Home Water Filtration Market Size, Share, Trends, Industry Analysis Report: By Product Type (Point-of-Use Filters, and Point-of-Entry Filters), Category, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM3370

- Base Year: 2024

- Historical Data: 2020-2023

Home Water Filtration Market Overview

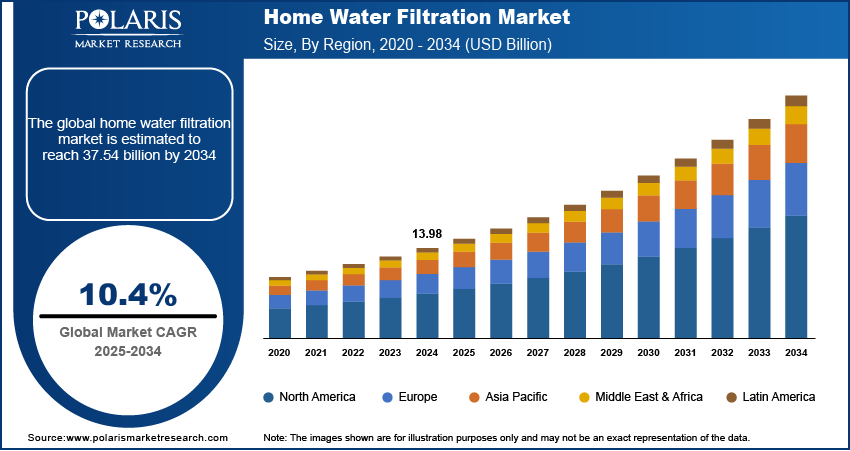

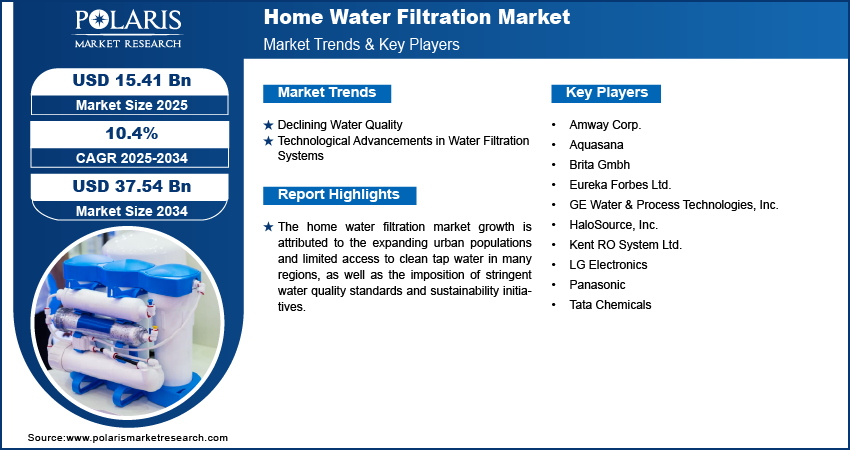

The home water filtration market size was valued at USD 13.98 billion in 2024 and is expected to reach USD 15.41 billion by 2025 and 37.54 billion by 2034, exhibiting a CAGR of 10.4% during 2025–2034.

The home water filtration market includes products and technologies designed to improve water quality by removing contaminants, impurities, and harmful substances from household water supplies.

Increasing consumer concerns over waterborne diseases and contaminants drive home water filtration market demand as households seek safer drinking water solutions. Moreover, rising purchasing power enables more consumers to invest in premium and smart filtration systems, boosting the market growth.

To Understand More About this Research: Request a Free Sample Report

Expanding urban populations and limited access to clean tap water in many regions contribute to home water filtration market opportunities, increasing the need for reliable filtration systems. Furthermore, stringent water quality standards and sustainability initiatives encourage the adoption of home water filtration solutions, further driving the market growth.

