HIV Diagnostics Market Size, Share, Trends, Industry Analysis Report: By Product (Consumables, Instruments, and Software and Services), Mode, Test Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5496

- Base Year: 2024

- Historical Data: 2020-2023

HIV Diagnostics Market Overview

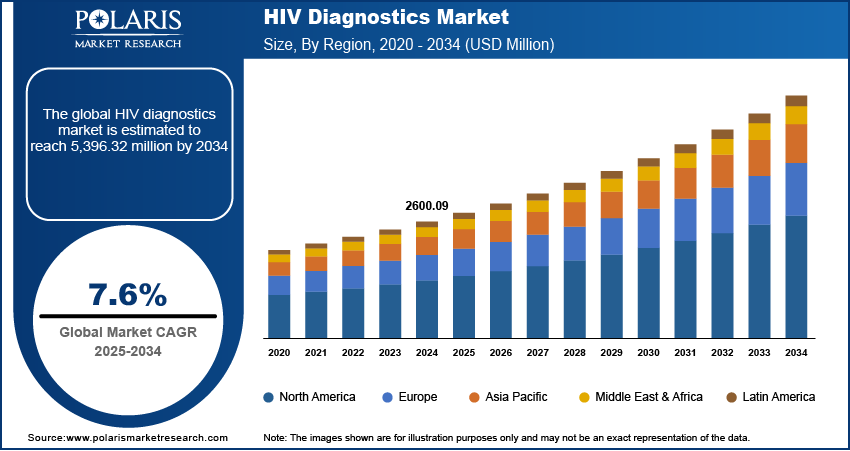

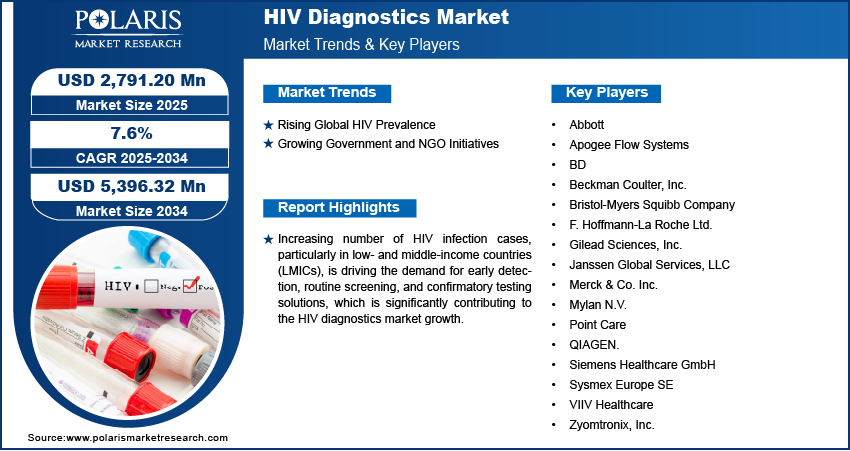

The HIV diagnostics market size was valued at USD 2,600.09 million in 2024 and is expected to reach USD 2,791.20 million by 2025 and USD 5,396.32 million by 2034, exhibiting a CAGR of 7.6% during 2025–2034.

The HIV diagnostics market encompasses a range of technologies and testing solutions used for the detection, monitoring, and management of human immunodeficiency virus (HIV) infections. It includes rapid diagnostic tests (RDTs), nucleic acid amplification tests (NAATs), immunoassays, and self-testing kits catering to healthcare facilities, diagnostic laboratories, and point-of-care settings. HIV diagnostics market growth is driven by advancements in molecular diagnostics, early detection techniques, and expanding screening programs, ensuring timely intervention and effective disease management.

Advancements in next-generation sequencing (NGS), AI-powered diagnostic platforms, and high-sensitivity assays are fostering HIV diagnostics market expansion, enhancing test accuracy, speed, and accessibility in diverse healthcare settings. Evolving global healthcare regulations, approval of innovative diagnostic assays, and streamlined reimbursement frameworks are boosting market growth and facilitating wider adoption and commercial expansion.

To Understand More About this Research: Request a Free Sample Report

The shift toward decentralized, rapid testing solutions is strengthening HIV diagnostics market trends, enabling immediate results, rapid clinical decision-making, and enhanced patient management, especially in resource-limited settings. Additionally, rising consumer preference for home-based HIV self-testing kits, supported by mobile health (mHealth) solutions and telemedicine, is driving HIV diagnostics market opportunities, promoting early detection and privacy-conscious screening.

HIV Diagnostics Market Dynamics

Rising Global HIV Prevalence

The increasing rate of HIV infection cases, particularly in low- and middle-income countries (LMICs), is significantly contributing to the HIV diagnostics market growth by driving the demand for early detection, routine screening, and confirmatory testing solutions. In 2022, approximately 31,800 individuals were newly infected with HIV in the US. During the same year, the total number of HIV diagnoses among individuals aged 13 and older reached 37,981 across the US. The expanding HIV patient pool necessitates scalable, high-accuracy diagnostic solutions, fueling market demand for point-of-care (POC) testing, rapid test kits, and advanced molecular diagnostics. Public health policies advocating universal access to HIV screening are enhancing market expansion, leading to higher adoption of self-testing and decentralized diagnostic approaches. The increasing burden of undiagnosed HIV cases is compelling governments and healthcare providers to invest in efficient, high-throughput testing technologies, thereby strengthening HIV diagnostics market development.

Growing Government and NGO Initiatives

Strategic investments from governments, World Health Organization (WHO), Joint United Nations Programme on HIV/AIDS (UNAIDS), and non-profit organizations are playing a critical role in propelling the HIV diagnostics market development by increasing access to low-cost, high-quality testing solutions in resource-limited settings. The FY 2025 US budget proposal allocates USD 593 million to the CDC, HRSA, IHS, and NIH to support the ‘Ending the HIV Epidemic initiative,’ marking a USD 20 million increase over FY23 funding levels. Large-scale funding initiatives, public-private partnerships, and subsidized testing programs are actively contributing to market expansion, improving affordability and availability of diagnostic solutions. The growing emphasis on early detection, prevention strategies, and treatment monitoring is transforming market dynamics, creating opportunities for next-generation molecular assays and AI-driven diagnostic platforms. Public health mandates advocating nationwide HIV screening are driving HIV diagnostics market demand, ensuring the adoption of advanced and cost-effective testing methodologies across diverse healthcare infrastructures.

HIV Diagnostics Market Segment Insights

HIV Diagnostics Market Assessment by Product Outlook

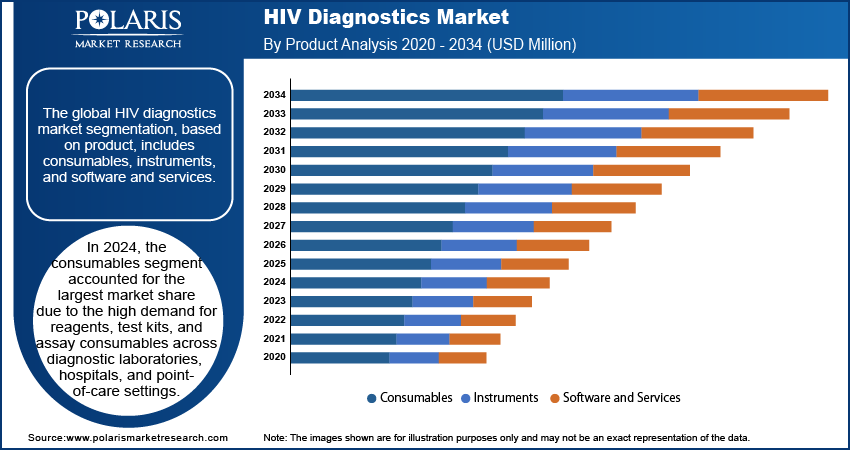

The global HIV diagnostics market segmentation, based on product, includes consumables, instruments, and software and services. In 2024, the consumables segment accounted for the largest market share due to the high demand for reagents, test kits, and assay consumables across diagnostic laboratories, hospitals, and point-of-care settings. The increasing adoption of nucleic acid-based tests (NATs), enzyme-linked immunosorbent assays (ELISAs), and rapid diagnostic tests (RDTs) has significantly contributed to consumables segment growth. Frequent replenishment of consumables due to high testing volumes, routine screening programs, and widespread government initiatives for HIV eradication have strengthened market demand. Technological advancements in multiplex assays, automation-compatible reagents, and high-sensitivity consumables are further enhancing market expansion and driving commercial adoption globally.

The software and services segment is expected to register the highest CAGR during the forecast period due to the growing integration of artificial intelligence (AI), machine learning (ML), and cloud-based diagnostic platforms. Increasing reliance on data-driven diagnostic solutions, predictive analytics, and digital health records is accelerating the software and services segment growth. The adoption of telehealth services, remote monitoring solutions, and AI-assisted diagnostic interpretation is driving demand for software-enabled HIV testing workflows. Rising government support for digital healthcare infrastructure, interoperability between diagnostic platforms, and automation of laboratory processes is contributing to segment expansion, ensuring efficiency and accuracy in HIV detection and management.

HIV Diagnostics Market Evaluation by End Use Outlook

The global HIV diagnostics market segmentation, based on end use, includes diagnostic laboratories, hospitals & clinics, and home settings. In 2024, the diagnostic laboratories segment accounted for the largest market share due to the widespread adoption of advanced HIV diagnostic technologies, centralized testing models, and stringent regulatory compliance standards. Laboratories serve as the primary hubs for high-throughput HIV testing, utilizing PCR-based assays, Western blot confirmatory tests, and immunoassay platforms to ensure accurate viral detection and load monitoring. Increasing government-funded HIV screening programs, accreditation-driven laboratory standardization, and expansion of private diagnostic service providers have further driven market growth. The need for comprehensive diagnostic solutions, including confirmatory testing and genotypic resistance assays, continues to strengthen HIV diagnostics market demand across laboratory settings.

The hospitals & clinics segment is expected to register significant growth over the forecast period due to rising inpatient and outpatient HIV testing volumes, integrated care models, and increased adoption of rapid diagnostic solutions. Hospitals play a crucial role in early HIV detection, pre-exposure prophylaxis (PrEP) screening, and patient management, driving the demand for point-of-care (POC) testing and bedside diagnostics. The expansion of specialized HIV treatment centers, increasing access to ART (antiretroviral therapy) clinics, and growing collaborations between hospitals and diagnostic companies are enhancing the segment size. Implementation of electronic health records (EHRs) and AI-driven diagnostic decision support systems is further accelerating market expansion, ensuring efficient HIV screening and treatment planning.

