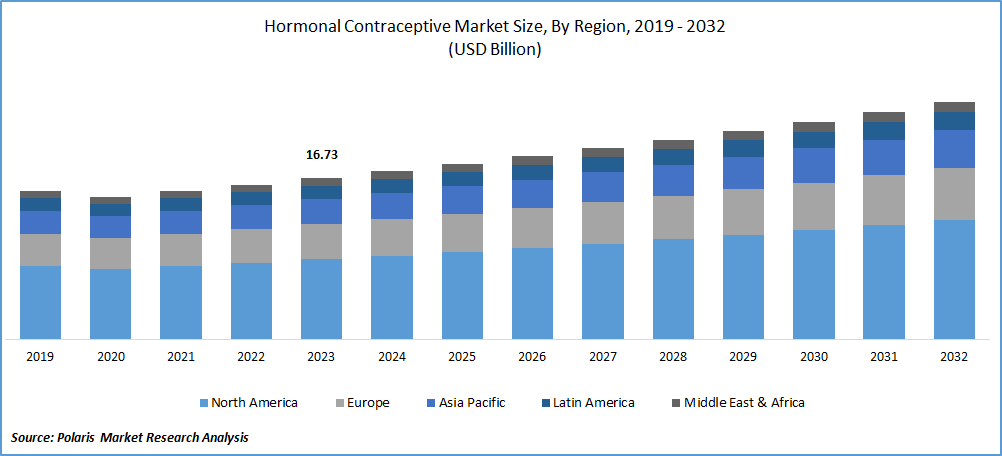

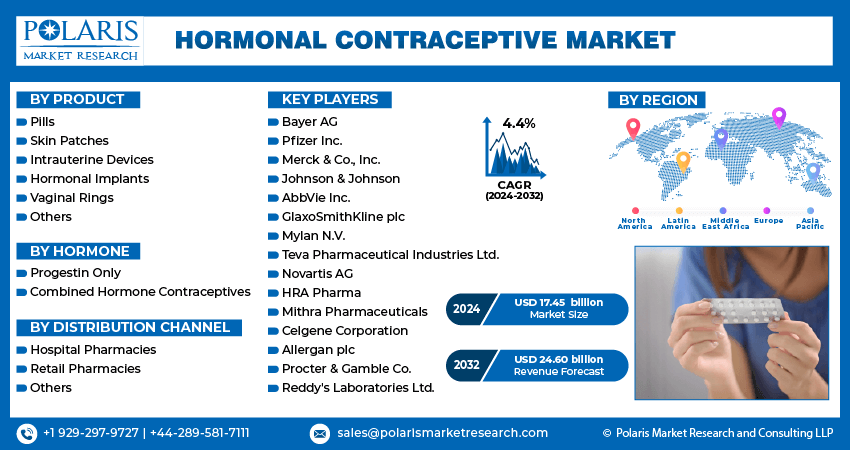

Global Hormonal Contraceptive Market Size was valued at USD 16.73 Billion in 2023. The industry is projected to grow from USD 17.45 Billion in 2024 to USD 24.60 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 4.4% during the forecast period.

Hormonal contraceptives are medications that use synthetic hormones to prevent pregnancy. They work by inhibiting ovulation, thickening cervical mucus, and altering the uterine lining to prevent fertilization and implantation. The global hormonal contraceptive market is experiencing robust growth, driven by increasing awareness about family planning and reproductive health and rising adoption of hormonal contraceptives as a reliable method of birth control. Further, the growing emphasis on women's health and empowerment, supportive government initiatives and policies promoting contraceptive access, and the rising prevalence of sexually transmitted infections (STIs), which encourages preventive measures. For instance, according to Centers for Disease Control and Prevention, from 2021 to 2022, the chlamydia rate among men increased by 1.8%, rising from 357.4 to 363.7 per 100,000.

To Understand More About this Research:Request a Free Sample Report

Trends in the market show a shift towards innovative hormonal contraceptives, such as long-acting reversible contraceptives (LARCs), and a rising demand for personalized and convenient options like oral contraceptives and hormonal patches. Additionally, there is a notable increase in the availability of hormonal contraceptives in emerging markets due to expanding healthcare infrastructure and improving economic conditions.

Hormonal Contraceptive Market Trends

Rising Demand for Long-Acting Reversible Contraceptives (LARCs)

One of the most prominent trends in the global hormonal contraceptive market is the growing preference for Long-Acting Reversible Contraceptives (LARCs). These include hormonal implants and intrauterine devices (IUDs), which offer effective contraception with minimal maintenance. LARCs are favored for their high efficacy and convenience, as they require less frequent user intervention compared to daily oral contraceptives. The increasing awareness of LARCs' benefits, coupled with healthcare providers' recommendations, is driving their adoption. Additionally, government and NGO programs promoting family planning and reproductive health are boosting LARC availability and accessibility, especially in emerging markets where traditional methods are more prevalent.

Shift Towards Personalized and Convenient Contraceptive Options

The market is witnessing a significant shift towards personalized and convenient hormonal contraceptive options. Innovations such as hormonal patches, rings, and combination oral contraceptives are gaining popularity due to their ease of use and the ability to fit individual preferences and lifestyles. These methods offer flexibility and enhanced user compliance, catering to a diverse range of needs and preferences. Technological advancements and ongoing research are also leading to the development of new formulations and delivery systems that promise improved efficacy and fewer side effects. This trend reflects a broader consumer demand for tailored healthcare solutions that align with personal health goals and convenience.

Expanding Market Reach in Emerging Economies

Emerging economies are becoming increasingly important in the global hormonal contraceptive market, driven by improvements in healthcare infrastructure, economic growth, and greater emphasis on family planning. As these regions experience economic development and enhanced healthcare access, there is a growing demand for modern contraceptive methods. Market players are expanding their presence in these areas through strategic partnerships, increased distribution channels, and localized marketing efforts. This expansion is supported by public health initiatives and educational programs aimed at raising awareness about contraceptive options and reproductive health. The focus on emerging markets represents a significant growth opportunity for companies operating in the hormonal contraceptive sector.

Hormonal Contraceptive Market Segment Insights

Hormonal Contraceptive Market Product Insights

In the global hormonal contraceptive market, the segment based on product types reveals diverse dynamics. Oral contraceptive pills remain the dominant segment due to their widespread use, well-established efficacy, and long-standing consumer familiarity. They offer a convenient and flexible option for many users, which maintains their leading position in the market. However, the fastest-growing segment is hormonal implants. These implants, which provide long-term contraception with minimal user intervention, are experiencing rapid growth due to their high efficacy and increasing acceptance among women seeking more convenient and reliable contraceptive methods. Hormonal implants align with the trend towards long-acting reversible contraceptives (LARCs), making them a key focus for innovation and market expansion.

Other segments, such as skin patches, vaginal rings, and intrauterine devices (IUDs), also contribute significantly to the market but show varied growth rates. Skin patches and vaginal rings offer alternatives to pills with different delivery methods, while IUDs, including hormonal varieties, are valued for their effectiveness and long-term use. The "Others" category encompasses less common methods, which contribute a smaller share of the market but can still be relevant for specific consumer needs. Overall, the market is evolving with a notable shift towards convenience and long-term solutions, driving growth in hormonal implants and maintaining the dominance of oral contraceptive pills.

Hormonal Contraceptive Market Hormone Insights

In the global hormonal contraceptive market, the two primary segments based on hormone type are Progestin-Only Contraceptives and Combined Hormone Contraceptives. Progestin-Only Contraceptives, which include methods like progestin-only pills, implants, and injections, are increasingly popular due to their suitability for women who cannot use estrogen or prefer a single-hormone approach. This segment is particularly dominant in regions where users seek alternatives due to health concerns or specific lifestyle needs. However, the Combined Hormone Contraceptives segment, encompassing oral contraceptive pills, patches, and rings that combine estrogen and progestin, remains the largest and most established in the market. These methods are favored for their effectiveness and additional benefits, such as regulation of menstrual cycles and reduced acne.

The highest growing segment is Progestin-Only Contraceptives, driven by increasing awareness of their benefits for women with contraindications to estrogen and the expanding range of available options. The demand for progestin-only methods is also fueled by their lower risk of certain side effects compared to combined options. Market growth in this segment is particularly notable in emerging economies, where healthcare access is improving and personalized contraceptive solutions are gaining traction. Combined Hormone Contraceptives, while still dominant, are growing at a slower rate compared to their progestin-only counterparts, as new innovations and preferences shift towards more tailored and flexible contraceptive solutions.

Hormonal Contraceptive Market Distribution Channel Insights

In the global hormonal contraceptive market, the distribution channels are segmented into hospital pharmacies, retail pharmacies, and others, each contributing differently to the market dynamics. Retail pharmacies currently dominate the market due to their widespread accessibility and convenience for consumers. This segment benefits from a high volume of transactions, driven by the ease of obtaining contraceptives without the need for a prescription or medical consultation, which aligns with consumer preferences for privacy and convenience. Retail pharmacies also offer a diverse range of products, enhancing their appeal to a broad customer base.

The highest-growing segment, however, is hospital pharmacies. This growth is fueled by increasing healthcare access and a rising focus on comprehensive reproductive health services within clinical settings. Hospital pharmacies are becoming more integral to the distribution of hormonal contraceptives as part of broader patient care and counseling programs. Additionally, the expansion of healthcare facilities and improved insurance coverage are contributing to the growing reliance on hospital pharmacies for contraceptive needs. While other distribution channels also contribute to market growth, the accelerated development of hospital pharmacies highlights a shift towards more integrated and supportive healthcare approaches.

Hormonal Contraceptive Market, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Hormonal Contraceptive Market Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America is the dominant region in the global hormonal contraceptive market, primarily due to its advanced healthcare infrastructure, high awareness of family planning, and extensive availability of various contraceptive options. The United States and Canada lead in market share, driven by strong healthcare systems, robust research and development activities, and high consumer spending on healthcare products. Additionally, government initiatives and comprehensive insurance coverage contribute to widespread access and adoption of hormonal contraceptives. The region's dominance is further supported by a well-established distribution network and continuous innovation in contraceptive technologies, positioning North America as a leader in market growth and development.

Hormonal Contraceptive Market, Regional Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

In Europe, the hormonal contraceptive market is characterized by high adoption rates and a well-established healthcare system that supports widespread access to contraceptive options. The market is driven by a strong emphasis on reproductive health and family planning, supported by various public health policies and initiatives. Countries like Germany, France, and the United Kingdom are notable contributors due to their advanced healthcare infrastructure and high awareness levels. However, growth rates are somewhat moderate compared to North America due to relatively saturated markets and stringent regulatory standards. Despite this, Europe remains a significant market due to ongoing innovations in contraceptive technologies and increasing demand for personalized contraceptive solutions.

The Asia-Pacific region is experiencing rapid growth in the hormonal contraceptive market, driven by rising healthcare investments, expanding economic development, and increasing awareness of reproductive health. Countries like China and India are major contributors due to their large populations and improving access to healthcare services. The market is also seeing heightened demand for modern contraceptive methods as public health initiatives and education programs promote family planning. The growth in this region is the highest among all regions, as expanding healthcare infrastructure and economic progress enhance market accessibility and adoption. Additionally, government support and a growing focus on women's health contribute to the dynamic expansion of the hormonal contraceptive market in Asia-Pacific.

Hormonal Contraceptive Market Key Market Players & Competitive Insights

Key players in the global hormonal contraceptive market include Bayer AG, Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, AbbVie Inc., GlaxoSmithKline plc, Mylan N.V., Teva Pharmaceutical Industries Ltd., Novartis AG, HRA Pharma, Mithra Pharmaceuticals, Celgene Corporation, Allergan plc, Procter & Gamble Co., and Reddy's Laboratories Ltd. These companies are pivotal in shaping the market through their diverse product portfolios, including oral contraceptives, patches, implants, and injectables. Their market presence is strengthened by ongoing research and development, strategic partnerships, and robust distribution networks.

Competitive analysis reveals a fragmented yet competitive market landscape where major pharmaceutical companies dominate with their extensive portfolios and global reach. Bayer, Pfizer, and Merck lead the market due to their comprehensive range of hormonal contraceptives and strong brand recognition. However, competition is intensifying with the entry of generics and biosimilars from companies like Mylan and Teva, which are expanding market access by offering cost-effective alternatives. Additionally, innovation in contraceptive technologies, such as long-acting and user-friendly methods, is a critical competitive factor driving market dynamics.

The market is also witnessing strategic mergers and acquisitions, as companies aim to consolidate their positions and expand their product offerings. Collaborations and partnerships are becoming increasingly common to enhance R&D capabilities and accelerate the development of new contraceptive solutions. Moreover, emerging players are leveraging digital platforms and direct-to-consumer models to capture a share of the growing market, reflecting a shift towards personalized and accessible contraceptive options. Overall, the global hormonal contraceptive market is characterized by vigorous competition and continuous innovation, with established players and new entrants vying for dominance.

Bayer AG is a global player in the global hormonal contraceptive market, renowned for its comprehensive portfolio that includes products such as Yasmin, Mirena, and Skyla. Bayer’s dominance is attributed to its strong R&D capabilities, extensive global reach, and established brand reputation. The company focuses on delivering innovative contraceptive solutions and is committed to advancing reproductive health through continuous research and development. A notable recent development is Bayer’s expansion of its digital health initiatives to enhance patient access and support for hormonal contraceptive users.

Pfizer Inc. is another major player in the hormonal contraceptive market, offering well-known products such as Depo-Provera and the NuvaRing. Pfizer's strength lies in its extensive global distribution network and its ability to leverage its broad pharmaceutical expertise to innovate within the contraceptive space. The company is actively involved in developing new formulations and delivery methods to meet diverse consumer needs.

Key Companies in the Hormonal Contraceptive Market include

- Bayer AG

- Pfizer Inc.

- Merck & Co., Inc.

- Johnson & Johnson

- AbbVie Inc.

- GlaxoSmithKline plc

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

- HRA Pharma

- Mithra Pharmaceuticals

- Celgene Corporation

- Allergan plc

- Procter & Gamble Co.

- Reddy's Laboratories Ltd.

Hormonal Contraceptive Industry Developments

- In July 2024, Pfizer received FDA approval for a new hormonal contraceptive injection, designed to offer extended protection and ease of use compared to existing options. This approval underscores Pfizer's commitment to advancing contraceptive technology and meeting evolving market demands.

- In April 2024, Bayer announced the launch of a new digital platform aimed at providing personalized contraceptive information and resources, marking a significant step in integrating technology with reproductive health management.

Hormonal Contraceptive Market Segmentation

Hormonal Contraceptive Product Outlook

- Pills

- Skin Patches

- Intrauterine Devices

- Hormonal Implants

- Vaginal Rings

- Others

Hormonal Contraceptive Hormone Outlook

- Progestin Only

- Combined Hormone Contraceptives

Hormonal Contraceptive Distribution Channel Outlook

- Hospital Pharmacies

- Retail Pharmacies

- Others

Hormonal Contraceptive Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hormonal Contraceptive Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 16.73 billion |

|

Market size value in 2024 |

USD 17.45 billion |

|

Revenue Forecast in 2032 |

USD 24.60 billion |

|

CAGR |

4.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

How the report is valuable for an organization?

Workflow/Innovation Strategy: The hormonal contraceptive market has been segmented into detailed segments of products, hormones, and distribution channel. Moreover, the study provides the reader with a detailed understanding of the different segments at both global and regional level.

Growth/Marketing Strategy: The growth and marketing strategy in the global hormonal contraceptive market focuses on expanding product offerings and enhancing consumer access through innovative solutions and targeted outreach. Companies are leveraging digital marketing and direct-to-consumer channels to increase brand visibility and educate users about their products. Strategic partnerships and collaborations with healthcare providers and organizations are crucial for market penetration and patient engagement. Emphasis on personalized contraceptive solutions and advancements in delivery methods are key to addressing diverse consumer needs. Additionally, expanding into emerging markets and investing in R&D are essential strategies for capturing new opportunities and driving sustained growth.

FAQ's

The global hormonal contraceptive Market size was valued at USD 16.73 Billion in 2023 and is projected to grow to USD 24.60 Billion by 2032.

The global market is projected to grow at a CAGR of 4.4% during the forecast period, 2023-2032.

North America had the largest share in the global market

Key players in the global hormonal contraceptive market include Bayer AG, Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, AbbVie Inc., GlaxoSmithKline plc, Mylan N.V., Teva Pharmaceutical Industries Ltd., Novartis AG, HRA Pharma, Mithra Pharmaceuticals, Celgene Corporation, Allergan plc, Procter & Gamble Co., and Reddy's Laboratories Ltd

The Progestin-Only Contraceptives dominated the market in 2023

The retail pharmacies segment had the largest share in the global market.

The hormonal contraceptive market refers to the sector of the healthcare industry focused on products designed to prevent pregnancy through hormonal regulation. These contraceptives use synthetic hormones to alter the natural hormonal cycle of the body, inhibiting ovulation or altering the uterine environment to prevent fertilization and implantation. The market includes a variety of products such as oral contraceptive pills, hormonal patches, implants, injections, and vaginal rings. It serves a global consumer base and is influenced by factors such as advancements in contraceptive technology, regulatory changes, consumer preferences, and increasing awareness of family planning and reproductive health

Here are some key trends observed in this market: Growth of Long-Acting Reversible Contraceptives (LARCs): Increasing adoption of LARCs like implants and IUDs due to their effectiveness and convenience. Personalization and Convenience: Rising demand for personalized contraceptive options, including hormonal patches, rings, and user-friendly oral contraceptives. Digital Health Integration: Expansion of digital platforms and apps to provide personalized contraceptive information and support. Emergence in Emerging Markets: Growing market presence in emerging economies due to improved healthcare infrastructure and increasing awareness

A new company entering the hormonal contraceptive market should focus on innovation and differentiation to stay ahead of the competition. Emphasizing the development of advanced, user-friendly contraceptive solutions, such as novel delivery systems or extended-release formulations, can set the company apart. Leveraging digital health technologies for personalized patient engagement and support can enhance market appeal. Additionally, targeting emerging markets with tailored products and strategic partnerships with local healthcare providers can capture new opportunities. Investing in comprehensive R&D and staying responsive to evolving consumer preferences and regulatory trends will further strengthen the company’s competitive edge.

Companies producing hormonal contraceptive and related products, healthcare providers, and other consulting firms.