Home Water Filtration Market Dynamics

Declining Water Quality

Increasing pollution, aging infrastructure, and chemical contamination in municipal water supplies lead to a decline in water quality. In February 2024, the Environmental Protection Agency reported that around 70 million people are exposed to PFAS, or "forever chemicals," in their drinking water. Industrial discharge, agricultural runoff, and rising levels of heavy metals, microplastics, and pharmaceutical residues in drinking water have raised significant health concerns among consumers. This growing contamination has led to a surge in demand for advanced home water filtration systems. Further, aging water infrastructure in many developed and developing regions is contributing to the home water filtration market expansion as outdated pipelines and treatment plants struggle to eliminate emerging contaminants. This failure increases the risks of bacterial growth, which adversely impacts public health and drives market demand. Additionally, lead contamination from corroding pipes encourages households to invest in advanced filtration solutions, thereby boosting the market demand. Moreover, the infiltration of chemicals such as chlorine byproducts and heavy metals in municipal water supplies intensifies consumer reliance on home filtration systems, accelerating home water filtration market growth.

Technological Advancements in Water Filtration Systems

Technological advancements in water filtration systems are playing a crucial role in accelerating home water filtration market development. Innovations in reverse osmosis (RO), activated carbon, UV purification, and smart filtration systems are significantly enhancing the efficiency, convenience, and overall effectiveness of water purification systems. For instance, Eaton is enhancing its activated carbon filter media technology with new BECO CARBON depth filter sheets that offer superior adsorption for liquid filtration. These sheets effectively remove unwanted by-products while enhancing taste, odor, and color. Additionally, smart water filtration systems are reshaping the market by integrating digital technologies. These systems come with features such as real-time water quality monitoring, automatic filter change alerts, and integration with mobile apps for remote control and tracking. These innovations offer added convenience and ensure that consumers receive optimal water quality at all times, thus boosting market adoption and expanding the consumer base.

Home Water Filtration Market Segment Insights

Home Water Filtration Market Assessment by Product Type Outlook

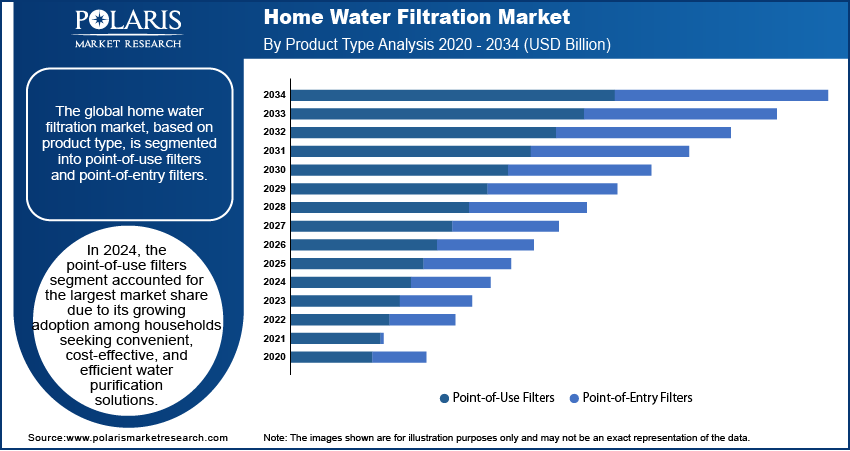

The global home water filtration market segmentation, based on product type, includes point-of-use filters and point-of-entry filters. In 2024, the point-of-use filters segment accounted for a larger market share due to its growing adoption among households seeking convenient, cost-effective, and efficient water purification solutions. The rising concerns over water contamination, including heavy metals, bacteria, and chemical pollutants, have significantly increased demand for home water filtration systems, driving consumers toward point-of-use filtration systems such as faucet-mounted filters, under-sink systems, countertop filters, and pitcher filters. These systems offer on-demand purified water, eliminating the need for bottled water and reducing plastic waste, which aligns with the increasing consumer preference for sustainable and eco-friendly solutions.

Home Water Filtration Market Evaluation by Distribution Channel Outlook

The global home water filtration market segmentation, based on distribution channels, includes online and offline. In 2024, the online segment accounted for a larger market share due to the increasing shift toward e-commerce platforms, which offer convenience, competitive pricing, and a wide range of product options. Consumers are increasingly purchasing home water filtration systems online due to detailed product comparisons, customer reviews, and doorstep delivery. The rise of direct-to-consumer brands and subscription-based filter replacement services has further contributed to the market growth for the segment. Additionally, digital marketing strategies, discounts, and exclusive online deals have boosted sales, making e-commerce a dominant channel in the home water filtration market.

Home Water Filtration Market Assessment by Regional Analysis

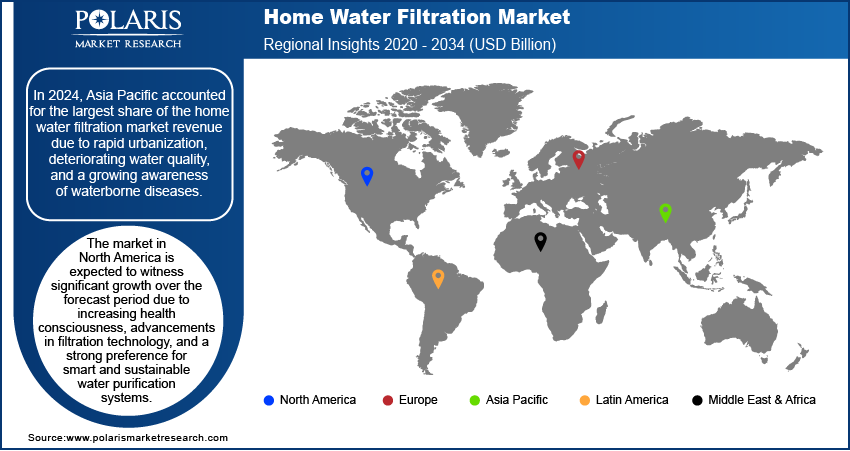

By region, the study provides home water filtration market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest share of the market revenue due to rapid urbanization, deteriorating water quality, and a growing awareness of waterborne diseases. The increasing presence of industrial pollutants, aging water infrastructure, and contamination from heavy metals and chemicals have heightened consumer concerns, leading to a surge in demand for home water filtration solutions. Additionally, rising disposable incomes and government and international body initiatives promoting clean drinking water have further accelerated the Asia Pacific market expansion. In 2023, the World Bank launched USD 50 million emission reduction-linked bond to finance water purification systems in Vietnam. This initiative aims to distribute 300,000 user-friendly purifiers to around 8,000 schools and community facilities at no cost, providing clean drinking water to up to 2 million children.

The North America home water filtration market is expected to witness significant growth during the forecast period due to increasing health consciousness, advancements in filtration technology, and a strong preference for smart and sustainable water purification systems. The region's stringent water quality regulations and growing consumer demand for high-performance filtration technologies such as reverse osmosis, UV purification, and activated carbon filters are among the key drivers of market dynamics. Additionally, the rising adoption of smart water filtration systems with real-time monitoring and IoT-enabled features is reshaping consumer preferences, further boosting market size. The shift toward eco-friendly and energy-efficient filtration solutions, coupled with growing concerns over contaminants such as lead, microplastics, and PFAS chemicals, is expected to propel market demand in the region. In October 2024, according to a US Geological Survey, an estimated 71 to 95 million people in the US (i.e., over 20% of the population) rely on groundwater with detectable levels of per- and polyfluoroalkyl substances in their drinking water.

Home Water Filtration Market Players & Competitive Analysis Report

The home water filtration market is highly competitive, with key players focusing on technological innovation, product diversification, and strategic partnerships to strengthen their market presence. Leading companies are investing in advanced filtration technologies to enhance efficiency and meet evolving consumer demands. The integration of smart filtration systems with IoT-enabled features, real-time water quality monitoring, and automatic filter replacement alerts has further intensified competition, attracting consumers and expanding market growth opportunities.

Major players in the home water filtration market are leveraging e-commerce and direct-to-consumer (DTC) sales channels, capitalizing on the shift toward online purchasing and subscription-based filter replacement services. Additionally, sustainability is a growing focus, with companies developing eco-friendly and energy-efficient filtration systems that reduce plastic waste and minimize water wastage, aligning with increasing consumer preferences for environmentally responsible solutions.

The home water filtration market witnesses competition from regional and local players, particularly in developing economies where affordability and accessibility are a few key factors influencing purchasing decisions. These companies are introducing cost-effective filtration solutions tailored to cater to specific regional water contamination issues, further driving market expansion.