HIV Diagnostics Market Regional Analysis

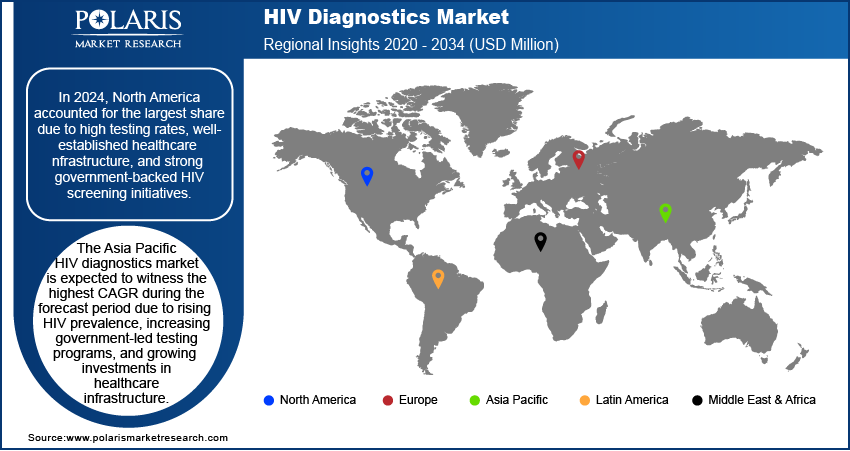

By region, the study provides HIV diagnostics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share in 2024 due to high testing rates, well-established healthcare infrastructure, and strong government-backed HIV screening initiatives. Extensive adoption of advanced diagnostic technologies, including nucleic acid amplification tests (NAATs), next-generation sequencing (NGS), and rapid point-of-care (POC) tests, has strengthened market demand. Robust funding from public health agencies such as the CDC and NIH, along with the presence of leading diagnostic manufacturers, has contributed to the North America HIV diagnostics market expansion. Rising awareness campaigns, increasing PrEP adoption, and favorable reimbursement policies continue to support market growth in the region. For instance, in March 2023, Emory University initiated a comprehensive program aimed at distributing one million rapid HIV self-testing kits throughout the US. This initiative seeks to enhance accessibility to HIV testing, facilitate early diagnosis, and ultimately improve public health outcomes related to HIV prevention and management.

The Asia Pacific HIV diagnostics market is expected to witness the highest CAGR during the forecast period due to rising HIV prevalence, increasing government-led testing programs, and growing investments in healthcare infrastructure. For instance, in August 2022, ICAP at Columbia University, alongside the Almaty AIDS Center and local NGOs, launched an innovative online HIV testing service in Almaty, Kazakhstan. This platform offers free, anonymous testing accessible with a single click, aiming to improve testing uptake and access to essential HIV services in the region. Expanding access to affordable diagnostic solutions, integration of AI-based HIV detection technologies, and deployment of mobile diagnostic units are driving market dynamics. Strengthening collaborations between global health organizations, regional governments, and private diagnostic firms are enhancing the HIV diagnostics market opportunity. Increasing awareness initiatives, expansion of ART coverage, and technological advancements in low-cost rapid test kits are further contributing to market expansion across emerging economies in the region.

HIV Diagnostics Key Market Players & Competitive Analysis Report

The competitive landscape of the HIV diagnostics market is characterized by global leaders and regional players competing through technological innovation, strategic partnerships, and market expansion initiatives. Leading companies leverage advanced R&D capabilities, AI-driven automation, and next-generation molecular diagnostics to enhance test accuracy, speed, and accessibility, addressing the growing market demand for high-sensitivity assays, point-of-care (POC) testing, and early HIV detection technologies. HIV diagnostics market trends indicate a surge in AI-powered diagnostic platforms, integration of cloud-based analytics, and the adoption of digital pathology solutions, driven by increasing government-backed screening programs, rising global HIV prevalence, and advancements in decentralized testing models.

Strategic investments, mergers and acquisitions, and cross-industry collaborations remain central to market expansion, enabling firms to accelerate innovation, optimize supply chains, and expand market presence in emerging economies. Post-merger integration and regulatory compliance strategies play a crucial role in strengthening competitive positioning, allowing companies to navigate evolving HIV diagnostics market dynamics and address stringent regulatory requirements. Competitive benchmarking involves market entry strategies, strategic alliances with healthcare institutions, and partnerships with public health agencies and research organizations to align with shifting market trends and technological advancements. The HIV diagnostics market is undergoing rapid technological evolution, with innovations such as next-generation sequencing (NGS) for viral load monitoring, AI-driven diagnostic algorithms, and multiplexed rapid testing kits reshaping market value and operational efficiencies. Companies are investing in scalable diagnostic platforms, microfluidic-based detection methods, and affordable self-testing kits to address market demand, industry trends, and evolving epidemiological needs. Pricing insights, revenue growth strategies, and competitive intelligence remain pivotal for identifying long-term market opportunities and ensuring sustainable profitability. Major players focus on technological leadership, precision diagnostics, and adaptable market strategies to navigate geopolitical uncertainties and drive HIV diagnostics market expansion in an increasingly competitive global ecosystem.

