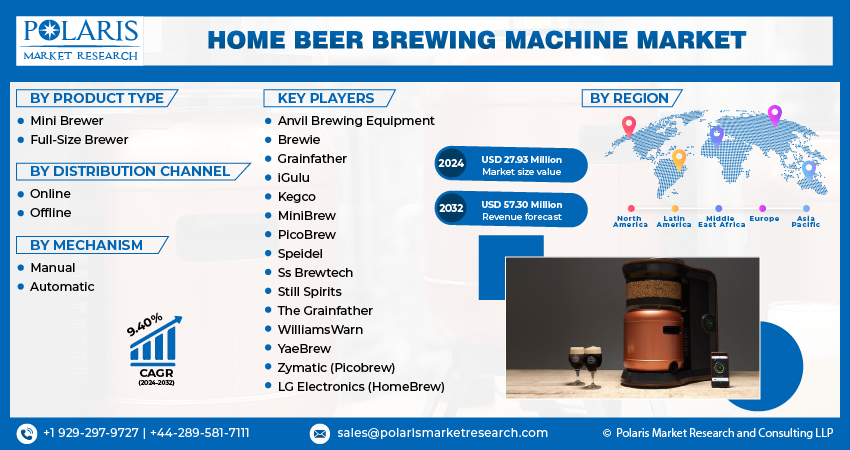

Home Beer Brewing Machine Market Share, Size, Trends, Industry Analysis Report, By Product Type (Mini Brewer, Full-Size Brewer); By Distribution Channel; By Mechanism; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3876

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

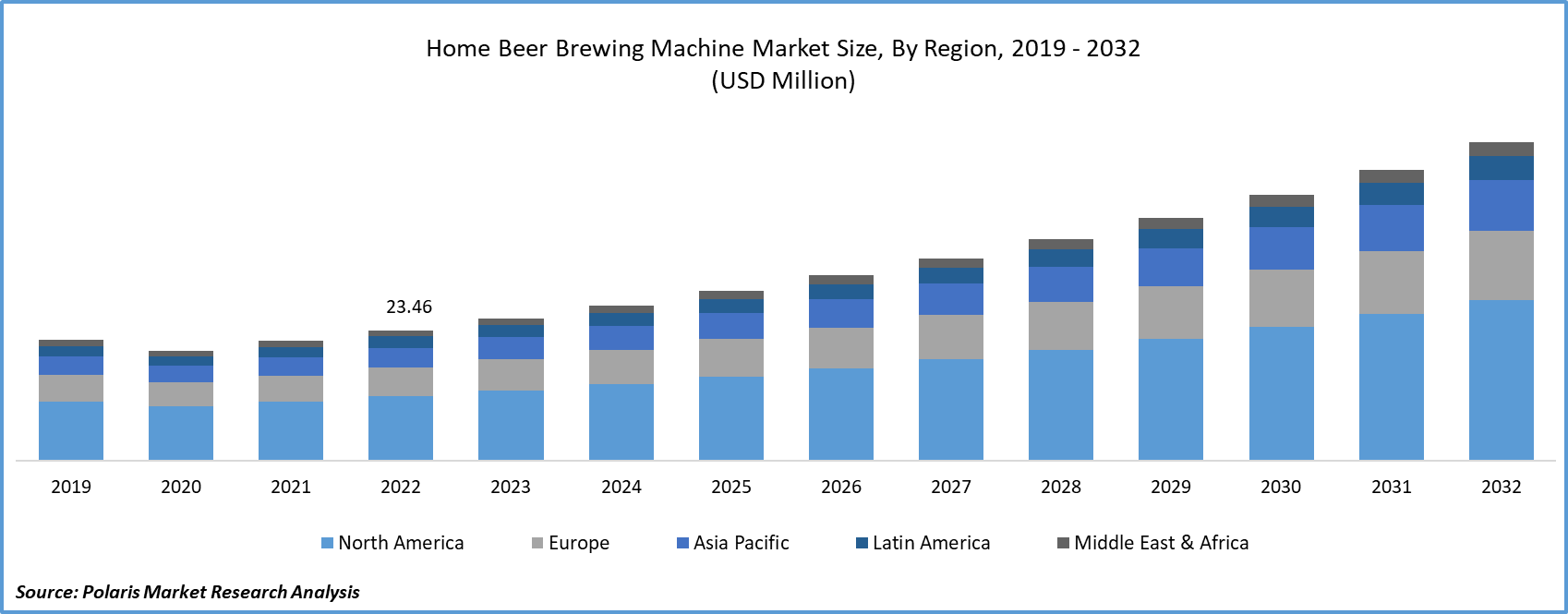

The global home beer brewing machine market was valued at USD 25.59 million in 2023 and is expected to grow at a CAGR of 9.40% during the forecast period.

In recent years, there has been a notable surge in the popularity of the home beer brewing machine market. This surge can be attributed to a combination of factors, including the burgeoning enthusiasm for craft beer, strides in technology, and a growing inclination towards a hands-on, do-it-yourself (DIY) approach to brewing.

To Understand More About this Research: Request a Free Sample Report

The market for home beer brewing machines has become a potent force in the brewing industry, spurred by a combination of factors, including the surge in craft beer enthusiasm, technological progress, and the do-it-yourself ethos. Despite hurdles like initial expenses and regulatory factors, the attraction of personalization, learning opportunities, and communal involvement remains a driving force behind this market's expansion. As this market evolves, it promises to be captivating to witness how these dynamics will further influence the brewing scene, both within households and in the broader industry.

- For instance, in August of 2019, LG unveiled its innovative product, HomeBrew. This self-cleaning home brewing machine revolutionizes beer production by utilizing specialized capsules. Through a seamless one-touch operation and an optimized fermentation algorithm, the brewing process is made exceptionally straightforward. The HomeBrew package includes an array of five distinct flavor capsules: American Pale Ale, American IPA, English Stout, Belgian-style Witbier, and Czech Pilsner.