Strategic mergers and acquisitions, and collaborations are shaping market dynamics, with established brands acquiring startups specializing in next-generation filtration technologies. As water contamination concerns continue to rise, the competitive landscape will remain dynamic, with innovation, regulatory compliance, and sustainability emerging as key differentiators for companies aiming to expand their share in the home water filtration market ecosystem.

LG Electronics is engaged in the manufacturing and distribution of consumer electronics and home appliances, specializing in innovative technology solutions. The company was founded in 1958 and headquartered in Seoul, South Korea. LG's product portfolio includes a wide range of items such as televisions, monitors, laptops, refrigerators, washing machines, air conditioners, water purifiers, and others. The services provided by LG Electronics encompass both consumer and commercial solutions, including smart home technologies under the LG ThinQ brand that enhance connectivity and user experience. The company has a significant global presence, operating in over 100 countries across North America, Europe, Asia Pacific, and globally. Furthermore, in the home water filtration, LG Electronics offers advanced water purification systems designed to improve water quality for households. Their water purifiers utilize advanced filtration technologies to remove contaminants while ensuring safe drinking water.

Panasonic Holdings Corporation is engaged in the development, manufacture, and sale of a wide range of electronic appliances and solutions, specializing in consumer electronics and industrial systems. The company was founded in 1918 as Matsushita Electric Housewares Manufacturing Works by Kōnosuke Matsushita. It is headquartered in Kadoma, Osaka Prefecture, Japan. Panasonic's product portfolio includes room air conditioners, televisions, digital cameras, home audio equipment, batteries, and various electronic components. The services provided by Panasonic encompass consumer electronics, automotive systems, and industrial solutions, catering to both individual consumers and businesses. The company operates globally with a presence in numerous countries across Asia, the Americas, and Europe, employing around 90,000 people worldwide. Moreover, in the home water filtration market, Panasonic plays a significant role by offering advanced water purification systems designed to enhance water quality for households. Their products utilize innovative filtration technologies to ensure safe drinking water while addressing consumer needs for convenience and efficiency.

List of Key Companies in Home Water Filtration Market

- Amway Corp.

- Aquasana

- Brita Gmbh

- Eureka Forbes Ltd.

- GE Water & Process Technologies, Inc.

- HaloSource, Inc.

- Kent RO System Ltd.

- LG Electronics

- Panasonic

- Tata Chemicals

Home Water Filtration Industry Developments

In April 2024, BOROUX launched the BOROUX Legacy water filtration system, featuring advanced technologies for optimal performance and durability. This innovative system combines superior design with effective filtration to ensure high-quality water and an enhanced wellness experience.

In November 2023, Amway launched the new eSpring Water Purifier, utilizing advanced UV-C LED technology from Crystal IS.

Home Water Filtration Market Segmentation

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- Point-of-Use Filters

- Counter Filters

- Counter Top Filters

- Pitcher Filters

- Faucet-Mounted Filters

- Others

- Point-of-Entry Filters

By Category Outlook (Revenue – USD Billion, 2020–2034)

- RO Filters

- UV Filters

- Gravity Filters

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Offline

- Online

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Home Water Filtration Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 13.98 billion |

|

Market Size Value in 2025 |

USD 15.41 billion |

|

Revenue Forecast in 2034 |

USD 37.54 billion |

|

CAGR |

10.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 13.98 billion in 2024 and is projected to grow to USD 37.54 billion by 2034.

The global market is projected to register a CAGR of 10.4% during the forecast period.

In 2024, Asia Pacific accounted for the largest share due to the rapid urbanization, deteriorating water quality, and a growing awareness of waterborne diseases

A few of the key players in the market are Amway Corp.; Aquasana; Brita Gmbh; Eureka Forbes Ltd.; GE Water & Process Technologies, Inc.; HaloSource, Inc.; Kent RO System Ltd.; LG Electronics; Panasonic; and Tata Chemicals.

In 2024, the point-of-use filters segment accounted for a larger market share due to its growing adoption among households seeking convenient, cost-effective, and efficient water purification solutions.

In 2024, the online segment accounted for a larger market share due to the increasing shift toward e-commerce platforms, which offer convenience, competitive pricing, and a wide range of product options.