Roche, officially known as F. Hoffmann-La Roche Ltd, is a biotechnology firm dedicated to advancing medical solutions for various significant ailments. Its focus encompasses the development of drugs and diagnostic tools to combat major diseases, such as cancer, autoimmune disorders, central nervous system conditions, eye-related afflictions, infectious ailments, and respiratory issues. Roche also provides comprehensive diabetes management solutions, in vitro diagnostic systems, and innovative cancer diagnostics based on tissue analysis. Roche's pursuits extend to pioneering research and exploration of novel disease prevention, detection, and treatment strategies. Its broad range of offerings caters to diverse stakeholders, including hospitals, commercial laboratories, healthcare practitioners, researchers, and pharmacists.

Gilead Sciences, Inc. is a biopharmaceutical company that specializes in the research, development, and commercialization of innovative medicines to treat life-threatening diseases. Gilead Sciences is recognized for its work in antiviral therapies, especially in the area of HIV and hepatitis B and C. The company's first major success came in 1996 when it launched Viread, a treatment for HIV. Since then, Gilead Sciences has developed several drugs, including Atripla, Truvada, and Harvoni, which have transformed the treatment of HIV and hepatitis C.

List Key Companies in HIV Diagnostics Market

- Abbott

- Apogee Flow Systems

- BD

- Beckman Coulter, Inc.

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd.

- Gilead Sciences, Inc.

- Janssen Global Services, LLC

- Merck & Co. Inc.

- Mylan N.V.

- QIAGEN.

- Siemens Healthcare GmbH

- Sysmex Europe SE

- VIIV Healthcare

HIV Diagnostics Industry Developments

In March 2025, bioLytical launched the INSTI Multiplex HIV-1/2 and Syphilis Antibody Test in Australia, achieving a major advancement in testing efficiency. This rapid tool delivers results in one minute, allowing for simultaneous antibody detection and facilitating quicker clinical decision-making.

In April 2023, Abbott collaborated with Population Services International (PSI) and Unitaid to enhance the affordability and accessibility of HIV self-test kits in low- and middle-income countries worldwide. This partnership aims to reduce barriers to testing by implementing cost-effective strategies to distribute these diagnostic tools, thereby improving early detection and management of HIV.

In July 2022, Abbott launched the Panbio HIV Self-Test, a rapid point-of-care test for detecting HIV-1 and HIV-2 antibodies from a fingerstick whole blood sample, available in approved markets outside the US.

HIV Diagnostics Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Consumables

- Instruments

- Software and Services

By Mode Outlook (Revenue, USD Million, 2020–2034)

- Self-Test

- Lab-Based

By Test Type Outlook (Revenue, USD Million, 2020–2034)

- Antibody Test

- HIV-1 Screening Tests

- HIV-1 Antibody Confirmatory Tests

- HIV-2 & Group O Diagnostic Tests

- Viral Load Test

- CD4 Test

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Diagnostic Laboratories

- Hospitals & Clinics

- Home Settings

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

HIV Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,600.09 million |

|

Market Size Value in 2025 |

USD 2,791.20 million |

|

Revenue Forecast in 2034 |

USD 5,396.32 million |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2,600.09 million in 2024 and is projected to grow to USD 5,396.32 million by 2034.

The global market is projected to register a CAGR of 7.6% during the forecast period.

In 2024, North America accounted for the largest share due to high testing rates, well-established healthcare infrastructure, and strong government-backed HIV screening initiatives.

A few of the key players in the market are Abbott; Apogee Flow Systems; BD; Beckman Coulter, Inc.; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd.; Gilead Sciences, Inc.; Janssen Global Services, LLC; Merck & Co. Inc.; Mylan N.V.; QIAGEN; Siemens Healthcare GmbH; Sysmex Europe SE; and VIIV Healthcare.

In 2024, the consumables segment accounted for the largest market share due to the high demand for reagents, test kits, and assay consumables across diagnostic laboratories, hospitals, and point-of-care settings.

In 2024, the diagnostic laboratories segment accounted for the largest market share due to the widespread adoption of advanced HIV diagnostic technologies, centralized testing models, and stringent regulatory compliance standards.