The market's growth is chiefly attributed to the surging consumption of beer. Furthermore, the increasing consumer inclination towards freshly brewed beer and the rising trend of on-premises sales are anticipated to drive the market's momentum.

The prospects of the home beer brewing machines industry appear highly favorable, with significant potential for global reach. As the global craft beer movement gains further traction, consumers are actively seeking distinct and tailor-made experiences with their beverages. There's an escalating willingness among consumers to delve into the brewing process, experiment with various ingredients, and create their own unique brews. This escalating interest in the culture of craft beer presents a vast opportunity for the market to extend its presence into diverse regions.

However, the initial investment in a home brewing machine can be a significant deterrent for some individuals. High-end automated systems, though technologically advanced, can carry a hefty price tag. This upfront cost can dissuade potential brewers, particularly those on a tight budget.

Growth Drivers

Increased focus on customized beer is projected to spur the product demand.

One of the most compelling drivers of the home beer brewing machine market is the allure of customization and experimentation. Homebrewers relish the freedom to craft beers that cater precisely to their palate. The ability to select specific hops, malts, yeasts, and adjuncts facilitates an infinite array of flavor profiles, making each batch a unique and personalized creation.

Moreover, home brewing offers an invaluable educational experience for enthusiasts. It serves as a gateway to understanding the intricate science behind brewing, from mashing temperatures to yeast propagation. This hands-on learning fosters a deeper appreciation for the art of brewing, elevating it from a mere pastime to a genuine passion.

Report Segmentation

The market is primarily segmented based on product type, distribution channel, mechanism, and region.

|

By Product Type |

By Distribution Channel |

By Mechanism |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

Full-size brewer segment is expected to witness highest growth during forecast period

The full-size brewer segment is projected to grow at a CAGR during the projected period. This growth is attributed to the rising presence of independent and small-scale brewers in the U.S., New Zealand, and Europe, driven by the increasing popularity of craft beer among customers. This trend augurs well for the full-sized brewing segment, as consumers increasingly seek personalized products, a trend notably observed in the beer brewing market. Full-sized brewers enable individuals to craft their distinct brews, a factor that has significantly added value to the market's expansion.

Moreover, contemporary full-sized home beer brewing systems are easily available and user-friendly. Equipped with intuitive interfaces and automated features, even beginners can effortlessly direct the brewing process. This enhanced accessibility has broadened the consumer base and enticed newcomers to engage in this engaging hobby.

By Distribution Channel Analysis

Offline segment accounted for the largest market share in 2022

The offline segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. The success of these stores is credited to their provision of top-notch service, comprehensive product details, and expert advice to customers. Moreover, consumers typically lean towards scrutinizing and appraising products prior to making a purchase, which consequently bolsters retail sales of home beer brewing machines through physical offline channels. However, it is anticipated that the online channel will experience the most rapid growth in terms of value sales during the forecast period.

By Mechanism Analysis

Automatic segment held the significant market revenue share in 2022

The automatic segment held a significant market share in revenue share in 2022. The surging popularity of do-it-yourself practices and the yearning for distinctive, individualized beverages are propelling the growth of automatic home beer brewing machines. These appliances empower users to explore a gamut of flavors, ingredients, and brewing techniques, facilitating the production of uniquely tailored beers that perfectly cater to their particular tastes and preferences.

Numerous manufacturers provide mobile applications offering access to a diverse range of pre-installed recipes, along with the capability to devise new ones. Manufacturers also allocate resources towards research and development to unveil advanced products equipped with an array of features, including a digital thermostat, multiple taps, and removable keg. These enhanced designs and intelligent features are poised to catalyze market growth.

Regional Insights

North America region dominated the global market in 2022

The North America region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. The growth of the segment market can be largely attributed to the growing interest in home brewing, particularly among the younger generation in countries such as the U.S., Canada, and other nations in the Americas, which has spurred an extensive demand for home beer brewing machines. The momentum of the DIY (do-it-yourself) movement has swept across various hobbies, including home brewing, further driving the need for brewing machines in residential households.

The home brewing beer machine market in the Asia-Pacific region has experienced notable growth in recent years and is expected to continue during the forecast period. This surge can be attributed to several key factors, such as the combination of cultural traditions, economic factors, and evolving consumer preferences:

Increasing disposable incomes across various countries in the Asia-Pacific region have led to a higher demand for premium and personalized products, including craft beer. Consumers are willing to invest in home brewing machines to create their own unique brews.

Furthermore, the pace of urbanization has ushered in shifts in lifestyle and consumption trends. Urban residents typically possess higher disposable incomes and exhibit a greater inclination towards recreational pursuits, including the practice of home brewing.

Key Market Players & Competitive Insights

The home brewing beer machine market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Anvil Brewing Equipment

- Brewie

- Grainfather

- iGulu

- Kegco

- LG Electronics (HomeBrew)

- MiniBrew

- PicoBrew

- Speidel

- Ss Brewtech

- Still Spirits

- The Grainfather

- WilliamsWarn

- YaeBrew

- Zymatic (Picobrew)

Recent Developments

- In November 2019, MiniBrew, a Netherlands-based food tech start-up unveiled their latest innovation, the MiniBrew Craft home brewing machine. This device boasts a distinctive copper-colored keg and a transparent mashing tun. Notably, it comes equipped with a built-in cooler that ensures the beer remains fresh for up to three months.

Home Beer Brewing Machine Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 27.93 million |

|

Revenue forecast in 2032 |

USD 57.30 million |

|

CAGR |

9.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product Type, By Distribution Channel, By Mechanism, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |